Bond Markets in Latin America

... • But it’s financial markets overall that are small in Latin America (and bond markets are not ...

... • But it’s financial markets overall that are small in Latin America (and bond markets are not ...

Module 15 Credit Review

... granting credit or approving a loan. • Provide the following information: – Salary, Employer, Outstanding Credit (Debt), Assets, Credit References, Checking and Savings ...

... granting credit or approving a loan. • Provide the following information: – Salary, Employer, Outstanding Credit (Debt), Assets, Credit References, Checking and Savings ...

Lexis Securities Mosaic: SEC Forms Guide

... The registration of securities offered by a company to its employees as part of a This is the most frequently filed benefit plan or performance incentive plan. As such, it is almost always an equity registration statement. ...

... The registration of securities offered by a company to its employees as part of a This is the most frequently filed benefit plan or performance incentive plan. As such, it is almost always an equity registration statement. ...

Presentation to Hon`ble Finance Minister

... the directors must be independent. If the chairman is executive - at least half of the directors must be independent. Separate Meetings of Independent Directors ...

... the directors must be independent. If the chairman is executive - at least half of the directors must be independent. Separate Meetings of Independent Directors ...

by Pierre Lortie

... – Criticisms concerning the quality of enforcement are common in all jurisdictions. In the USA, the GAO reports on this matter are revealing – One cannot judge the quality and efficiency of law enforcement in a country by the number of suits and jail sentences. There are 1.6 million adults incarcera ...

... – Criticisms concerning the quality of enforcement are common in all jurisdictions. In the USA, the GAO reports on this matter are revealing – One cannot judge the quality and efficiency of law enforcement in a country by the number of suits and jail sentences. There are 1.6 million adults incarcera ...

Hutchins Center Roundtable discussion, presentation by Richard

... o The private sector barely made student loans available at any price until the government guaranteed them. o If private-sector companies were paid to provide food stamps, unemployment insurance, Social Security, SSI, or veterans disability (not just administer them, but also pay the benefits), they ...

... o The private sector barely made student loans available at any price until the government guaranteed them. o If private-sector companies were paid to provide food stamps, unemployment insurance, Social Security, SSI, or veterans disability (not just administer them, but also pay the benefits), they ...

Lecture 6

... rB be the required return to the debt rs be the required return to the firm's equity ro be the discount rate applied to the business risk of the firm ...

... rB be the required return to the debt rs be the required return to the firm's equity ro be the discount rate applied to the business risk of the firm ...

Chapter 19 -- The Capital Market

... Privileged Subscription -- The sale of new securities in which existing shareholders are given a preference in purchasing these securities up to the proportion of common shares that they already own; also known as a rights offering. Preemptive Right -- The privilege of shareholders to maintain their ...

... Privileged Subscription -- The sale of new securities in which existing shareholders are given a preference in purchasing these securities up to the proportion of common shares that they already own; also known as a rights offering. Preemptive Right -- The privilege of shareholders to maintain their ...

Canada`s international transactions in securities

... partially offset by a $1.5 billion sale of non-US foreign shares. US stock prices were down by 1.9% in October. Canadian investment in foreign debt securities totalled $433 million in October, following two months of divestment. The investment activity was mainly in US corporate bonds and, to a less ...

... partially offset by a $1.5 billion sale of non-US foreign shares. US stock prices were down by 1.9% in October. Canadian investment in foreign debt securities totalled $433 million in October, following two months of divestment. The investment activity was mainly in US corporate bonds and, to a less ...

The Subprime Crisis And The Yin and Yang of Financial

... liquidity have made market participants and regulators became complacent about all types of potential risk But securitzation is not a free lunch: 1. It requires an in-depth understanding of credit risk not only for financial institutions but also for the common market participants 2. Firms that rely ...

... liquidity have made market participants and regulators became complacent about all types of potential risk But securitzation is not a free lunch: 1. It requires an in-depth understanding of credit risk not only for financial institutions but also for the common market participants 2. Firms that rely ...

The Asset-Backed Securities Markets, the Crisis

... credit rating process and the interplay between credit rating and regulatory capital requirements to shed some light on the role of credit rating on the ABS expansion and subsequent crisis. We then provide an historical perspective on the development of the ABS credit market to put the recent crisis ...

... credit rating process and the interplay between credit rating and regulatory capital requirements to shed some light on the role of credit rating on the ABS expansion and subsequent crisis. We then provide an historical perspective on the development of the ABS credit market to put the recent crisis ...

Mineral Mountain Resources Closes Private Placements for Gross

... Neither TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This release includes certain statements that may be deemed to be “forward-looking statements” and “ ...

... Neither TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This release includes certain statements that may be deemed to be “forward-looking statements” and “ ...

Collateralized Mortgage Obligations (CMOs)

... 1970 Ginnie Mae issued the first bonds backed by pools of mortgages to free up funds for more home loans 1977 The first private mortgage backed securities are sold 1983 Freddie Mac issues the first collateralized mortgage obligation, which allows investors to pick their level of risk ...

... 1970 Ginnie Mae issued the first bonds backed by pools of mortgages to free up funds for more home loans 1977 The first private mortgage backed securities are sold 1983 Freddie Mac issues the first collateralized mortgage obligation, which allows investors to pick their level of risk ...

Why Bail-In Securities Are Fool`s Gold

... The banking system is more “systemic” than almost any other because of its unusual degree of interconnectivity: One bank’s loan is another’s deposit. If banks held the bail-in securities of other banks, trouble at one bank would instantly spread to other banks. Interconnectivity would be reinforced, ...

... The banking system is more “systemic” than almost any other because of its unusual degree of interconnectivity: One bank’s loan is another’s deposit. If banks held the bail-in securities of other banks, trouble at one bank would instantly spread to other banks. Interconnectivity would be reinforced, ...

Economic Letter Economic Letter - Federal Reserve Bank of Dallas

... funds that pool money from investors to purchase securities. They are often categorized by the types of securities they invest in, including money market instruments (money market mutual funds), stocks (equity funds) and fixed-income securities (fixed-income funds, including ultra-short bond funds). ...

... funds that pool money from investors to purchase securities. They are often categorized by the types of securities they invest in, including money market instruments (money market mutual funds), stocks (equity funds) and fixed-income securities (fixed-income funds, including ultra-short bond funds). ...

PREMIUM NUTRIENTS BERHAD (“PNB” OR “COMPANY

... Paragraph 8.03 further provides that the cash company must ensure that its available cash be utilised only for implementing a proposal to acquire a new core business as approved by the Securities Commission or pro rata distributions to shareholders in the event it is unable to fulfil its obligations ...

... Paragraph 8.03 further provides that the cash company must ensure that its available cash be utilised only for implementing a proposal to acquire a new core business as approved by the Securities Commission or pro rata distributions to shareholders in the event it is unable to fulfil its obligations ...

short selling regulations

... with a public float capitalisation of not less than HK$20 billion for a period of 20 consecutive trading days commencing from the second day of their listing on the Exchange and an aggregate turnover of not less than HK$500 million during such period; and ...

... with a public float capitalisation of not less than HK$20 billion for a period of 20 consecutive trading days commencing from the second day of their listing on the Exchange and an aggregate turnover of not less than HK$500 million during such period; and ...

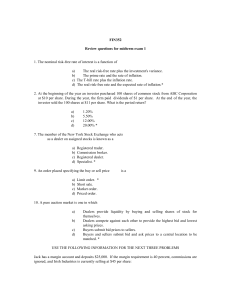

FIN432 - CSUN.edu

... The prime rate and the rate of inflation. c) The T-bill rate plus the inflation rate. d) The real risk-free rate and the expected rate of inflation.* 2. At the beginning of the year an investor purchased 100 shares of common stock from ABC Corporation at $10 per share. During the year, the firm paid ...

... The prime rate and the rate of inflation. c) The T-bill rate plus the inflation rate. d) The real risk-free rate and the expected rate of inflation.* 2. At the beginning of the year an investor purchased 100 shares of common stock from ABC Corporation at $10 per share. During the year, the firm paid ...

1 REVISION 2 I WHAT ARE THE OPPOSITES? income

... 4. L__________ means that a company has enough cash or assets that can easily be turned into cash to cover its liabilities. 5. C_______ o________ include purchases of fixed and financial assets, running expenses, interest payments, taxation and payment of dividends. 6. Listed companies have to a____ ...

... 4. L__________ means that a company has enough cash or assets that can easily be turned into cash to cover its liabilities. 5. C_______ o________ include purchases of fixed and financial assets, running expenses, interest payments, taxation and payment of dividends. 6. Listed companies have to a____ ...

Obama`s Financial Plan, Round One

... influence it more in Congress," Shrum told a gathering of financial-company representatives Wednesday morning. "In this environment, I think the risk of not being at the table is very high." So which issues are likely to be the most contentious? Here are four: CONSUMER PROTECTION Perhaps the boldest ...

... influence it more in Congress," Shrum told a gathering of financial-company representatives Wednesday morning. "In this environment, I think the risk of not being at the table is very high." So which issues are likely to be the most contentious? Here are four: CONSUMER PROTECTION Perhaps the boldest ...

State of Connecticut Stable Value Fund

... registered investment under the 1940 Act and has not been registered with the Securities and Exchange Commission. How is the rate of interest stated? Participant balances are credited interest daily. The interest rate on the Connecticut Stable Value Fund is declared at least quarterly and is listed ...

... registered investment under the 1940 Act and has not been registered with the Securities and Exchange Commission. How is the rate of interest stated? Participant balances are credited interest daily. The interest rate on the Connecticut Stable Value Fund is declared at least quarterly and is listed ...

Cash Flow: External Sources

... aware of any balloon payment provisions within your loan agreement and the impact that they can have on your cash flow. If included, these provisions will stipulate that the loan be paid off prior to the end of the loan period. For example, a twenty-five year note for the purchase of a building coul ...

... aware of any balloon payment provisions within your loan agreement and the impact that they can have on your cash flow. If included, these provisions will stipulate that the loan be paid off prior to the end of the loan period. For example, a twenty-five year note for the purchase of a building coul ...

Opinion Letter - Vision Financial Markets

... 1. Seller is not an “affiliate” of the Company and has not been for at least the preceding three (3) months; (or if an entity) None of the officers, directors or managers of Seller is a director, executive officer or 10% shareholder of the Company nor has been one for at least the preceding 90 days; ...

... 1. Seller is not an “affiliate” of the Company and has not been for at least the preceding three (3) months; (or if an entity) None of the officers, directors or managers of Seller is a director, executive officer or 10% shareholder of the Company nor has been one for at least the preceding 90 days; ...