SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... (b) Each of the Reporting Persons and Covered Persons has the sole power to vote or direct the vote and sole power to dispose or to direct the disposition of the Securities reported for it, either for its own benefit or for the benefit of its investment clients or its partners, as the case may be, e ...

... (b) Each of the Reporting Persons and Covered Persons has the sole power to vote or direct the vote and sole power to dispose or to direct the disposition of the Securities reported for it, either for its own benefit or for the benefit of its investment clients or its partners, as the case may be, e ...

securities regulations

... - the optimal allocation of fin resources should be achieved by the maintenance of a free and open securities mkt - conditions: perfect knowledge of the mkt and mkt opportunities for both seller and buyer, free access to the mkt, complete mobility of financial resources - these conditions do not exi ...

... - the optimal allocation of fin resources should be achieved by the maintenance of a free and open securities mkt - conditions: perfect knowledge of the mkt and mkt opportunities for both seller and buyer, free access to the mkt, complete mobility of financial resources - these conditions do not exi ...

Download attachment

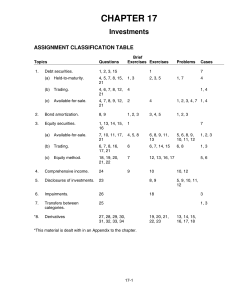

... A debt security is impaired when “it is probable that the investor will be unable to collect all amounts due according to the contractual terms.” When an impairment has occurred, the security is written down to its fair value, which is also the security’s new cost basis. The amount of the writedown ...

... A debt security is impaired when “it is probable that the investor will be unable to collect all amounts due according to the contractual terms.” When an impairment has occurred, the security is written down to its fair value, which is also the security’s new cost basis. The amount of the writedown ...

Primary Market

... • The cost of these long term financing means is known for the life of the asset ...

... • The cost of these long term financing means is known for the life of the asset ...

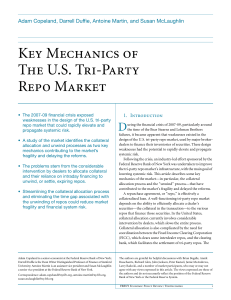

Key Mechanics of Tri-Party Repo Markets

... The GCF Repo Market The GCF (General Collateral Finance) repo market is a blindbrokered interdealer market, meaning that dealers involved in the transactions do not know each other’s identity. GCF trades are arranged by interdealer brokers that preserve the participant’s anonymity. Only securities t ...

... The GCF Repo Market The GCF (General Collateral Finance) repo market is a blindbrokered interdealer market, meaning that dealers involved in the transactions do not know each other’s identity. GCF trades are arranged by interdealer brokers that preserve the participant’s anonymity. Only securities t ...

Climate Policies Deserve a Negative Discount Rate

... The thesis defended in this Article is that using a negative discount rate to evaluate climate policies may be justified. This conclusion follows from two important steps, each of which is an interesting separate thesis. First, different policies should be evaluated with different discount rates, de ...

... The thesis defended in this Article is that using a negative discount rate to evaluate climate policies may be justified. This conclusion follows from two important steps, each of which is an interesting separate thesis. First, different policies should be evaluated with different discount rates, de ...

FSB Securities Lending and Repos: Market Overview and Financial

... leverage up to 140% of the value of the fund and run short positions up to 40%) and US investment funds registered under the Investment Company Act of 1940 (“1940 Act” funds). We note that some US “1940 Act” funds borrow securities for example in connection with short selling. However, such funds th ...

... leverage up to 140% of the value of the fund and run short positions up to 40%) and US investment funds registered under the Investment Company Act of 1940 (“1940 Act” funds). We note that some US “1940 Act” funds borrow securities for example in connection with short selling. However, such funds th ...

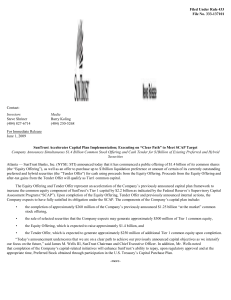

SUNTRUST BANKS INC (Form: FWP, Received: 06

... This news release may contain forward-looking statements. Statements regarding our expectations with respect to the Equity Offering and Tender Offer, our expectations with respect to our capital plan, the components and size thereof, and our ability to implement our capital plan are forward-looking ...

... This news release may contain forward-looking statements. Statements regarding our expectations with respect to the Equity Offering and Tender Offer, our expectations with respect to our capital plan, the components and size thereof, and our ability to implement our capital plan are forward-looking ...

Is Bitcoin a Security?

... found to be, Bitcoin miners are either acquiring securities directly from the issuer, or those who purchase Bitcoins from them are acquiring securities directly from the issuer; transactions on the blockchain are publicly disclosed, even if the transacting parties are identified only anonymously; an ...

... found to be, Bitcoin miners are either acquiring securities directly from the issuer, or those who purchase Bitcoins from them are acquiring securities directly from the issuer; transactions on the blockchain are publicly disclosed, even if the transacting parties are identified only anonymously; an ...

Armour Residential REIT, Inc.

... reporting period. Actual results could differ from those estimates. Significant estimates affecting the accompanying financial statements include the valuation of Agency Securities and interest rate contracts. Cash Cash includes cash on deposit with financial institutions and investments in high qua ...

... reporting period. Actual results could differ from those estimates. Significant estimates affecting the accompanying financial statements include the valuation of Agency Securities and interest rate contracts. Cash Cash includes cash on deposit with financial institutions and investments in high qua ...

Bond Markets

... and mutual funds) are the major suppliers of funds for Munis and corporate bonds foreign investors and governments are the major suppliers of funds for T-notes and T-bonds ...

... and mutual funds) are the major suppliers of funds for Munis and corporate bonds foreign investors and governments are the major suppliers of funds for T-notes and T-bonds ...

Reporting Guidance for All Loan-Backed and Structured Finance

... SSAPs to address a variety of application questions, mostly focusing on definitions and scope limitations of each of the noted SSAPs. SSAP No. 43R—Loan-backed and Structured Securities (SSAP No. 43R) was originally identified as a SSAP to review within the Investment Classification Project. Pursuant ...

... SSAPs to address a variety of application questions, mostly focusing on definitions and scope limitations of each of the noted SSAPs. SSAP No. 43R—Loan-backed and Structured Securities (SSAP No. 43R) was originally identified as a SSAP to review within the Investment Classification Project. Pursuant ...

Robbing Peter to Pay Paul: Ponzi Schemes Throughout History

... Ponzi schemes have captured the public’s attention recently with the fall of Bernard Madoff’s investment fund, which, at approximately $36 billion, is the biggest financial fraud in history. The principle behind a Ponzi scheme is simple. The Securities Exchange Commission defines it as investment fr ...

... Ponzi schemes have captured the public’s attention recently with the fall of Bernard Madoff’s investment fund, which, at approximately $36 billion, is the biggest financial fraud in history. The principle behind a Ponzi scheme is simple. The Securities Exchange Commission defines it as investment fr ...

Reporting Standard ARS 720.4 ABS/RBA Debt Securities Held

... Report short-term debt securities held that are issued by resident nonfinancial businesses and that are not bills of exchange. Item 1.2.2.2 is a derived item. Report the value of other short-term debt securities held in item 1.2.2.2 as the sum of: ...

... Report short-term debt securities held that are issued by resident nonfinancial businesses and that are not bills of exchange. Item 1.2.2.2 is a derived item. Report the value of other short-term debt securities held in item 1.2.2.2 as the sum of: ...

Bade_Parkin_Macro_Lecture_CH20

... If the exchange rate is $1.33 Canadian per U.S. dollar, then the two monies have the same value—you can buy a Big Mac in Toronto or New York for either $4 (Canadian) or $3 (U.S.). But if a Big Mac in New York rises to $4 and the exchange rate remains at $1.33 Canadian per U.S. dollar, then money buy ...

... If the exchange rate is $1.33 Canadian per U.S. dollar, then the two monies have the same value—you can buy a Big Mac in Toronto or New York for either $4 (Canadian) or $3 (U.S.). But if a Big Mac in New York rises to $4 and the exchange rate remains at $1.33 Canadian per U.S. dollar, then money buy ...

14. procedure for application and allotment

... a. An application for a minor must include the full names and date of birth of the minor, as well as the full names and address of the adult (Parent or Guardian) making the application on such minor’s behalf. b. An application from a corporate body must bear the corporate body’s common seal and be c ...

... a. An application for a minor must include the full names and date of birth of the minor, as well as the full names and address of the adult (Parent or Guardian) making the application on such minor’s behalf. b. An application from a corporate body must bear the corporate body’s common seal and be c ...

Les faits

... 2. pursuant to paragraph 184(1)(d) of the Act, any exemptions available under New Brunswick securities law do not apply to the Respondent, for a period of 10 years; 3. pursuant to subsection 186(1) of the Act, the Respondent shall pay an administrative penalty for failing to comply with New Brunswic ...

... 2. pursuant to paragraph 184(1)(d) of the Act, any exemptions available under New Brunswick securities law do not apply to the Respondent, for a period of 10 years; 3. pursuant to subsection 186(1) of the Act, the Respondent shall pay an administrative penalty for failing to comply with New Brunswic ...

1 NASDAQ US Dividend Achievers™ 50 Index Methodology

... replaced with the security that meets the Eligibility Criteria with the highest current dividend yield as of the last quarterly rebalance that is not currently in the Index. The replacement security is added to the Index at the same weight as the security that was removed. At each month-end, if an I ...

... replaced with the security that meets the Eligibility Criteria with the highest current dividend yield as of the last quarterly rebalance that is not currently in the Index. The replacement security is added to the Index at the same weight as the security that was removed. At each month-end, if an I ...

Financial Management: Principles and Applications

... 15) There are more companies listed on NASDAQ than are listed on the New York Stock Exchange. Answer: TRUE Diff: 1 Topic: 2.3 The Financial Marketplace: Securities Markets Keywords: stock exchanges 16) Organized security exchanges do not physically occupy space. Answer: FALSE Diff: 1 Topic: 2.3 The ...

... 15) There are more companies listed on NASDAQ than are listed on the New York Stock Exchange. Answer: TRUE Diff: 1 Topic: 2.3 The Financial Marketplace: Securities Markets Keywords: stock exchanges 16) Organized security exchanges do not physically occupy space. Answer: FALSE Diff: 1 Topic: 2.3 The ...

Notice of the Ministry of Labor and Social Security and China

... Clearing Corporation shall check and ratify the corresponding minimum clearing reserve in accordance with the relevant provisions on the management of clearing reserve. The balance at the end of a day in the clearing reserve account of a clearing participant shall not be lower than the minimum limit ...

... Clearing Corporation shall check and ratify the corresponding minimum clearing reserve in accordance with the relevant provisions on the management of clearing reserve. The balance at the end of a day in the clearing reserve account of a clearing participant shall not be lower than the minimum limit ...

Checklist ANNEX XXII Disclosure requirements in summaries

... characteristics that demonstrate capacity to produce funds to service any payments due and payable on the securities a description of the general characteristics of the obligors and in the case of a small number of easily dentifiable obligors, a general description of each obligor a description ...

... characteristics that demonstrate capacity to produce funds to service any payments due and payable on the securities a description of the general characteristics of the obligors and in the case of a small number of easily dentifiable obligors, a general description of each obligor a description ...

Chapter 2 The Financial Markets and Interest Rates

... variability around the mean, or average of the rate of return in the financial markets • Maturity Premium — Additional return required by investors in long-term securities to compensate them for greater risk of price fluctuations on those securities caused by interest rate changes ...

... variability around the mean, or average of the rate of return in the financial markets • Maturity Premium — Additional return required by investors in long-term securities to compensate them for greater risk of price fluctuations on those securities caused by interest rate changes ...

Real Estate Joint Venture Interests as Securities

... existence of a security, see generally Rapp, supra note 16. 27. The Court stated: In the Securities Act the term "security" was defined to include by name or description many documents in which there is common trading for speculation or investment. Some, such as notes, bonds, and stocks, are pretty ...

... existence of a security, see generally Rapp, supra note 16. 27. The Court stated: In the Securities Act the term "security" was defined to include by name or description many documents in which there is common trading for speculation or investment. Some, such as notes, bonds, and stocks, are pretty ...

How the Foreign Exchange Market Works.p65

... Large value transactions are usually classified as ‘contracts’ and take place at a specially negotiated ‘contract rate’. There may be as many contract rates as there are contracts, even within the same institution. Small value transactions are usually deemed to be ‘counter transactions’ and take pla ...

... Large value transactions are usually classified as ‘contracts’ and take place at a specially negotiated ‘contract rate’. There may be as many contract rates as there are contracts, even within the same institution. Small value transactions are usually deemed to be ‘counter transactions’ and take pla ...

Do Debt Markets Price Ṣukūk and Conventional Bonds

... This paper reports empirical findings that do not support the market‟s current practice that the 16-year old ṣukūk debt securities, which are Sharī„ah-compliant, are the same as conventional bonds. This market has grown to about US$840 billion since this type of debt funding instruments were first i ...

... This paper reports empirical findings that do not support the market‟s current practice that the 16-year old ṣukūk debt securities, which are Sharī„ah-compliant, are the same as conventional bonds. This market has grown to about US$840 billion since this type of debt funding instruments were first i ...