Lorem ipsum dolor sit amet, consetetur sadip-scing

... another number of annual payment dates. The coupon is paid on a proportionate basis on each payment date, ie, the coupon payment on each payment date corresponds to the coupon rate divided by the annual number of payment dates. Coupon payments fall due on the first calendar day of a given month foll ...

... another number of annual payment dates. The coupon is paid on a proportionate basis on each payment date, ie, the coupon payment on each payment date corresponds to the coupon rate divided by the annual number of payment dates. Coupon payments fall due on the first calendar day of a given month foll ...

ANSWER - We can offer most test bank and solution manual you need.

... a. The most important difference between spot markets versus futures markets is the maturity of the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than ...

... a. The most important difference between spot markets versus futures markets is the maturity of the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than ...

ANSWER: True - We can offer most test bank and solution manual

... a. The most important difference between spot markets versus futures markets is the maturity of the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than ...

... a. The most important difference between spot markets versus futures markets is the maturity of the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than ...

The Year Ahead in Healthcare Convertible Bonds

... underlying equities that exhibit strong growth potential and solid credit fundamentals. ...

... underlying equities that exhibit strong growth potential and solid credit fundamentals. ...

Stock Underwriting

... The easiest way to become a public company is to merge into the public shell. – One big advantage is the time and money saved. The entrepreneurs pay little to “acquire” the shell. The entrepreneurs essentially purchase control of the shell by buying stocks from the existing controlling shareholders. ...

... The easiest way to become a public company is to merge into the public shell. – One big advantage is the time and money saved. The entrepreneurs pay little to “acquire” the shell. The entrepreneurs essentially purchase control of the shell by buying stocks from the existing controlling shareholders. ...

A Multiple Lender Approach to Understanding Supply and Search in

... The American stock market is as transparent a market as you are likely to find. Trades are posted virtually instantaneously, and so are the prices being sought by buyers and sellers. But a related market -- vital to the operation of the stock market as we know it -- is so opaque that even the inside ...

... The American stock market is as transparent a market as you are likely to find. Trades are posted virtually instantaneously, and so are the prices being sought by buyers and sellers. But a related market -- vital to the operation of the stock market as we know it -- is so opaque that even the inside ...

ICICI-Prudential-Fixed-Maturity-Plan-Series 73

... The Scheme will not have any exposure to Securitised Debt. The tenure of the Scheme is 392 days from the date of the allotment. 1. The Scheme shall endeavour to invest in instruments having credit rating as indicated above or higher. 2. In case instruments/securities as indicated above are not avail ...

... The Scheme will not have any exposure to Securitised Debt. The tenure of the Scheme is 392 days from the date of the allotment. 1. The Scheme shall endeavour to invest in instruments having credit rating as indicated above or higher. 2. In case instruments/securities as indicated above are not avail ...

Chapter 21

... 6 Which sources of investment information are the most helpful to investors? 7 What can investors learn from stock, bond, and mutual ...

... 6 Which sources of investment information are the most helpful to investors? 7 What can investors learn from stock, bond, and mutual ...

Private Offerings to U.S. Investors by Non

... engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading securities. On its face, most investment funds fall within this definition. There are exceptions to the definition of “investment company,” however, that most investment funds seek to fall within ...

... engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading securities. On its face, most investment funds fall within this definition. There are exceptions to the definition of “investment company,” however, that most investment funds seek to fall within ...

Forward Rate Contract - Western Australian Treasury Corporation

... cannot guarantee the accuracy of that information. Thus, any recommendations are made in good faith but are provided only to assist you with any decisions which you make. These recommendations are not intended to be a substitute for professional advice on a particular matter. Before accepting or rej ...

... cannot guarantee the accuracy of that information. Thus, any recommendations are made in good faith but are provided only to assist you with any decisions which you make. These recommendations are not intended to be a substitute for professional advice on a particular matter. Before accepting or rej ...

notice to warrantholders

... arithmetic mean of the closing price of the underlying securities on the Exchange for the five (5) schedule Valuation Dates, as determined by the Issuer and verified by the Calculation Agent, subject to adjustments in accordance with the Conditions and without regard to any subsequently ...

... arithmetic mean of the closing price of the underlying securities on the Exchange for the five (5) schedule Valuation Dates, as determined by the Issuer and verified by the Calculation Agent, subject to adjustments in accordance with the Conditions and without regard to any subsequently ...

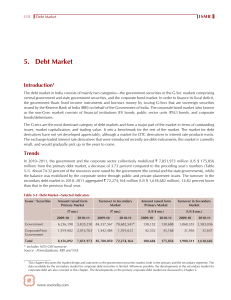

5. Debt Market

... of the CMBs depend on the temporary cash requirement of the government. The announcement of their auction is made by the RBI through a Press Release that would be issued one day prior to the date of auction. The settlement of the auction is on a T+1 basis. Dated Government Securities: Dated governme ...

... of the CMBs depend on the temporary cash requirement of the government. The announcement of their auction is made by the RBI through a Press Release that would be issued one day prior to the date of auction. The settlement of the auction is on a T+1 basis. Dated Government Securities: Dated governme ...

Amendment No 3 dated August 10, 2016 to the Simplified Prospectus

... ee) On page 117, the following paragraph is added after the paragraph beginning with “The fund may use derivative consistent with its investment objective…” under “Investment strategies”: “The fund also uses derivatives to hedge the exposure of its investments denominated in foreign currencies attr ...

... ee) On page 117, the following paragraph is added after the paragraph beginning with “The fund may use derivative consistent with its investment objective…” under “Investment strategies”: “The fund also uses derivatives to hedge the exposure of its investments denominated in foreign currencies attr ...

FIRM ELEMENT TRAINING - Securities Training Corporation

... programs to determine whether these techniques are at play within a firm’s business—taking place entirely throughout the firm’s transaction systems, or one part of the firm. FINRA will also focus on how firms use information taken from the report cards to improve operations and compliance. ...

... programs to determine whether these techniques are at play within a firm’s business—taking place entirely throughout the firm’s transaction systems, or one part of the firm. FINRA will also focus on how firms use information taken from the report cards to improve operations and compliance. ...

financial institutions and markets

... CMISA, Korea’s financial regulatory scheme will be restructured to functional regulation, under which a single regulation is imposed on a single investment service regardless of the institutions that provide it. Investor protection is expected to be stronger under the CMISA. New devices for investor ...

... CMISA, Korea’s financial regulatory scheme will be restructured to functional regulation, under which a single regulation is imposed on a single investment service regardless of the institutions that provide it. Investor protection is expected to be stronger under the CMISA. New devices for investor ...

The Securities and Exchange Commission has not

... them, upon written request, in the accordance with applicable law, the information furnished to offerees.* • Irrevocably appointing each of the Secretary of the SEC and, the Securities Administrator or other legally designated officer of the State in which the issuer maintains its principal place of ...

... them, upon written request, in the accordance with applicable law, the information furnished to offerees.* • Irrevocably appointing each of the Secretary of the SEC and, the Securities Administrator or other legally designated officer of the State in which the issuer maintains its principal place of ...

Payment of Management Fee

... on Singapore Exchange Securities Trading Limited for the last 10 business days of the relevant period in which the Management Fees accrue (as provided in the Trust Deed and the stapling deed dated 10 July 2013). The number of Stapled Securities issued and allotted to the REIT Manager’s account was d ...

... on Singapore Exchange Securities Trading Limited for the last 10 business days of the relevant period in which the Management Fees accrue (as provided in the Trust Deed and the stapling deed dated 10 July 2013). The number of Stapled Securities issued and allotted to the REIT Manager’s account was d ...

Reporting Form SRF 536.0 Repurchase Agreements Instructions

... Repos involve the provision of collateral and an exchange of cash whereas securities lending/borrowing doesn’t necessarily involve cash exchange or collateral. Debt securities purchased under agreements to resell and security borrowing by issuer Item 1 collects information about debt securities purc ...

... Repos involve the provision of collateral and an exchange of cash whereas securities lending/borrowing doesn’t necessarily involve cash exchange or collateral. Debt securities purchased under agreements to resell and security borrowing by issuer Item 1 collects information about debt securities purc ...

Negotiable/Transferable Instruments Conventions

... Market participants should accept prime bank credit subject to their available credit limits. There is an onus on the seller to provide the buyer with details of the transaction in a timely manner. There is also an onus on the buyer to notify the seller of any rejection of the transaction due to lac ...

... Market participants should accept prime bank credit subject to their available credit limits. There is an onus on the seller to provide the buyer with details of the transaction in a timely manner. There is also an onus on the buyer to notify the seller of any rejection of the transaction due to lac ...

Inflation-Indexed Securities: Description and Market Experience

... security of anyone who lives on a fixed income: inflation, which eats away at the purchasing power of any asset or fixed income stream. Many different individuals may be exposed to the risks of inflation. A young couple saving for a down payment on a house, or for a child’s education, may find that ...

... security of anyone who lives on a fixed income: inflation, which eats away at the purchasing power of any asset or fixed income stream. Many different individuals may be exposed to the risks of inflation. A young couple saving for a down payment on a house, or for a child’s education, may find that ...

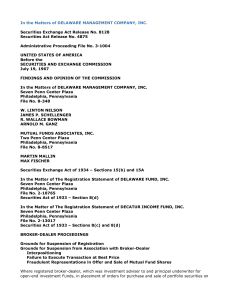

In the Matters of DELAWARE MANAGEMENT COMPANY, INC

... executions on portfolio transactions, the ultimate effect of such trades is to increase the cost of securities purchased by investment companies and reduce the amount the investment companies receive for portfolio securities sold as compared with the costs of purchase and proceeds of sale they might ...

... executions on portfolio transactions, the ultimate effect of such trades is to increase the cost of securities purchased by investment companies and reduce the amount the investment companies receive for portfolio securities sold as compared with the costs of purchase and proceeds of sale they might ...

Oaktree High Yield Bond Fund

... Under normal market conditions, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in bonds that are, at the time of investment, rated below investment grade (lower than BBBby Standard & Poor’s Ratings Services (“S&P”), lower than Baa3 by Moody’s Investors ...

... Under normal market conditions, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in bonds that are, at the time of investment, rated below investment grade (lower than BBBby Standard & Poor’s Ratings Services (“S&P”), lower than Baa3 by Moody’s Investors ...

Chapter 22: Borrowings Models

... 8 % interest rate. After 20 years, how much equity would you have in the house? How much of the principal had been repaid? Answer: So the monthly payment would be d = 100000( ...

... 8 % interest rate. After 20 years, how much equity would you have in the house? How much of the principal had been repaid? Answer: So the monthly payment would be d = 100000( ...