Chapter 2

... payments deficit. This deficit would put downward pressure on the dollar. To prevent any change in the exchange rate the monetary authorities would decrease the money supply, increasing interest rates to attract capital inflows that would eliminate the balance of payments deficit. This action dampen ...

... payments deficit. This deficit would put downward pressure on the dollar. To prevent any change in the exchange rate the monetary authorities would decrease the money supply, increasing interest rates to attract capital inflows that would eliminate the balance of payments deficit. This action dampen ...

Notes on the Shadow Exchange Rate The shadow exchange rate

... country and its trading partners. The real exchange should be an effective exchange rate so that price differentials with different trading partners are adjusted for the relative share of each partner in a country’s foreign trade. Where the purchasing power parity explanation of exchange rate moveme ...

... country and its trading partners. The real exchange should be an effective exchange rate so that price differentials with different trading partners are adjusted for the relative share of each partner in a country’s foreign trade. Where the purchasing power parity explanation of exchange rate moveme ...

Globalization and Capital Markets

... returns, and easier to act upon by policy. • If we run policies on the theory that we can under-compensate foreign investors all of the time, they are likely to demand higher interest on loans. • Asian official creditors clearly are worried about the dollar. ...

... returns, and easier to act upon by policy. • If we run policies on the theory that we can under-compensate foreign investors all of the time, they are likely to demand higher interest on loans. • Asian official creditors clearly are worried about the dollar. ...

Contents of the course

... Five factors of stability for the ERM : (4) Existence of capital controls • Allow some monetary independence to the countries, by preventing large capital flows if interest rates differentials. Ex. tight monetary policy of Spain in the late 1980’s (high interest rates). Peseta protected from depre ...

... Five factors of stability for the ERM : (4) Existence of capital controls • Allow some monetary independence to the countries, by preventing large capital flows if interest rates differentials. Ex. tight monetary policy of Spain in the late 1980’s (high interest rates). Peseta protected from depre ...

Policy, Exchange Rates, and the International System W. Max Corden

... swings were big, most of the movements (outside of the speculative bubble of 1984—85) were in an equilibrating direction. Having maintained the dollar well outside of its purchasing power parity range would have been far worse. Is the high level of capital mobility in the international financial sys ...

... swings were big, most of the movements (outside of the speculative bubble of 1984—85) were in an equilibrating direction. Having maintained the dollar well outside of its purchasing power parity range would have been far worse. Is the high level of capital mobility in the international financial sys ...

chapter-15

... TABLE 15.5 Examples of currency crises Mexico, December 1994–1995. Mexico’s central bank maintained the value of the peso within a band that depreciated four percent a year against the U.S. dollar. In order to reduce interest rates on its debt, the Mexican government in April 1994 began issuing deb ...

... TABLE 15.5 Examples of currency crises Mexico, December 1994–1995. Mexico’s central bank maintained the value of the peso within a band that depreciated four percent a year against the U.S. dollar. In order to reduce interest rates on its debt, the Mexican government in April 1994 began issuing deb ...

PDF Download

... come about as a result of rising capital mobility. To overcome the inconsistency, one element of the quartet had to be dropped. The international community decided to drop the fixed exchange rate element and moved to a regime of floating rates. Europe decided to drop independent monetary policy and ...

... come about as a result of rising capital mobility. To overcome the inconsistency, one element of the quartet had to be dropped. The international community decided to drop the fixed exchange rate element and moved to a regime of floating rates. Europe decided to drop independent monetary policy and ...

In 1998 eleven EU member-states had met the convergence criteria

... The Estonian kroon, Lithuanian litas, and Slovenian tolar were included in the ERM II on 28 June 2004; the Cypriot pound, the Latvian lats and the Maltese lira on 2 May 2005; the Slovak koruna on 28 November 2005. The currencies of the three largest countries which joined the European Union on 1 Ma ...

... The Estonian kroon, Lithuanian litas, and Slovenian tolar were included in the ERM II on 28 June 2004; the Cypriot pound, the Latvian lats and the Maltese lira on 2 May 2005; the Slovak koruna on 28 November 2005. The currencies of the three largest countries which joined the European Union on 1 Ma ...

Sustaining China’s Economic Growth after the Global Financial Crisis geneRal DisCUssiOn mr . Goodfriend:

... rate spread. Now, why is the Ministry of Finance in favor of this? You have to look at the history, for example, of the creation of their sovereign wealth fund, which they started by giving $200 billion worth of foreign currency assets to the China Investment Corporation (CIC) in 2007. Ted Truman ha ...

... rate spread. Now, why is the Ministry of Finance in favor of this? You have to look at the history, for example, of the creation of their sovereign wealth fund, which they started by giving $200 billion worth of foreign currency assets to the China Investment Corporation (CIC) in 2007. Ted Truman ha ...

THE THEORY OF OPTIMUM CURRENCY AREAS P K

... believing that national monetary and fiscal policies could successfully fine-tune aggregate demand to offset private sector shocks on the supply or demand sides.” (McKinnon 2000). The theory of OCA therefore rests on the assumption of “stationary expectations”, or in other words it presumes that age ...

... believing that national monetary and fiscal policies could successfully fine-tune aggregate demand to offset private sector shocks on the supply or demand sides.” (McKinnon 2000). The theory of OCA therefore rests on the assumption of “stationary expectations”, or in other words it presumes that age ...

Fundamental Flaws in the European Project

... inserted into the 1997 Amsterdam Treaty – that government annual budget deficits must not exceed 3% and a national debt ceiling equivalent to no more than 60% of GDP must be observed. Admittedly, examples of violation of the national budget constraints can be cited for either large countries like G ...

... inserted into the 1997 Amsterdam Treaty – that government annual budget deficits must not exceed 3% and a national debt ceiling equivalent to no more than 60% of GDP must be observed. Admittedly, examples of violation of the national budget constraints can be cited for either large countries like G ...

Nominal Exchange Rates

... to its equilibrium, there is no need for intervention. • Any current account imbalance is exactly matched by an offsetting balance in capital/financial accounts. • If there is intervention, it is recorded as part of the financial account. ©The McGraw-Hill Companies, 2008 ...

... to its equilibrium, there is no need for intervention. • Any current account imbalance is exactly matched by an offsetting balance in capital/financial accounts. • If there is intervention, it is recorded as part of the financial account. ©The McGraw-Hill Companies, 2008 ...

Practice 40

... ____ 10. Assume a country has adopted a floating exchange rate regime and the central bank decides to engage in a contractionary monetary policy. Which of the following is LIKELY to occur? A. The country's currency will depreciate. B. Interest rates will rise, the currency will appreciate, and this ...

... ____ 10. Assume a country has adopted a floating exchange rate regime and the central bank decides to engage in a contractionary monetary policy. Which of the following is LIKELY to occur? A. The country's currency will depreciate. B. Interest rates will rise, the currency will appreciate, and this ...

Banking and the Endogenous Money Supply as viewed from a

... Portfolio adjustments in this case take place within the sphere of bank deposits, and do not require base money; hence, there is no bias towards interest rate volatility but towards two-side exchange rate volatility. Fiscal Policy does not necessarily tend to be pro-cyclical, as its monetary absorpt ...

... Portfolio adjustments in this case take place within the sphere of bank deposits, and do not require base money; hence, there is no bias towards interest rate volatility but towards two-side exchange rate volatility. Fiscal Policy does not necessarily tend to be pro-cyclical, as its monetary absorpt ...

The Small Open Economy - The Economics Network

... include changes in domestic and foreign trade policy policies such as tariffs or quotas. • All these changes require a different real exchange rate to equilibrate the market. ...

... include changes in domestic and foreign trade policy policies such as tariffs or quotas. • All these changes require a different real exchange rate to equilibrate the market. ...

Fixed.v.s.floating 2012

... that offsets the original disturbance. It is more optimal to change one price, the exchange rate, rather than many prices, or wages, which are sticky in the short run. ...

... that offsets the original disturbance. It is more optimal to change one price, the exchange rate, rather than many prices, or wages, which are sticky in the short run. ...

Open-Economy Macroeconomics

... rates. Purchasing-power parity is a theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries. According to the purchasing-power parity theory, a unit of any given currency should be able to buy the same quantity of goods in a ...

... rates. Purchasing-power parity is a theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries. According to the purchasing-power parity theory, a unit of any given currency should be able to buy the same quantity of goods in a ...

Company Name - University of Wisconsin–La Crosse

... is any asset that can easily be used to purchase goods and services. ...

... is any asset that can easily be used to purchase goods and services. ...

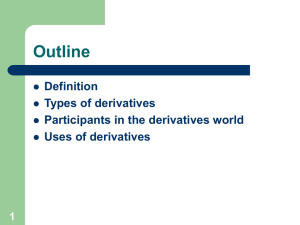

ch01 - Class Index

... Futures contracts involve a promise to exchange a product for cash by a set ...

... Futures contracts involve a promise to exchange a product for cash by a set ...

Parkin-Bade Chapter 34

... A fixed exchange rate policy is one that pegs the exchange rate at a value decided by the government or central bank and that blocks the unregulated forces of demand and supply by direct intervention in the foreign exchange market. A fixed exchange rate requires active intervention in the foreign ex ...

... A fixed exchange rate policy is one that pegs the exchange rate at a value decided by the government or central bank and that blocks the unregulated forces of demand and supply by direct intervention in the foreign exchange market. A fixed exchange rate requires active intervention in the foreign ex ...

Currency Crises: Sources & Solutions

... British central bank to intervene to raise in British interest rates, all the way to iD3. After a major intervention effort on the part of the Bank of England, which included a rise in its lending rate from 10% to 15%, which still wasn’t enough, the British were finally forced to give up on Septembe ...

... British central bank to intervene to raise in British interest rates, all the way to iD3. After a major intervention effort on the part of the Bank of England, which included a rise in its lending rate from 10% to 15%, which still wasn’t enough, the British were finally forced to give up on Septembe ...