Are Banks And Stock Markets Positively Related?

... By the standards of emerging markets, the South African capital market is considered to be robust, liquid and well developed. Currently, South African securities are traded simultaneously in Johannesburg, London, New York, Frankfurt and Zurich. The Johannesburg Stock Exchange, which was formed in 18 ...

... By the standards of emerging markets, the South African capital market is considered to be robust, liquid and well developed. Currently, South African securities are traded simultaneously in Johannesburg, London, New York, Frankfurt and Zurich. The Johannesburg Stock Exchange, which was formed in 18 ...

Cellectar Biosciences, Inc. (Form: SC 13D, Received

... Greenhouse and Stettner share sole voting and investment power over 179,806 shares of Common Stock and 179,000 Warrants owned by Special Situations Cayman Fund, L.P., 539,418 shares of Common Stock and 537,000 Warrants owned by Special Situations Fund III QP, L.P. and 422,962 shares of Common Stock ...

... Greenhouse and Stettner share sole voting and investment power over 179,806 shares of Common Stock and 179,000 Warrants owned by Special Situations Cayman Fund, L.P., 539,418 shares of Common Stock and 537,000 Warrants owned by Special Situations Fund III QP, L.P. and 422,962 shares of Common Stock ...

Document

... •1 Adjusted for local and cross-border inter-dealer double-counting (ie “net-net” basis). 2 Previously classified as part of the so-called "Traditional FX market". 3 The category "other FX products" covers highly leveraged transactions and/or trades whose notional amount is variable and where a deco ...

... •1 Adjusted for local and cross-border inter-dealer double-counting (ie “net-net” basis). 2 Previously classified as part of the so-called "Traditional FX market". 3 The category "other FX products" covers highly leveraged transactions and/or trades whose notional amount is variable and where a deco ...

Chp 10 Slides File

... 6. Abuses in the IPO Market a. Spinning - occurs when the underwriter allocates shares from an IPO to corporate executives who may be considering an IPO or to another business that will require the help of a securities firm. b. Laddering - brokers encourage investors to place first-day bids for the ...

... 6. Abuses in the IPO Market a. Spinning - occurs when the underwriter allocates shares from an IPO to corporate executives who may be considering an IPO or to another business that will require the help of a securities firm. b. Laddering - brokers encourage investors to place first-day bids for the ...

Corporate Governance Standards in Cross

... This paper will examine five Chinese company stocks that have been listed on United States exchanges with either initial public offerings (IPOs) or reverse mergers, often called reverse take-overs (RTOs). Their shares were initially well received in the market, especially as China’s economy conti ...

... This paper will examine five Chinese company stocks that have been listed on United States exchanges with either initial public offerings (IPOs) or reverse mergers, often called reverse take-overs (RTOs). Their shares were initially well received in the market, especially as China’s economy conti ...

The Stock Market and the Economy

... a. Higher stock prices increase household wealth and consumption, but only in the future; therefore, current consumption, output, income, and aggregate spending are not affected. b. Higher stock prices decrease household wealth, causing a decrease in current and future consumption, and a decrease in ...

... a. Higher stock prices increase household wealth and consumption, but only in the future; therefore, current consumption, output, income, and aggregate spending are not affected. b. Higher stock prices decrease household wealth, causing a decrease in current and future consumption, and a decrease in ...

hanoi university

... in American history, lasted from 1929 to 1939. Its effects was felt in virtually all corners of the world, and it is one of the great economic calamities in history” ( www.en.wikipedia.org ) It began in the United State soon after The New York stock market crash of 1929 and lasted until 1939. By 193 ...

... in American history, lasted from 1929 to 1939. Its effects was felt in virtually all corners of the world, and it is one of the great economic calamities in history” ( www.en.wikipedia.org ) It began in the United State soon after The New York stock market crash of 1929 and lasted until 1939. By 193 ...

DBQ DOSSIER - The Skyscraper Museum

... In the 1920s, the United States economy experienced remarkable growth that affected every industry and every market. Likewise, the economic crisis that followed the stock market crash of 1929 had consequences that extended into the far reaches of the country. The documents contained in this dossier ...

... In the 1920s, the United States economy experienced remarkable growth that affected every industry and every market. Likewise, the economic crisis that followed the stock market crash of 1929 had consequences that extended into the far reaches of the country. The documents contained in this dossier ...

Practice four

... These figures imply that Portfolio A provides a better risk-reward tradeoff than the market portfolio. 16 Not possible. Portfolio A clearly dominates the market portfolio. It has a lower standard deviation with a higher expected return. 17 Not possible. Given these data, the SML is: E(r) = 10% + (1 ...

... These figures imply that Portfolio A provides a better risk-reward tradeoff than the market portfolio. 16 Not possible. Portfolio A clearly dominates the market portfolio. It has a lower standard deviation with a higher expected return. 17 Not possible. Given these data, the SML is: E(r) = 10% + (1 ...

TITLE 9 Chapter 9:18 PREVIOUS CHAPTER STOCK THEFT ACT

... less, in either case, the amount of any compensation which may have been paid to the owner by or on behalf of the person convicted. (3) A fine imposed in terms of this section may be recovered in the manner provided by section 348 of the Criminal Procedure and Evidence Act [Chapter 9:07], and any am ...

... less, in either case, the amount of any compensation which may have been paid to the owner by or on behalf of the person convicted. (3) A fine imposed in terms of this section may be recovered in the manner provided by section 348 of the Criminal Procedure and Evidence Act [Chapter 9:07], and any am ...

Corporation

... Each partner (generally) is fully liability for the partnership’s torts As with all tort actions, recovery of damages limited by partners’ assets Tort remedies generally fall on parties with deep pockets ...

... Each partner (generally) is fully liability for the partnership’s torts As with all tort actions, recovery of damages limited by partners’ assets Tort remedies generally fall on parties with deep pockets ...

Limited Liability Partnership

... Rs.20 .The firm plans to issue 500,000 additional equity shares at a price of Rs.12 per share .The market value per share after this issue is expected to drop to Rs.17.33. Now if a shareholder has 100 shares, his financial situation with respect to Pradhan’s equity when he exercises the preemptive r ...

... Rs.20 .The firm plans to issue 500,000 additional equity shares at a price of Rs.12 per share .The market value per share after this issue is expected to drop to Rs.17.33. Now if a shareholder has 100 shares, his financial situation with respect to Pradhan’s equity when he exercises the preemptive r ...

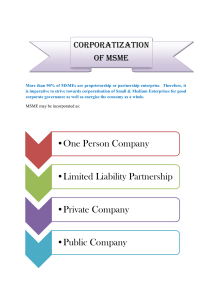

One Person Company •Limited Liability Partnership •Private

... “Public Company” A company : which is not a private company; private company which is Subsidiary of a Public Company ...

... “Public Company” A company : which is not a private company; private company which is Subsidiary of a Public Company ...

Internationalization of Stock Markets: Potential Problems for United

... exists to protect the investor and to fulfill the need for fair and efficient access to and exit from the market. Given that premise, the role of the SEC is to "protect investors (principally, but not exclusively, U.S. investors) and the U.S. securities markets, and in the performance of that role t ...

... exists to protect the investor and to fulfill the need for fair and efficient access to and exit from the market. Given that premise, the role of the SEC is to "protect investors (principally, but not exclusively, U.S. investors) and the U.S. securities markets, and in the performance of that role t ...

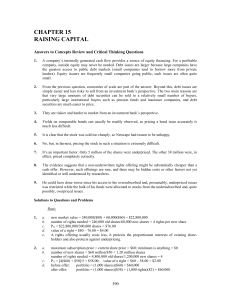

Answers to Concepts Review and Critical

... that very large amounts of debt securities can be sold to a relatively small number of buyers, particularly large institutional buyers such as pension funds and insurance companies, and debt securities are much easier to price. ...

... that very large amounts of debt securities can be sold to a relatively small number of buyers, particularly large institutional buyers such as pension funds and insurance companies, and debt securities are much easier to price. ...

ANN Model to Predict Stock Prices at Stock Exchange Markets

... Since it was not possible to test all the sixty listed stocks at the NSE, stocks for this research were chosen from those that met some criteria. The considerations were: the stock was part of the 20-share index (barometer of the economic), it was consistently traded in the 5-year period and the st ...

... Since it was not possible to test all the sixty listed stocks at the NSE, stocks for this research were chosen from those that met some criteria. The considerations were: the stock was part of the 20-share index (barometer of the economic), it was consistently traded in the 5-year period and the st ...

Traditional Investment Alternatives (cont`d)

... companies, mutual funds, banks, and other organizations that trade large quantities of securities Copyright © Houghton Mifflin Company. All rights reserved. ...

... companies, mutual funds, banks, and other organizations that trade large quantities of securities Copyright © Houghton Mifflin Company. All rights reserved. ...

Corporate Finance Sample Exam 2A Dr. A. Frank Thompson

... d. The expected return on Stock A should be greater than that on Stock B. e. The expected return on Stock B should be greater than that on Stock A. ____ 15. Consider the following information and then calculate the required rate of return for the Scientific Investment Fund, which holds 4 stocks. The ...

... d. The expected return on Stock A should be greater than that on Stock B. e. The expected return on Stock B should be greater than that on Stock A. ____ 15. Consider the following information and then calculate the required rate of return for the Scientific Investment Fund, which holds 4 stocks. The ...

Chapter 15

... Analyzing Stocks (cont’d) – Gross domestic product (GDP): the total market value of all products and services produced in a country – Fiscal policy: the means by which the U.S. government imposes taxes on individuals and corporations and by which it spends its money – Impact of international econom ...

... Analyzing Stocks (cont’d) – Gross domestic product (GDP): the total market value of all products and services produced in a country – Fiscal policy: the means by which the U.S. government imposes taxes on individuals and corporations and by which it spends its money – Impact of international econom ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... finance to corporate bodies, governments and their agencies on medium to long-term basis. The capital market is a network of specialized financial institutions, series of mechanisms, processes and infrastructure that, in various ways, facilitate the bringing together of suppliers and users of medium ...

... finance to corporate bodies, governments and their agencies on medium to long-term basis. The capital market is a network of specialized financial institutions, series of mechanisms, processes and infrastructure that, in various ways, facilitate the bringing together of suppliers and users of medium ...

Summary The Gulf cooperation council was formed in 1981, and it

... affected by the economic positioning of the country whether it is experiencing a boom or a recession. The GCC countries are, however, not overly affected by the international prices of other stock markets and their performance. The only reason that it is affected by the US Treasury bill rates is bec ...

... affected by the economic positioning of the country whether it is experiencing a boom or a recession. The GCC countries are, however, not overly affected by the international prices of other stock markets and their performance. The only reason that it is affected by the US Treasury bill rates is bec ...

File - Ms. Pena`s History Class

... • Dow Jones Industrial Average- measure of stock market’s health • In the 1920s, stock prices rose and Americans rushed to buy stocks • Americans engaged in overspeculation- bought stocks for quick profit • Many people began buying on margin ...

... • Dow Jones Industrial Average- measure of stock market’s health • In the 1920s, stock prices rose and Americans rushed to buy stocks • Americans engaged in overspeculation- bought stocks for quick profit • Many people began buying on margin ...

Download attachment

... The development of a yield curve on a wide range of actively traded debt securities will result in a benchmark security which market participants will use in setting up their trading, investment / lending and borrowing policies. The financial markets thrive on information. An efficient secondary mar ...

... The development of a yield curve on a wide range of actively traded debt securities will result in a benchmark security which market participants will use in setting up their trading, investment / lending and borrowing policies. The financial markets thrive on information. An efficient secondary mar ...

Form 4 Statement of Changes in Beneficial Ownership of Securities

... There are no Derivative Securities Explanation of Responses (1) This Form 4 is filed by Elliott Associates, L.P. (the "Reporting Person"). The Reporting Person may be deemed to be a member of a Section 13(d) group that collectively beneficially owns more than 10% of the Issuer's outstanding shares o ...

... There are no Derivative Securities Explanation of Responses (1) This Form 4 is filed by Elliott Associates, L.P. (the "Reporting Person"). The Reporting Person may be deemed to be a member of a Section 13(d) group that collectively beneficially owns more than 10% of the Issuer's outstanding shares o ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.