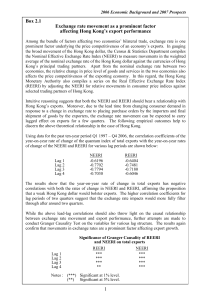

Exchange rate movement as a prominent factor affecting Hong

... Kong’s principal trading partners. Apart from the nominal exchange rate between two economies, the relative change in price level of goods and services in the two economies also affects the price competitiveness of the exporting economy. In this regard, the Hong Kong Monetary Authority also compiles ...

... Kong’s principal trading partners. Apart from the nominal exchange rate between two economies, the relative change in price level of goods and services in the two economies also affects the price competitiveness of the exporting economy. In this regard, the Hong Kong Monetary Authority also compiles ...

chapter 5. flexible prices

... This equation states PP of each country’s currency must be the same whether spent on the domestic market or converted into foreign currency and spent abroad. Consider the figure below where the vertical axis plots the domestic price level, and the horizontal plots spot exchange rate. The line drawn ...

... This equation states PP of each country’s currency must be the same whether spent on the domestic market or converted into foreign currency and spent abroad. Consider the figure below where the vertical axis plots the domestic price level, and the horizontal plots spot exchange rate. The line drawn ...

fixed exchange rate - McGraw Hill Higher Education

... – Argentina fought hyperinflation by valuing its peso on par with the dollar • Inflation quickly decreased and stayed stable for more than 10 years • Fixed exchange system broke down because unsound domestic policies created fears that Argentina would default on international loans ...

... – Argentina fought hyperinflation by valuing its peso on par with the dollar • Inflation quickly decreased and stayed stable for more than 10 years • Fixed exchange system broke down because unsound domestic policies created fears that Argentina would default on international loans ...

Monetary policy

... price stability by influencing aggregate demand or spending in the economy. These tools are: Open market operation. Changing the bank rate. Changing the cash reserve ratio. ...

... price stability by influencing aggregate demand or spending in the economy. These tools are: Open market operation. Changing the bank rate. Changing the cash reserve ratio. ...

Sample questions

... (i) Find the equilibrium value of r, and the home current account at period 1. (ii) What effect does have on the equilibrium world interest rate? (iii) What is the home current account at time t? (iv) When will home run a current account deficit in period 1? 2. Consider a one-good small endowment ...

... (i) Find the equilibrium value of r, and the home current account at period 1. (ii) What effect does have on the equilibrium world interest rate? (iii) What is the home current account at time t? (iv) When will home run a current account deficit in period 1? 2. Consider a one-good small endowment ...

AP Macro Unit 5 PPT

... 2. If the U.S. dollar depreciates relative to other countries does the balance of payments move toward a deficit or a surplus? - US exports are desirable - America exports more - Net exports (Xn) increase - The current account balance decreases and moves toward a surplus. ...

... 2. If the U.S. dollar depreciates relative to other countries does the balance of payments move toward a deficit or a surplus? - US exports are desirable - America exports more - Net exports (Xn) increase - The current account balance decreases and moves toward a surplus. ...

Contents of the course - Solvay Brussels School of

... – Interest rates on LT government bonds max 2% above the average of interest rates in the 3 lowest inflation countries. ...

... – Interest rates on LT government bonds max 2% above the average of interest rates in the 3 lowest inflation countries. ...

A simple model of monetary policy and currency crises

... The main debate regarding the optimal conduct of monetary policy in the aftermath of a "nancial crisis could be broadly summarized as follows: while higher domestic nominal interest rates should generally lead to a stronger exchange rate and therefore improve the "nances of domestic "rms which have ...

... The main debate regarding the optimal conduct of monetary policy in the aftermath of a "nancial crisis could be broadly summarized as follows: while higher domestic nominal interest rates should generally lead to a stronger exchange rate and therefore improve the "nances of domestic "rms which have ...

Экономические науки

... rates are determined everyday in large global currency exchange markets. There is no fixed value for any of the major currency – all currency values are described in relation to another currency. The relationship between interest rates, and other domestic monetary policies, and currency exchange rat ...

... rates are determined everyday in large global currency exchange markets. There is no fixed value for any of the major currency – all currency values are described in relation to another currency. The relationship between interest rates, and other domestic monetary policies, and currency exchange rat ...

PF-L5 - Killarney School

... Instead of buying and selling money, we will look at a more familiar example where money is exchanged for a product. Your uncle buys and then sells vegetables from his market-garden stand. He has asked you to help with the business. One day you are asked to pick up 100 kg of carrots. You buy them fr ...

... Instead of buying and selling money, we will look at a more familiar example where money is exchanged for a product. Your uncle buys and then sells vegetables from his market-garden stand. He has asked you to help with the business. One day you are asked to pick up 100 kg of carrots. You buy them fr ...

One market, One Money

... control of a particular territory determined which goods and which people were subject to his jurisdiction. The creation of a trade balance, of Central Banks and especially of a free internal market are the result of this stage that, within the history of economic thought, was defined as the era of ...

... control of a particular territory determined which goods and which people were subject to his jurisdiction. The creation of a trade balance, of Central Banks and especially of a free internal market are the result of this stage that, within the history of economic thought, was defined as the era of ...

Price Adjustments and Balance-of

... demand curves, the market for foreign exchange is stable. If U.S. income rises, demand for imports rises and so does demand for foreign exchange. The rightward shift of the demand for foreign exchange creates a current account deficit and an increase in the price of pounds (a depreciation of the ...

... demand curves, the market for foreign exchange is stable. If U.S. income rises, demand for imports rises and so does demand for foreign exchange. The rightward shift of the demand for foreign exchange creates a current account deficit and an increase in the price of pounds (a depreciation of the ...

Impact

... content. Price of Imported coal goes up leading to power tariff increase which in turn will impact the common man. Supply constraints in food and infrastructure fuelling inflation. It comes down to the common man, it leads to inflationary trends, and therefore it also affects the interest rates. CAD ...

... content. Price of Imported coal goes up leading to power tariff increase which in turn will impact the common man. Supply constraints in food and infrastructure fuelling inflation. It comes down to the common man, it leads to inflationary trends, and therefore it also affects the interest rates. CAD ...

14.02 Principles of Macroeconomics Problem Set 5 Spring 2003

... rates than under flexible exchange rates. j) Fiscal policy is more effective (in terms of affecting GDP) under flexible exchange rates than under fixed exchange rates. k) The appearance of twin deficits is typical in an economy with 1) flexible exchange rates 2) expansionary fiscal policy 3) restric ...

... rates than under flexible exchange rates. j) Fiscal policy is more effective (in terms of affecting GDP) under flexible exchange rates than under fixed exchange rates. k) The appearance of twin deficits is typical in an economy with 1) flexible exchange rates 2) expansionary fiscal policy 3) restric ...

Introduction to International Business

... (388,350/130 = $2,987), and then invest these dollars in a US account. For this to be preferable to the simplest solution, you would have to be able to make a lot of interest (4,000 - 2,987 = $1,013), which would turn out to be an annual rate of 51% ((1,013/4000) * 2). If, however, you could lock in ...

... (388,350/130 = $2,987), and then invest these dollars in a US account. For this to be preferable to the simplest solution, you would have to be able to make a lot of interest (4,000 - 2,987 = $1,013), which would turn out to be an annual rate of 51% ((1,013/4000) * 2). If, however, you could lock in ...

Socialist Economic Transformation

... nonoptimal. Changes must be made. This is costly to the credibility of the reform program. My earlier discussion of wages and exchange rates illustrates this point. Some reforms can precede the freeing of prices and the effort to reduce the budget deficit. There is a recursive relation between rules ...

... nonoptimal. Changes must be made. This is costly to the credibility of the reform program. My earlier discussion of wages and exchange rates illustrates this point. Some reforms can precede the freeing of prices and the effort to reduce the budget deficit. There is a recursive relation between rules ...

14.02 Principles of Macroeconomics Fall 2005 Quiz 3 Solutions

... 6. Assume that the uncovered interest parity condition holds. Then, under a fixed exchange rate regime, investment unambiguously increases in the short-run as a consequence of a fiscal expansion. This statement is false under a flexible exchange rate regime. True. If UIP holds, under fixed exchange ...

... 6. Assume that the uncovered interest parity condition holds. Then, under a fixed exchange rate regime, investment unambiguously increases in the short-run as a consequence of a fiscal expansion. This statement is false under a flexible exchange rate regime. True. If UIP holds, under fixed exchange ...

the real lessons of “black thursday”

... under pressure, and the authorities were obliged to sell US dollars. The monetary base would not shrink, and the money market would not tighten, as required by the CBA, because the decrease in the US$ buyers’ HK$ balances were exactly offset by the increase in the Exchange Fund’s HK$ balances. After ...

... under pressure, and the authorities were obliged to sell US dollars. The monetary base would not shrink, and the money market would not tighten, as required by the CBA, because the decrease in the US$ buyers’ HK$ balances were exactly offset by the increase in the Exchange Fund’s HK$ balances. After ...

Fiscal Policy Under Flexible Exchange Rates

... monetary policy may make the attainment of other targets besides income possible. Examples of alternative targets include interest rates and exchange rates. Consider an income and interest rate target of Y* and i*as an example. ...

... monetary policy may make the attainment of other targets besides income possible. Examples of alternative targets include interest rates and exchange rates. Consider an income and interest rate target of Y* and i*as an example. ...

The Meiji Restoration

... – Satsuma is in Southwestern part of Kyushu • Satsuma was the second largest han • Satsuma produced sugar and controlled Okinawan sugar production. ...

... – Satsuma is in Southwestern part of Kyushu • Satsuma was the second largest han • Satsuma produced sugar and controlled Okinawan sugar production. ...

Stabilizing role of own currency in a small open economy

... Is there a case for enlarging euro area? Stabilizing role of own currency in a small open economy ...

... Is there a case for enlarging euro area? Stabilizing role of own currency in a small open economy ...

I. Exchange Rates

... exchange rates introduces uncertainty into international transactions • 2. There are two major benefits of fixed exchange rates • 3. But there are some disadvantages to fixed exchange rates ...

... exchange rates introduces uncertainty into international transactions • 2. There are two major benefits of fixed exchange rates • 3. But there are some disadvantages to fixed exchange rates ...

ppt

... The Euro: how do you run a common currency without a common government? • The weak economies want low interest rates, and wouldn't mind a bit of inflation; but Germany is dead set on maintaining price stability at all cost. • Europe cannot deal with "asymmetric shocks" the way the United States doe ...

... The Euro: how do you run a common currency without a common government? • The weak economies want low interest rates, and wouldn't mind a bit of inflation; but Germany is dead set on maintaining price stability at all cost. • Europe cannot deal with "asymmetric shocks" the way the United States doe ...

Chamberlain Canadian Imports has agreed to

... a. What is the price of the beer, in U.S. dollars, if it is purchased at today's spot rate? b. What is the cost, in U.S. dollars, of the second 15,000 cases if payment is made in 90 days and the spot rate at that time equals today's 90-day forward rate? c. If the exchange rate for the Canadian dolla ...

... a. What is the price of the beer, in U.S. dollars, if it is purchased at today's spot rate? b. What is the cost, in U.S. dollars, of the second 15,000 cases if payment is made in 90 days and the spot rate at that time equals today's 90-day forward rate? c. If the exchange rate for the Canadian dolla ...