European Commission

... (the risk of default), linked to a debt obligation referenced in the contract. CDS are used by investors for hedging and investing. As a hedge a CDS provides protection against the credit risk arising from holding debt instruments. As an investment vehicle CDS can be used to express a view on the fu ...

... (the risk of default), linked to a debt obligation referenced in the contract. CDS are used by investors for hedging and investing. As a hedge a CDS provides protection against the credit risk arising from holding debt instruments. As an investment vehicle CDS can be used to express a view on the fu ...

Announces Filing of Final Prospectus for Bought Deal Prospectus

... expenditure activities in Colombia and for general corporate and working capital purposes. The Corporation's on-going capital expenditures are expected to be incurred in connection with drilling, completion and equipping operations by the Corporation, as well as land, seismic, facilities constructio ...

... expenditure activities in Colombia and for general corporate and working capital purposes. The Corporation's on-going capital expenditures are expected to be incurred in connection with drilling, completion and equipping operations by the Corporation, as well as land, seismic, facilities constructio ...

entrada - Bolsa de Madrid

... The value of the regulated exchanges as the only trusted venues for price discovery has been evidenced, once again, just recently. The suspension of trading a few days ago on Borsa Italiana and the London Stock Exchange was not followed by a migration of liquidity and trading to other trading venues ...

... The value of the regulated exchanges as the only trusted venues for price discovery has been evidenced, once again, just recently. The suspension of trading a few days ago on Borsa Italiana and the London Stock Exchange was not followed by a migration of liquidity and trading to other trading venues ...

“Mini-Tender” Offer

... representing a discount of 4.33% and 4.41%, respectively, to the closing prices of Thomson Reuters shares on the Toronto Stock Exchange and New York Stock Exchange on September 10, 2014, the last trading day before the mini-tender offer was commenced. In addition, the offer is highly conditional. TR ...

... representing a discount of 4.33% and 4.41%, respectively, to the closing prices of Thomson Reuters shares on the Toronto Stock Exchange and New York Stock Exchange on September 10, 2014, the last trading day before the mini-tender offer was commenced. In addition, the offer is highly conditional. TR ...

Ch 4

... No, you would be subject to interest rate reinvestment rate risk. You might expect to “roll over” the Treasury bills at a constant (or even increasing) rate of interest, but if interest rates fall, your investment income will decrease. ...

... No, you would be subject to interest rate reinvestment rate risk. You might expect to “roll over” the Treasury bills at a constant (or even increasing) rate of interest, but if interest rates fall, your investment income will decrease. ...

Directive 6: Market Information

... automated trading systems. This is conditional upon the participant using the price data exclusively for trading on SIX Swiss Exchange markets, confirmation of which must be provided by the compliance officer. ...

... automated trading systems. This is conditional upon the participant using the price data exclusively for trading on SIX Swiss Exchange markets, confirmation of which must be provided by the compliance officer. ...

OCA - Federation of European Securities Exchanges

... Note: Following FESE Statistics Methodology only those shares admitted to listing on a stock market at the end of the period are included. ...

... Note: Following FESE Statistics Methodology only those shares admitted to listing on a stock market at the end of the period are included. ...

ch9_IM_1E

... Using the Internet for Stock Pricing 9. Pick a company whose stock is traded on the NYSE. Use one of the stock valuation models discussed in this chapter together with information that you can find by searching the Internet to compute an intrinsic value for the stock. Compare your estimate of intrin ...

... Using the Internet for Stock Pricing 9. Pick a company whose stock is traded on the NYSE. Use one of the stock valuation models discussed in this chapter together with information that you can find by searching the Internet to compute an intrinsic value for the stock. Compare your estimate of intrin ...

Dividend Policy

... Using the Internet for Stock Pricing 9. Pick a company whose stock is traded on the NYSE. Use one of the stock valuation models discussed in this chapter together with information that you can find by searching the Internet to compute an intrinsic value for the stock. Compare your estimate of intrin ...

... Using the Internet for Stock Pricing 9. Pick a company whose stock is traded on the NYSE. Use one of the stock valuation models discussed in this chapter together with information that you can find by searching the Internet to compute an intrinsic value for the stock. Compare your estimate of intrin ...

Examining the first stages of Market Performance

... most significantly, the emerging markets differ in age. Some emerging financial markets are relatively old (e.g. The Kuala Lumpur Stock Exchange and the Singapore Stock Exchange were formally established as separate markets in 1973, but their common history can be traced as far back to 1910). In con ...

... most significantly, the emerging markets differ in age. Some emerging financial markets are relatively old (e.g. The Kuala Lumpur Stock Exchange and the Singapore Stock Exchange were formally established as separate markets in 1973, but their common history can be traced as far back to 1910). In con ...

Closing Press Release - Bluerock Residential Growth REIT

... A common stock issued pursuant to the full exercise of an option to purchase additional shares of Class A common stock granted to the underwriters, at a price to the public of $13.00 per share. The Company received approximately $77.6 million in total net proceeds from the offering after deducting u ...

... A common stock issued pursuant to the full exercise of an option to purchase additional shares of Class A common stock granted to the underwriters, at a price to the public of $13.00 per share. The Company received approximately $77.6 million in total net proceeds from the offering after deducting u ...

Monthly Seasonality in the New Zealand Stock Market

... these stocks. Therefore, the study of seasonality implies that investors could employ the anomaly findings to predict the future behavior of prices (Fama, 1965). Seasonal anomalies, therefore, are in contradiction to any of the three forms of efficient market hypothesis (EMH), particularly the weak- ...

... these stocks. Therefore, the study of seasonality implies that investors could employ the anomaly findings to predict the future behavior of prices (Fama, 1965). Seasonal anomalies, therefore, are in contradiction to any of the three forms of efficient market hypothesis (EMH), particularly the weak- ...

Firm Churn on Main Street and Wall Street

... which are baskets or indexes of a fixed number of stocks, the Nasdaq is a stock exchange. It is an all-electronic exchange, with no physical trading floor like the New York and American stock exchanges. Of these three exchanges, the Nasdaq is generally seen as having the easiest requirements and sta ...

... which are baskets or indexes of a fixed number of stocks, the Nasdaq is a stock exchange. It is an all-electronic exchange, with no physical trading floor like the New York and American stock exchanges. Of these three exchanges, the Nasdaq is generally seen as having the easiest requirements and sta ...

NYSE National, Inc. Schedule of Fees and Rebates As Of

... MDR credit (in such percent as is specified above) of the market data revenue attributable to such ETP Holder’s executions and displayed quotes in securities priced at $1.00 or greater. b) Adjustments. To the extent market data revenue from Tape “A”, "B" or “C” securities transactions is subject to ...

... MDR credit (in such percent as is specified above) of the market data revenue attributable to such ETP Holder’s executions and displayed quotes in securities priced at $1.00 or greater. b) Adjustments. To the extent market data revenue from Tape “A”, "B" or “C” securities transactions is subject to ...

Download attachment

... Why does a company issue stock? Why would the founders share the profits with thousands of people when they could keep profits to themselves? The reason is that at some point every company needs to raise money. To do this, companies can either borrow it from somebody or raise it by selling part of t ...

... Why does a company issue stock? Why would the founders share the profits with thousands of people when they could keep profits to themselves? The reason is that at some point every company needs to raise money. To do this, companies can either borrow it from somebody or raise it by selling part of t ...

Managing Finance and Budgets

... lengths of credit. Typically used in business to business trading. Discounts for Early Payment Typically used in manufacturing or where there are relatively high profit margins. Discounts can be expensive; if the company has a ROCE less than around 20%, it would be unlikely to benefit. Debt Factorin ...

... lengths of credit. Typically used in business to business trading. Discounts for Early Payment Typically used in manufacturing or where there are relatively high profit margins. Discounts can be expensive; if the company has a ROCE less than around 20%, it would be unlikely to benefit. Debt Factorin ...

Now you can invest in high-growth companies just before they go

... How GFC invests in private valuations before a company goes public Ground Floor Capital and its investors provide the final round of financing for high-growth companies before taking them public in North American markets. A word from our CEO on GFC’s due diligence process “At Ground Floor Capital, w ...

... How GFC invests in private valuations before a company goes public Ground Floor Capital and its investors provide the final round of financing for high-growth companies before taking them public in North American markets. A word from our CEO on GFC’s due diligence process “At Ground Floor Capital, w ...

A KEY TO CAPITAL MARKETS IN EMERGING COUNTRIES

... Unlike borrowing, equity does not have principal and interest repayment obligations that may pressure the cash flow of a company ...

... Unlike borrowing, equity does not have principal and interest repayment obligations that may pressure the cash flow of a company ...

Notice of a bondholder intention to sell a certain number of bonds to

... Hereby ____________________ (the full name of a bondholder) notifies of its intention to sell series 03 documentary interest-bearing non-convertible pay-to-bearer bonds issued by "Southern Telecommunications Company" PJSC, subject to mandatory centralized safe custody, state registration number of t ...

... Hereby ____________________ (the full name of a bondholder) notifies of its intention to sell series 03 documentary interest-bearing non-convertible pay-to-bearer bonds issued by "Southern Telecommunications Company" PJSC, subject to mandatory centralized safe custody, state registration number of t ...

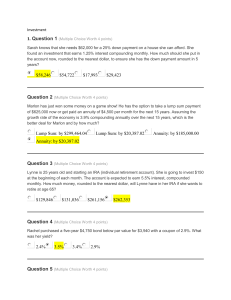

Investment - OpenStudy

... at the beginning of each month. The account is expected to earn 5.5% interest, compounded monthly. How much money, rounded to the nearest dollar, will Lynne have in her IRA if she wants to retire at age 65? ...

... at the beginning of each month. The account is expected to earn 5.5% interest, compounded monthly. How much money, rounded to the nearest dollar, will Lynne have in her IRA if she wants to retire at age 65? ...

CfP: Workshop on Commodity Trading Companies in the First

... multinational enterprise, replacing the role and services offered by merchants and trading companies. Theory suggests that falling margins and competition from manufacturing firms force trading companies to either disappear or diversify away from pure trading and turn into hybrid trading companies o ...

... multinational enterprise, replacing the role and services offered by merchants and trading companies. Theory suggests that falling margins and competition from manufacturing firms force trading companies to either disappear or diversify away from pure trading and turn into hybrid trading companies o ...

Introduction to Securities Law

... In this Unit, we will familiarise ourselves with some of the more common terms and concepts specific to securities law. We will also better understand the structure of the securities market, the manner ...

... In this Unit, we will familiarise ourselves with some of the more common terms and concepts specific to securities law. We will also better understand the structure of the securities market, the manner ...

CMC-Q1-2016-New Complaints Management Framework

... Complaints relating to transactions spanning up to 7 years or beyond may require more time to enable firms respond to allegations. Complaints that include criminal elements which are referred to the Exchange, these complaints are not likely to be concluded within 20 working days. Appeals against dir ...

... Complaints relating to transactions spanning up to 7 years or beyond may require more time to enable firms respond to allegations. Complaints that include criminal elements which are referred to the Exchange, these complaints are not likely to be concluded within 20 working days. Appeals against dir ...

Who we are

... PMEX aims to bring futures contracts of all the above commodities on its trading platform ...

... PMEX aims to bring futures contracts of all the above commodities on its trading platform ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.