under Fixed Price Method

... The capital market can encourage broader ownership of productive assets by small savers to enable them benefit from Bangladesh's economic growth. The capital market can provide avenues for investment opportunities that encourage a thrift culture critical to increase domestic savings and investment r ...

... The capital market can encourage broader ownership of productive assets by small savers to enable them benefit from Bangladesh's economic growth. The capital market can provide avenues for investment opportunities that encourage a thrift culture critical to increase domestic savings and investment r ...

Guide to listing on AIM for Indian companies

... The NOMAD is responsible for the company’s compliance with the AIM Rules for Companies (the “AIM Rules”) on and following admission. The AIM Rules are published by the London Stock Exchange and set out the rules and responsibilities that an AIM company must comply with. These are comprehensive and w ...

... The NOMAD is responsible for the company’s compliance with the AIM Rules for Companies (the “AIM Rules”) on and following admission. The AIM Rules are published by the London Stock Exchange and set out the rules and responsibilities that an AIM company must comply with. These are comprehensive and w ...

Question 1 Miss Maple is considering two securities, A and B, and

... 1. The expected return on any portfolio must be less than or equal to the return on the stock with the highest return. It cannot be greater than this stock’s return because all stocks with lower returns will pull down the value of the weighted average return. Similarly, the expected return on any po ...

... 1. The expected return on any portfolio must be less than or equal to the return on the stock with the highest return. It cannot be greater than this stock’s return because all stocks with lower returns will pull down the value of the weighted average return. Similarly, the expected return on any po ...

Checklist for shareholders` agreement

... If so, will existing shareholders have the right to buy such shares in any amount other than their proportion of the current shareholding which they hold? ...

... If so, will existing shareholders have the right to buy such shares in any amount other than their proportion of the current shareholding which they hold? ...

Long Term Effect of Liquidity on Stock Market Development

... market. From the theoretical perspective, higher stock price volatility discourages savers and thus inhibits investment. In addition to this, investors tend to demand higher risk premium during high stock price volatility which increases cost of capital thus choking investment thereby leading to low ...

... market. From the theoretical perspective, higher stock price volatility discourages savers and thus inhibits investment. In addition to this, investors tend to demand higher risk premium during high stock price volatility which increases cost of capital thus choking investment thereby leading to low ...

An explanation of some basic concepts for Ratios and Analysis for

... getting from dividends. Investors who require a minimum stream of cash flow from their investment portfolio can secure this cash flow by investing in stocks paying relatively high, stable dividend yields. ...

... getting from dividends. Investors who require a minimum stream of cash flow from their investment portfolio can secure this cash flow by investing in stocks paying relatively high, stable dividend yields. ...

Closure of share capital increase Saint

... This document constitutes an advertisement and not a prospectus. This press release must not be published, released or distributed, directly or indirectly, in the United States of America (including its territories and possessions, any State of the United States and the District of Columbia), Austra ...

... This document constitutes an advertisement and not a prospectus. This press release must not be published, released or distributed, directly or indirectly, in the United States of America (including its territories and possessions, any State of the United States and the District of Columbia), Austra ...

Live Stream Coffee Chat - Group 7-8

... right message from the top to the bottom of the pyramid. Usually the message is changed or not even delivered. ...

... right message from the top to the bottom of the pyramid. Usually the message is changed or not even delivered. ...

Private Equity Funds in Namibia: Venturing Forth

... • Recovering from bubble of late 1990s • As much venture capital raised in 2 years as in previous 20 • People with bright ideas + garage + venture capital = world beating company • Everyone wanted to be next Cisco or Amazon • New economy and stock market boom • US accounted for three-quarters of glo ...

... • Recovering from bubble of late 1990s • As much venture capital raised in 2 years as in previous 20 • People with bright ideas + garage + venture capital = world beating company • Everyone wanted to be next Cisco or Amazon • New economy and stock market boom • US accounted for three-quarters of glo ...

Surveillance in a changing SecuritieS market landScape

... Equities Research at TABB Group, prefaced the discussion with three observations based on her research: 1. There is a correlation between market integrity and confidence, and once confidence dips, following an event such as the Flash Crash, it takes time for it to recover; ...

... Equities Research at TABB Group, prefaced the discussion with three observations based on her research: 1. There is a correlation between market integrity and confidence, and once confidence dips, following an event such as the Flash Crash, it takes time for it to recover; ...

Business 7e - Pride, Hughes, Kapor

... companies, mutual funds, banks, and other organizations that trade large quantities of securities Copyright © Houghton Mifflin Company. All rights reserved. ...

... companies, mutual funds, banks, and other organizations that trade large quantities of securities Copyright © Houghton Mifflin Company. All rights reserved. ...

Fin432_gj_ch2

... 4. Review the importance of global securities markets, their performance, procedures and and associated risks. 5. Discuss trading hours and regulation of securities markets. 6. Explain the motives, procedures and calculations in long purchases, margin transactions and short sales. ...

... 4. Review the importance of global securities markets, their performance, procedures and and associated risks. 5. Discuss trading hours and regulation of securities markets. 6. Explain the motives, procedures and calculations in long purchases, margin transactions and short sales. ...

Notice of Issue Price and Selling Price for Offering in Japan [PDF

... network solutions providers. IIJ and its group companies provide total network solutions that mainly cater to high-end corporate customers. The company's services include high-quality systems integration and security services, Internet access, and cloud computing. Moreover, the company has built one ...

... network solutions providers. IIJ and its group companies provide total network solutions that mainly cater to high-end corporate customers. The company's services include high-quality systems integration and security services, Internet access, and cloud computing. Moreover, the company has built one ...

ch01 - Class Index

... Types of derivatives Participants in the derivatives world Uses of derivatives ...

... Types of derivatives Participants in the derivatives world Uses of derivatives ...

FREE Sample Here

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

April 2016 Newsletter

... According to David Kotok of Cumberland Advisors, 23 countries, 5 currencies and 24% of global output are now under some version of Negative Interest Rate Policy. What was just months ago considered to be a lastditch weapon of monetary policy shock and awe seems to have run out of both shock and awe. ...

... According to David Kotok of Cumberland Advisors, 23 countries, 5 currencies and 24% of global output are now under some version of Negative Interest Rate Policy. What was just months ago considered to be a lastditch weapon of monetary policy shock and awe seems to have run out of both shock and awe. ...

How Efficient Markets Undervalue Stocks: CAPM and ECMH under

... Thus the Investment Dartboard results only confirmed what the academics already knew: you can't beat the market.8 Or so it seemed from the first round. Undeterred by their initial defeat, investment managers continued to step up to the plate in subsequent Investment Dartboard contests. And as the co ...

... Thus the Investment Dartboard results only confirmed what the academics already knew: you can't beat the market.8 Or so it seemed from the first round. Undeterred by their initial defeat, investment managers continued to step up to the plate in subsequent Investment Dartboard contests. And as the co ...

388 kb PowerPoint presentation

... foreign financing, either through direct loans from mother companies abroad or loans from foreign banks, or through issues of debt securities and GDRs/ADRs on external capital markets. 5. The future of stock markets in accession countries has not yet been decided. One possible solution is integratio ...

... foreign financing, either through direct loans from mother companies abroad or loans from foreign banks, or through issues of debt securities and GDRs/ADRs on external capital markets. 5. The future of stock markets in accession countries has not yet been decided. One possible solution is integratio ...

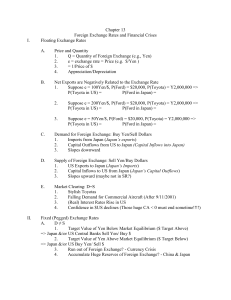

Chapter 13 - Montana State University

... Why does international lending occur? Is it desirable? Why do “financial crises” sometimes occur? I. Theoretical Rationale A. If the return on capital (MPK) is higher in country A than country B, ...

... Why does international lending occur? Is it desirable? Why do “financial crises” sometimes occur? I. Theoretical Rationale A. If the return on capital (MPK) is higher in country A than country B, ...

New Venture Creation

... • What type of ventures lends themselves to the use of informal investors? – Ventures with capital requirements of between $50,000 and $500,000 – Ventures with sales potential of between $2 million and $20 million within 5 to 10 years – Small, established, privately held ventures with sales and prof ...

... • What type of ventures lends themselves to the use of informal investors? – Ventures with capital requirements of between $50,000 and $500,000 – Ventures with sales potential of between $2 million and $20 million within 5 to 10 years – Small, established, privately held ventures with sales and prof ...

Lester Coyle - We look at where the bonds will be in a year

... Many double Bs should get upgraded as the senior notes pay down, and ratings-sensitive investors will pay more for a bond with an investment grade rating. Whereas many investors focus on the headline base yield, we look at where the bonds are likely to be in a year. What is the worst investment? We ...

... Many double Bs should get upgraded as the senior notes pay down, and ratings-sensitive investors will pay more for a bond with an investment grade rating. Whereas many investors focus on the headline base yield, we look at where the bonds are likely to be in a year. What is the worst investment? We ...

bovespa index methodology

... 4. In the course of the portfolio cycle, it is designated to be under ‘exceptional trading status’ (see the Concepts and Practices Manual for BM&FBOVESPA Indices). In this event, the removal will be implemented from the close as of the first trading day following recognition of such status. WEIGHTI ...

... 4. In the course of the portfolio cycle, it is designated to be under ‘exceptional trading status’ (see the Concepts and Practices Manual for BM&FBOVESPA Indices). In this event, the removal will be implemented from the close as of the first trading day following recognition of such status. WEIGHTI ...

(Debt/Equity Swap)? - G. William Schwert

... •66% of these bonds are still outstanding •given the waiting period and the stock price drop after the call is announced, these bonds may not remain "in-the-money" when the call would be exercised ...

... •66% of these bonds are still outstanding •given the waiting period and the stock price drop after the call is announced, these bonds may not remain "in-the-money" when the call would be exercised ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.