U.S. TREAS Form treas-irs-1065-schedule-d-1992

... organization if the fair market value of the property exceeds the partnership’s adjusted basis in such property. ● Any loss on the disposition of converted wetland or highly erodible cropland that is first used for farming after March 1, 1986, is reported as a long-term capital loss on Schedule D, b ...

... organization if the fair market value of the property exceeds the partnership’s adjusted basis in such property. ● Any loss on the disposition of converted wetland or highly erodible cropland that is first used for farming after March 1, 1986, is reported as a long-term capital loss on Schedule D, b ...

Euronav NV (Form: 6-K, Received: 01/05/2017 16:12:38)

... Antwerp, Belgium 5 January 2017 – Euronav NV ( NYSE: EURN & Euronext: EURN ) ("Euronav" or the "Company") announces today that it has entered into a five-year sale and leaseback agreement for four VLCC vessels with investment vehicles advised by Wafra Capital Partners Inc., a private equity partners ...

... Antwerp, Belgium 5 January 2017 – Euronav NV ( NYSE: EURN & Euronext: EURN ) ("Euronav" or the "Company") announces today that it has entered into a five-year sale and leaseback agreement for four VLCC vessels with investment vehicles advised by Wafra Capital Partners Inc., a private equity partners ...

Corporate Securities Law Prospectus Exemption

... The rationale underlying the Exemption is that an investor who already holds a listed security of the issuer has previously made an investment decision concerning the issuer and its securities and therefore should be able to subscribe for the same security without requiring the issuer to incur signi ...

... The rationale underlying the Exemption is that an investor who already holds a listed security of the issuer has previously made an investment decision concerning the issuer and its securities and therefore should be able to subscribe for the same security without requiring the issuer to incur signi ...

R14-Chp-00-2-1D-CPA Rev-Sec 61-121-165-1001-1031

... What is Joe’s recognized gain or loss on this sale? a. $0 b $2,300 c. $7,600 d. None of these 3. (CPAM91#23) In a "like-kind" exchange of an investment asset for a similar asset that will also be held as an investment, no taxable gain or loss will be recognized on the transaction if both assets are: ...

... What is Joe’s recognized gain or loss on this sale? a. $0 b $2,300 c. $7,600 d. None of these 3. (CPAM91#23) In a "like-kind" exchange of an investment asset for a similar asset that will also be held as an investment, no taxable gain or loss will be recognized on the transaction if both assets are: ...

Century Park Pictures Corporation

... our auditors have issued an audit opinion for the Company which includes a statement describing our going concern status. This means, in our auditor's opinion, substantial doubt about our ability to continue as a going concern exists at the date of their opinion. The Company's continued existence is ...

... our auditors have issued an audit opinion for the Company which includes a statement describing our going concern status. This means, in our auditor's opinion, substantial doubt about our ability to continue as a going concern exists at the date of their opinion. The Company's continued existence is ...

Exchange Rates Teacher

... • An appreciation of a currency takes place when its value rises against other currencies, whereas a depreciation occurs when a currencies’ value falls against other currencies. ...

... • An appreciation of a currency takes place when its value rises against other currencies, whereas a depreciation occurs when a currencies’ value falls against other currencies. ...

The incumbent presentation shall attempt to delineate

... Given the above, our understanding is that we have to view the issue of collective behaviour from an alternative point. Let us assume, for a moment, that an investor trades to the direction of past prices (i.e. buys when prices go up and sells when they go down). By definition, this investor will ad ...

... Given the above, our understanding is that we have to view the issue of collective behaviour from an alternative point. Let us assume, for a moment, that an investor trades to the direction of past prices (i.e. buys when prices go up and sells when they go down). By definition, this investor will ad ...

synta pharmaceuticals corp. - corporate

... Compensation Policy (the “Policy”), a copy of which is filed as Exhibit 10.1 to Synta’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2015 (File No. 001-33277), and is incorporated herein by reference. Pursuant to the Policy, in connection with his appointment to Synta’s Board of Dire ...

... Compensation Policy (the “Policy”), a copy of which is filed as Exhibit 10.1 to Synta’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2015 (File No. 001-33277), and is incorporated herein by reference. Pursuant to the Policy, in connection with his appointment to Synta’s Board of Dire ...

derivatives_general_paper

... clearing and settlement happen immediately after the transaction. “Derivatives” is a generic name which covers all other markets. The three main subclasses are: - futures: the parties agree about quality and price but for delivery in the future, typically a few months later. The biggest futures’ mar ...

... clearing and settlement happen immediately after the transaction. “Derivatives” is a generic name which covers all other markets. The three main subclasses are: - futures: the parties agree about quality and price but for delivery in the future, typically a few months later. The biggest futures’ mar ...

What`s New - Global Financial Data

... But wait! If you look at the table on the previous page, Germany’s stock market had the strongest recovery of any stock market in the world. However, these figures are deceptive. The strong recovery only reflected how much the hyperinflation of 1922 and 1923 devastated German financial assets. In re ...

... But wait! If you look at the table on the previous page, Germany’s stock market had the strongest recovery of any stock market in the world. However, these figures are deceptive. The strong recovery only reflected how much the hyperinflation of 1922 and 1923 devastated German financial assets. In re ...

Prestigious Stock Exchanges - Federal Reserve Bank of New York

... studies have shown that the Eurobond market has become the world’s largest bond market in recent years (Peristiani 2007; Peristiani and Santos 2008). As for equity markets, the more competitive European and emerging-market stock exchanges have in fact become better able to retain their home base, wh ...

... studies have shown that the Eurobond market has become the world’s largest bond market in recent years (Peristiani 2007; Peristiani and Santos 2008). As for equity markets, the more competitive European and emerging-market stock exchanges have in fact become better able to retain their home base, wh ...

Growth/Value/Momentum Returns as a Function of the Cross

... Index publishers such as Frank Russell and Salomon Smith Barney use fundamental information such as book-to-market ratio at a moment in time to define a taxonomy ...

... Index publishers such as Frank Russell and Salomon Smith Barney use fundamental information such as book-to-market ratio at a moment in time to define a taxonomy ...

WTI-Brent spread and the value of refining firms

... Over the eight year period (2006-13) our regression analysis finds there is a significant and material relationship between the WTI-Brent spread and the value of U.S. refiners. For the full period, we find that a 1% decline in the spread lead to a 0.07% increase in the refining and marketing equity ...

... Over the eight year period (2006-13) our regression analysis finds there is a significant and material relationship between the WTI-Brent spread and the value of U.S. refiners. For the full period, we find that a 1% decline in the spread lead to a 0.07% increase in the refining and marketing equity ...

The Economic Impact of the Stock Market Boom and Crash of 1929

... retirements, and more important, for the portion of these listed stocks which are owned by corporations or foreigners.4 We sometimes forget that the New York Stock Exchange was only one of 34 exchanges operating in this country in the 1920’s. We really want to know the capital gains and losses from ...

... retirements, and more important, for the portion of these listed stocks which are owned by corporations or foreigners.4 We sometimes forget that the New York Stock Exchange was only one of 34 exchanges operating in this country in the 1920’s. We really want to know the capital gains and losses from ...

Stock Market Efficiency and Insider Trading Kris McKinley, Elon

... reflected in the stocks’ prices. While it was not surprising to see the long-run (one-year) returns are statistically significant, it was a surprise to see the one year insider selling returns are significant, rather than the one year insider buying data. Due to the fact that there are numerous reas ...

... reflected in the stocks’ prices. While it was not surprising to see the long-run (one-year) returns are statistically significant, it was a surprise to see the one year insider selling returns are significant, rather than the one year insider buying data. Due to the fact that there are numerous reas ...

CF072M

... Latest available share price of the comparable companies should be used in calculating the market capitalization and price earnings ratio. The Sponsor(s) should provide details of the selection basis of the comparable companies, including but not limited to, how each of the comparable companies’ sca ...

... Latest available share price of the comparable companies should be used in calculating the market capitalization and price earnings ratio. The Sponsor(s) should provide details of the selection basis of the comparable companies, including but not limited to, how each of the comparable companies’ sca ...

Exploring the Web 1-25

... they often seek additional funding in equity markets after going public. The success of these seasoned-equity offerings (SEOs) is very dependent on the current price of the company’s stock. ...

... they often seek additional funding in equity markets after going public. The success of these seasoned-equity offerings (SEOs) is very dependent on the current price of the company’s stock. ...

Simplified stock markets described by number operators

... In some recent papers, [1, 2], we have discussed why and how a quantum mechanical framework, and in particular operator algebras and the number representation, can be used in the analysis of some simplified models of stock markets. In these models, among the other simplifications, no financial deriv ...

... In some recent papers, [1, 2], we have discussed why and how a quantum mechanical framework, and in particular operator algebras and the number representation, can be used in the analysis of some simplified models of stock markets. In these models, among the other simplifications, no financial deriv ...

Chapter 11: Structuring the Deal--Payment and Legal Considerations

... Stock purchases involve the exchange of the target’s stock for either cash, debt, or the stock of the acquiring firm. True or False ...

... Stock purchases involve the exchange of the target’s stock for either cash, debt, or the stock of the acquiring firm. True or False ...

Foreign Profitability and Dividend Policy - HEC

... restrictions Operating regions/countries usually experience varied rates of profitability, risk and growth. Valuation likely varies depending upon the location of the operations disaggregation needed A geographical breakdown of firms’ operations may provides investors with useful information. ...

... restrictions Operating regions/countries usually experience varied rates of profitability, risk and growth. Valuation likely varies depending upon the location of the operations disaggregation needed A geographical breakdown of firms’ operations may provides investors with useful information. ...

DCF Tutorial Part 1

... "I'd be a bum on the street with a tin cup if the markets were always efficient" – Warren Buffett • The Opportunity Cost of Money – – Also known as the Hurdle Rate ...

... "I'd be a bum on the street with a tin cup if the markets were always efficient" – Warren Buffett • The Opportunity Cost of Money – – Also known as the Hurdle Rate ...

Stock Underwriting

... Tombstones ad is considered as an essential ingredient of the process. This is more in the nature of announcement than advertisement. A tombstone is a boxed-in ad that appears in financial sections of newspaper and magazines that announces the particulars of the issue. It contains the name of the co ...

... Tombstones ad is considered as an essential ingredient of the process. This is more in the nature of announcement than advertisement. A tombstone is a boxed-in ad that appears in financial sections of newspaper and magazines that announces the particulars of the issue. It contains the name of the co ...

lecture-notes-2-1

... know the prices set by one another, the OTC market is very competitive and not very different from a market with an organized exchange. Many common stocks are traded over-the-counter, although a majority of the largest corporations have their shares traded at organized stock exchanges such as the ...

... know the prices set by one another, the OTC market is very competitive and not very different from a market with an organized exchange. Many common stocks are traded over-the-counter, although a majority of the largest corporations have their shares traded at organized stock exchanges such as the ...

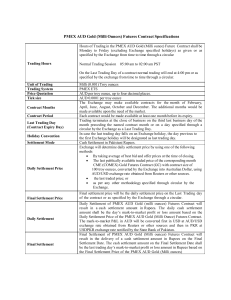

PMEX AUD Gold Futures Contract

... AUD per troy ounce, up to four decimal places. AUD 0.0001 per troy ounce The Exchange may make available contracts for the month of February, April, June, August, October and December. The additional months would be made available upon the need of the market. Each contract would be made available at ...

... AUD per troy ounce, up to four decimal places. AUD 0.0001 per troy ounce The Exchange may make available contracts for the month of February, April, June, August, October and December. The additional months would be made available upon the need of the market. Each contract would be made available at ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.