Repo and Securities Lending - Federal Reserve Bank of New York

... source of funding for securities dealers. Hence, the main collateral providers in the tri-party repo market are securities dealers—in particular, primary dealers. Some large hedge funds and other institutions with large portfolios of securities also borrow in the tri-party repo market, but they repr ...

... source of funding for securities dealers. Hence, the main collateral providers in the tri-party repo market are securities dealers—in particular, primary dealers. Some large hedge funds and other institutions with large portfolios of securities also borrow in the tri-party repo market, but they repr ...

unit – i investment setting - KV Institute of Management and

... Risk: Risk of holding securities is related with the probability of actual return becoming less than the expected return. The word risk is synonymous with the phrase variability of return. Investments’ risk is just as important as measuring its expected rate of return because minimizing risk and max ...

... Risk: Risk of holding securities is related with the probability of actual return becoming less than the expected return. The word risk is synonymous with the phrase variability of return. Investments’ risk is just as important as measuring its expected rate of return because minimizing risk and max ...

NBER WORKING PAPER SERIES COUNTRY RISK, FOREIGN BORROWING AND SOCIAL DISCOUNT RATE IN

... equation (9), it is necessary to carefully analyze the meanings of weights ...

... equation (9), it is necessary to carefully analyze the meanings of weights ...

DEUTSCHE BANK AKTIENGESELLSCHAFT (Form

... The Issuer’s estimated value of the securities is equal to the sum of our valuations of the following two components of the securities: (i) a bond and (ii) an embedded derivative(s). The value of the bond component of the securities is calculated based on the present value of the stream of cash paym ...

... The Issuer’s estimated value of the securities is equal to the sum of our valuations of the following two components of the securities: (i) a bond and (ii) an embedded derivative(s). The value of the bond component of the securities is calculated based on the present value of the stream of cash paym ...

Reducing the Fear of Inflation with TIPS

... change in interest rates. Duration is expressed as a number of years and allows bonds of different maturities and coupon rates to be directly compared. The higher the duration, the greater the magnitude of price change as interest rates change. In other words, long-term bonds carry greater interest ...

... change in interest rates. Duration is expressed as a number of years and allows bonds of different maturities and coupon rates to be directly compared. The higher the duration, the greater the magnitude of price change as interest rates change. In other words, long-term bonds carry greater interest ...

naic blanks (e) working group - National Association of Insurance

... that are still owned as of the end of the current reporting year (amounts purchased and sold during the current reporting year are reported in detail on Schedule D, Part 5 and only in subtotal in Schedule D, Part 3). This should include all transactions that adjust the cost basis of the securities. ...

... that are still owned as of the end of the current reporting year (amounts purchased and sold during the current reporting year are reported in detail on Schedule D, Part 5 and only in subtotal in Schedule D, Part 3). This should include all transactions that adjust the cost basis of the securities. ...

Fidelity Convertible Securities Investment Trust

... expressed or implied in any forward-looking statements made by the Fund. Any number of important factors could contribute to these digressions, including, but not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, glo ...

... expressed or implied in any forward-looking statements made by the Fund. Any number of important factors could contribute to these digressions, including, but not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, glo ...

Is Cash still King?

... and boosting consumer spending by influencing interest rates on retail lending. When accompanied by other measures such as quantitative easing, these combined actions help stimulate credit in economies and again encourage banks to lend money back into the economy. ...

... and boosting consumer spending by influencing interest rates on retail lending. When accompanied by other measures such as quantitative easing, these combined actions help stimulate credit in economies and again encourage banks to lend money back into the economy. ...

Foreign Exchange Management

... C. the maximum loan rate ceiling on loans in the international money D. the maximum interest rate offered on bonds that are issued in London. 16. The margin for a currency future should be maintained with the clearinghouse by A. The buyer. B. The seller. C. Both the buyer and the seller. D. Either t ...

... C. the maximum loan rate ceiling on loans in the international money D. the maximum interest rate offered on bonds that are issued in London. 16. The margin for a currency future should be maintained with the clearinghouse by A. The buyer. B. The seller. C. Both the buyer and the seller. D. Either t ...

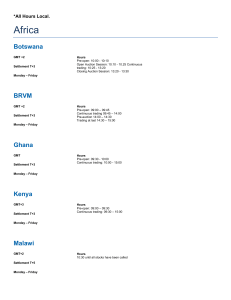

Global Trading Hours

... Static or dynamic price limits are set to avert sudden fluctuations in the prices of transferable securities. Price limits are determined as percentages of divergence from their reference prices. A price tolerance level of +/-30% from the previous day’s closing price is set for most securities. Vola ...

... Static or dynamic price limits are set to avert sudden fluctuations in the prices of transferable securities. Price limits are determined as percentages of divergence from their reference prices. A price tolerance level of +/-30% from the previous day’s closing price is set for most securities. Vola ...

Chapter 22 - The Citadel

... in the price of its stock, then the best predictor of tomorrow’s price is today’s price. Slide 22-40 ...

... in the price of its stock, then the best predictor of tomorrow’s price is today’s price. Slide 22-40 ...

Download attachment

... United Kingdom and rest of Europe: Except as otherwise specified herein, this material is communicated by UBS Limited, a subsidiary of UBS AG, to persons who are market counterparties or intermediate customers (as detailed in the FSA Rules) and is only available to such persons. The information cont ...

... United Kingdom and rest of Europe: Except as otherwise specified herein, this material is communicated by UBS Limited, a subsidiary of UBS AG, to persons who are market counterparties or intermediate customers (as detailed in the FSA Rules) and is only available to such persons. The information cont ...

Trial Measures for Overseas Securities Investment by Qualified

... implement the decisions on implementation according to the investment targets, strategies, policies, instructions and restrictions, fully disclose all the important facts involving the interest conflicts, and respect the secrecy of the clients’ information. Article 17 If the domestic institutional i ...

... implement the decisions on implementation according to the investment targets, strategies, policies, instructions and restrictions, fully disclose all the important facts involving the interest conflicts, and respect the secrecy of the clients’ information. Article 17 If the domestic institutional i ...

Sun Pharmaceuticals (SUNPHA)

... of 8-10% also looks a bit conservative given the residual traction from gGleevec (four months exclusivity), Japanese traction from H2 and likely product launches in H2FY17 from Halol (assuming USFDA resolution). This indicates that the management is expecting some genuine pricing pressure in the US ...

... of 8-10% also looks a bit conservative given the residual traction from gGleevec (four months exclusivity), Japanese traction from H2 and likely product launches in H2FY17 from Halol (assuming USFDA resolution). This indicates that the management is expecting some genuine pricing pressure in the US ...

Document

... As APX Eurolight trading system allows fast implementation and members support this: APX has started up national market, precursor to international Willingness to develop this further with international partners ...

... As APX Eurolight trading system allows fast implementation and members support this: APX has started up national market, precursor to international Willingness to develop this further with international partners ...

Chapter 5: The Structure of Interest Rates

... • Interest-rate risk one of main sources of risk to any security • Rate of discount has a relatively greater effect on the present value of long-term securities, rendering them riskier • Present value of bonds with longer time to maturity are higher • For a given change in interest rates on all bond ...

... • Interest-rate risk one of main sources of risk to any security • Rate of discount has a relatively greater effect on the present value of long-term securities, rendering them riskier • Present value of bonds with longer time to maturity are higher • For a given change in interest rates on all bond ...

Settlement model

... - Settlement of cash obligations on net basis (same day immediately after market close) via the RTGS system. - Clearing members (commercial banks : members of RTGS system) : real time trading caps based on certain collateral agreed with the brokerage firms. ...

... - Settlement of cash obligations on net basis (same day immediately after market close) via the RTGS system. - Clearing members (commercial banks : members of RTGS system) : real time trading caps based on certain collateral agreed with the brokerage firms. ...

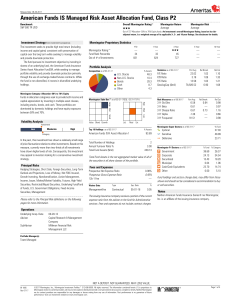

American Funds IS Managed Risk Asset Allocation Fund

... Deposit Insurance Corporation, the Federal Reserve Board, or any other U.S. governmental agency. Growth Investing Growth securities may be subject to increased volatility as the value of these securities is highly sensitive to market fluctuations and future earnings expectations. These securities ty ...

... Deposit Insurance Corporation, the Federal Reserve Board, or any other U.S. governmental agency. Growth Investing Growth securities may be subject to increased volatility as the value of these securities is highly sensitive to market fluctuations and future earnings expectations. These securities ty ...

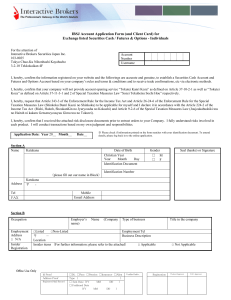

IBSJ Account Application Form (and Client Card) for Exchange listed

... Interactive Brokers (“IB”) can maintain its low commission structure because we have built automated trade processes to minimize human intervention and discretion. In this respect, we have established some simple terms which govern trading in all IB accounts. These rules recognize that from time to ...

... Interactive Brokers (“IB”) can maintain its low commission structure because we have built automated trade processes to minimize human intervention and discretion. In this respect, we have established some simple terms which govern trading in all IB accounts. These rules recognize that from time to ...

F2015L01378 F2015L01378 - Federal Register of Legislation

... bid class means the class of securities to which offers of securities under a foreign scrip bid relates. ...

... bid class means the class of securities to which offers of securities under a foreign scrip bid relates. ...

The essential How will the Fed`s balance sheet return to normal?

... ••First, raise the fed funds rates. ••Next, reduce securities holdings in a gradual and predictable fashion by ceasing to reinvest the repaid principal of maturing securities. ••Ultimately, the Fed “will hold no more securities than necessary to implement monetary policy efficiently and effectively, ...

... ••First, raise the fed funds rates. ••Next, reduce securities holdings in a gradual and predictable fashion by ceasing to reinvest the repaid principal of maturing securities. ••Ultimately, the Fed “will hold no more securities than necessary to implement monetary policy efficiently and effectively, ...

Custody of Client Assets

... surprise examination by an independent public accountant; and – If the adviser or one of its related persons actually maintains client funds or securities as a qualified custodian, the adviser must obtain an internal control report from an independent public accountant on an annual basis in addition ...

... surprise examination by an independent public accountant; and – If the adviser or one of its related persons actually maintains client funds or securities as a qualified custodian, the adviser must obtain an internal control report from an independent public accountant on an annual basis in addition ...

Using Data Envelopment Analysis to Select Efficient Large Market

... were found to be most desirable (referred to here as efficient), and an additional four were found to be somewhat desirable. Of these fourteen “efficient” stocks, several displayed robustness to unfavorable changes, while others did not. INTRODUCTION The decision to purchase stock can be difficult s ...

... were found to be most desirable (referred to here as efficient), and an additional four were found to be somewhat desirable. Of these fourteen “efficient” stocks, several displayed robustness to unfavorable changes, while others did not. INTRODUCTION The decision to purchase stock can be difficult s ...

Reporting Standard ARS 720.5 ABS/RBA Equity Securities Held

... Item 2 collects information on the value of equity securities held by the ADI or RFC that were issued by resident entities and not listed on the Australian Stock Exchange (ASX), by the counterparty of the issuer. Report all equity securities, including trading securities and investment securities, i ...

... Item 2 collects information on the value of equity securities held by the ADI or RFC that were issued by resident entities and not listed on the Australian Stock Exchange (ASX), by the counterparty of the issuer. Report all equity securities, including trading securities and investment securities, i ...