Beyond traditional way of financing

... capital • Cons: Long processing time; itself is not capital to be used ...

... capital • Cons: Long processing time; itself is not capital to be used ...

Notice of Issue Price and Selling Price for Offering in Japan [PDF

... Note: This press release does not constitute an offer of any securities for sale. This press release has been prepared for the purpose of publicly announcing that the Company has determined matters relating to the issuance of new shares and the secondary offering of its shares and not for the purpos ...

... Note: This press release does not constitute an offer of any securities for sale. This press release has been prepared for the purpose of publicly announcing that the Company has determined matters relating to the issuance of new shares and the secondary offering of its shares and not for the purpos ...

Creative Exit Strategies

... do projections to estimate changes expected – Higher margins on costs savings or change in workforce ...

... do projections to estimate changes expected – Higher margins on costs savings or change in workforce ...

Closure of share capital increase Saint

... solicitation of an order to buy or subscribe for securities. The distribution of this press release may be restricted by law or regulations in certain jurisdictions. Consequently, persons who are physically located in those jurisdictions and in which this press release is circulated, published or di ...

... solicitation of an order to buy or subscribe for securities. The distribution of this press release may be restricted by law or regulations in certain jurisdictions. Consequently, persons who are physically located in those jurisdictions and in which this press release is circulated, published or di ...

risk management strategies

... This CTCL set up gives us client level control. Limits to all clients are set based on SPAN methodology. The customer gets limits commensurate with the credit available in his account. Every order is routed invariably through the CTCL system. Online MTM of top N losers are monitored and appropriate ...

... This CTCL set up gives us client level control. Limits to all clients are set based on SPAN methodology. The customer gets limits commensurate with the credit available in his account. Every order is routed invariably through the CTCL system. Online MTM of top N losers are monitored and appropriate ...

Ocean Rig UDW Inc.

... Ocean Rig UDW Inc. Announces Pricing of 28,571,428 Shares of Common Stock Nicosia, Cyprus – June 3, 2015 – Ocean Rig UDW Inc. (NASDAQ: ORIG) (the “Company” or “Ocean Rig”) announced today that it priced the offering of 28,571,428 shares of its common stock, par value $0.01 per share, at a price of $ ...

... Ocean Rig UDW Inc. Announces Pricing of 28,571,428 Shares of Common Stock Nicosia, Cyprus – June 3, 2015 – Ocean Rig UDW Inc. (NASDAQ: ORIG) (the “Company” or “Ocean Rig”) announced today that it priced the offering of 28,571,428 shares of its common stock, par value $0.01 per share, at a price of $ ...

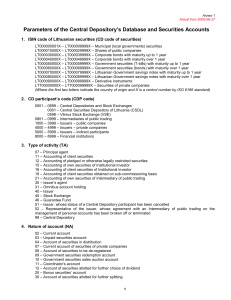

1. ISIN code of Lithuanian securities (CD code of securities)

... Parameters of the Central Depository’s Database and Securities Accounts 1. ISIN code of Lithuanian securities (CD code of securities) LT000000001X – LT000009999X – Municipal (local governments) securities LT000010000X – LT000029999X – Shares of public companies LT000030000X – LT000039999X – Corporat ...

... Parameters of the Central Depository’s Database and Securities Accounts 1. ISIN code of Lithuanian securities (CD code of securities) LT000000001X – LT000009999X – Municipal (local governments) securities LT000010000X – LT000029999X – Shares of public companies LT000030000X – LT000039999X – Corporat ...

ร่าง

... to hedging overall investment risks of the securities company or [ii] the performance of remaining obligation; (2) close out its derivatives positions unless: (a) entering into such derivatives contract for the purpose of hedging investment risks or obligation of the securities company; (b) such der ...

... to hedging overall investment risks of the securities company or [ii] the performance of remaining obligation; (2) close out its derivatives positions unless: (a) entering into such derivatives contract for the purpose of hedging investment risks or obligation of the securities company; (b) such der ...

Financial Statement Analysis and Security Valuation

... Amortized cost is based on the historical cost measurement rule and avoids manipulation in the financial statements. But historical cost does not capture any change in value since acquisition. Market prices give the change in value since acquisition. But (fair) market values can be biased if market ...

... Amortized cost is based on the historical cost measurement rule and avoids manipulation in the financial statements. But historical cost does not capture any change in value since acquisition. Market prices give the change in value since acquisition. But (fair) market values can be biased if market ...

table of contents - Napa County

... Treasurer may place further restrictions upon the types of investments for which money on deposit in the Treasury may be invested. Permitted investments and investment parameters for the Pooled Investment Fund are: A. U.S. Treasury Obligations -United States Treasury notes, bonds, bills, or certific ...

... Treasurer may place further restrictions upon the types of investments for which money on deposit in the Treasury may be invested. Permitted investments and investment parameters for the Pooled Investment Fund are: A. U.S. Treasury Obligations -United States Treasury notes, bonds, bills, or certific ...

How Interest Rates Work

... And if you couldn't borrow money, you could never buy a house or a car, or enjoy many of the other advantages of life with credit, like buying air tickets and paying bills online with a credit card. ...

... And if you couldn't borrow money, you could never buy a house or a car, or enjoy many of the other advantages of life with credit, like buying air tickets and paying bills online with a credit card. ...

Practice Problems - Matthew H. Shapiro

... d. Consider a more realistic market, where both firms and consumers are allowed to take out loans. Graph and explain what happens the equilibrium amount of loans and interest rate as the following sequence of events unfolds: ...

... d. Consider a more realistic market, where both firms and consumers are allowed to take out loans. Graph and explain what happens the equilibrium amount of loans and interest rate as the following sequence of events unfolds: ...

COPPER DEVELOPMENT Corp

... Irrevocably appointing each of the Secretary of the SEC and, the Securities Administrator or other legally designated officer of the State in which the Issuer maintains its principal place of business and any State in which this notice is filed, as its agents for service of process, and agreeing tha ...

... Irrevocably appointing each of the Secretary of the SEC and, the Securities Administrator or other legally designated officer of the State in which the Issuer maintains its principal place of business and any State in which this notice is filed, as its agents for service of process, and agreeing tha ...

Off-Balance Sheet Financing Off-balance sheet

... “Window Dressing” Financial Statements: Examples #1 • A company is concerned that its liquidity may not be perceived as sufficient. • Prior to the end of its financial reporting period it takes out a short-term loan from its bank in order to increase its reported cash balance. The same result can a ...

... “Window Dressing” Financial Statements: Examples #1 • A company is concerned that its liquidity may not be perceived as sufficient. • Prior to the end of its financial reporting period it takes out a short-term loan from its bank in order to increase its reported cash balance. The same result can a ...

Management Buy Outs

... LBOs use the assets or cash flows of the company to secure debt financing, bonds or bank loans, to purchase the outstanding equity of the company. ...

... LBOs use the assets or cash flows of the company to secure debt financing, bonds or bank loans, to purchase the outstanding equity of the company. ...

Mortgage Markets(9) - Rohan Chambers` Home Page

... Borrowers refinance if rates drop by paying off higher rate loan and financing at a new, lower rate Investor receives payoff but has to invest at the new, lower interest rate Manage the risk with ARMs or by selling loans soon after their origination ...

... Borrowers refinance if rates drop by paying off higher rate loan and financing at a new, lower rate Investor receives payoff but has to invest at the new, lower interest rate Manage the risk with ARMs or by selling loans soon after their origination ...

A Single Protocol for Clearing and Settlement?

... “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” ...

... “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” ...

A Single Protocol for Clearing and Settlement?

... “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” ...

... “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” ...

ELECTRO RENT CORP (Form: 4, Received: 08/10

... 6. Ownership Form: Direct 7. Nature of Indirect (D) or Indirect (I) (Instr. 4) Beneficial Ownership (Instr. ...

... 6. Ownership Form: Direct 7. Nature of Indirect (D) or Indirect (I) (Instr. 4) Beneficial Ownership (Instr. ...

Why should a company use a broker

... unregistered broker must therefore either admit they used the unregistered broker (and therefore subject themselves to the potential pitfalls) or file a false Form D (which can subject principals of the issuer to substantial penalties under Section 24 of the Securities Act of 1933). ► If an unregist ...

... unregistered broker must therefore either admit they used the unregistered broker (and therefore subject themselves to the potential pitfalls) or file a false Form D (which can subject principals of the issuer to substantial penalties under Section 24 of the Securities Act of 1933). ► If an unregist ...

Payroll Deduction and Authorization Form

... Effective immediately, I hereby authorize California Bear Credit Union to receive my payroll deduction in the amount indicated below per pay period. This authorization will remain in effect until the Credit Union or myself cancel it. I agree to hold harmless the Credit Union and its employees for an ...

... Effective immediately, I hereby authorize California Bear Credit Union to receive my payroll deduction in the amount indicated below per pay period. This authorization will remain in effect until the Credit Union or myself cancel it. I agree to hold harmless the Credit Union and its employees for an ...

TATA MOTORS LTD/FI (Form: 6-K, Received: 09/27

... Safe Harbor: Statements included herein may constitute “forward-looking statements”. Forward-looking statements are based on expectations, forecasts and assumptions by management and involve risks, uncertainties, and other factors that may cause our actual results, performance or achievements to mat ...

... Safe Harbor: Statements included herein may constitute “forward-looking statements”. Forward-looking statements are based on expectations, forecasts and assumptions by management and involve risks, uncertainties, and other factors that may cause our actual results, performance or achievements to mat ...

Investment Securities Internal Control Questionnaire

... a. The amount of any remuneration received or to be received, directly or indirectly, by any broker/dealer from the customer in connection with the transaction? b. The amount of any remuneration received or to be received by the bank from the customer and the source and amount of any other remunerat ...

... a. The amount of any remuneration received or to be received, directly or indirectly, by any broker/dealer from the customer in connection with the transaction? b. The amount of any remuneration received or to be received by the bank from the customer and the source and amount of any other remunerat ...

Financing Options for African universities by Amini

... options for accessing public and private funds for infrastructure. 1. What role can African pension funds play in reducing the cost of capital? 2. Why are we not issuing bonds to build educational infrastructure in Africa? In the US, private and public universities issue bonds for all sorts of capit ...

... options for accessing public and private funds for infrastructure. 1. What role can African pension funds play in reducing the cost of capital? 2. Why are we not issuing bonds to build educational infrastructure in Africa? In the US, private and public universities issue bonds for all sorts of capit ...