Announces Filing of Final Prospectus for Bought Deal Prospectus

... expenditure activities in Colombia and for general corporate and working capital purposes. The Corporation's on-going capital expenditures are expected to be incurred in connection with drilling, completion and equipping operations by the Corporation, as well as land, seismic, facilities constructio ...

... expenditure activities in Colombia and for general corporate and working capital purposes. The Corporation's on-going capital expenditures are expected to be incurred in connection with drilling, completion and equipping operations by the Corporation, as well as land, seismic, facilities constructio ...

Valneva Closes Acquisition of Dukoral Vaccine

... trials for product candidates, the ability to manufacture, market, commercialize and achieve market acceptance for product candidates, the ability to protect intellectual property and operate the business without infringing on the intellectual property rights of others, estimates for future performa ...

... trials for product candidates, the ability to manufacture, market, commercialize and achieve market acceptance for product candidates, the ability to protect intellectual property and operate the business without infringing on the intellectual property rights of others, estimates for future performa ...

Chapter 3 Financial Instruments, Financial Markets, and Financial

... parts of Europe, such as Netherlands. Ironically, it had been preceded by a period of great prosperity for Britain. The mid 1760s and 1770s saw a credit boom which spurred greater manufacturing and industrial activity. The period of 1770 to 1772 was politically very stable for Britain and its colony ...

... parts of Europe, such as Netherlands. Ironically, it had been preceded by a period of great prosperity for Britain. The mid 1760s and 1770s saw a credit boom which spurred greater manufacturing and industrial activity. The period of 1770 to 1772 was politically very stable for Britain and its colony ...

Wealth and balance sheet effects of exchange rate In addition to its

... wealth and net worth on the availability of bank loans. It is usually difficult and costly for banks to directly assess the clients’ future capacity to repay loans. As a result, households’ wealth and companies’ net worth, as synthetic indicators, are important factors underlying the decision to gra ...

... wealth and net worth on the availability of bank loans. It is usually difficult and costly for banks to directly assess the clients’ future capacity to repay loans. As a result, households’ wealth and companies’ net worth, as synthetic indicators, are important factors underlying the decision to gra ...

Reserves/Reserve Requirements Review

... the next 3 questions: • A bank has excess reserves of $10,000 and deposit liabilities of $40,000 when the required reserve ratio is 20 percent. • 6) Required Reserves: • 7) Total Reserves: • 8) If the reserve ratio is raised to 25, what will the new required reserves be? • 9) If the reserve ratio is ...

... the next 3 questions: • A bank has excess reserves of $10,000 and deposit liabilities of $40,000 when the required reserve ratio is 20 percent. • 6) Required Reserves: • 7) Total Reserves: • 8) If the reserve ratio is raised to 25, what will the new required reserves be? • 9) If the reserve ratio is ...

WHOLE FOODS MARKET INC (Form: 8-K, Received

... convertible subordinated debentures. The debentures, priced with an annual accretion rate of 5% and an initial conversion premium of 23.90%, will result in gross proceeds to the Company of approximately $100 million. The Company may issue an additional amount of debentures to cover over-allotments, ...

... convertible subordinated debentures. The debentures, priced with an annual accretion rate of 5% and an initial conversion premium of 23.90%, will result in gross proceeds to the Company of approximately $100 million. The Company may issue an additional amount of debentures to cover over-allotments, ...

Margin Handbook

... believe that a firm must contact them for a margin call to be valid, and that the firm cannot liquidate securities or other assets in their accounts to meet the call unless the firm has contacted them first. This is not the case. While we will attempt to notify you of margin calls, we are not requir ...

... believe that a firm must contact them for a margin call to be valid, and that the firm cannot liquidate securities or other assets in their accounts to meet the call unless the firm has contacted them first. This is not the case. While we will attempt to notify you of margin calls, we are not requir ...

Nippon Sheet Glass Decides to Issue Preferred Shares— Outcome

... through third-party allocation. The allocation will made to a fund centered on Sumitomo Mitsui Banking Corporation, the Company’s main financing bank, along with other entities. The proceeds from the issuance will be appropriated for debt repayment and capital investments related to the manufacturin ...

... through third-party allocation. The allocation will made to a fund centered on Sumitomo Mitsui Banking Corporation, the Company’s main financing bank, along with other entities. The proceeds from the issuance will be appropriated for debt repayment and capital investments related to the manufacturin ...

Non-Bank Finance Companies Criteria

... and predictability of earnings over a period rather than a position at a particular point in time. Ind-Ra also looks at operating expenses relative to loans or leases, including the mix of variable and fixed costs. Ind-Ra recognizes that NBFCs may have very different cost structures. For example, an ...

... and predictability of earnings over a period rather than a position at a particular point in time. Ind-Ra also looks at operating expenses relative to loans or leases, including the mix of variable and fixed costs. Ind-Ra recognizes that NBFCs may have very different cost structures. For example, an ...

Securities Trading Policy

... Securities (or any financial products associated with the Group's Securities) while in possession of price sensitive information. In addition, the General Trading Policy for Restricted Persons (see section 1.2 above) sets out additional restrictions which apply to Restricted Persons. The law imposes ...

... Securities (or any financial products associated with the Group's Securities) while in possession of price sensitive information. In addition, the General Trading Policy for Restricted Persons (see section 1.2 above) sets out additional restrictions which apply to Restricted Persons. The law imposes ...

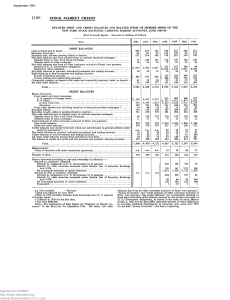

Detailed Debit and Credit Balances and Related Items of Member

... Entirely by obligations of U. S. Government or its agencies Entirely by other securities exempted under Section 3 (a) of Securities Exchange Act—1934 By nonexempt securities or mixed collateral Secured by firm or partners' collateral: Entirely by obligations of U S. Government or its agencies Entire ...

... Entirely by obligations of U. S. Government or its agencies Entirely by other securities exempted under Section 3 (a) of Securities Exchange Act—1934 By nonexempt securities or mixed collateral Secured by firm or partners' collateral: Entirely by obligations of U S. Government or its agencies Entire ...

Developing corporate bond markets in Asia, BIS Papers No 26, Part

... restriction impedes genuine capital market activity. Prospectus requirements for issuing bonds in Singapore have also been streamlined. An issuer can now make multiple offers of separate tranches of debentures under a debenture issuance programme, provided that it registers with the MAS a base prosp ...

... restriction impedes genuine capital market activity. Prospectus requirements for issuing bonds in Singapore have also been streamlined. An issuer can now make multiple offers of separate tranches of debentures under a debenture issuance programme, provided that it registers with the MAS a base prosp ...

Order book for Retail Bonds factsheet

... London Stock Exchange’s electronic Order book for Retail Bonds (ORB) was launched in February 2010 in response to growing private investor demand for easier access to bond trading. It offers a cost-effective, transparent and efficient platform for concentrating on-screen liquidity and facilitating p ...

... London Stock Exchange’s electronic Order book for Retail Bonds (ORB) was launched in February 2010 in response to growing private investor demand for easier access to bond trading. It offers a cost-effective, transparent and efficient platform for concentrating on-screen liquidity and facilitating p ...

Euronav NV (Form: 6-K, Received: 01/05/2017 16:12:38)

... it has entered into a five-year sale and leaseback agreement for four VLCC vessels with investment vehicles advised by Wafra Capital Partners Inc., a private equity partnership. The four VLCCs are the Nautilus (2006), Navarin (2007), Neptun (2007) and Nucleus (2007). The transaction assumes a net en ...

... it has entered into a five-year sale and leaseback agreement for four VLCC vessels with investment vehicles advised by Wafra Capital Partners Inc., a private equity partnership. The four VLCCs are the Nautilus (2006), Navarin (2007), Neptun (2007) and Nucleus (2007). The transaction assumes a net en ...

Finance - Leeds Beckett University

... Disadvantages If family or friends are involved, could cause ill feeling in event of default. Costs Flexible -as agreed between parties. Regional Venture Capital These regionally based companies provide equity and loan finance from £50,000 up to £500,000. Some have specifically targeted funds to ...

... Disadvantages If family or friends are involved, could cause ill feeling in event of default. Costs Flexible -as agreed between parties. Regional Venture Capital These regionally based companies provide equity and loan finance from £50,000 up to £500,000. Some have specifically targeted funds to ...

policy

... The Government may create a mutual fund out of its share in public sector corporations. Leasing based securities may also be helpful in replacing the interest based savings instruments with shariah compliant securities. ...

... The Government may create a mutual fund out of its share in public sector corporations. Leasing based securities may also be helpful in replacing the interest based savings instruments with shariah compliant securities. ...

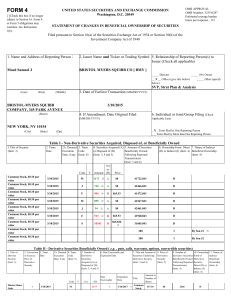

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting of one-quarter of market share units granted on March 10, 2014. ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to ...

... ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting of one-quarter of market share units granted on March 10, 2014. ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to ...

RMS Policy - Adinath Capital Services Limited

... is reversed by the end of the day by making a contra sale (or purchase) of the exact same quantity, thereby nullifying the original position. 2.2) Delivery Trades: The net purchase or sale of a scrip in a client account that is settled by way of a delivery on T+2. Delivery in respect of sale transac ...

... is reversed by the end of the day by making a contra sale (or purchase) of the exact same quantity, thereby nullifying the original position. 2.2) Delivery Trades: The net purchase or sale of a scrip in a client account that is settled by way of a delivery on T+2. Delivery in respect of sale transac ...

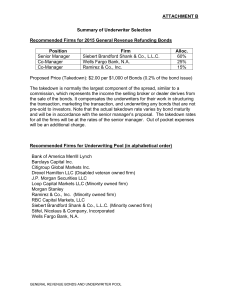

Download attachment

... approaches. The first approach was to study the validity of conventional instruments used by the local capital market from the Shariah perspective. The study focused on the structure, mechanism and use of the instruments to ascertain whether they were against Shariah principles. The second approach ...

... approaches. The first approach was to study the validity of conventional instruments used by the local capital market from the Shariah perspective. The study focused on the structure, mechanism and use of the instruments to ascertain whether they were against Shariah principles. The second approach ...

Securities Markets Primary Versus Secondary Markets How

... borrow up to 50% of the stock value Set by the Fed Maintenance margin: margin: minimum amount equity in trading can be before additional funds must be put into the account Margin call: call: notification from broker you must put up additional funds ...

... borrow up to 50% of the stock value Set by the Fed Maintenance margin: margin: minimum amount equity in trading can be before additional funds must be put into the account Margin call: call: notification from broker you must put up additional funds ...

DOC - ESW Group

... LLP (“MSCM”), the Company’s independent registered public accountants, merged with MNP LLP (“MNP”). Most of the professional staff of MSCM continued with MNP either as employees or partners of MNP and will continue their practice with MNP. As a result of the merger and change in legal entity, MSCM r ...

... LLP (“MSCM”), the Company’s independent registered public accountants, merged with MNP LLP (“MNP”). Most of the professional staff of MSCM continued with MNP either as employees or partners of MNP and will continue their practice with MNP. As a result of the merger and change in legal entity, MSCM r ...

DOC - ESW Group

... Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): June 1, 2013 ...

... Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): June 1, 2013 ...

Measure of Market Risk

... Counterparty deafult is an extreme case, but losses can also occur when a counterparty’s credit quality decreases. Credit risk is an issue even when the bank holds only payment obligations. ¾ Liquidity Risk. The risk of losses because of travel-time delays of assets. ¾ Operational Risk. Fraud. ...

... Counterparty deafult is an extreme case, but losses can also occur when a counterparty’s credit quality decreases. Credit risk is an issue even when the bank holds only payment obligations. ¾ Liquidity Risk. The risk of losses because of travel-time delays of assets. ¾ Operational Risk. Fraud. ...