Presented

... Banks and Insurances as Risk Bearers (continued) For banks the risk assumption on the balance sheet is only a small part of their activity; the main activities are intermediation and other services. The investment bank is a sort of broker (financial intermediary) to access the financial markets. It ...

... Banks and Insurances as Risk Bearers (continued) For banks the risk assumption on the balance sheet is only a small part of their activity; the main activities are intermediation and other services. The investment bank is a sort of broker (financial intermediary) to access the financial markets. It ...

2014 Annual Report

... limitation, statements regarding funding requirements. These statements are based on management’s current expectations regarding future events and operating performance, are based on information currently available to management, speak only as of the date of 2014 Reporting Documents and are subject ...

... limitation, statements regarding funding requirements. These statements are based on management’s current expectations regarding future events and operating performance, are based on information currently available to management, speak only as of the date of 2014 Reporting Documents and are subject ...

the relationship betweeen financial leverage and

... Wald (2000) observes that highly profitable firms have lower levels of leverage than less profitable firms because they first use their earnings before seeking outside capital. In addition, stock prices reflect how the firm performs. Firms tend to issue equity rather than use debt when their stock p ...

... Wald (2000) observes that highly profitable firms have lower levels of leverage than less profitable firms because they first use their earnings before seeking outside capital. In addition, stock prices reflect how the firm performs. Firms tend to issue equity rather than use debt when their stock p ...

understanding monetary policy series no 27 the nigerian money

... activities exhibited some elements of short-term lending and borrowing. The market was a contemporary part of the London money market. It worked by moving funds from London to Nigeria during the farming season to finance the export of farm produce and when the season was over with no need for money, ...

... activities exhibited some elements of short-term lending and borrowing. The market was a contemporary part of the London money market. It worked by moving funds from London to Nigeria during the farming season to finance the export of farm produce and when the season was over with no need for money, ...

Policy Enhancement Summary

... This is general information only and does not take into account factors like the personal circumstances, financial situation or needs of any individual. Before acting on this information individuals should consider the information in the context of such factors and should also consider the Priority ...

... This is general information only and does not take into account factors like the personal circumstances, financial situation or needs of any individual. Before acting on this information individuals should consider the information in the context of such factors and should also consider the Priority ...

Korea Securities Depository

... Global custody service for domestic investors Unique model that CSD provides global custody service by expanding the scope of its eligible securities from domestic securities to global securities - cross-border custody, settlement and corporate action services over the 36 markets of 34 countries wi ...

... Global custody service for domestic investors Unique model that CSD provides global custody service by expanding the scope of its eligible securities from domestic securities to global securities - cross-border custody, settlement and corporate action services over the 36 markets of 34 countries wi ...

Pillar 3 Disclosures Quantitative Disclosures As at 31

... Exposures comprise on-balance sheet amounts and off-balance sheet amounts. Off-balance sheet amounts are converted into exposures using applicable conversion factors under MAS Notice 637. Exposures incorporate the effects of credit risk mitigation as permitted under MAS Notice 637 ...

... Exposures comprise on-balance sheet amounts and off-balance sheet amounts. Off-balance sheet amounts are converted into exposures using applicable conversion factors under MAS Notice 637. Exposures incorporate the effects of credit risk mitigation as permitted under MAS Notice 637 ...

Regulatory Sanctions and Reputational Damage in Financial Markets

... of a company engaging in fraud in any given year at 14.5%. The imposition of penalties for misconduct is an important part of the armoury available to regulators, which, following the financial crisis, they have shown a greater willingness to deploy. However, this paper suggests that they are only o ...

... of a company engaging in fraud in any given year at 14.5%. The imposition of penalties for misconduct is an important part of the armoury available to regulators, which, following the financial crisis, they have shown a greater willingness to deploy. However, this paper suggests that they are only o ...

New listing package to enhance competitiveness of HK financial

... A restructured listing framework with an integrated Listing Committee, streamlined listing process and strengthened back-end enforcement will be introduced to enhance Hong Kong's position as a premier capital formation centre and its status as an international financial centre. "The Administration, ...

... A restructured listing framework with an integrated Listing Committee, streamlined listing process and strengthened back-end enforcement will be introduced to enhance Hong Kong's position as a premier capital formation centre and its status as an international financial centre. "The Administration, ...

Robbing Peter to Pay Paul: Ponzi Schemes Throughout History

... billion, is the biggest financial fraud in history. The principle behind a Ponzi scheme is simple. The Securities Exchange Commission defines it as investment fraud involving the payment of returns to existing investors from funds contributed by new investors, with the organizer usually focusing on ...

... billion, is the biggest financial fraud in history. The principle behind a Ponzi scheme is simple. The Securities Exchange Commission defines it as investment fraud involving the payment of returns to existing investors from funds contributed by new investors, with the organizer usually focusing on ...

Financial Crises and Financial Dependence

... industries. We also find that growth in sales/earnings and stock returns are less negatively affected by banking crises for firms with proxies that suggest better information disclosure. To explain our results, we hypothesize that the depth of the financial system allows sectors dependent on externa ...

... industries. We also find that growth in sales/earnings and stock returns are less negatively affected by banking crises for firms with proxies that suggest better information disclosure. To explain our results, we hypothesize that the depth of the financial system allows sectors dependent on externa ...

Code of conduct for Discretionary FSPs

... state whether the discretionary FSP receives commission, incentives, fee reductions or rebates from an administrative FSP or product supplier for placing a client’s funds with them; (i) if the discretionary FSP is capable to do so, provide a client with the option to receive reports and statements i ...

... state whether the discretionary FSP receives commission, incentives, fee reductions or rebates from an administrative FSP or product supplier for placing a client’s funds with them; (i) if the discretionary FSP is capable to do so, provide a client with the option to receive reports and statements i ...

When and how US dollar shortages evolved into the full crisis

... longer than 1 year in which two parties borrow and lend the same value of different currencies evaluated at the foreign exchange (FX) spot rate as of the contract date. A number of financial institutions manage their payments and receipts in an aggregated manner, controlling the maturity profile of ...

... longer than 1 year in which two parties borrow and lend the same value of different currencies evaluated at the foreign exchange (FX) spot rate as of the contract date. A number of financial institutions manage their payments and receipts in an aggregated manner, controlling the maturity profile of ...

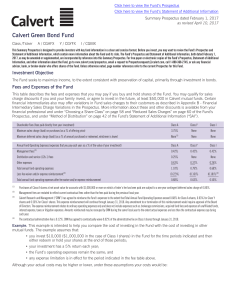

Calvert Green Bond Fund

... has provided financial support to FNMA and FHLMC, but there can be no assurance that it will support these or other GSEs in the future. Management Risk. The success of the Fund’s investment program depends on portfolio management’s successful application of analytical skills and investment judgment. ...

... has provided financial support to FNMA and FHLMC, but there can be no assurance that it will support these or other GSEs in the future. Management Risk. The success of the Fund’s investment program depends on portfolio management’s successful application of analytical skills and investment judgment. ...

Risk Management Lessons from the Credit Crisis

... Many financial institutions that experienced large losses over the past few months apparently employed sophisticated risk management systems. That losses occurred does not necessarily imply that there were failures in risk management, however. As Stulz (2008) put it, “A large loss is not evidence of ...

... Many financial institutions that experienced large losses over the past few months apparently employed sophisticated risk management systems. That losses occurred does not necessarily imply that there were failures in risk management, however. As Stulz (2008) put it, “A large loss is not evidence of ...

Thematic Review on mortgage Underwriting and Origination Practices

... jurisdictions, and has been a common practice in most jurisdictions where not required. The exceptions are the UK, where verification was neither required nor recent practice, and the US, where borrowers could apply for a “low doc” loan which does not require verification of income but bears a highe ...

... jurisdictions, and has been a common practice in most jurisdictions where not required. The exceptions are the UK, where verification was neither required nor recent practice, and the US, where borrowers could apply for a “low doc” loan which does not require verification of income but bears a highe ...

Minimum 2017 ~€1 billion

... Today, Abertis is the world leader in infrastructure management, with a growth mission ...

... Today, Abertis is the world leader in infrastructure management, with a growth mission ...

Synovus to Acquire Entaire Global Companies, Inc.

... Synovus to Acquire Entaire Global Companies, Inc. COLUMBUS, GA, AUGUST 18, 2016 — Synovus Financial Corp. (NYSE: SNV) today announced a definitive agreement to acquire Entaire Global Companies, Inc. (“Entaire”), an Atlanta-based specialty financial services company. Entaire is a private life insuran ...

... Synovus to Acquire Entaire Global Companies, Inc. COLUMBUS, GA, AUGUST 18, 2016 — Synovus Financial Corp. (NYSE: SNV) today announced a definitive agreement to acquire Entaire Global Companies, Inc. (“Entaire”), an Atlanta-based specialty financial services company. Entaire is a private life insuran ...

uba capital plc - The Nigerian Stock Exchange

... investee; b) it is exposed, or has rights, to variable returns from its involvement with the investee and c) has the ability to use its power to affect its returns. All three of these criteria must be met for an investor to have control over an investee. Previously, control was defined as the power ...

... investee; b) it is exposed, or has rights, to variable returns from its involvement with the investee and c) has the ability to use its power to affect its returns. All three of these criteria must be met for an investor to have control over an investee. Previously, control was defined as the power ...

The development of the risky financial behavior scale: A measure of

... term for studying financial decisions, financial risk tolerance has been studied from both a traditional normative method and a psychological method. More on the relationship of risk tolerance with these two methods will be reviewed in a later chapter. Grable pointed out that the first introduction ...

... term for studying financial decisions, financial risk tolerance has been studied from both a traditional normative method and a psychological method. More on the relationship of risk tolerance with these two methods will be reviewed in a later chapter. Grable pointed out that the first introduction ...

Towards a framework for calibrating macroprudential leverage limits

... credit booms gone bust96, and the build-up of leverage and subsequent deleveraging by banks and within financial markets more generally is widely viewed as a cause of the 2007-09 global financial crisis and its severe economic impact. Negative externalities related to excessive leverage may material ...

... credit booms gone bust96, and the build-up of leverage and subsequent deleveraging by banks and within financial markets more generally is widely viewed as a cause of the 2007-09 global financial crisis and its severe economic impact. Negative externalities related to excessive leverage may material ...