Webtrader Business Terms For Securities Trading

... automatically in or entered into the Trading Platform, must reflect the relevant Securities current market value and represent actual orders and trades. The “current market value” of a trade is the price which based on an overall assessment reflects the current pricing of the relevant Securities. An ...

... automatically in or entered into the Trading Platform, must reflect the relevant Securities current market value and represent actual orders and trades. The “current market value” of a trade is the price which based on an overall assessment reflects the current pricing of the relevant Securities. An ...

Financial capital

... financial restructuring process that is still in progress as of today. During the earnings presentation for the first quarter of 2015, Abengoa announced a reduction in its anticipated corporate cash flows from operations for the year in progress at the time, to € 600-800 M over a previous estimate o ...

... financial restructuring process that is still in progress as of today. During the earnings presentation for the first quarter of 2015, Abengoa announced a reduction in its anticipated corporate cash flows from operations for the year in progress at the time, to € 600-800 M over a previous estimate o ...

Document

... • Level II: This type of ADR is listed on an exchange or quoted on any official US stock exchange, including the NYSE and NASDAQ. Level II ADRs meet the registration requirements of the SEC, but they also get higher visibility trading volume. The company must report an annual reconciliation of earni ...

... • Level II: This type of ADR is listed on an exchange or quoted on any official US stock exchange, including the NYSE and NASDAQ. Level II ADRs meet the registration requirements of the SEC, but they also get higher visibility trading volume. The company must report an annual reconciliation of earni ...

RED HAT INC

... 428(b). In accordance with the rules and regulations of the U.S. Securities and Exchange Commission (the "Commission") and the instructions to Registration Statement on Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as a prospectus p ...

... 428(b). In accordance with the rules and regulations of the U.S. Securities and Exchange Commission (the "Commission") and the instructions to Registration Statement on Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as a prospectus p ...

IT 55 - The Business Expansion Scheme (BES)

... company, or qualifying subsidiary, branch or agency, as the case may be, carries on qualifying trading operations. The company’s stage of development Under the EU “Community Guidelines on State Aid to promote Risk Capital Investments in Small and Medium-Sized Enterprises”8, Member States are require ...

... company, or qualifying subsidiary, branch or agency, as the case may be, carries on qualifying trading operations. The company’s stage of development Under the EU “Community Guidelines on State Aid to promote Risk Capital Investments in Small and Medium-Sized Enterprises”8, Member States are require ...

Determinants of stock-bond market comovement in the Eurozone

... correlation between the two asset classes. Ilmanen (2003) argues that during periods of high inflation, changes in common discount rates dominate the changes in cash-flow expectations and lead to a positive stock-bond return correlation. Andersson et al. (2008) use data for the US, UK and Germany an ...

... correlation between the two asset classes. Ilmanen (2003) argues that during periods of high inflation, changes in common discount rates dominate the changes in cash-flow expectations and lead to a positive stock-bond return correlation. Andersson et al. (2008) use data for the US, UK and Germany an ...

markets work in war

... A more recent understanding refers to the history of analysis from the economic point of view. In the latter case, “Economic History” is part of the more general “Economic Approach to Social Science” championed by Gary Becker.1 The “New Economic History” or “Cliometrics” has gained prominence becaus ...

... A more recent understanding refers to the history of analysis from the economic point of view. In the latter case, “Economic History” is part of the more general “Economic Approach to Social Science” championed by Gary Becker.1 The “New Economic History” or “Cliometrics” has gained prominence becaus ...

4028-10-Syllabus

... – A first order Markov process is one where this probability distribution only depends on the previous value: ie p = p(x1,t1|x2,t2) – Generally just called a Markov process ...

... – A first order Markov process is one where this probability distribution only depends on the previous value: ie p = p(x1,t1|x2,t2) – Generally just called a Markov process ...

Advances in Environmental Biology

... methods. Charting method refers to drawing data charts to understand the future path of the data. Charting method is a thematic system which requires analyzer to use laws and skills to perceive and interpret the future models. Mechanical laws or indices, on the other hand, imposes order and compatib ...

... methods. Charting method refers to drawing data charts to understand the future path of the data. Charting method is a thematic system which requires analyzer to use laws and skills to perceive and interpret the future models. Mechanical laws or indices, on the other hand, imposes order and compatib ...

REGENERON PHARMACEUTICALS INC (Form: 8

... ”), and Teva Pharmaceuticals International GmbH (“ Teva ”), a wholly owned subsidiary of Teva Pharmaceutical Industries Ltd., entered into a collaboration agreement to develop and commercialize fasinumab (also known as REGN475), Regeneron’s investigational nerve-growth-factor antibody in Phase 3 cli ...

... ”), and Teva Pharmaceuticals International GmbH (“ Teva ”), a wholly owned subsidiary of Teva Pharmaceutical Industries Ltd., entered into a collaboration agreement to develop and commercialize fasinumab (also known as REGN475), Regeneron’s investigational nerve-growth-factor antibody in Phase 3 cli ...

Annexure – 1

... client orders. Brokers should maintain all activities/ alerts log with audit trail facility. The DMA Server should have internally generated unique numbering for all such client order/trades. A systems audit of the DMA systems and software shall be periodically carried out by the broker as may be sp ...

... client orders. Brokers should maintain all activities/ alerts log with audit trail facility. The DMA Server should have internally generated unique numbering for all such client order/trades. A systems audit of the DMA systems and software shall be periodically carried out by the broker as may be sp ...

Principles of Economics, Case and Fair,9e

... Attempts to stabilize the economy can prove destabilizing because of time lags. An expansionary policy that should have begun to take effect at point A does not actually begin to have an impact until point D, when the economy is already on an upswing. Hence, the policy pushes the economy to points E ...

... Attempts to stabilize the economy can prove destabilizing because of time lags. An expansionary policy that should have begun to take effect at point A does not actually begin to have an impact until point D, when the economy is already on an upswing. Hence, the policy pushes the economy to points E ...

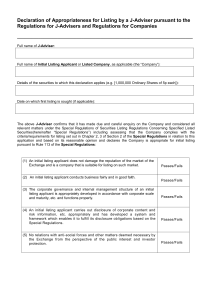

Declaration of Appropriateness for Listing by a J

... Exchange and is a company that is suitable for listing on such market. (2) An initial listing applicant conducts business fairly and in good faith. (3) The corporate governance and internal management structure of an initial listing applicant is appropriately developed in accordance with corporate s ...

... Exchange and is a company that is suitable for listing on such market. (2) An initial listing applicant conducts business fairly and in good faith. (3) The corporate governance and internal management structure of an initial listing applicant is appropriately developed in accordance with corporate s ...

An approach on how to trade in commodities market

... agricultural product that can be bought and sold, such as copper or coffee. Now the next question arises - what are Commodity Markets??? So the answer is any place where all raw or primary products are exchanged is called commodity market. Commodity markets can include direct physical trading and de ...

... agricultural product that can be bought and sold, such as copper or coffee. Now the next question arises - what are Commodity Markets??? So the answer is any place where all raw or primary products are exchanged is called commodity market. Commodity markets can include direct physical trading and de ...

Chapter 3

... • Acquiring firms prefer pooling method to avoid negative impact of goodwill amortization on reported earnings • Stock prices of acquiring firms are not penalized when purchase method accounting is used • No statistical significant difference in stock price reactions to accounting method used in non ...

... • Acquiring firms prefer pooling method to avoid negative impact of goodwill amortization on reported earnings • Stock prices of acquiring firms are not penalized when purchase method accounting is used • No statistical significant difference in stock price reactions to accounting method used in non ...

1. The person generally directly responsible for

... A. cannot lose more than the amount of his/her equity investment. B. has less legal liability than a limited partner. C. faces double taxation whereas a limited partner does not. D. has more management responsibility than a limited partner. E. is the term applied only to corporations which invest in ...

... A. cannot lose more than the amount of his/her equity investment. B. has less legal liability than a limited partner. C. faces double taxation whereas a limited partner does not. D. has more management responsibility than a limited partner. E. is the term applied only to corporations which invest in ...

Convertible Bonds

... investment advice or an offer or solicitation to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and the manager accepts no responsibility for individual i ...

... investment advice or an offer or solicitation to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and the manager accepts no responsibility for individual i ...

Monetary Policy, Private Information, and

... prices of foreign assets and news (public and private) originating in U.S. money and equity markets. Our first contribution is to show that some agents have private information about future U.S. interest rates and about aggregate returns in equity markets. Our second contribution is to show that thi ...

... prices of foreign assets and news (public and private) originating in U.S. money and equity markets. Our first contribution is to show that some agents have private information about future U.S. interest rates and about aggregate returns in equity markets. Our second contribution is to show that thi ...

Oxygen Biotherapeutics, Inc. - Morningstar Document Research

... Morrisville, NC, April 4, 2014 – Oxygen Biotherapeutics, Inc., (NASDAQ: OXBT) a specialty pharmaceutical company focused on developing and commercializing a portfolio of products for the critical care market, announced today that it has appointed Gerald Proehl, former President and CEO of Santarus, ...

... Morrisville, NC, April 4, 2014 – Oxygen Biotherapeutics, Inc., (NASDAQ: OXBT) a specialty pharmaceutical company focused on developing and commercializing a portfolio of products for the critical care market, announced today that it has appointed Gerald Proehl, former President and CEO of Santarus, ...

Transaction Costs, Trade Throughs, and Riskless Principal Trading

... • Small traders and many institutional traders trade at a disadvantage because they do not know market prices as well as dealers do. • Transaction costs are high in bond markets in comparison to transaction costs in equities. – Risk considerations suggest the opposite. ...

... • Small traders and many institutional traders trade at a disadvantage because they do not know market prices as well as dealers do. • Transaction costs are high in bond markets in comparison to transaction costs in equities. – Risk considerations suggest the opposite. ...

New Issue of Securities (Chapter 6 of Listing Requirements): Fund

... Receipt of confirmation from Bursa Depository that the additional new shares are ready for crediting into the respective account holders; and (iii) An announcement in accordance to paragraph 12.2 of Guidance Note 17 is submitted via Bursa Link before 3.00 p.m. on the market day prior to the listing ...

... Receipt of confirmation from Bursa Depository that the additional new shares are ready for crediting into the respective account holders; and (iii) An announcement in accordance to paragraph 12.2 of Guidance Note 17 is submitted via Bursa Link before 3.00 p.m. on the market day prior to the listing ...

an empirical analysis - Indian Commerce Association (ICA)

... of the major sources of raising resources for Indian corporate, thereby enabling financial development and macroeconomic growth. In fact, Indian stock market is one of the emerging markets in the world. Thus, an organised and well regulated stock market provides liquidity to shares, ensures safety a ...

... of the major sources of raising resources for Indian corporate, thereby enabling financial development and macroeconomic growth. In fact, Indian stock market is one of the emerging markets in the world. Thus, an organised and well regulated stock market provides liquidity to shares, ensures safety a ...

Strategic Challenges Facing HKEx

... IPs are not direct registered members of the companies they invest Need a safer, more user-friendly and convenient IP service which will attract large scale participation of investors ...

... IPs are not direct registered members of the companies they invest Need a safer, more user-friendly and convenient IP service which will attract large scale participation of investors ...

Chapter 8: Tax-Deferred Exchanges

... Similar to Type A but specific requirements must be met Acquirer must acquire substantially all the asset of Target solely for voting stock of Acquirer Must distribute any remaining assets and stock of Acquirer to its shareholders and then liquidate The assets acquired must permit Acquirer to contin ...

... Similar to Type A but specific requirements must be met Acquirer must acquire substantially all the asset of Target solely for voting stock of Acquirer Must distribute any remaining assets and stock of Acquirer to its shareholders and then liquidate The assets acquired must permit Acquirer to contin ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.