Firms and Financial Markets

... • The securities market allow businesses and individual investors to trade the securities issued by public corporations. – The primary market is a market in which securities are bought and sold for the first time. In this market, the firm selling securities actually receives the money raised. For ex ...

... • The securities market allow businesses and individual investors to trade the securities issued by public corporations. – The primary market is a market in which securities are bought and sold for the first time. In this market, the firm selling securities actually receives the money raised. For ex ...

Finanical Crisis Facts

... To create these securities, the investment banks purchased home mortgage loans from the original lenders (originators) and bundles them together Sub-prime borrowers would eventually pay higher interest rates than traditional mortgage borrowers As a result, securities backed by subprime promised high ...

... To create these securities, the investment banks purchased home mortgage loans from the original lenders (originators) and bundles them together Sub-prime borrowers would eventually pay higher interest rates than traditional mortgage borrowers As a result, securities backed by subprime promised high ...

Grad Finale PPT - Valparaiso University

... May help make repayment more manageable by combining several federal loans into one monthly payment at one fixed interest rate. www.studentloans.gov ...

... May help make repayment more manageable by combining several federal loans into one monthly payment at one fixed interest rate. www.studentloans.gov ...

set 2 - Princeton University Press

... (maximum amount, lending terms, duration, commitment fee, option to convert into term loan at maturity?,…) Over 75% of commercial and industrial loans at large US banks = take-downs under loan commitments. Liability side : – long term debt and equity WHY? Concern about refinancing (Thakor-Hong-Green ...

... (maximum amount, lending terms, duration, commitment fee, option to convert into term loan at maturity?,…) Over 75% of commercial and industrial loans at large US banks = take-downs under loan commitments. Liability side : – long term debt and equity WHY? Concern about refinancing (Thakor-Hong-Green ...

Explaining Cross-Sectional Differences in Credit Default

... The Dodd-Frank Act extended the application of the antifraud provisions of the U.S. securities laws to instances where there is: (1) conduct within the United States that constitutes significant steps in furtherance of the violation, even if the securities transaction occurs outside the United State ...

... The Dodd-Frank Act extended the application of the antifraud provisions of the U.S. securities laws to instances where there is: (1) conduct within the United States that constitutes significant steps in furtherance of the violation, even if the securities transaction occurs outside the United State ...

Definition of commercial bank

... – products are: bank loans, commodities, currencies, derivatives ...

... – products are: bank loans, commodities, currencies, derivatives ...

Gift of Publicly Listed Securities Form (Dec 2015)

... I understand that I will receive a Gift-in-Kind tax receipt for these securities from Big Brothers Big Sisters of Toronto for the closing price, on the date these securities are received in BBBST’s account. These securities have been donated to BBBST without restriction and can be sold by BBBST at a ...

... I understand that I will receive a Gift-in-Kind tax receipt for these securities from Big Brothers Big Sisters of Toronto for the closing price, on the date these securities are received in BBBST’s account. These securities have been donated to BBBST without restriction and can be sold by BBBST at a ...

Lessons from the Financial Crisis

... Losses on ABS, especially CDO’s, are gigantic. Losses on ABS CDO’s eventually account for 42% of total bank writedowns (Benmelech and Dlugosz) ...

... Losses on ABS, especially CDO’s, are gigantic. Losses on ABS CDO’s eventually account for 42% of total bank writedowns (Benmelech and Dlugosz) ...

Practice Exam 3

... C) Was worsened by the implementing of tighter regulations regarding asset holdings. D) Was worsened by the ceilings on interest rates which banks and S&L's could pay customers. 14) Financial intermediaries, particularly banks, A) are experts in the production of information about firms so that it c ...

... C) Was worsened by the implementing of tighter regulations regarding asset holdings. D) Was worsened by the ceilings on interest rates which banks and S&L's could pay customers. 14) Financial intermediaries, particularly banks, A) are experts in the production of information about firms so that it c ...

Security Analysis and Portfolio Management

... any kind of financial transaction refers to financial market. Financial market is a platform where buyers and sellers are involved in sale and purchase of financial products like shares, mutual funds, bonds and so on. ...

... any kind of financial transaction refers to financial market. Financial market is a platform where buyers and sellers are involved in sale and purchase of financial products like shares, mutual funds, bonds and so on. ...

Hybrids: What you need to know

... believes they have a known cash flow. However, depending on the structure and future interest rates movements, this cash flow can fluctuate and in a worst case scenario, can also be halted. At the conversion date, holders may have different options, such as; converting the securities into the underl ...

... believes they have a known cash flow. However, depending on the structure and future interest rates movements, this cash flow can fluctuate and in a worst case scenario, can also be halted. At the conversion date, holders may have different options, such as; converting the securities into the underl ...

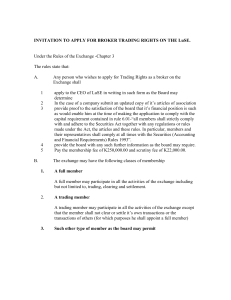

APPLICATION FOR LuSE MEMBERSHIP

... as would enable him at the time of making the application to comply with the capital requirement contained in rule 6.01-“all members shall strictly comply with and adhere to the Securities Act together with any regulations or rules made under the Act, the articles and these rules. In particular, mem ...

... as would enable him at the time of making the application to comply with the capital requirement contained in rule 6.01-“all members shall strictly comply with and adhere to the Securities Act together with any regulations or rules made under the Act, the articles and these rules. In particular, mem ...

RTF

... collateral having a market value, as determined by reliable and continuously available price quotations, at least equal to the amount of the loan or extension of credit outstanding, shall not exceed the greater of (i) ten percent (10%) of the sum of the bank's capital plus those portions of the bank ...

... collateral having a market value, as determined by reliable and continuously available price quotations, at least equal to the amount of the loan or extension of credit outstanding, shall not exceed the greater of (i) ten percent (10%) of the sum of the bank's capital plus those portions of the bank ...

G.S. 53C-6-1

... collateral having a market value, as determined by reliable and continuously available price quotations, at least equal to the amount of the loan or extension of credit outstanding, shall not exceed the greater of (i) ten percent (10%) of the sum of the bank's capital plus those portions of the bank ...

... collateral having a market value, as determined by reliable and continuously available price quotations, at least equal to the amount of the loan or extension of credit outstanding, shall not exceed the greater of (i) ten percent (10%) of the sum of the bank's capital plus those portions of the bank ...

FLCLASS Investment Policy - Florida Cooperative Liquid Assets

... Federal Home Loan Mortgage Corporation, the Federal National Mortgage Association, the ExportImport Bank, the Tennessee Valley Authority, the Government National Mortgage Association, the World Bank, or an entity or organization that is not listed in this paragraph but that is created by, or the cre ...

... Federal Home Loan Mortgage Corporation, the Federal National Mortgage Association, the ExportImport Bank, the Tennessee Valley Authority, the Government National Mortgage Association, the World Bank, or an entity or organization that is not listed in this paragraph but that is created by, or the cre ...

Broker-dealer Companies Indicators

... 15. Trading in securities where the owners give authorisation to third parties to manage their shareowner’s and money accounts where there are ‘connected’ money transactions in trading securities between owners and authorised persons. 16. Trading in securities for the benefit of offshore legal entit ...

... 15. Trading in securities where the owners give authorisation to third parties to manage their shareowner’s and money accounts where there are ‘connected’ money transactions in trading securities between owners and authorised persons. 16. Trading in securities for the benefit of offshore legal entit ...

1 WORKDAY, INC. POLICY ON HEDGING IN SECURITIES The

... Investing in Workday’s securities provides an opportunity to share in the future growth of Workday. Investment in Workday and sharing in the growth of Workday, however, does not mean short-range speculation based on fluctuations in the market. Therefore, you may not trade in options, warrants, puts ...

... Investing in Workday’s securities provides an opportunity to share in the future growth of Workday. Investment in Workday and sharing in the growth of Workday, however, does not mean short-range speculation based on fluctuations in the market. Therefore, you may not trade in options, warrants, puts ...

Syndicated Loans as Securities

... The Judge prefaced his opinion with the remark that the majority opinion “misreads the facts, makes bad banking law and bad securities law, and stands on its head the law of this circuit and of the Supreme Court in Reves v. Ernst & Young.” He considered that the participants, “rather than being comm ...

... The Judge prefaced his opinion with the remark that the majority opinion “misreads the facts, makes bad banking law and bad securities law, and stands on its head the law of this circuit and of the Supreme Court in Reves v. Ernst & Young.” He considered that the participants, “rather than being comm ...

Securities and Exchange Commission v. Ralston Purina Co

... Is an offering of treasury stock to corporate employees within the exemption of §4(2) of the Securities Act of 1933? Holding No. Securities Act of 1933 §4(2) exempts only those offerings that are not a public offering. Absent special circumstances, stock sale to employees is a public offering. The U ...

... Is an offering of treasury stock to corporate employees within the exemption of §4(2) of the Securities Act of 1933? Holding No. Securities Act of 1933 §4(2) exempts only those offerings that are not a public offering. Absent special circumstances, stock sale to employees is a public offering. The U ...

Obtaining Short-Term Financing VS Long

... greater the risk a lender takes in making a loan, the higher the interest rate required. By Issuing Bonds 1. Indenture term-The terms of agreement in a bond issue 2. Secured bond- A bond issued with some form of collateral 3. Unsecured Bond- A bond backed only by the reputation of the issuer; also c ...

... greater the risk a lender takes in making a loan, the higher the interest rate required. By Issuing Bonds 1. Indenture term-The terms of agreement in a bond issue 2. Secured bond- A bond issued with some form of collateral 3. Unsecured Bond- A bond backed only by the reputation of the issuer; also c ...

Lecture 2

... Can use these rights to constrain / motivate their ‘agents’. Legal, accounting, regulatory systems: To address the complicated principal-agent problems that arise in these situations. ...

... Can use these rights to constrain / motivate their ‘agents’. Legal, accounting, regulatory systems: To address the complicated principal-agent problems that arise in these situations. ...

FF018G

... holders of the Issuer’s securities dated ……………………as having been purchased or agreed to be purchased by it and the purchase consideration for all such property has been duly satisfied; ...

... holders of the Issuer’s securities dated ……………………as having been purchased or agreed to be purchased by it and the purchase consideration for all such property has been duly satisfied; ...

Financial Markets

... from investors Selling of new securities is handled by investment dealers Investment dealers act as intermediaries between buyers and sellers ...

... from investors Selling of new securities is handled by investment dealers Investment dealers act as intermediaries between buyers and sellers ...

3.1 Sources of Financing Part 2

... Cannot raise money with sale of stock Unlikely to be able to issue a bond ...

... Cannot raise money with sale of stock Unlikely to be able to issue a bond ...