Formosa Bonds

... Management risk is the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired results, and that certain policies or developments may affect the investment techniques available to PIMCO in connection with managing the strategy. Derivatives may involve cert ...

... Management risk is the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired results, and that certain policies or developments may affect the investment techniques available to PIMCO in connection with managing the strategy. Derivatives may involve cert ...

Frequently Asked Questions on Rajiv Gandhi Equity Savings

... 5) What is the maximum amount that you may invest under RGESS for availing tax benefits? You may invest any amount up to Rs.50,000 in eligible securities to be held in your demat account designated for RGESS for availing tax benefits. 6) Can you invest more than Rs.50,000 and claim tax benefit under ...

... 5) What is the maximum amount that you may invest under RGESS for availing tax benefits? You may invest any amount up to Rs.50,000 in eligible securities to be held in your demat account designated for RGESS for availing tax benefits. 6) Can you invest more than Rs.50,000 and claim tax benefit under ...

Setting the Discount Rate for Valuing Pension Liabilities

... levels of public attention. By setting actuarial assumptions in accordance with plan experience and the best expectations of actuarial modeling, we attempt to minimize the differences between expected and actual experience as it emerges over time, with the ultimate aim of appropriately funding the p ...

... levels of public attention. By setting actuarial assumptions in accordance with plan experience and the best expectations of actuarial modeling, we attempt to minimize the differences between expected and actual experience as it emerges over time, with the ultimate aim of appropriately funding the p ...

FORWARD LOOKING STATEMENTS

... Certain statements included in this website and the documents incorporated into this website by hyperlink or reference contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities E ...

... Certain statements included in this website and the documents incorporated into this website by hyperlink or reference contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities E ...

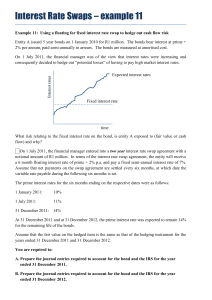

Interest Rate Swaps – example 11

... What risk relating to the fixed interest rate on the bond, is entity A exposed to (fair value or cash flow) and why? On 1 July 2011, the financial manager entered into a two year interest rate swap agreement with a notional amount of R1 million. In terms of the interest rate swap agreement, the enti ...

... What risk relating to the fixed interest rate on the bond, is entity A exposed to (fair value or cash flow) and why? On 1 July 2011, the financial manager entered into a two year interest rate swap agreement with a notional amount of R1 million. In terms of the interest rate swap agreement, the enti ...

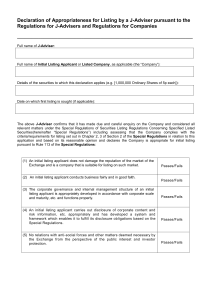

Declaration of Appropriateness for Listing by a J

... Full name of Initial Listing Applicant or Listed Company, as applicable (the “Company”): ...

... Full name of Initial Listing Applicant or Listed Company, as applicable (the “Company”): ...

CHAPTER 12

... Trading securities are current assets by definition. Individual held-to-maturity and available-for-sale securities are either current or noncurrent depending on when they are expected to be sold. It’s not necessary that a company report individual amounts for the three categories of investments – he ...

... Trading securities are current assets by definition. Individual held-to-maturity and available-for-sale securities are either current or noncurrent depending on when they are expected to be sold. It’s not necessary that a company report individual amounts for the three categories of investments – he ...

H R Khan: Promoting retail investor participation in government bonds

... competition from other instruments, many of them having tax benefits, such as, small savings schemes from the Government like Savings bonds and National Savings Certificates (NSCs). These instruments are targeted at the retail investors and the effective return on these instruments work out to be hi ...

... competition from other instruments, many of them having tax benefits, such as, small savings schemes from the Government like Savings bonds and National Savings Certificates (NSCs). These instruments are targeted at the retail investors and the effective return on these instruments work out to be hi ...

transparency in electronic business negotiations

... costs, the more transparent is the market. A certain level of price transparency is necessary for competition and to be able to compare prices. Some other studies are measuring level of transparency directly on B2B exchanges as a level of eservices providing tools for more transparent bidding and ne ...

... costs, the more transparent is the market. A certain level of price transparency is necessary for competition and to be able to compare prices. Some other studies are measuring level of transparency directly on B2B exchanges as a level of eservices providing tools for more transparent bidding and ne ...

PSF Floating Rate Loan - Pacific Life Annuities

... on the investments and investment strategies used. See the applicable underlying fund prospectus for more complete information regarding investment risks. Active Management The investment is actively managed and subject to the risk that the advisor's usage of investment techniques and risk analyses ...

... on the investments and investment strategies used. See the applicable underlying fund prospectus for more complete information regarding investment risks. Active Management The investment is actively managed and subject to the risk that the advisor's usage of investment techniques and risk analyses ...

Unemployment,Job creation and job destruction

... • Workers are not interchangeable parts. Skills and preferences vary as do job requirements. Takes time to match the individual and the job. • Changes in the composition of demand (sectoral shift), firm failure, poor job performance, desire for career change all contribute to frictional unemployment ...

... • Workers are not interchangeable parts. Skills and preferences vary as do job requirements. Takes time to match the individual and the job. • Changes in the composition of demand (sectoral shift), firm failure, poor job performance, desire for career change all contribute to frictional unemployment ...

Selected US Securities Law Issues

... – Rule 904 permits resale over a “designated offshore securities market” (including the TSX, TSXV and CSE) by non-affiliates of the issuer, or who are affiliates solely by virtue of being an officer or director of the issuer, subject to certain conditions – Rule 903, available to affiliates, require ...

... – Rule 904 permits resale over a “designated offshore securities market” (including the TSX, TSXV and CSE) by non-affiliates of the issuer, or who are affiliates solely by virtue of being an officer or director of the issuer, subject to certain conditions – Rule 903, available to affiliates, require ...

Amazing Market Why does the stock market exist? The answer

... shares of ownership to many stockholders. Shareholders would then own a portion of any earnings, while their potential loss was limited to the amount each had invested in a company's stock. As Hamilton had earlier recognized with government bonds, investors will buy new shares of stock only if they' ...

... shares of ownership to many stockholders. Shareholders would then own a portion of any earnings, while their potential loss was limited to the amount each had invested in a company's stock. As Hamilton had earlier recognized with government bonds, investors will buy new shares of stock only if they' ...

A How To Read Performance Report Guide

... still being held. Also called a paper profit or loss. It becomes a realized gain/loss when the security is actually sold or disposed of. ...

... still being held. Also called a paper profit or loss. It becomes a realized gain/loss when the security is actually sold or disposed of. ...

“Mini-Tender” Offer

... representing a discount of 4.33% and 4.41%, respectively, to the closing prices of Thomson Reuters shares on the Toronto Stock Exchange and New York Stock Exchange on September 10, 2014, the last trading day before the mini-tender offer was commenced. In addition, the offer is highly conditional. TR ...

... representing a discount of 4.33% and 4.41%, respectively, to the closing prices of Thomson Reuters shares on the Toronto Stock Exchange and New York Stock Exchange on September 10, 2014, the last trading day before the mini-tender offer was commenced. In addition, the offer is highly conditional. TR ...

WORD

... 5. Where the conditions under subparagraph 6 of the preceding point exist: When the aggregate dollar amount of transaction failures reported in a single day has been less than NT$10 million for each of the previous 6 business days and the figures for both long margin positions and open interest on ...

... 5. Where the conditions under subparagraph 6 of the preceding point exist: When the aggregate dollar amount of transaction failures reported in a single day has been less than NT$10 million for each of the previous 6 business days and the figures for both long margin positions and open interest on ...

Self Regulation - Superfinanciera

... Congress let stock exchanges continue to regulate own activity ...

... Congress let stock exchanges continue to regulate own activity ...

WB Credentials (Nov 09)

... Local banks can play a key role in balancing the market interest and closing the existing arbitrages ...

... Local banks can play a key role in balancing the market interest and closing the existing arbitrages ...

Jindal Saw (SAWPIP)

... tenders for water and oil & gas segments. Jindal Saw expects additional orders in the next few months. Over a medium to longer term horizon, within the water sector segment, specific and renewed focus of the Government of India on infrastructure, including urbanisation, is expected to accelerate. Th ...

... tenders for water and oil & gas segments. Jindal Saw expects additional orders in the next few months. Over a medium to longer term horizon, within the water sector segment, specific and renewed focus of the Government of India on infrastructure, including urbanisation, is expected to accelerate. Th ...

securities offerings on the internet

... require several years of revenue streams to attract Wall Street investment bankers. However, online issuers have tended to be very small in terms of revenue. Consequently, the amount of capital they have been able to raise has not been significant enough for them to be financially attractive to esta ...

... require several years of revenue streams to attract Wall Street investment bankers. However, online issuers have tended to be very small in terms of revenue. Consequently, the amount of capital they have been able to raise has not been significant enough for them to be financially attractive to esta ...

Asian Holdings of US Treasury Securities: Trade Integration as a

... equities (18%), Latin America is the opposite. They invest more in equities—more than double that of debt securities. Latin America’s holding of US Treasury is a mere 3% (in fact, only two countries, Brazil and Mexico, appear within the top 27 holders). The Asian share is apparently substantial, and ...

... equities (18%), Latin America is the opposite. They invest more in equities—more than double that of debt securities. Latin America’s holding of US Treasury is a mere 3% (in fact, only two countries, Brazil and Mexico, appear within the top 27 holders). The Asian share is apparently substantial, and ...

The Treasury Bill Auction and the When-Issued

... The rest of this paper is organized as follows. We outline, in Section 2, the institutional structure of the when-issued market and the auction for Treasury bills. In Section 3 we describe the data and some summary statistics. We find that on average it was about 2 basis points cheaper to buy 13-wee ...

... The rest of this paper is organized as follows. We outline, in Section 2, the institutional structure of the when-issued market and the auction for Treasury bills. In Section 3 we describe the data and some summary statistics. We find that on average it was about 2 basis points cheaper to buy 13-wee ...

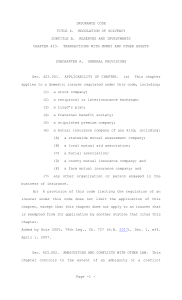

INSURANCE CODE TITLE 4. REGULATION OF SOLVENCY

... through which an insurer holds securities in the Federal Reserve book-entry system and the records of a custodian bank through which an insurer holds securities with a clearing corporation must show that the securities are held for the insurer and show the accounts for which the securities are held. ...

... through which an insurer holds securities in the Federal Reserve book-entry system and the records of a custodian bank through which an insurer holds securities with a clearing corporation must show that the securities are held for the insurer and show the accounts for which the securities are held. ...

our information brochure (PDF 197 KB)

... movements in exchange rates. It is highly suited to investors with assets in more than one currency, with investment plans in a foreign currency, or with a clear currency vision. A DCD will be of interest to you if you do not mind if the capital and interest are converted into an alternative currenc ...

... movements in exchange rates. It is highly suited to investors with assets in more than one currency, with investment plans in a foreign currency, or with a clear currency vision. A DCD will be of interest to you if you do not mind if the capital and interest are converted into an alternative currenc ...

HSI 12.31.16 - Stmt of Fin Condition

... instruments sold, not yet purchased, including debt and equity securities and derivative transactions, are reported in the statement of financial condition on a basis and are recorded at fair value. Refer to Note 5, "Financial Instruments Owned, at Fair Value and Financial Instruments Sold, Not Yet ...

... instruments sold, not yet purchased, including debt and equity securities and derivative transactions, are reported in the statement of financial condition on a basis and are recorded at fair value. Refer to Note 5, "Financial Instruments Owned, at Fair Value and Financial Instruments Sold, Not Yet ...