Emerging Market Repo

... Morgan Stanley Dean Witter does not undertake to advise you of changes in its opinion or information. Morgan Stanley Dean Witter and others associated with it may make markets or specialize in, have positions in and effect transactions in securities of issuers mentioned and may also perform or seek ...

... Morgan Stanley Dean Witter does not undertake to advise you of changes in its opinion or information. Morgan Stanley Dean Witter and others associated with it may make markets or specialize in, have positions in and effect transactions in securities of issuers mentioned and may also perform or seek ...

Substituted Compliance - Program on International Financial Systems

... corporate governance standards on foreign issuers, often conflicting with local practices such as the composition of supervisory boards in Germany and other jurisdictions. While the most egregious of the conflicts were eventually smoothed over, the Sarbanes-Oxley Act experience awoke foreign firms t ...

... corporate governance standards on foreign issuers, often conflicting with local practices such as the composition of supervisory boards in Germany and other jurisdictions. While the most egregious of the conflicts were eventually smoothed over, the Sarbanes-Oxley Act experience awoke foreign firms t ...

Wolfsberg Statement - Guidance on a Risk Based Approach for

... Conversely, low levels of assets or low value transactions involving customers that would otherwise appear to be higher risk mean that a financial institution may decide to treat such customers as lower risk within an overall risk based approach. ...

... Conversely, low levels of assets or low value transactions involving customers that would otherwise appear to be higher risk mean that a financial institution may decide to treat such customers as lower risk within an overall risk based approach. ...

table of contents - Napa County

... prevailing, which persons of prudence, discretion and intelligence exercise in the management of their own affairs, not for speculation, but for investment, considering the probable safety of their capital as well as the probable income to be derived.” The County Treasurer, the Assistant Treasurer, ...

... prevailing, which persons of prudence, discretion and intelligence exercise in the management of their own affairs, not for speculation, but for investment, considering the probable safety of their capital as well as the probable income to be derived.” The County Treasurer, the Assistant Treasurer, ...

Chapter 6

... 6.1 Stock Exchange and Share-Market Investment (cont.) • Diversified investment portfolio (cont.) – Expected portfolio return is the weighted average of expected returns of each share – Portfolio variance (risk) is the correlation of pairs of securities within the portfolio ...

... 6.1 Stock Exchange and Share-Market Investment (cont.) • Diversified investment portfolio (cont.) – Expected portfolio return is the weighted average of expected returns of each share – Portfolio variance (risk) is the correlation of pairs of securities within the portfolio ...

- Covenant University Repository

... is positive when the profits of the firms increased because of the injection of debt and negative when profits decreased because of employment of debt. The total risk facing an organization can be managed by combining operating leverage and financial leverage in varying degrees. The hypotheses teste ...

... is positive when the profits of the firms increased because of the injection of debt and negative when profits decreased because of employment of debt. The total risk facing an organization can be managed by combining operating leverage and financial leverage in varying degrees. The hypotheses teste ...

Agenix Annual Report 2016 - CCP Technologies Limited

... report as Chair, in a year which saw substantial changes to our Company. During the year we reviewed numerous investment opportunities to set the future for the Company, culminating with the decision to acquire CCP Group, which was announced to the market on 24 March 2016. On 29 July 2016, sharehold ...

... report as Chair, in a year which saw substantial changes to our Company. During the year we reviewed numerous investment opportunities to set the future for the Company, culminating with the decision to acquire CCP Group, which was announced to the market on 24 March 2016. On 29 July 2016, sharehold ...

Financial Statements of Route1 Inc

... To the Shareholders of Route1 Inc. We have audited the accompanying consolidated financial statements of Route1 Inc. and its subsidiary, which comprise the consolidated statements of financial postition as at December 31, 2016 and December 31, 2015 and the consolidated statements of comprehensive in ...

... To the Shareholders of Route1 Inc. We have audited the accompanying consolidated financial statements of Route1 Inc. and its subsidiary, which comprise the consolidated statements of financial postition as at December 31, 2016 and December 31, 2015 and the consolidated statements of comprehensive in ...

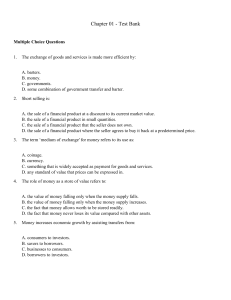

Financial Institutions Instruments and Markets, 5th Edition

... D. A swap can involve interest payments and currencies 29. The key reason for the existence of markets of financial assets is: A. that holders of shares generally want to exchange them for bonds and other financial instruments. B. the high expenditure for many individuals and businesses. C. that the ...

... D. A swap can involve interest payments and currencies 29. The key reason for the existence of markets of financial assets is: A. that holders of shares generally want to exchange them for bonds and other financial instruments. B. the high expenditure for many individuals and businesses. C. that the ...

ICICI-Prudential-Fixed-Maturity-Plan-Series 73

... Reverse Repo and Repo in Government Securities/Government Securities/T-bills) and derivatives. 5. Post New Fund Offer period and towards the maturity of the Scheme, there may be higher allocation to cash and cash equivalent. 6. In the event of any deviations from floor and ceiling of credit ratings ...

... Reverse Repo and Repo in Government Securities/Government Securities/T-bills) and derivatives. 5. Post New Fund Offer period and towards the maturity of the Scheme, there may be higher allocation to cash and cash equivalent. 6. In the event of any deviations from floor and ceiling of credit ratings ...

NBER WORKING PAPER SERIES QUALITATIVE EASING: Roger E.A. Farmer

... rational forward looking agents are able to trade securities in a set of complete financial markets. In this context, central bank asset swaps are irrelevant because the existence of complete markets acts to transfer risk efficiently to those who are most capable of bearing it. In a complete markets e ...

... rational forward looking agents are able to trade securities in a set of complete financial markets. In this context, central bank asset swaps are irrelevant because the existence of complete markets acts to transfer risk efficiently to those who are most capable of bearing it. In a complete markets e ...

SAP`s Financial Asset Management

... processes of your organization. This leads to measurable results for the realization phase and later for the daily operation. COMNSERV has worked on many of the 160 FAM Implementations world-wide, We have developed best practices and several rapid deployment solutions around FAM. Tools that are embe ...

... processes of your organization. This leads to measurable results for the realization phase and later for the daily operation. COMNSERV has worked on many of the 160 FAM Implementations world-wide, We have developed best practices and several rapid deployment solutions around FAM. Tools that are embe ...

Form 10-Q 1 800 FLOWERS COM INC

... financial information and pursuant to the rules and regulations of the Securities and Exchange Commission. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements. In the opinion ...

... financial information and pursuant to the rules and regulations of the Securities and Exchange Commission. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements. In the opinion ...

World bank documents

... Markets are imperfect. It is costly to acquire and process information about potential investments. There are costs and uncertainties associated with writing, interpreting, and enforcing contracts. And, there are costs associated with transacting goods, services, and financial instruments. These mar ...

... Markets are imperfect. It is costly to acquire and process information about potential investments. There are costs and uncertainties associated with writing, interpreting, and enforcing contracts. And, there are costs associated with transacting goods, services, and financial instruments. These mar ...

Three essays on risk management and financial stability

... The third essay Risk Management Lessons From The 2008 Financial Crisis deals with the pending crisis in more detail. In this essay, we discuss the history, macroeconomic conditions, and milestones of the US mortgage crisis that later resulted in the global liquidity and credit shortages. We also des ...

... The third essay Risk Management Lessons From The 2008 Financial Crisis deals with the pending crisis in more detail. In this essay, we discuss the history, macroeconomic conditions, and milestones of the US mortgage crisis that later resulted in the global liquidity and credit shortages. We also des ...

The Lender of Last Resort in the Eurozone

... Regarding liquidity supply, a central bank typically has two options whenever it provides the finance sector with the necessary liquidity. One option is to provide liquidity for the entire system, via its monetary-policy operations (macro-level liquidity supply). The other option is for the central ...

... Regarding liquidity supply, a central bank typically has two options whenever it provides the finance sector with the necessary liquidity. One option is to provide liquidity for the entire system, via its monetary-policy operations (macro-level liquidity supply). The other option is for the central ...

Proposal - Mountain Plains Management Conference

... find norms for all firms. For leading firms, using norms represented by industry averages may not be applicable. In addition, “window dressing” can occur so as to make ratios look good in the short run, while international operations can present problems as a different set of accounting regulations ...

... find norms for all firms. For leading firms, using norms represented by industry averages may not be applicable. In addition, “window dressing” can occur so as to make ratios look good in the short run, while international operations can present problems as a different set of accounting regulations ...

Download attachment

... The development of a yield curve on a wide range of actively traded debt securities will result in a benchmark security which market participants will use in setting up their trading, investment / lending and borrowing policies. The financial markets thrive on information. An efficient secondary mar ...

... The development of a yield curve on a wide range of actively traded debt securities will result in a benchmark security which market participants will use in setting up their trading, investment / lending and borrowing policies. The financial markets thrive on information. An efficient secondary mar ...

Information for investors

... for purchase and for sale (the bid-ask spread), as well as the fact that there is no bid-ask quotation for the appropriate volume of transactions at any moment (or period). Therefore, the investor may find it impossible to buy or sell some liquid assets under normal market conditions. This can happe ...

... for purchase and for sale (the bid-ask spread), as well as the fact that there is no bid-ask quotation for the appropriate volume of transactions at any moment (or period). Therefore, the investor may find it impossible to buy or sell some liquid assets under normal market conditions. This can happe ...