Chapter 5- Valuation Concepts

... paid each period, generally each six months, on a bond. Coupon Interest Rate: The stated annual rate of interest paid on a bond. Maturity Date: A specified date on which the par value of a bond must be repaid. Original Maturity: The number of years to maturity at the time the bond is issued. ...

... paid each period, generally each six months, on a bond. Coupon Interest Rate: The stated annual rate of interest paid on a bond. Maturity Date: A specified date on which the par value of a bond must be repaid. Original Maturity: The number of years to maturity at the time the bond is issued. ...

More Builders and Fewer Traders

... Over the past three decades, the share of resources corporations use to repurchase their own shares has soared. For example, take the 248 companies continuously listed in the S&P 500 since 1981. That year, stock buybacks by these firms consumed a mere 2 percent of net income. Between 1984 and 1993, ...

... Over the past three decades, the share of resources corporations use to repurchase their own shares has soared. For example, take the 248 companies continuously listed in the S&P 500 since 1981. That year, stock buybacks by these firms consumed a mere 2 percent of net income. Between 1984 and 1993, ...

foreign exchange market (forex)

... • the variety of factors that affect exchange rates; • the low margins of relative profit compared with other markets of fixed income. ...

... • the variety of factors that affect exchange rates; • the low margins of relative profit compared with other markets of fixed income. ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... *The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information requir ...

... *The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information requir ...

Lecture 3

... Inland farmers came to east coast to sell their grain to dealers who, in turn, shipped it all over the country. Too much supply right after the harvest. Unpurchased crops were left to rot. In the off-season price became too high when crops were unavailable. Not good for both the farmers and the deal ...

... Inland farmers came to east coast to sell their grain to dealers who, in turn, shipped it all over the country. Too much supply right after the harvest. Unpurchased crops were left to rot. In the off-season price became too high when crops were unavailable. Not good for both the farmers and the deal ...

CFA-AFR-Dark-Pools-2.. - CFA Society Melbourne

... And with that, what a segue I have created to take note of some findings about ‘dark pools’ from the FT. And we’re talking about equities trading here, not swimming. Citing a survey by the London-based CFA Institute, Philip Stafford reports trading of US equities on dark pools has grown by 48 per ce ...

... And with that, what a segue I have created to take note of some findings about ‘dark pools’ from the FT. And we’re talking about equities trading here, not swimming. Citing a survey by the London-based CFA Institute, Philip Stafford reports trading of US equities on dark pools has grown by 48 per ce ...

VUS 10 Great Depression - Suffolk Public Schools Blog

... price in the hope of reselling it later at a profit. One way people make money off stocks is through speculation. They buy them at one price. Then when the stock’s price goes up, they sell their stock at a profit. Between 1920 and 1929 prices on the New York Stock Exchange, the nation’s largest stoc ...

... price in the hope of reselling it later at a profit. One way people make money off stocks is through speculation. They buy them at one price. Then when the stock’s price goes up, they sell their stock at a profit. Between 1920 and 1929 prices on the New York Stock Exchange, the nation’s largest stoc ...

A Collaborative Kalman Filter for Time

... this text show that the behavior of all stocks in SH contain large amounts of information about the market ,so we need to consider the trading information of thousands of stocks jointly every day. ...

... this text show that the behavior of all stocks in SH contain large amounts of information about the market ,so we need to consider the trading information of thousands of stocks jointly every day. ...

1. Application for quotation of added securities

... (including any exercise price and expiry dates for options or the amount outstanding on partly paid securities and dates for payments, conversion price and conversion dates) ...

... (including any exercise price and expiry dates for options or the amount outstanding on partly paid securities and dates for payments, conversion price and conversion dates) ...

press announcement - Jamaica Stock Exchange

... were cancelled, ten (10) ordinary shares in the capital of Pan Jam (herein called “Pan Jam Stock Units”) for each thirteen (13) cancelled First Jamaica Stock Units (called “a Lot”). Holdings of First Jamaica Stock Units which result in a fraction of a Lot (such as a person holding 100 First Jamaica ...

... were cancelled, ten (10) ordinary shares in the capital of Pan Jam (herein called “Pan Jam Stock Units”) for each thirteen (13) cancelled First Jamaica Stock Units (called “a Lot”). Holdings of First Jamaica Stock Units which result in a fraction of a Lot (such as a person holding 100 First Jamaica ...

An Empirical Analysis of the Determinants of Market Capitalization in

... perpetuity, funds to state and local government without pressures and ample time to repay loans. Similarly, the study by Maku and Atanda(2009,2010) shows that stock prices and depreciating Naira rate are positively related while all share index is more responsive to changes in macroeconomic variable ...

... perpetuity, funds to state and local government without pressures and ample time to repay loans. Similarly, the study by Maku and Atanda(2009,2010) shows that stock prices and depreciating Naira rate are positively related while all share index is more responsive to changes in macroeconomic variable ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... International K.K. and Capital International, Inc., CUSIP: B9CGTC3 Page 3 of 5 collectively provide investment management services under the name "Capital International Investors." Please see Items 5 through 11 of each reporting person's cover sheet in this Schedule 13G filing for such person's deem ...

... International K.K. and Capital International, Inc., CUSIP: B9CGTC3 Page 3 of 5 collectively provide investment management services under the name "Capital International Investors." Please see Items 5 through 11 of each reporting person's cover sheet in this Schedule 13G filing for such person's deem ...

CHAPTER 5 Small Business and the Entrepreneur

... What is stock performance, and what are the factors that lead to changes in stock price? What are the different types and characteristics of bonds, and how is the safety of bonds evaluated? What is the difference among bond mutual funds, money market funds, and equity funds? What are the advantages ...

... What is stock performance, and what are the factors that lead to changes in stock price? What are the different types and characteristics of bonds, and how is the safety of bonds evaluated? What is the difference among bond mutual funds, money market funds, and equity funds? What are the advantages ...

Session 0340-2017

... and TA. For details of the theorem you can reference Mr. O’Neil’ book3. MT is the most important theorem which consider the stock momentum, the pivotal support and resist point. The MT is important because quite a lot auto-trading systems are set based on MT theorem. Many institutions, like FINVIZ.c ...

... and TA. For details of the theorem you can reference Mr. O’Neil’ book3. MT is the most important theorem which consider the stock momentum, the pivotal support and resist point. The MT is important because quite a lot auto-trading systems are set based on MT theorem. Many institutions, like FINVIZ.c ...

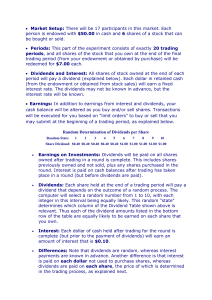

Experimental Instructions

... will be executed for you based on "limit orders" to buy or sell that you may submit at the beginning of a trading period, as explained below. Random Determination of Dividends per Share Random State: ...

... will be executed for you based on "limit orders" to buy or sell that you may submit at the beginning of a trading period, as explained below. Random Determination of Dividends per Share Random State: ...

File

... – Consols—Bond with no maturity date, pay interest forever – Coupon Securities—Attached to bond and sent in to collect interest [generally semi-annually] – Zero-coupon—Sold at price well below face value. Collect interest when the bond matures. – Tax Exempt—Interest earned is not taxed (issued by st ...

... – Consols—Bond with no maturity date, pay interest forever – Coupon Securities—Attached to bond and sent in to collect interest [generally semi-annually] – Zero-coupon—Sold at price well below face value. Collect interest when the bond matures. – Tax Exempt—Interest earned is not taxed (issued by st ...

Stock Markets

... • Generally lists smaller firms than NYSE Euronext • Operates as a broker-specialist market-maker system similar to NYSE Euronext • Pioneered exchange traded funds (ETFs) – ETFs are index funds that are listed on an exchange and can be traded intraday ...

... • Generally lists smaller firms than NYSE Euronext • Operates as a broker-specialist market-maker system similar to NYSE Euronext • Pioneered exchange traded funds (ETFs) – ETFs are index funds that are listed on an exchange and can be traded intraday ...

Measuring Efficiency in Corporate Law: The Role of Shareholder

... Intermediation in US Capital Markets • Growing intermediation of the markets – Institutions own over 50% of public equity – Percentage is closer to 80% at the largest public companies ...

... Intermediation in US Capital Markets • Growing intermediation of the markets – Institutions own over 50% of public equity – Percentage is closer to 80% at the largest public companies ...

Growth stocks

... Income stocks are those that historically have paid a larger-than-average percentage of their net income as dividends The proportion of net income paid out as dividends is the payout ratio The proportion of net income retained is the ...

... Income stocks are those that historically have paid a larger-than-average percentage of their net income as dividends The proportion of net income paid out as dividends is the payout ratio The proportion of net income retained is the ...

Code Of Corporate Disclosure Practices For Prevention Of Insider

... Simultaneous release of information When the Company organizes meetings with analysts, the Company shall make a press release or post relevant information on its website after every such meet. The Company may also consider live web casting of analyst meets. Medium of disclosure/dissemination Disclos ...

... Simultaneous release of information When the Company organizes meetings with analysts, the Company shall make a press release or post relevant information on its website after every such meet. The Company may also consider live web casting of analyst meets. Medium of disclosure/dissemination Disclos ...

CEE Trader - Wiener Börse

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

ING to sell 33 million shares in NN Group

... ordinary shares in NN Group. NN Group will not be issuing or selling shares as part of this transaction, and will not receive any proceeds from the offering. The transaction reduces ING Group’s stake in NN Group from 25.8% to 16.2% of outstanding shares (net of treasury shares). The shares will be o ...

... ordinary shares in NN Group. NN Group will not be issuing or selling shares as part of this transaction, and will not receive any proceeds from the offering. The transaction reduces ING Group’s stake in NN Group from 25.8% to 16.2% of outstanding shares (net of treasury shares). The shares will be o ...

addressing emerging risks in the nigerian

... our regulations to allow product innovation for new products like: ...

... our regulations to allow product innovation for new products like: ...

European Commission

... (the risk of default), linked to a debt obligation referenced in the contract. CDS are used by investors for hedging and investing. As a hedge a CDS provides protection against the credit risk arising from holding debt instruments. As an investment vehicle CDS can be used to express a view on the fu ...

... (the risk of default), linked to a debt obligation referenced in the contract. CDS are used by investors for hedging and investing. As a hedge a CDS provides protection against the credit risk arising from holding debt instruments. As an investment vehicle CDS can be used to express a view on the fu ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.