The Greek Letters

... A portfolio manager is often interested in acquiring a put option on his or her portfolio. The provides protection against market declines while preserving the potential for a gain if the market does well. Options markets don’t always have the liquidity to absorb the trades required by managers of l ...

... A portfolio manager is often interested in acquiring a put option on his or her portfolio. The provides protection against market declines while preserving the potential for a gain if the market does well. Options markets don’t always have the liquidity to absorb the trades required by managers of l ...

bosch limited code of practices and procedures for fair

... care. Unanticipated questions may be taken on notice and a considered response given later. If the answer includes unpublished price sensitive information, a public announcement should be made before responding. (iv) Simultaneous release of information When any meeting is organised with analysts, a ...

... care. Unanticipated questions may be taken on notice and a considered response given later. If the answer includes unpublished price sensitive information, a public announcement should be made before responding. (iv) Simultaneous release of information When any meeting is organised with analysts, a ...

WCI Communities, Inc. (Form: SC 13G/A, Received

... * The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information requi ...

... * The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information requi ...

CESifo Working Paper Series

... in particular the probability that they are serviced, paid back (in the case of bonds), and remain tradable (for instance that no currency restrictions prohibit the repatriation of the funds invested). Financial markets are therefore not per se related to the fate of a nation or population. A nation ...

... in particular the probability that they are serviced, paid back (in the case of bonds), and remain tradable (for instance that no currency restrictions prohibit the repatriation of the funds invested). Financial markets are therefore not per se related to the fate of a nation or population. A nation ...

A Multiple Lender Approach to Understanding Supply and Search in

... government says, the employees could rip off their own firms by arranging for the firms to overpay when they borrowed shares…. The S.E.C., which also filed civil fraud allegations, says the actions brought in $12 million for the traders. This is a $700 million [sic] market, according to calculations ...

... government says, the employees could rip off their own firms by arranging for the firms to overpay when they borrowed shares…. The S.E.C., which also filed civil fraud allegations, says the actions brought in $12 million for the traders. This is a $700 million [sic] market, according to calculations ...

The Effect of Interest Rates on Market Valuation

... will earn at some point in the future and a forecast for a future dividend, an interest rate to discount what those future earnings are worth to you today and a resulting multiple which that stock will command as a result of the first elements. For example, compared to historical averages, the S&P 5 ...

... will earn at some point in the future and a forecast for a future dividend, an interest rate to discount what those future earnings are worth to you today and a resulting multiple which that stock will command as a result of the first elements. For example, compared to historical averages, the S&P 5 ...

Funds that seek to make money in rising and falling markets

... How can you invest in hedge funds, and would you even want to? SEC regulations limit hedge funds to 99 investors, and at least 65 of them must be accredited ($1 million net worth). Therefore, hedge funds were out of reach for average investors. Now though, mutual funds companies have registered hedg ...

... How can you invest in hedge funds, and would you even want to? SEC regulations limit hedge funds to 99 investors, and at least 65 of them must be accredited ($1 million net worth). Therefore, hedge funds were out of reach for average investors. Now though, mutual funds companies have registered hedg ...

Limit Orders - Fight Finance

... Foreign exchange (FX), short term debt (money market securities), bonds, forwards and swaps are commonly traded in the over-the-counter (OTC) markets. OTC trading is not done through a centralised exchange, it's just a trade between two parties in person or over the phone or using a computer. Usuall ...

... Foreign exchange (FX), short term debt (money market securities), bonds, forwards and swaps are commonly traded in the over-the-counter (OTC) markets. OTC trading is not done through a centralised exchange, it's just a trade between two parties in person or over the phone or using a computer. Usuall ...

SCHEDULE 13G Amendment No. 0 PIEDMONT OFFICE RLTY TR

... Hamilton, Bermuda, and various foreign-based subsidiaries provide investment advisory and management services to a number of non-U.S. investment companies and certain institutional investors. FIL, which is a qualified institution under section 240.13d-1(b)(1)(ii), is the beneficial owner of 3,894,80 ...

... Hamilton, Bermuda, and various foreign-based subsidiaries provide investment advisory and management services to a number of non-U.S. investment companies and certain institutional investors. FIL, which is a qualified institution under section 240.13d-1(b)(1)(ii), is the beneficial owner of 3,894,80 ...

contracts 9,899,780,283 traded

... equity strategies that employ a lot of stock options. This may be the main reason why, in a mature market and in the face of declining volatility, the market for individual equity options has continued to grow in the U.S. the way it has. Last year, contract volume at the Chicago Board Options Exchan ...

... equity strategies that employ a lot of stock options. This may be the main reason why, in a mature market and in the face of declining volatility, the market for individual equity options has continued to grow in the U.S. the way it has. Last year, contract volume at the Chicago Board Options Exchan ...

Main Findings from FOL Review and Foreign Investor

... Definition of the “Deemed Foreign Investors” under the Investment Law (2014) should be revised: The Investment Law, Article 23.1 stipulates that if 51% or more of charter capital of a company is held by foreign investors, such company must satisfy the conditions and carry out investment procedures i ...

... Definition of the “Deemed Foreign Investors” under the Investment Law (2014) should be revised: The Investment Law, Article 23.1 stipulates that if 51% or more of charter capital of a company is held by foreign investors, such company must satisfy the conditions and carry out investment procedures i ...

MEASURING INVESTMENT RETURNS AND RISKS

... Probabilityi x [Return1i - E(R1)][Return2i - E(R2)] In a portfolio, there is a covariance for each asset pairing – the many covariances account for most of a portfolio’s variance. All else equal, covariance is large when the data points fall along the regression line instead of away from it beca ...

... Probabilityi x [Return1i - E(R1)][Return2i - E(R2)] In a portfolio, there is a covariance for each asset pairing – the many covariances account for most of a portfolio’s variance. All else equal, covariance is large when the data points fall along the regression line instead of away from it beca ...

WNE UW - Derivatives Markets

... Traditionally derivatives exchanges have used what is known as the open outcry system. This involves traders physically meeting on the floor of the exchange, shouting, and using a complicated set of hand signals to indicate the trades they would like to carry out. Exchanges are increasingly replacin ...

... Traditionally derivatives exchanges have used what is known as the open outcry system. This involves traders physically meeting on the floor of the exchange, shouting, and using a complicated set of hand signals to indicate the trades they would like to carry out. Exchanges are increasingly replacin ...

Earnings Release

... Moreover, the announcement timing is also an explicative factor of market reactions. In fact, markets anticipate the delay between the end of the fiscal year and the announcement date because it generally remains constant. According to Trueman (1990), a longer delay in the announcement is interprete ...

... Moreover, the announcement timing is also an explicative factor of market reactions. In fact, markets anticipate the delay between the end of the fiscal year and the announcement date because it generally remains constant. According to Trueman (1990), a longer delay in the announcement is interprete ...

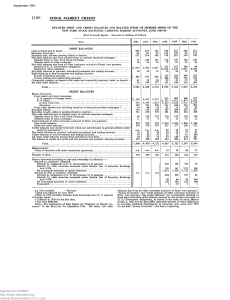

Detailed Debit and Credit Balances and Related Items of Member

... Entirely by obligations of U. S. Government or its agencies Entirely by other securities exempted under Section 3 (a) of Securities Exchange Act—1934 By nonexempt securities or mixed collateral Secured by firm or partners' collateral: Entirely by obligations of U S. Government or its agencies Entire ...

... Entirely by obligations of U. S. Government or its agencies Entirely by other securities exempted under Section 3 (a) of Securities Exchange Act—1934 By nonexempt securities or mixed collateral Secured by firm or partners' collateral: Entirely by obligations of U S. Government or its agencies Entire ...

Sell government securities: Market

... A company pools the resources of many investors and uses funds to purchase various types of financial securities (a portfolio) Different funds have different goals (stability, growth, etc.) And different levels of risk Investments are professionally managed No-load fund ...

... A company pools the resources of many investors and uses funds to purchase various types of financial securities (a portfolio) Different funds have different goals (stability, growth, etc.) And different levels of risk Investments are professionally managed No-load fund ...

united states securities and exchange commission

... The Thomas O’Brien Daly Trust, under instrument of trust dated March 22, 2000, of which George W. LeMaitre is the sole trustee, holds 100 shares of common stock. The trust is for the benefit of one minor child, who is George W. LeMaitre’s nephew. George W. LeMaitre, as trustee, has sole voting and i ...

... The Thomas O’Brien Daly Trust, under instrument of trust dated March 22, 2000, of which George W. LeMaitre is the sole trustee, holds 100 shares of common stock. The trust is for the benefit of one minor child, who is George W. LeMaitre’s nephew. George W. LeMaitre, as trustee, has sole voting and i ...

Stock Market Development And Economic Growth In South Africa: An Ardl-Bounds Testing Approach

... The South African capital market is robust, liquid and well developed. The Johannesburg Stock Exchange (JSE), which was formed in 1887 is, in terms of capitalisation, one of the largest stock exchanges in the world. The JSE is included in the Morgan Stanley Index and the International Finance Corpor ...

... The South African capital market is robust, liquid and well developed. The Johannesburg Stock Exchange (JSE), which was formed in 1887 is, in terms of capitalisation, one of the largest stock exchanges in the world. The JSE is included in the Morgan Stanley Index and the International Finance Corpor ...

Corporate Governance Reform (3) — Private Placement —

... Some have pointed out that tighter regulations are necessary for private placements, given that they can significantly dilute shareholders’ ownership. Companies are entitled to issue new shares or reissue treasury stock to raise capital. These are called share offerings (Corporate Law Articles 199-2 ...

... Some have pointed out that tighter regulations are necessary for private placements, given that they can significantly dilute shareholders’ ownership. Companies are entitled to issue new shares or reissue treasury stock to raise capital. These are called share offerings (Corporate Law Articles 199-2 ...

Emerging Derivative Markets

... D. Market overview for Korea D $630 bn = 130% of GDP ; tripled in two years KTB-futures: $5 bn daily; contract $87,000; OI $7 bn; 90% OTC ...

... D. Market overview for Korea D $630 bn = 130% of GDP ; tripled in two years KTB-futures: $5 bn daily; contract $87,000; OI $7 bn; 90% OTC ...

Chapter IV: How Securities are Traded? etImUlbRtRtUv

... mantMrUvkarkat;bnßykare)a:geLIgrbs;TIpSar nigedIm,ICMrujTMnukcitþGñkvinieyaK. Chapter III: How Securities are Traded? ...

... mantMrUvkarkat;bnßykare)a:geLIgrbs;TIpSar nigedIm,ICMrujTMnukcitþGñkvinieyaK. Chapter III: How Securities are Traded? ...

Lei, Noussair, and Plott: Non-Speculative Bubbles in Experimental

... futures markets. The presence of these futures markets induces prices to follow fundamentals, presumably by inducing greater backward induction. This is an intriguing result although the structure of the futures markets is quite stylized. Dufwenberg, Lindqvist, and Moore (2003) study markets in whic ...

... futures markets. The presence of these futures markets induces prices to follow fundamentals, presumably by inducing greater backward induction. This is an intriguing result although the structure of the futures markets is quite stylized. Dufwenberg, Lindqvist, and Moore (2003) study markets in whic ...

hanmi financial corp

... The Company intends to contribute a substantial portion of the net proceeds from the offering to Hanmi Bank as additional capital and to support future organic growth and future acquisition driven growth. The Company intends to retain the remaining net proceeds at the Company level for use as workin ...

... The Company intends to contribute a substantial portion of the net proceeds from the offering to Hanmi Bank as additional capital and to support future organic growth and future acquisition driven growth. The Company intends to retain the remaining net proceeds at the Company level for use as workin ...

Problem Set 2

... (B) The return can be expressed as the difference between the current yield and the rate of capital gains. (C) The rate of return will be greater than the interest rate when the price of the bond falls between time t and time t+1. (D) All of the above are true. (E) Only (A) and (B) of the above are ...

... (B) The return can be expressed as the difference between the current yield and the rate of capital gains. (C) The rate of return will be greater than the interest rate when the price of the bond falls between time t and time t+1. (D) All of the above are true. (E) Only (A) and (B) of the above are ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.