Will Failure of the "European Monetary Union" Jeopardise the

... which played the role of a numeraire to fix the central rates of European currencies and of a unit of account in the intervention and the credit mechanisms; 2. an Exchange Rate Mechanism (ERM), which allowed a margin of fluctuation of each EC currency of + 2.25% in respect to the central rate, for ...

... which played the role of a numeraire to fix the central rates of European currencies and of a unit of account in the intervention and the credit mechanisms; 2. an Exchange Rate Mechanism (ERM), which allowed a margin of fluctuation of each EC currency of + 2.25% in respect to the central rate, for ...

Week 12

... Last week we introduced the basic elements required to analyse an open economy The current account: imports and exports The capital account: saving/investment flows The balance of payments equilibrium as a combination of the two The role of exchange rates ...

... Last week we introduced the basic elements required to analyse an open economy The current account: imports and exports The capital account: saving/investment flows The balance of payments equilibrium as a combination of the two The role of exchange rates ...

INBU 4200 Spring 2004

... goods should force China's currency, the yuan, higher against the dollar. As China's exports to the U.S. increase more than China's imports from the U.S., for example, the demand for yuan rises because China's exporters either want to be paid in yuan or have to be paid in yuan due to government regu ...

... goods should force China's currency, the yuan, higher against the dollar. As China's exports to the U.S. increase more than China's imports from the U.S., for example, the demand for yuan rises because China's exporters either want to be paid in yuan or have to be paid in yuan due to government regu ...

Peru_en.pdf

... (b) Monetary and exchange rate policy In response to the international financial crisis, the monetary authorities initially took policy measures to ensure liquidity in the local financial market, both in new soles and in dollars, in order to stabilize both the money and currency markets. Monetary po ...

... (b) Monetary and exchange rate policy In response to the international financial crisis, the monetary authorities initially took policy measures to ensure liquidity in the local financial market, both in new soles and in dollars, in order to stabilize both the money and currency markets. Monetary po ...

Mankiw8e_Student_PPTs_Chapter 13 - E-SGH

... does not occur. First, the central bank might want to avoid the large depreciation of the domestic currency and therefore, may respond by decreasing the money supply M. Second, the depreciation of the domestic currency may suddenly increase the price of domestic goods, causing an increase in the ove ...

... does not occur. First, the central bank might want to avoid the large depreciation of the domestic currency and therefore, may respond by decreasing the money supply M. Second, the depreciation of the domestic currency may suddenly increase the price of domestic goods, causing an increase in the ove ...

PDF Download

... more than $200.0bn. Even India has reserves in excess of $100.0bn. At some stage, these nations are going to develop sufficient self-confidence that they will reduce their degree of intervention or possibly even stop completely. At some time before the decade is over, some Asian countries will proba ...

... more than $200.0bn. Even India has reserves in excess of $100.0bn. At some stage, these nations are going to develop sufficient self-confidence that they will reduce their degree of intervention or possibly even stop completely. At some time before the decade is over, some Asian countries will proba ...

E. technical analysis

... spends more money than it obtains from abroad, the possibility of devaluation increases, but if a country receives more money than it obtains from abroad, the probability of revaluation increases. iv. Inflation rates are linked to exchange rates according to the purchasing power parity doctrine. Und ...

... spends more money than it obtains from abroad, the possibility of devaluation increases, but if a country receives more money than it obtains from abroad, the probability of revaluation increases. iv. Inflation rates are linked to exchange rates according to the purchasing power parity doctrine. Und ...

Chapter 2:

... exchange rate is defined as the domestic currency required to purchase a unit of the foreign currency, a domestic currency appreciation is defined as a fall in the domestic to foreign ratio, and a depreciation is defined as a rise in this ratio. The initial section of this chapter shows how a pair o ...

... exchange rate is defined as the domestic currency required to purchase a unit of the foreign currency, a domestic currency appreciation is defined as a fall in the domestic to foreign ratio, and a depreciation is defined as a rise in this ratio. The initial section of this chapter shows how a pair o ...

Open Economy Tutorial

... does not occur. First, the central bank might want to avoid the large depreciation of the domestic currency and therefore, may respond by decreasing the money supply M. Second, the depreciation of the domestic currency may suddenly increase the price of domestic goods, causing an increase in the ove ...

... does not occur. First, the central bank might want to avoid the large depreciation of the domestic currency and therefore, may respond by decreasing the money supply M. Second, the depreciation of the domestic currency may suddenly increase the price of domestic goods, causing an increase in the ove ...

Problem Set 3 Answers Part 1

... b. Again, assume that Mexico discovers more oil. Draw a new peso demand line reflecting this change. How will this affect the balance of payments and the exchange rate, and how is this different than what we would observe under a flexible exchange rate system? The new demand curve for pesos is the s ...

... b. Again, assume that Mexico discovers more oil. Draw a new peso demand line reflecting this change. How will this affect the balance of payments and the exchange rate, and how is this different than what we would observe under a flexible exchange rate system? The new demand curve for pesos is the s ...

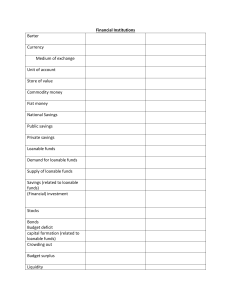

Financial Institutions Unit 6

... Barter Currency Medium of exchange Unit of account Store of value Commodity money Fiat money National Savings Public savings Private savings Loanable funds Demand for loanable funds Supply of loanable funds Savings (related to loanable funds) (Financial) investment ...

... Barter Currency Medium of exchange Unit of account Store of value Commodity money Fiat money National Savings Public savings Private savings Loanable funds Demand for loanable funds Supply of loanable funds Savings (related to loanable funds) (Financial) investment ...

Course: Marketing Theory and Practice (561/5534) Semester:

... Relationship between international trade, balance of payments and the determination of exchange rate Types of foreign exchange rate determination system Fixed, floating and flexible exchange rates and their advantages and disadvantages ...

... Relationship between international trade, balance of payments and the determination of exchange rate Types of foreign exchange rate determination system Fixed, floating and flexible exchange rates and their advantages and disadvantages ...

Key Development at a Glance - Claremont Graduate University

... VI.Further measures to be taken 1. Conditions for Further Liberalization of Capital Account A.Improvement of Macroeconomics:High average GDP per person, steady economic growth, efficiency of the economy, stabil ity of prices, healthy public finance, etc. B.Improvement of corporate governance and he ...

... VI.Further measures to be taken 1. Conditions for Further Liberalization of Capital Account A.Improvement of Macroeconomics:High average GDP per person, steady economic growth, efficiency of the economy, stabil ity of prices, healthy public finance, etc. B.Improvement of corporate governance and he ...

From the perspective of economics and geopolitics, each new

... or financed, a dollar depreciation will have to be part of it. If an Argentina or Turkey exhibited the same debt path numbers that the US is currently, investors would be thinking “crash,” if indeed a crisis had not already some time ago. The main thing that is different about the United States is t ...

... or financed, a dollar depreciation will have to be part of it. If an Argentina or Turkey exhibited the same debt path numbers that the US is currently, investors would be thinking “crash,” if indeed a crisis had not already some time ago. The main thing that is different about the United States is t ...

INTERNATIONAL MONETARY INSTITUTIONS Read and translate

... a different view of and a different interest in what happens in the international monetary sphere from that of the individual as a worker. Business activity is heavily influenced by international monetary conditions affecting prices, exchange rates, interest rates, imposition of controls on exports ...

... a different view of and a different interest in what happens in the international monetary sphere from that of the individual as a worker. Business activity is heavily influenced by international monetary conditions affecting prices, exchange rates, interest rates, imposition of controls on exports ...

Quiz 3 Solution Set 14.02 Macroeconomics May 23, 2006

... investors, firms and consumers to revise their expectations of future interest rates and output. 3. A fiscal contraction always reduces output in the short run. Ans: False. A fiscal contraction improves the budget balance, and leads to a lower interest rate and a higher investment in the medium run. ...

... investors, firms and consumers to revise their expectations of future interest rates and output. 3. A fiscal contraction always reduces output in the short run. Ans: False. A fiscal contraction improves the budget balance, and leads to a lower interest rate and a higher investment in the medium run. ...

The Central Bank “Printing Press”: Boon or Bane? Remedies for

... markets, usually by issuing bonds denominated in euros. Hence, given that tax revenues are proving insufficient to cover payments on Greek debt and that investors are reluctant to purchase new Greek bonds, the country has had to obtain emergency loans (from the ECB and the International Monetary Fu ...

... markets, usually by issuing bonds denominated in euros. Hence, given that tax revenues are proving insufficient to cover payments on Greek debt and that investors are reluctant to purchase new Greek bonds, the country has had to obtain emergency loans (from the ECB and the International Monetary Fu ...

Real Growth of GDP Euro Area Countries

... Costs and Risks as I see them: • Lack of real convergence – therefore inflationary pressures – depreciation of savings • Monetary policy not suited for Slovak Business Cycle • Centralization – all eggs in one ECB basket, less currency competition and flight opportunities • Arbitrariness in setting ...

... Costs and Risks as I see them: • Lack of real convergence – therefore inflationary pressures – depreciation of savings • Monetary policy not suited for Slovak Business Cycle • Centralization – all eggs in one ECB basket, less currency competition and flight opportunities • Arbitrariness in setting ...

Exchange Rates and International Finance

... The Nominal Exchange Rate • Why trade currencies? – To facilitate international trade – Traders in financial markets demand currencies in order to make financial transactions. – The average foreign exchange traded around the world is $4 trillion per day. ...

... The Nominal Exchange Rate • Why trade currencies? – To facilitate international trade – Traders in financial markets demand currencies in order to make financial transactions. – The average foreign exchange traded around the world is $4 trillion per day. ...

Exchange Rate Dynamics

... (iv) Real FX rate or q falls: • S falls more than P / Pf . • q = S / (P/ P f ) falls as well. -> a falling real exchange rate reflects a rising international competitiveness; This is called ‘Real Appreciation of Domestic Currency” <- a falling real exchange rate has a unfavorable reaction, decreasi ...

... (iv) Real FX rate or q falls: • S falls more than P / Pf . • q = S / (P/ P f ) falls as well. -> a falling real exchange rate reflects a rising international competitiveness; This is called ‘Real Appreciation of Domestic Currency” <- a falling real exchange rate has a unfavorable reaction, decreasi ...

Key dates in financial history - Center for Financial Stability

... futures contracts for anything other than a physical commodity. 1973: United States devalues, then floats the dollar; other major currencies also float, ending the Bretton Wood system in practice. A period of higher inflation follows in most countries. Western European countries attempt to reduce ex ...

... futures contracts for anything other than a physical commodity. 1973: United States devalues, then floats the dollar; other major currencies also float, ending the Bretton Wood system in practice. A period of higher inflation follows in most countries. Western European countries attempt to reduce ex ...

+ NX(ε) - BrainMass

... market into net capital flow and trade balance components. This rearrangement is called the loanable funds market. ...

... market into net capital flow and trade balance components. This rearrangement is called the loanable funds market. ...