Risk and Return: The Portfolio Theory The crux of portfolio theory

... broken down into two sources: - Firm specific risk (only faced by that firm), - Market wide risk (affects all investments). • Firm-specific risk can be reduced, if not eliminated, by increasing the number of investments in your portfolio (i.e. by being diversified). Market wide risk cannot. • On eco ...

... broken down into two sources: - Firm specific risk (only faced by that firm), - Market wide risk (affects all investments). • Firm-specific risk can be reduced, if not eliminated, by increasing the number of investments in your portfolio (i.e. by being diversified). Market wide risk cannot. • On eco ...

- Roosevelt Institute

... areas of disagreement. But after much discussion and multiple reviews, we are convinced that the methods and data we have used provide a clear and rigorous path to answering this question. We hope this analysis contributes to the public debate about the real costs of the finance sector to society, h ...

... areas of disagreement. But after much discussion and multiple reviews, we are convinced that the methods and data we have used provide a clear and rigorous path to answering this question. We hope this analysis contributes to the public debate about the real costs of the finance sector to society, h ...

bolsas y mercados españoles, sistemas de negociación, sa

... measures to provide liquidity to securities traded on the Market. Members of the Latin America Securities Market may become specialists, either after having undertaken liquidity commitments through an agreement with the entity issuing the respective securities or after having done so unilaterally. T ...

... measures to provide liquidity to securities traded on the Market. Members of the Latin America Securities Market may become specialists, either after having undertaken liquidity commitments through an agreement with the entity issuing the respective securities or after having done so unilaterally. T ...

FRAUD AND ERROR IN MANIPULATIVE FINANCIAL SITUATIONS

... because of the topic‘s importance, being able to attract and keep a qualitative resource such as employees is an important and delicate matter. The companies that have issued public share are also concerned about the selling price of the entity, a fraud scandal, meaning a public, one would mean the ...

... because of the topic‘s importance, being able to attract and keep a qualitative resource such as employees is an important and delicate matter. The companies that have issued public share are also concerned about the selling price of the entity, a fraud scandal, meaning a public, one would mean the ...

Heading 3

... We undertake no obligation to publicly update or revise any forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which merely reflect company expectations at the time of writing. Actual results may differ materially from expectations conv ...

... We undertake no obligation to publicly update or revise any forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which merely reflect company expectations at the time of writing. Actual results may differ materially from expectations conv ...

2015 - MFSA

... composed of a chairman and five non-executive directors, two of whom are independent directors from outside the Mizzi Organisation. The members of the Board for the year under review were Dr John C. Grech, Mr Carmel J. Farrugia, Dr Louis Camilleri Preziosi, Mr Kenneth Mizzi, Mr Brian Mizzi and Mr Ma ...

... composed of a chairman and five non-executive directors, two of whom are independent directors from outside the Mizzi Organisation. The members of the Board for the year under review were Dr John C. Grech, Mr Carmel J. Farrugia, Dr Louis Camilleri Preziosi, Mr Kenneth Mizzi, Mr Brian Mizzi and Mr Ma ...

primary dealership in ghana

... Maturity Date - The date on which a security becomes due and payable. Multiple-price Auction – A competitive auction whereby securities are sold at the highest price / lowest yield and each successful bidder pays the price that was bid. Notional Bond Holding Limit – The minimum amount a PD is requir ...

... Maturity Date - The date on which a security becomes due and payable. Multiple-price Auction – A competitive auction whereby securities are sold at the highest price / lowest yield and each successful bidder pays the price that was bid. Notional Bond Holding Limit – The minimum amount a PD is requir ...

Investment Securities Internal Control Questionnaire

... securities of safekeeping receipts to determine if the securities delivered are the securities purchased? 22. Are commitments and advises reviewed by an independent third party who is not connected with the ...

... securities of safekeeping receipts to determine if the securities delivered are the securities purchased? 22. Are commitments and advises reviewed by an independent third party who is not connected with the ...

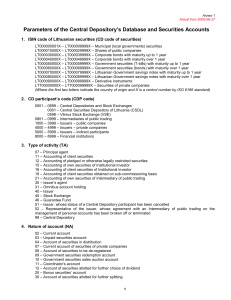

1. ISIN code of Lithuanian securities (CD code of securities)

... LT000030000X – LT000039999X – Corporate bonds with maturity up to 1 year LT000040000X – LT000049999X – Corporate bonds with maturity over 1 year LT000050000X – LT000059999X – Government securities (T-bills) with maturity up to 1 year LT000060000X – LT000069999X – Government securities (bonds) with m ...

... LT000030000X – LT000039999X – Corporate bonds with maturity up to 1 year LT000040000X – LT000049999X – Corporate bonds with maturity over 1 year LT000050000X – LT000059999X – Government securities (T-bills) with maturity up to 1 year LT000060000X – LT000069999X – Government securities (bonds) with m ...

Annuities Market in Kenya - Retirement Benefits Authority

... years. Innovative annuity products, while offering potentially desirable income streams, may be particularly difficult to evaluate by consumers (FSA 2002a). Equally, consumers are unlikely to find it economical to make a full assessment of the risks that life insurance companies are exposed to acros ...

... years. Innovative annuity products, while offering potentially desirable income streams, may be particularly difficult to evaluate by consumers (FSA 2002a). Equally, consumers are unlikely to find it economical to make a full assessment of the risks that life insurance companies are exposed to acros ...

Towards a General Theory of Financial Regulation

... compensation schemes; dividend covenants; and pricing of bonds, where debt holders are the principals. 3. “the stock market is a ‘fair game’” where information concerning companies is rapidly absorbed making quoted prices unbiased estimates of true market value (Fama, 1970). A stronger version of th ...

... compensation schemes; dividend covenants; and pricing of bonds, where debt holders are the principals. 3. “the stock market is a ‘fair game’” where information concerning companies is rapidly absorbed making quoted prices unbiased estimates of true market value (Fama, 1970). A stronger version of th ...

wiwi.uni-frankfurt.de

... • IMF criticized: Greater interest in safeguarding foreign creditors, than ...

... • IMF criticized: Greater interest in safeguarding foreign creditors, than ...

NBER WORKING PAPER SERIES FINANCIAL INNOVATIONS AND MACROECONOMIC VOLATILITY Urban Jermann Vincenzo Quadrini

... decades. Because changes in debt and equity issuance are negatively correlated, these findings suggest that firms have become more flexible in the choice of their financial structure. This greater flexibility is, in our framework, the driving force for the milder business cycle. During the 80s and t ...

... decades. Because changes in debt and equity issuance are negatively correlated, these findings suggest that firms have become more flexible in the choice of their financial structure. This greater flexibility is, in our framework, the driving force for the milder business cycle. During the 80s and t ...

Risks Underlying Islamic Modes of Financing

... • Renting an asset to the party who sold it, has been questioned by scholars. 3. Pricing of Sukuk • Muslim economists and Shariah scholars have not come up with an alternative to the interest rate as a readily available indicator of profitability. Hence the use of LIBOR/KIBOR as a benchmark has beco ...

... • Renting an asset to the party who sold it, has been questioned by scholars. 3. Pricing of Sukuk • Muslim economists and Shariah scholars have not come up with an alternative to the interest rate as a readily available indicator of profitability. Hence the use of LIBOR/KIBOR as a benchmark has beco ...

Annual Report 2014

... 2014, which comprise the accounting policies, income statement, balance sheet, statement of changes in equity, cash flow statement and notes. The financial statements are prepared in accordance with the Danish Financial Statements Act. Management’s responsibility for the financial statements Managem ...

... 2014, which comprise the accounting policies, income statement, balance sheet, statement of changes in equity, cash flow statement and notes. The financial statements are prepared in accordance with the Danish Financial Statements Act. Management’s responsibility for the financial statements Managem ...

ECB`s core inflation forecast is still too optimistic

... This research report was created by Danske Bank A/S and is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank A/S, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The res ...

... This research report was created by Danske Bank A/S and is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank A/S, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The res ...

AP8200-investment

... persons of prudence, discretion and intelligence exercise in the management of their own affairs, not for speculation, but for investment, considering the probable safety of their capital as well as the probable income to the derived. The standard of prudence to be used by investment officials shall ...

... persons of prudence, discretion and intelligence exercise in the management of their own affairs, not for speculation, but for investment, considering the probable safety of their capital as well as the probable income to the derived. The standard of prudence to be used by investment officials shall ...

Mackenzie Canadian Large Cap Growth Fund

... including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to desig ...

... including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to desig ...

Sense of Initiative and Entrepreneurship

... – A project should always yield more than it costs. It should be profitable. It is the task of an investment analysis and/or an assessment of economic efficiency to demonstrate just that. Methods include a number of different procedures, which range from the simple static calculation of the break-ev ...

... – A project should always yield more than it costs. It should be profitable. It is the task of an investment analysis and/or an assessment of economic efficiency to demonstrate just that. Methods include a number of different procedures, which range from the simple static calculation of the break-ev ...

H R Khan: Promoting retail investor participation in government bonds

... I am extremely happy to be invited for this important conference on capital markets organized by the ASSOCHAM, I am particularly pleased as the focus of the conference is on Investors who along with Issuers, Instruments, Intermediaries, (market) Infrastructure, Incentives & Innovation constitute, wh ...

... I am extremely happy to be invited for this important conference on capital markets organized by the ASSOCHAM, I am particularly pleased as the focus of the conference is on Investors who along with Issuers, Instruments, Intermediaries, (market) Infrastructure, Incentives & Innovation constitute, wh ...