Comparing Direct PLUS and Private Loans

... In most cases, lenders will allow you to borrow up to the cost of attendance minus other financial aid. ...

... In most cases, lenders will allow you to borrow up to the cost of attendance minus other financial aid. ...

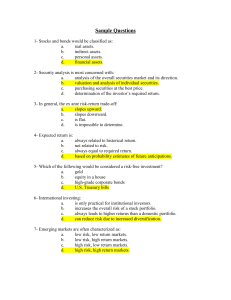

Capital Market

... The money markets are used for the raising of short term finance, sometimes for loans that are expected to be paid back as early as overnight. Funds borrowed from the money markets are typically used for general operating expenses, to cover brief periods of illiquidity. ...

... The money markets are used for the raising of short term finance, sometimes for loans that are expected to be paid back as early as overnight. Funds borrowed from the money markets are typically used for general operating expenses, to cover brief periods of illiquidity. ...

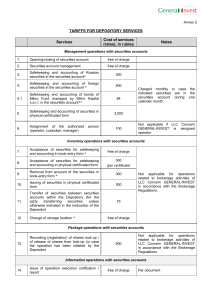

The Law of Ukraine On Securities and Stock Market of 23.02.2006

... securities as: bonds of enterprises, bonds of local loans, state bonds of Ukraine, treasury obligations of Ukraine, investment certificates and savings (depository) certificates. It is noted that professional activity on the stock market is an activity of legal entities on rendering financial and ot ...

... securities as: bonds of enterprises, bonds of local loans, state bonds of Ukraine, treasury obligations of Ukraine, investment certificates and savings (depository) certificates. It is noted that professional activity on the stock market is an activity of legal entities on rendering financial and ot ...

Are you wondering why a company pulled your credit

... to tell us about on your loan application is a leading cause of mortgage fraud. This is done to ensure no new liabilities have been incurred since loan origination which could alter your ability to repay this loan. If any additional liabilities or an increase in existing credit is revealed during th ...

... to tell us about on your loan application is a leading cause of mortgage fraud. This is done to ensure no new liabilities have been incurred since loan origination which could alter your ability to repay this loan. If any additional liabilities or an increase in existing credit is revealed during th ...

Filing of Preliminary Prospectus for Initial Public

... “expect”, “estimate”, “will”, “anticipate”, “intend”, “believe” and “continue” or the negative thereof or similar variations. Actual results may differ materially from those currently anticipated in such statements and the Company undertakes no obligation to update such statements, except as require ...

... “expect”, “estimate”, “will”, “anticipate”, “intend”, “believe” and “continue” or the negative thereof or similar variations. Actual results may differ materially from those currently anticipated in such statements and the Company undertakes no obligation to update such statements, except as require ...

ACC 557 Week 5 DQ2 “ Receivables” Please respond to the

... is designed by the company once they decide that they are willing to take the risk of extending credit to customers. The factor that is most affected in today’s business environment is the economy and credit scores. You must ensure that the consumer you want to lend money too, or give a product or s ...

... is designed by the company once they decide that they are willing to take the risk of extending credit to customers. The factor that is most affected in today’s business environment is the economy and credit scores. You must ensure that the consumer you want to lend money too, or give a product or s ...

Chapter 2

... sale of debt or equity in the primary market. To underwrite a new security issue, the investment banker buys the entire issue at a guaranteed price from the issuing firm and resells the securities to institutional investors and the public. ...

... sale of debt or equity in the primary market. To underwrite a new security issue, the investment banker buys the entire issue at a guaranteed price from the issuing firm and resells the securities to institutional investors and the public. ...

INTRODUCTION TO

... Dividends can now only be paid out of actually realized gains : It will reduce both the quantum of dividends ...

... Dividends can now only be paid out of actually realized gains : It will reduce both the quantum of dividends ...

Application for an additional listing

... Beirut Stock Exchange Application for An Additional Listing Approval On the BSE ...

... Beirut Stock Exchange Application for An Additional Listing Approval On the BSE ...

Corporate Securities Law Prospectus Exemption

... the issuer and its securities and therefore should be able to subscribe for the same security without requiring the issuer to incur significant time and expense associated with preparing a prospectus or offering document. In essence, the Exemption represents a significantly streamlined avenue for re ...

... the issuer and its securities and therefore should be able to subscribe for the same security without requiring the issuer to incur significant time and expense associated with preparing a prospectus or offering document. In essence, the Exemption represents a significantly streamlined avenue for re ...

Treasury Terminology

... ‘Society for Worldwide Interbank Financial Telecommunication’ is a cooperative society created under Belgian law and having its Corporate Office at Brussels. The Society, which has been in operation since May 1977 and covers most of Western Europe and North America, operates a computer-guided commun ...

... ‘Society for Worldwide Interbank Financial Telecommunication’ is a cooperative society created under Belgian law and having its Corporate Office at Brussels. The Society, which has been in operation since May 1977 and covers most of Western Europe and North America, operates a computer-guided commun ...

New rules on collateral for securities in repurchase agreements

... On March 5, 2002 the Central Bank of Iceland announced plans to change which securities qualify for repurchase agreements. The main principle of the rules is that bonds will be usable as collateral for repurchase agreements, if they fulfil the following conditions: 1. Bonds shall be issued denominat ...

... On March 5, 2002 the Central Bank of Iceland announced plans to change which securities qualify for repurchase agreements. The main principle of the rules is that bonds will be usable as collateral for repurchase agreements, if they fulfil the following conditions: 1. Bonds shall be issued denominat ...

PDF

... management and related credit risk-trading activities.4 This is likely to be value-enhancing where it adds liquidity and helps to achieve a more efficient allocation, which would have been impossible before due to, for example, absent markets.5 In this context, pooling and tranching of credit risks, ...

... management and related credit risk-trading activities.4 This is likely to be value-enhancing where it adds liquidity and helps to achieve a more efficient allocation, which would have been impossible before due to, for example, absent markets.5 In this context, pooling and tranching of credit risks, ...

Introduction of Mega Solar Project Bond Trust

... provides solar power plant developers in Japan with a capital markets alternative that can provide debt financing prior to construction completion. It is the world’s first rated securities backed by solar renewable power projects. Project Bond Trust may provide huge benefits to both issuers and in ...

... provides solar power plant developers in Japan with a capital markets alternative that can provide debt financing prior to construction completion. It is the world’s first rated securities backed by solar renewable power projects. Project Bond Trust may provide huge benefits to both issuers and in ...

What Types of Financial Market Structures Exist

... dealers themselves post bid and asked prices for this asset and then stand ready to buy or sell units of this asset with anyone who chooses to trade at these posted prices. The dealers provide customers more flexibility in trading than brokers, because dealers can offset imbalances in the demand and ...

... dealers themselves post bid and asked prices for this asset and then stand ready to buy or sell units of this asset with anyone who chooses to trade at these posted prices. The dealers provide customers more flexibility in trading than brokers, because dealers can offset imbalances in the demand and ...

Investopedia explains `Credit Facility`

... company is how it will incorporate debt in its capital structure, at the same time it must consider the parameters of its equity financing. The company must look at its capital structure as a whole, determining how much capital it needs immediately and over time, and the combination of equity and de ...

... company is how it will incorporate debt in its capital structure, at the same time it must consider the parameters of its equity financing. The company must look at its capital structure as a whole, determining how much capital it needs immediately and over time, and the combination of equity and de ...

First Professional Doctorate of Acupuncture and Oriental Medicine

... certificate-seeking students and completed their degree or certificate within 150 percent of “normal time.” For example, for a four-year school, the graduation rate would be the percentage of students who completed that program within six years or less. Loan Default Rate: The percentage of student b ...

... certificate-seeking students and completed their degree or certificate within 150 percent of “normal time.” For example, for a four-year school, the graduation rate would be the percentage of students who completed that program within six years or less. Loan Default Rate: The percentage of student b ...

Fin Crisis Background

... Response of Consumers Increased access to credit and delusional optimism resulted in: Short-Term Speculative Focus Borrowing More and Saving Less ...

... Response of Consumers Increased access to credit and delusional optimism resulted in: Short-Term Speculative Focus Borrowing More and Saving Less ...

Schroders Outlook 2015: UK Corporate Bonds

... strategic bond fundsi, as well as equity and multi-asset income funds. In the hunt for yield driven by government intervention in financial markets, investors have become comfortable taking on additional corporate credit risk, but less sanguine about interest rate exposure or ‘duration’. This is bec ...

... strategic bond fundsi, as well as equity and multi-asset income funds. In the hunt for yield driven by government intervention in financial markets, investors have become comfortable taking on additional corporate credit risk, but less sanguine about interest rate exposure or ‘duration’. This is bec ...

Repurchase Agreements (Repo) - International Islamic Financial

... Paragraph 10 of International Accounting Standard 39 “Financial Instruments: Recognition and Measurement” defines “repurchase agreement (Repo) as an agreement to transfer a financial asset to another party in exchange for cash or other consideration and a concurrent obligation to reacquire the finan ...

... Paragraph 10 of International Accounting Standard 39 “Financial Instruments: Recognition and Measurement” defines “repurchase agreement (Repo) as an agreement to transfer a financial asset to another party in exchange for cash or other consideration and a concurrent obligation to reacquire the finan ...

Cash and Marketable Securities

... Global Company in the Czech Republic and Slovak Republic-Case of McDonald Financial Markets in the Czech Republic and their Regulation in the Context of Global Crisis Microsoft Business Activities in the Czech Republic Public Finance/ Health Care Sector in CR The Financial Aspects of doing Business ...

... Global Company in the Czech Republic and Slovak Republic-Case of McDonald Financial Markets in the Czech Republic and their Regulation in the Context of Global Crisis Microsoft Business Activities in the Czech Republic Public Finance/ Health Care Sector in CR The Financial Aspects of doing Business ...

National Settlement Depository

... ► NSD :The biggest securities depository functioning as non-banking credit organization ...

... ► NSD :The biggest securities depository functioning as non-banking credit organization ...