MANSFIELD TOWNSHIP BURLINGTON COUNTY RESOLUTION

... U.S. Government securities and reports daily to the Federal Reserve Bank of New York its position in and borrowing on such U.S. Government securities. B. Notwithstanding the above authorization, the monies on hand in the following funds and accounts shall be further limited as to maturities, specifi ...

... U.S. Government securities and reports daily to the Federal Reserve Bank of New York its position in and borrowing on such U.S. Government securities. B. Notwithstanding the above authorization, the monies on hand in the following funds and accounts shall be further limited as to maturities, specifi ...

Appendix 5

... Rules, the Companies (Winding Up and Miscellaneous Provisions) Ordinance, the Securities and Futures (Stock Market Listing) Rules and any other applicable legislation has been included therein or, if the final version has not yet been submitted (or reviewed), will be included therein before it is so ...

... Rules, the Companies (Winding Up and Miscellaneous Provisions) Ordinance, the Securities and Futures (Stock Market Listing) Rules and any other applicable legislation has been included therein or, if the final version has not yet been submitted (or reviewed), will be included therein before it is so ...

Intermediate-Term Municipal Bond

... to 17 years. To be included in the index, bonds must be rated investment-grade (Baa3/BBB- or higher) by one or more of the following rating agencies: Moody’s, S&P, or Fitch (using the lower of two, or the middle of three ratings). Bonds must also meet requirements for par amount outstanding, and mus ...

... to 17 years. To be included in the index, bonds must be rated investment-grade (Baa3/BBB- or higher) by one or more of the following rating agencies: Moody’s, S&P, or Fitch (using the lower of two, or the middle of three ratings). Bonds must also meet requirements for par amount outstanding, and mus ...

Emerging Markets Local Currency

... Aegon USA Investment Management, LLC (“AUIM”), a wholly owned indirect subsidiary of Aegon N.V., is a U.S.-based investment adviser registered with the Securities and Exchange Commission (“SEC”) and part of Aegon Asset Management, the global investment management division of Aegon Group. AUIM is a l ...

... Aegon USA Investment Management, LLC (“AUIM”), a wholly owned indirect subsidiary of Aegon N.V., is a U.S.-based investment adviser registered with the Securities and Exchange Commission (“SEC”) and part of Aegon Asset Management, the global investment management division of Aegon Group. AUIM is a l ...

FREE Sample Here

... 1. Deregulation of financial institutions and mergers have created a more competitive environment for retail brokerage houses. TRUE ...

... 1. Deregulation of financial institutions and mergers have created a more competitive environment for retail brokerage houses. TRUE ...

relevant aspects of management of banks investment activities on

... WSPÓŁPRACA EUROPEJSKA NR 1(1) 2015 / EUROPEAN COOPERATION Vol. 1(1) 2015 ...

... WSPÓŁPRACA EUROPEJSKA NR 1(1) 2015 / EUROPEAN COOPERATION Vol. 1(1) 2015 ...

“Auction Design and Strategy,” Presentation

... I won. Therefore, I overestimated the most. My bid only matters when I win, so I should condition my bid on winning (i.e., that I overestimated the most). • Winning is bad news about my estimate of value. No one else was willing to bid as much. ...

... I won. Therefore, I overestimated the most. My bid only matters when I win, so I should condition my bid on winning (i.e., that I overestimated the most). • Winning is bad news about my estimate of value. No one else was willing to bid as much. ...

amherst securities group and pierpont securities merge to create

... products, today announced that they have entered into a definitive agreement to merge in a transaction that will create a market-leading fixed-income broker-dealer. The combined company will be known as Amherst Pierpont Securities LLC (“Amherst Pierpont Securities”). Financial terms of the transacti ...

... products, today announced that they have entered into a definitive agreement to merge in a transaction that will create a market-leading fixed-income broker-dealer. The combined company will be known as Amherst Pierpont Securities LLC (“Amherst Pierpont Securities”). Financial terms of the transacti ...

Positioning Your Portfolio for Rising Interest Rates

... 1. A credit rating, as represented by the Credit Quality Breakdown, is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of credit worthiness of an issuer with respect to debt obligations, including specific securities, money market instruments, or other bonds ...

... 1. A credit rating, as represented by the Credit Quality Breakdown, is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of credit worthiness of an issuer with respect to debt obligations, including specific securities, money market instruments, or other bonds ...

1 The primary investment objective of Fund B is to maximize the

... (the “Collateral Manager”) to provide investment advisory services to the Special Purpose Entities with the objective of maximizing the present value of distributions to the Segregated Securities from Collateral Securities. The Collateral Manager has been contractually charged with the responsibilit ...

... (the “Collateral Manager”) to provide investment advisory services to the Special Purpose Entities with the objective of maximizing the present value of distributions to the Segregated Securities from Collateral Securities. The Collateral Manager has been contractually charged with the responsibilit ...

Access the France- Germany interconnector (IFD)

... To qualify for this service, you must: sign up to the Rules on Access to the French Public Transmission Network for Imports and Exports; be a Balance Responsible entity (BR) or attach your import/export transactions to a BR perimeter of your choosing; contact the sales department at Ampr ...

... To qualify for this service, you must: sign up to the Rules on Access to the French Public Transmission Network for Imports and Exports; be a Balance Responsible entity (BR) or attach your import/export transactions to a BR perimeter of your choosing; contact the sales department at Ampr ...

fair value - WikiLeaks

... Ireland, Hungary and the Czech Republic are now saying “wait a minute” after their original agreement. A good sign for the compact was that Italy was able to auction off some one year notes at a slightly lower rate than last time and to some decent demand. My concern, and one shared by many traders ...

... Ireland, Hungary and the Czech Republic are now saying “wait a minute” after their original agreement. A good sign for the compact was that Italy was able to auction off some one year notes at a slightly lower rate than last time and to some decent demand. My concern, and one shared by many traders ...

IHS buys Toronto-based Dyadem International

... Proactive Investors is a publisher and is not registered with or authorised by the Financial Conduct Authority (FCA). You understand and agree that no content published constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable ...

... Proactive Investors is a publisher and is not registered with or authorised by the Financial Conduct Authority (FCA). You understand and agree that no content published constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable ...

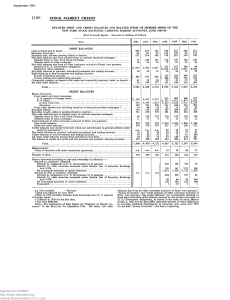

Detailed Debit and Credit Balances and Related Items of Member

... Net debit balances due from member firms of national securities exchanges: Member firms of New York Stock Exchange Member firms of other exchanges Net debit balances due from all other customers exclusive of firms' own partners: Secured by U. S. Government obligations Secured by other collateral Net ...

... Net debit balances due from member firms of national securities exchanges: Member firms of New York Stock Exchange Member firms of other exchanges Net debit balances due from all other customers exclusive of firms' own partners: Secured by U. S. Government obligations Secured by other collateral Net ...

Balance Sheets Methodology

... The government facts and figures (as well as United States government-authored reports) cited or quoted in this document are not subject to domestic copyright or other intellectual property right protections in the United States, unless otherwise noted. The other content of this document (including ...

... The government facts and figures (as well as United States government-authored reports) cited or quoted in this document are not subject to domestic copyright or other intellectual property right protections in the United States, unless otherwise noted. The other content of this document (including ...

PowerPoint Slides

... Term Structure of Interest Rates Relationship between yields to maturity and maturity Yield curve - a graph of the yields on bonds relative to the number of years to maturity ...

... Term Structure of Interest Rates Relationship between yields to maturity and maturity Yield curve - a graph of the yields on bonds relative to the number of years to maturity ...

form 31-103f1 calculation of excess working capital

... Form 31-103F1 Calculation of Excess Working Capital must be prepared using the accounting principles that you use to prepare your financial statements in accordance with National Instrument 52-107 Acceptable Accounting Principles and Auditing Standards. Section 12.1 of Companion Policy 31-103CP Regi ...

... Form 31-103F1 Calculation of Excess Working Capital must be prepared using the accounting principles that you use to prepare your financial statements in accordance with National Instrument 52-107 Acceptable Accounting Principles and Auditing Standards. Section 12.1 of Companion Policy 31-103CP Regi ...

31-103F1 [F], January 11, 2015

... Form 31-103F1 Calculation of Excess Working Capital must be prepared using the accounting principles that you use to prepare your financial statements in accordance with National Instrument 52-107 Acceptable Accounting Principles and Auditing Standards. Section 12.1 of Companion Policy 31-103CP Regi ...

... Form 31-103F1 Calculation of Excess Working Capital must be prepared using the accounting principles that you use to prepare your financial statements in accordance with National Instrument 52-107 Acceptable Accounting Principles and Auditing Standards. Section 12.1 of Companion Policy 31-103CP Regi ...

Exchange Rates Teacher

... • However, the disadvantage is that net inflows and outflows of currency will occur because there is no mechanism to change relative prices and the terms of trade. The move to a floating exchange rate should provide the automatic balancing mechanism in the balance of payments. ...

... • However, the disadvantage is that net inflows and outflows of currency will occur because there is no mechanism to change relative prices and the terms of trade. The move to a floating exchange rate should provide the automatic balancing mechanism in the balance of payments. ...

Infrastructure Developments in the Market for Commonwealth Government Securities

... (that is, those entities with accounts in Austraclear).7 Austraclear creates beneficial entitlements that can then be traded between market participants. As such, Austraclear appears on the Registry as the owner of all but a small amount of each CGS on issue. There are well-defined market convention ...

... (that is, those entities with accounts in Austraclear).7 Austraclear creates beneficial entitlements that can then be traded between market participants. As such, Austraclear appears on the Registry as the owner of all but a small amount of each CGS on issue. There are well-defined market convention ...

LEARNING HOW RAYMOND JAMES PROTECTS YOUR ACCOUNT

... annually by an independent public accounting firm. Raymond James Bank, N.A. is a national bank chartered by the Office of the Comptroller of the Currency (OCC) and subject to the rules of the Federal Financial Institutions Examination Council (FFIEC), which includes the Board of Governors of the Fed ...

... annually by an independent public accounting firm. Raymond James Bank, N.A. is a national bank chartered by the Office of the Comptroller of the Currency (OCC) and subject to the rules of the Federal Financial Institutions Examination Council (FFIEC), which includes the Board of Governors of the Fed ...

Urgent Notice for non-EU issuers of Securities

... Depending on where the application is first made after November 2003, the home Member State will be fixed for all time. MTN Programmes or one-off debt issuance. Given the €1,000 benchmark, if an issuer does an issuance in a denomination of US$1,000 which, given the exchange rates at the time, is not ...

... Depending on where the application is first made after November 2003, the home Member State will be fixed for all time. MTN Programmes or one-off debt issuance. Given the €1,000 benchmark, if an issuer does an issuance in a denomination of US$1,000 which, given the exchange rates at the time, is not ...

Angie`s List, Inc.

... remaining one-half vest ratably on a quarterly basis over a one year period thereafter. PRSUs earned subsequent to the first anniversary of the grant date vest one-half upon achievement of the corresponding stock price target, and the remaining one-half vest ratably on a quarterly basis over a one y ...

... remaining one-half vest ratably on a quarterly basis over a one year period thereafter. PRSUs earned subsequent to the first anniversary of the grant date vest one-half upon achievement of the corresponding stock price target, and the remaining one-half vest ratably on a quarterly basis over a one y ...

PRINCIPLES OF INVESTMENT MAY 2012

... those who need the funds (borrowers). The money market also allows institutions with surplus funds to invest them in highly liquid assets, thereby allowing them to realise cash easily, should the need arise. In addition, the money market is a mechanism, which the central bank uses to influence money ...

... those who need the funds (borrowers). The money market also allows institutions with surplus funds to invest them in highly liquid assets, thereby allowing them to realise cash easily, should the need arise. In addition, the money market is a mechanism, which the central bank uses to influence money ...

![31-103F1 [F], January 11, 2015](http://s1.studyres.com/store/data/021286480_1-c986ef7bfcd613a4eda28487f5276795-300x300.png)