“Silver risk”, currency speculation and bank failures in

... standard did survive in the US after the 1893 speculation (with a few short intervals) until the 1970s. A second generation model is more appropriate, because it allows for a “grey” area, where the currency peg is not necessarily doomed, but can be overthrown if expectations coalesce around this equ ...

... standard did survive in the US after the 1893 speculation (with a few short intervals) until the 1970s. A second generation model is more appropriate, because it allows for a “grey” area, where the currency peg is not necessarily doomed, but can be overthrown if expectations coalesce around this equ ...

Impact of Macroeconomic Announcements on Exchange Rates

... very short-lived. “…but it recovered to end the day off 21 points to 10,653.56.” Research Question: How influential are certain types of macroeconomic news on asset prices, and how long-lived is their effect? ...

... very short-lived. “…but it recovered to end the day off 21 points to 10,653.56.” Research Question: How influential are certain types of macroeconomic news on asset prices, and how long-lived is their effect? ...

The South African Rand

... want to have an open long position in Rand because the currency is strengthening. If they hold a short they want to cover their short position. • Based on Balance of Payments a currency trader would want to have an open short position in Rand. Due to this method predicting a weakening of the rand ov ...

... want to have an open long position in Rand because the currency is strengthening. If they hold a short they want to cover their short position. • Based on Balance of Payments a currency trader would want to have an open short position in Rand. Due to this method predicting a weakening of the rand ov ...

Should Ireland stay in the Euro

... devaluation – coupled with and a short holiday for Greece from the euro-zone, returning at a lower exchange rate has also been proposed. The underlying logic of these proposals is clear: the problem originates in loss of competitiveness. Any discussion on this issue in Ireland has been dominated by ...

... devaluation – coupled with and a short holiday for Greece from the euro-zone, returning at a lower exchange rate has also been proposed. The underlying logic of these proposals is clear: the problem originates in loss of competitiveness. Any discussion on this issue in Ireland has been dominated by ...

Reflections on Currency Crises Korkut Erturk Department of Economics

... The particular type of stabilization programs that was used in the Southern Cone countries in the late 1970s was the first of its kind in two respects. Firstly, disinflation was being attempted for the first time in context of a liberalized capital account. Secondly, in these programs the nominal ex ...

... The particular type of stabilization programs that was used in the Southern Cone countries in the late 1970s was the first of its kind in two respects. Firstly, disinflation was being attempted for the first time in context of a liberalized capital account. Secondly, in these programs the nominal ex ...

China, the US, and Currency Issues

... An international currency is used by non-residents. • The prospects for a country’s status as an international currency is not the same as its exchange rate prospects. • Example: 1993-95 – The dollar depreciated strongly, reaching an all-time low against the yen, among much hand-wringing. – And yet ...

... An international currency is used by non-residents. • The prospects for a country’s status as an international currency is not the same as its exchange rate prospects. • Example: 1993-95 – The dollar depreciated strongly, reaching an all-time low against the yen, among much hand-wringing. – And yet ...

Monetary Unions

... However, ECB is required to maintain annual increases in a Harmonized Index of Consumer Prices at or below 2% Expansionary fiscal policies (at member country level) However, under EU’s Growth and Stability Pact, convergence criteria have evolved into rules setting limits to fiscal policy of memb ...

... However, ECB is required to maintain annual increases in a Harmonized Index of Consumer Prices at or below 2% Expansionary fiscal policies (at member country level) However, under EU’s Growth and Stability Pact, convergence criteria have evolved into rules setting limits to fiscal policy of memb ...

relevant macroeconomic parameters

... of domestic debt, the cost of servicing the public domestic debt, and the level of revenues via the tax withheld from the interest income on the sale of government securities. An increase in T-Bill rate will raise government revenues due to the 20% withholding tax on interest income. At the same tim ...

... of domestic debt, the cost of servicing the public domestic debt, and the level of revenues via the tax withheld from the interest income on the sale of government securities. An increase in T-Bill rate will raise government revenues due to the 20% withholding tax on interest income. At the same tim ...

The Costs and Benefits of the Euro In European Monetary Union

... Even though a country gives up its right to change monetary policy, it still retains the right to change its fiscal policies. This means that EMU countries will still be able to change how much they tax the people (Eudey, pp. 20). If only one EMU country is having economic problems, then the other c ...

... Even though a country gives up its right to change monetary policy, it still retains the right to change its fiscal policies. This means that EMU countries will still be able to change how much they tax the people (Eudey, pp. 20). If only one EMU country is having economic problems, then the other c ...

IS-LM - Lorenzo Burlon

... loans to U.S. corporations, they are fairly confident that they will be repaid with interest. By contrast, in some less developed countries, it is plausible to fear that political upheaval may lead to a default on loan repayments. Borrowers in such countries often have to pay higher interest rates t ...

... loans to U.S. corporations, they are fairly confident that they will be repaid with interest. By contrast, in some less developed countries, it is plausible to fear that political upheaval may lead to a default on loan repayments. Borrowers in such countries often have to pay higher interest rates t ...

Capital Inflows and Reserve Accumulation: The Recent

... authorities see the balance as tilted against capital inflows. Among their calculations, the authors compute the month-to-month percent change in the exchange rate and reserves for a large set of countries. They then compared the likelihood that the exchange rate fluctuated by less and reserves by m ...

... authorities see the balance as tilted against capital inflows. Among their calculations, the authors compute the month-to-month percent change in the exchange rate and reserves for a large set of countries. They then compared the likelihood that the exchange rate fluctuated by less and reserves by m ...

Hedging currency risk for foreign assets and liabilities

... settled in the foreseeable future. Thus, the parent has a EUR-denominated loan on its balance sheet. The debt and the loan are eliminated from the balance sheet in consolidation, as are all of the EURdenominated cash flows between the parent and the subsidiary. The transaction gain or loss in the pa ...

... settled in the foreseeable future. Thus, the parent has a EUR-denominated loan on its balance sheet. The debt and the loan are eliminated from the balance sheet in consolidation, as are all of the EURdenominated cash flows between the parent and the subsidiary. The transaction gain or loss in the pa ...

Real Exchange Rate

... Real Exchange Rate This suggests that firms should primarily be concerned with changes in the real value of their dollar in foreign country. That is, the inflation-adjusted, or real, exchange rate: ...

... Real Exchange Rate This suggests that firms should primarily be concerned with changes in the real value of their dollar in foreign country. That is, the inflation-adjusted, or real, exchange rate: ...

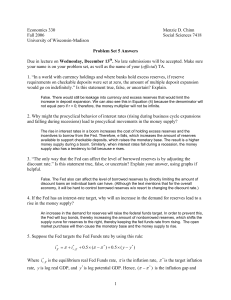

Problem Set 5 Answers

... decrease in the price level increases the real money stock, thereby shifting out the LM curve. Interest rates fall, and hence investment and output rises to Y2 (greater than Y1). As long as output is less than potential GDP, prices keep on falling, the expected price level keeps on being revised dow ...

... decrease in the price level increases the real money stock, thereby shifting out the LM curve. Interest rates fall, and hence investment and output rises to Y2 (greater than Y1). As long as output is less than potential GDP, prices keep on falling, the expected price level keeps on being revised dow ...

The return of currency hedging

... Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. The iShares Funds are distributed by Bl ...

... Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. The iShares Funds are distributed by Bl ...

Session 12: Managing an Open Economy

... the above shown; e.g., exchange rate changes may take time to affect actual imports and exports. Nontradables prices may rise quickly if there is excess demand, but the inflation may persist once it starts. When there is unemployment, unions strike may prevent prices from falling. The automatic tend ...

... the above shown; e.g., exchange rate changes may take time to affect actual imports and exports. Nontradables prices may rise quickly if there is excess demand, but the inflation may persist once it starts. When there is unemployment, unions strike may prevent prices from falling. The automatic tend ...

Argentina: Where To Go From Here?

... that since December of 2001 Argentina has been operating without a banking sector. (2) Massive tariff and non-tariff barriers to international trade keep Argentina isolated from world markets with the exception of Brazil. (3) The extensive privatization process that took place during the 1990s was not ...

... that since December of 2001 Argentina has been operating without a banking sector. (2) Massive tariff and non-tariff barriers to international trade keep Argentina isolated from world markets with the exception of Brazil. (3) The extensive privatization process that took place during the 1990s was not ...

, Institute Di de

... The model consists of two countries: a small home country and the rest of the world. Time is continuous. In addition to the nominal stock of don~esticmoney, M , residents of the home country hold two other financial assets, namely domestic and foreign bonds. These are prrlect substitutes the one lor ...

... The model consists of two countries: a small home country and the rest of the world. Time is continuous. In addition to the nominal stock of don~esticmoney, M , residents of the home country hold two other financial assets, namely domestic and foreign bonds. These are prrlect substitutes the one lor ...

Chapter 11

... This chapter examines the markets where Americans exchange dollars for other currencies, and expands the text’s analysis of the macroeconomy to include trading with other nations. It explores the relationship between foreign exchange markets and our economy, and the effects of monetary policy in an ...

... This chapter examines the markets where Americans exchange dollars for other currencies, and expands the text’s analysis of the macroeconomy to include trading with other nations. It explores the relationship between foreign exchange markets and our economy, and the effects of monetary policy in an ...

FINANCIAL MARKE TS 2 SOLUTIONS NOV 2014

... a) Monetary Policy relates to the control of some measure (or measures) of the money supply and /or the level and structure of interest rates. The importance attached to monetary policy within a government’s policy package will depend not only upon its view of the operations of the economy but also ...

... a) Monetary Policy relates to the control of some measure (or measures) of the money supply and /or the level and structure of interest rates. The importance attached to monetary policy within a government’s policy package will depend not only upon its view of the operations of the economy but also ...

To view this press release as a file

... CPI rose by 0.6 percent in the past year.2 If the volatile prices of fruit and vegetables are also excluded, the increase in the CPI reached 0.8 percent. While short-term inflation expectations (1–3 years), based on the various sources, increased slightly over the period (June average compared with ...

... CPI rose by 0.6 percent in the past year.2 If the volatile prices of fruit and vegetables are also excluded, the increase in the CPI reached 0.8 percent. While short-term inflation expectations (1–3 years), based on the various sources, increased slightly over the period (June average compared with ...