derivatives

... obligations, resulting in bankruptcy, liquidation, or a rescue effort of some kind. Barings failed in this way, when unauthorized trading left them with a large exposure to a drop in Japanese equity markets, and such a drop occurred in response to the Kobe earthquake. Credit risk is the risk that an ...

... obligations, resulting in bankruptcy, liquidation, or a rescue effort of some kind. Barings failed in this way, when unauthorized trading left them with a large exposure to a drop in Japanese equity markets, and such a drop occurred in response to the Kobe earthquake. Credit risk is the risk that an ...

Sources of Financing: Debt and Equity

... If you don’t know who the fool is on the deal, it’s you!...Michael Wolff ...

... If you don’t know who the fool is on the deal, it’s you!...Michael Wolff ...

Chapter 5

... Orders in Auction Markets Most NYSE volume from matched public buy and sell orders Specialists act as both brokers and dealers in the stocks assigned to ...

... Orders in Auction Markets Most NYSE volume from matched public buy and sell orders Specialists act as both brokers and dealers in the stocks assigned to ...

Venture capital, IPOs, and Seasoned Offerings

... Initial Public Offering (IPO) - First offering of stock to the general public. Underwriter - Firm that buys an issue of securities from a company and resells it to the public. Spread - Difference between public offer price and price paid by underwriter. ...

... Initial Public Offering (IPO) - First offering of stock to the general public. Underwriter - Firm that buys an issue of securities from a company and resells it to the public. Spread - Difference between public offer price and price paid by underwriter. ...

Debt Finance - LLEP Business Gateway

... 1. Loans and overdrafts – loans from banks or other lending institutions primarily take the form of overdrafts or fixed-term loans. There are also peer-to-peer (P2P) business loans and start-up loans; 2. Finance secured on assets – finance secured on assets includes debt instruments such as asset fi ...

... 1. Loans and overdrafts – loans from banks or other lending institutions primarily take the form of overdrafts or fixed-term loans. There are also peer-to-peer (P2P) business loans and start-up loans; 2. Finance secured on assets – finance secured on assets includes debt instruments such as asset fi ...

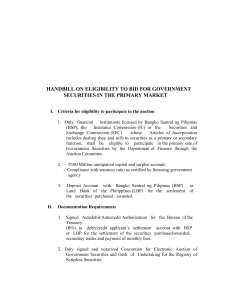

handbill on eligibility to bid for government securities in the primary

... UNIMPAIRED CAPITAL AND SURPLUS means the combined capital accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside fo ...

... UNIMPAIRED CAPITAL AND SURPLUS means the combined capital accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside fo ...

Lester Coyle - We look at where the bonds will be in a year

... Many double Bs should get upgraded as the senior notes pay down, and ratings-sensitive investors will pay more for a bond with an investment grade rating. Whereas many investors focus on the headline base yield, we look at where the bonds are likely to be in a year. What is the worst investment? We ...

... Many double Bs should get upgraded as the senior notes pay down, and ratings-sensitive investors will pay more for a bond with an investment grade rating. Whereas many investors focus on the headline base yield, we look at where the bonds are likely to be in a year. What is the worst investment? We ...

Securities Markets

... issuers to sell new securities over time after filing a single registration Private placement means new securities are sold directly to investors, bypassing the open market ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

... issuers to sell new securities over time after filing a single registration Private placement means new securities are sold directly to investors, bypassing the open market ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

TO THE SPANISH NATIONAL SECURITIES MARKET

... to a capital increase through an accelerated bookbuild offering, excluding the preemption right (the “Capital Increase”), the bookbuilding process carried on by BofA Merrill Lynch and Morgan Stanley & Co. International plc. (jointly, the “Joint Global Coordinators and Joint Bookrunners”), and BBVA i ...

... to a capital increase through an accelerated bookbuild offering, excluding the preemption right (the “Capital Increase”), the bookbuilding process carried on by BofA Merrill Lynch and Morgan Stanley & Co. International plc. (jointly, the “Joint Global Coordinators and Joint Bookrunners”), and BBVA i ...

Form 4 Statement of Changes in Beneficial Ownership of Securities

... Explanation of Responses (1) This Form 4 is filed by Elliott Associates, L.P. (the "Reporting Person"). The Reporting Person may be deemed to be a member of a Section 13(d) group that collectively beneficially owns more than 10% of the Issuer's outstanding shares of Common Stock. The Reporting Perso ...

... Explanation of Responses (1) This Form 4 is filed by Elliott Associates, L.P. (the "Reporting Person"). The Reporting Person may be deemed to be a member of a Section 13(d) group that collectively beneficially owns more than 10% of the Issuer's outstanding shares of Common Stock. The Reporting Perso ...

Roger Coffin, a lead Partner in our Regulatory Advisory

... Advisory Practice and a member of the PwC Global Regulatory Leadership team. Mr. Coffin has twenty years experience working with financial institutions on regulatory, compliance and control issues. Mr. Coffin is responsible for managing the firm’s investment management and securities industry practi ...

... Advisory Practice and a member of the PwC Global Regulatory Leadership team. Mr. Coffin has twenty years experience working with financial institutions on regulatory, compliance and control issues. Mr. Coffin is responsible for managing the firm’s investment management and securities industry practi ...

NSE scraps second-tier securities market, seeks stakeholders support

... dwindle with performance below expectations in terms of profitability and return on investment. Also, trading activities in this sector is so low that so far its contribution to the total market capitalization is less than one percent. The approval to go ahead with the name change has been given by ...

... dwindle with performance below expectations in terms of profitability and return on investment. Also, trading activities in this sector is so low that so far its contribution to the total market capitalization is less than one percent. The approval to go ahead with the name change has been given by ...

personal financial statement

... For the purpose of procuring and maintaining credit from time to time in any form whatsoever, for claims and demands against the undersigned, the undersigned submits the following as being a true and accurate statement of its financial condition on the following date, and agree that if any change oc ...

... For the purpose of procuring and maintaining credit from time to time in any form whatsoever, for claims and demands against the undersigned, the undersigned submits the following as being a true and accurate statement of its financial condition on the following date, and agree that if any change oc ...

Credit Basics

... • The average household with debt carries approximately $10-12,000 and has 9 credit cards • Americans shelled out more than $24 BILLION dollars in credit card fees in 2004 ...

... • The average household with debt carries approximately $10-12,000 and has 9 credit cards • Americans shelled out more than $24 BILLION dollars in credit card fees in 2004 ...

Test Your IQ (Investment Quotient)

... 1. Money Market Securities Which of the following is not a common characteristic of money market securities? a. sold on a discount basis b. mature in less than one year c. most important risk is default risk d. all of the above are characteristics 2. Money Market Securities Which of the following mo ...

... 1. Money Market Securities Which of the following is not a common characteristic of money market securities? a. sold on a discount basis b. mature in less than one year c. most important risk is default risk d. all of the above are characteristics 2. Money Market Securities Which of the following mo ...

The Financial Crisis

... forced banks to loan money to minorities who could not afford the houses that they acquired…and democrats are in the pockets of the big banks, of course. ...

... forced banks to loan money to minorities who could not afford the houses that they acquired…and democrats are in the pockets of the big banks, of course. ...

Seminar 8 - Wednesday 19-10-2016 questions

... and a 2 year duration (lifespan) of loan until full amortization b) Bond issue. Face value (principal) of AED 1,000,000, Coupon rate of 5% with payment annual and duration to maturity being 2 years. As an individual UAE registered firm your credit worthiness has been rated by Standard & Poors as “Ba ...

... and a 2 year duration (lifespan) of loan until full amortization b) Bond issue. Face value (principal) of AED 1,000,000, Coupon rate of 5% with payment annual and duration to maturity being 2 years. As an individual UAE registered firm your credit worthiness has been rated by Standard & Poors as “Ba ...

Introduction to Securities Law

... In this Unit, we will familiarise ourselves with some of the more common terms and concepts specific to securities law. We will also better understand the structure of the securities market, the manner ...

... In this Unit, we will familiarise ourselves with some of the more common terms and concepts specific to securities law. We will also better understand the structure of the securities market, the manner ...

interest rate

... Bond market – enables corporations and governments to borrow in order to finance their needs. Cost of borrowing results from the interest rate applied (interest rate = cost of money). Interest rates depend on the creditworthiness of the issuer/debtor, available collateral, and general availability o ...

... Bond market – enables corporations and governments to borrow in order to finance their needs. Cost of borrowing results from the interest rate applied (interest rate = cost of money). Interest rates depend on the creditworthiness of the issuer/debtor, available collateral, and general availability o ...

The Global Risk of Subprime

... unregulated, $3 trillion over-the-counter market for complex structured assets, some of which happen to contain subprime residential mortgages. • The subprime structured asset crisis of 2007 represents a sharp reversal in how global investors view all securitized assets and custom derivative structu ...

... unregulated, $3 trillion over-the-counter market for complex structured assets, some of which happen to contain subprime residential mortgages. • The subprime structured asset crisis of 2007 represents a sharp reversal in how global investors view all securitized assets and custom derivative structu ...

Air France-KLM successfully places a perpetual subordinated bond

... Air France-KLM successfully places a perpetual subordinated bond issue raising 400 million euros Air France-KLM has successfully placed yesterday an issue of perpetual subordinated bonds for an amount of 400 million euros. Investors indicated a very high level of interest for this issue, with an ord ...

... Air France-KLM successfully places a perpetual subordinated bond issue raising 400 million euros Air France-KLM has successfully placed yesterday an issue of perpetual subordinated bonds for an amount of 400 million euros. Investors indicated a very high level of interest for this issue, with an ord ...