Chapter 5 The Time Value of Money

... 4. If a company decides to issue debt, what determines whether it is bank debt or bonds issued to the public debt market? 5. What determines whether a company accesses the shortterm money market vs. borrowing from a bank? ...

... 4. If a company decides to issue debt, what determines whether it is bank debt or bonds issued to the public debt market? 5. What determines whether a company accesses the shortterm money market vs. borrowing from a bank? ...

Shopping - MBA6113-Technology

... almost immediately reselling them for a fraction more. If his firm hadn't moved its computers, says Mr. Cummings, "we'd be out of business." Dozens of other firms, ranging from Citadel Derivatives Group to a brokerage unit of J.P. Morgan Chase & Co., also employ split-second trading strategies. Tha ...

... almost immediately reselling them for a fraction more. If his firm hadn't moved its computers, says Mr. Cummings, "we'd be out of business." Dozens of other firms, ranging from Citadel Derivatives Group to a brokerage unit of J.P. Morgan Chase & Co., also employ split-second trading strategies. Tha ...

The Hunger-Makers: How Deutsche Bank, Goldman

... futures on commodities exchanges are only bets, comparable to a zero-sum game, and that they cannot distort spot prices. This argument does apply to traditional speculators whose trading with futures is based on the actual development of supply and demand for raw materials on the physical markets. I ...

... futures on commodities exchanges are only bets, comparable to a zero-sum game, and that they cannot distort spot prices. This argument does apply to traditional speculators whose trading with futures is based on the actual development of supply and demand for raw materials on the physical markets. I ...

Chapter 12 - U of L Class Index

... consumption and earn a return to compensate them for doing so – Borrowers have better access to the capital that is available so that they can invest in productive assets Financial markets also provide us with information about the returns that are required for various levels of risk. ...

... consumption and earn a return to compensate them for doing so – Borrowers have better access to the capital that is available so that they can invest in productive assets Financial markets also provide us with information about the returns that are required for various levels of risk. ...

IB Comment Letter to SEC Opposing New Margin Requirements for

... change in market conditions, an unexpectedly large gain or loss in the position, or because the trade was done to take advantage of an available arbitrage opportunity. By artificially constraining investors’ decisions, because those investors may fear being categorized as a “pattern day trader”, the ...

... change in market conditions, an unexpectedly large gain or loss in the position, or because the trade was done to take advantage of an available arbitrage opportunity. By artificially constraining investors’ decisions, because those investors may fear being categorized as a “pattern day trader”, the ...

TAN RANGE EXPLORATION CORP (Form: 6-K

... biogeochem prep lab in Mwanza, Tanzania. “Our biogeochem capability will also provide us with a low cost means of evaluating large tracts of land in order to identify target areas that are the most prospective,” he emphasized. “At that point we will determine the suitability of bringing in a joint v ...

... biogeochem prep lab in Mwanza, Tanzania. “Our biogeochem capability will also provide us with a low cost means of evaluating large tracts of land in order to identify target areas that are the most prospective,” he emphasized. “At that point we will determine the suitability of bringing in a joint v ...

Impact of the U.S subprime crises on MENA stock markets: new

... - January 2004 ‘ June 2007 ‘ before the crisis, when the global economy was in the expansion stage of the economic cycle - July 2007 ‘ May 2011 ‘ when the global financial system and the world economy went through difficult times marked by the advent of the financial crisis in the United States, its ...

... - January 2004 ‘ June 2007 ‘ before the crisis, when the global economy was in the expansion stage of the economic cycle - July 2007 ‘ May 2011 ‘ when the global financial system and the world economy went through difficult times marked by the advent of the financial crisis in the United States, its ...

Slide 1 - OECD.org

... Special cases • For enterprises, which according to the government decision mainly act as providers of goods and services not for profit, but where the activity is market production – one should use the multiplier method as done for other market producers - except the comparison of profitability be ...

... Special cases • For enterprises, which according to the government decision mainly act as providers of goods and services not for profit, but where the activity is market production – one should use the multiplier method as done for other market producers - except the comparison of profitability be ...

Tom Lawless

... Look around in region – can you use them? This is a volume business – harness economies of ...

... Look around in region – can you use them? This is a volume business – harness economies of ...

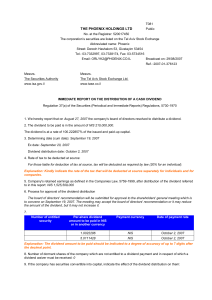

dividend

... 4. Rate of tax to be deducted at source: For those liable for deduction of tax at source, tax will be deducted as required by law (20% for an individual). Explanation: Kindly indicate the rate of the tax that will be deducted at source separately for individuals and for companies. 5. Company's retai ...

... 4. Rate of tax to be deducted at source: For those liable for deduction of tax at source, tax will be deducted as required by law (20% for an individual). Explanation: Kindly indicate the rate of the tax that will be deducted at source separately for individuals and for companies. 5. Company's retai ...

50 The LC Gupta Committee Report: Some Observations

... when the product concerned is stock index futures contracts. As discussed in Bhaumik (1998), effective enforcement of margin requirements is an important precondition for avoidance of a derivatives-market-initiated systemic crisis. This, in turn, requires daily settlement of margin calls by traders ...

... when the product concerned is stock index futures contracts. As discussed in Bhaumik (1998), effective enforcement of margin requirements is an important precondition for avoidance of a derivatives-market-initiated systemic crisis. This, in turn, requires daily settlement of margin calls by traders ...

securities offerings on the internet

... common to new entities that attempt to do business in a new way. For example, investment bankers increase the potential market for an issuance by performing due diligence investigations concerning the offering and the issuer. This reduces the potential for fraud,13 thus reducing the risk14 to potent ...

... common to new entities that attempt to do business in a new way. For example, investment bankers increase the potential market for an issuance by performing due diligence investigations concerning the offering and the issuer. This reduces the potential for fraud,13 thus reducing the risk14 to potent ...

Contents Stock Market Indicators Measuring market bredth Sample

... Most analysts prefer the A/D ratio as an indicator, because it is more amenable to comparisons than the A-D line. The A/D ratio has an absolute value that does not vary in function of the number of components being analyzed – it remains constant, regardless of the number of stocks under considerati ...

... Most analysts prefer the A/D ratio as an indicator, because it is more amenable to comparisons than the A-D line. The A/D ratio has an absolute value that does not vary in function of the number of components being analyzed – it remains constant, regardless of the number of stocks under considerati ...

Low beta continues to perform

... This trend has been mirrored in global shares ETF investors have been actively playing this trend over the last few months The autopilot looks to have been taken off the market since the opening weeks of the third quarter, as evident by the 5% fall in the S&P 500 index over the last nine trading ...

... This trend has been mirrored in global shares ETF investors have been actively playing this trend over the last few months The autopilot looks to have been taken off the market since the opening weeks of the third quarter, as evident by the 5% fall in the S&P 500 index over the last nine trading ...

Treatment of employee stock options granted by non

... moment options are vested if not exercised. To get full coverage and separate data on employee stock options data will have to be collected in business surveys. On the other hand, as mentioned above the data will perhaps be more readily available from business reports in the future. In cases where f ...

... moment options are vested if not exercised. To get full coverage and separate data on employee stock options data will have to be collected in business surveys. On the other hand, as mentioned above the data will perhaps be more readily available from business reports in the future. In cases where f ...

order - TeacherWeb

... Stop-Limit Order • Instructs the broker to buy or sell when your stock hits the “stop” price, but not to pay more or accept less than the “limit price” ▫ Your trade is schedule to occur at a price between the “stop price” and the “limit price” ▫ Risk: Your trade might not be executed at all ▫ Advan ...

... Stop-Limit Order • Instructs the broker to buy or sell when your stock hits the “stop” price, but not to pay more or accept less than the “limit price” ▫ Your trade is schedule to occur at a price between the “stop price” and the “limit price” ▫ Risk: Your trade might not be executed at all ▫ Advan ...

02_riskreturn_ch12

... If the market is weak form efficient, then investors cannot earn abnormal returns by trading on market information Implies that technical analysis will not lead to abnormal returns Empirical evidence indicates that markets are generally weak form efficient ...

... If the market is weak form efficient, then investors cannot earn abnormal returns by trading on market information Implies that technical analysis will not lead to abnormal returns Empirical evidence indicates that markets are generally weak form efficient ...

A common factor analysis for the US and the German stock markets

... tests from the classical perspective to a sample of this size is likely to indicate statistical significance for values that won’t be statistical significant otherwise. Since there is no general approach to tackle this issue and many analyses of highfrequency data are often conducted using conventio ...

... tests from the classical perspective to a sample of this size is likely to indicate statistical significance for values that won’t be statistical significant otherwise. Since there is no general approach to tackle this issue and many analyses of highfrequency data are often conducted using conventio ...

Dr. Mitchell - people.vcu.edu

... Therefore they begin selling it off as fast as they can. The more they want to sell, the more pressure there is on the exchange rate, and the faster foreign exchange reserves fall, making the fears come true. Some actors may begin to bet against the local currency in other ways, such as by selling f ...

... Therefore they begin selling it off as fast as they can. The more they want to sell, the more pressure there is on the exchange rate, and the faster foreign exchange reserves fall, making the fears come true. Some actors may begin to bet against the local currency in other ways, such as by selling f ...

Foreign Companies and U.S. Securities Markets in a Time of

... very strongly believe is the right direction, continues through the critical point, which is when people stop making predictions and start voting. At the same time that our economy is afloat on a sea of change, there are enduring values and certain fundamental truths that can serve as our compass in ...

... very strongly believe is the right direction, continues through the critical point, which is when people stop making predictions and start voting. At the same time that our economy is afloat on a sea of change, there are enduring values and certain fundamental truths that can serve as our compass in ...

PDF Download

... shares of stocks and flows, inward as well as outward, has increased. Those of the United States and Japan have largely declined, with those of Japan remaining relatively small. The rise in EU shares is largely due to crossborder M&As. The United States remains the single largest host country, but i ...

... shares of stocks and flows, inward as well as outward, has increased. Those of the United States and Japan have largely declined, with those of Japan remaining relatively small. The rise in EU shares is largely due to crossborder M&As. The United States remains the single largest host country, but i ...

Telefónica, SA

... Further to Relevant Events notices published on March 2, 2016 in relation to the issue by TELEFÓNICA of equity-linked bonds (the “Bonds”), via its wholly-owned subsidiary Telefónica Participaciones, S.A.U. (the “Issuer”), we hereby announce that the reference price of the TELEFÓNICA shares for the p ...

... Further to Relevant Events notices published on March 2, 2016 in relation to the issue by TELEFÓNICA of equity-linked bonds (the “Bonds”), via its wholly-owned subsidiary Telefónica Participaciones, S.A.U. (the “Issuer”), we hereby announce that the reference price of the TELEFÓNICA shares for the p ...

Change of Control Amendment/Termination New Plan Benefits

... will lapse and (iii) any Performance Share or Unit (that is not converted as described below) will be considered to have vested at target levels. The Committee may, in its discretion, provide for cancellation of each Award in exchange for a cash payment per share based upon the change of control pri ...

... will lapse and (iii) any Performance Share or Unit (that is not converted as described below) will be considered to have vested at target levels. The Committee may, in its discretion, provide for cancellation of each Award in exchange for a cash payment per share based upon the change of control pri ...

Balancing Public Market Benefits and Burdens for Smaller

... hide would prefer to go private rather than provide disclosure. Regulation FD and Sarbanes-Oxley, on the other hand, likely were not expected to have a disproportionate effect on any issuers.9 Accumulating evidence suggests that the regulations described herein have disproportionately impacted small ...

... hide would prefer to go private rather than provide disclosure. Regulation FD and Sarbanes-Oxley, on the other hand, likely were not expected to have a disproportionate effect on any issuers.9 Accumulating evidence suggests that the regulations described herein have disproportionately impacted small ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.