"Sarbanes-Oxley" For Credit Rating Agencies?

... Finally, Part VII draws conclusions from the analysis presented below. II. The Current Financial Crisis In 2008, events unfolded which prevented the world from remaining blind to the problems that had been brewing for years. First, the Federal Reserve Bank of New York pulled Bear Stearns back from t ...

... Finally, Part VII draws conclusions from the analysis presented below. II. The Current Financial Crisis In 2008, events unfolded which prevented the world from remaining blind to the problems that had been brewing for years. First, the Federal Reserve Bank of New York pulled Bear Stearns back from t ...

Slide 1

... Common roots of diverse financial imbalances Low real interest rates lead to excessive risk taking • Two coincident factors compressed real interest rates: • Intrinsic to Eurozone accession process: • Interest rate convergence • Enhanced by „europhoria” (high income expectations related to rapid co ...

... Common roots of diverse financial imbalances Low real interest rates lead to excessive risk taking • Two coincident factors compressed real interest rates: • Intrinsic to Eurozone accession process: • Interest rate convergence • Enhanced by „europhoria” (high income expectations related to rapid co ...

Associated Entity Disclosure Return

... Check with your state electoral commission about requirements in your state. NSW Electoral Commission* http://www.elections.nsw.gov.au/ Victorian Electoral Commission http://www.vec.vic.gov.au/ Electoral Commission of Queensland* http://www.ecq.qld.gov.au/ Western Australian Electoral Commission* ht ...

... Check with your state electoral commission about requirements in your state. NSW Electoral Commission* http://www.elections.nsw.gov.au/ Victorian Electoral Commission http://www.vec.vic.gov.au/ Electoral Commission of Queensland* http://www.ecq.qld.gov.au/ Western Australian Electoral Commission* ht ...

No visible near-term trigger

... This report does not regard the specific investment objectives, financial situation, and the particular needs of any specific person who may receive this report. Investors must undertake independent analysis with their own legal, tax, and financial advisors and reach their own conclusions regarding ...

... This report does not regard the specific investment objectives, financial situation, and the particular needs of any specific person who may receive this report. Investors must undertake independent analysis with their own legal, tax, and financial advisors and reach their own conclusions regarding ...

Document - Oman College of Management & Technology

... in a portfolio of securities rather than in a single security because of risk factor. By constructing a portfolio, investors attempt to spread risk by not putting all their eggs into one basket. Thus diversification of investment tend to reduce risk by spreading risk over many assets. What is involv ...

... in a portfolio of securities rather than in a single security because of risk factor. By constructing a portfolio, investors attempt to spread risk by not putting all their eggs into one basket. Thus diversification of investment tend to reduce risk by spreading risk over many assets. What is involv ...

FOR IMMEDIATE RELEASE Markel Ventures

... Netherlands. Tromp designs and manufactures sheeting lines for pizza, pastry, pie and bread bakers worldwide. Terms of the transaction were not disclosed. "We are excited to join forces with Tromp," stated Ken Newsome, president of AMF. "This strategic addition enables us to leverage our position as ...

... Netherlands. Tromp designs and manufactures sheeting lines for pizza, pastry, pie and bread bakers worldwide. Terms of the transaction were not disclosed. "We are excited to join forces with Tromp," stated Ken Newsome, president of AMF. "This strategic addition enables us to leverage our position as ...

Financial System Review - December 2012

... segments of the housing market. These household imbalances could themselves be a trigger for financial system stress or they could amplify adverse economic shocks originating elsewhere. Finally, the low interest rate environment in major advanced economies represents another risk to the financial sy ...

... segments of the housing market. These household imbalances could themselves be a trigger for financial system stress or they could amplify adverse economic shocks originating elsewhere. Finally, the low interest rate environment in major advanced economies represents another risk to the financial sy ...

Banker for the World: Global Capital and America`s Financialization

... The 1999 Gramm-Leach-Bliley Act, which eliminated the wall separating commercial and investment banking, followed a similar trajectory. The 1956 Bank Holding Company Act had prohibited banks from engaging in commercial activities in addition to accepting deposits and making commercial loans. Althoug ...

... The 1999 Gramm-Leach-Bliley Act, which eliminated the wall separating commercial and investment banking, followed a similar trajectory. The 1956 Bank Holding Company Act had prohibited banks from engaging in commercial activities in addition to accepting deposits and making commercial loans. Althoug ...

Financing Local Infrastructure – Linking Local

... may be inadequate. Furthermore, local financial markets are often insufficiently developed to meet the demands of local governments. Financial markets might not see local governments as potential clients whereas banks and other financial intermediaries, where they exist, might not be familiar with l ...

... may be inadequate. Furthermore, local financial markets are often insufficiently developed to meet the demands of local governments. Financial markets might not see local governments as potential clients whereas banks and other financial intermediaries, where they exist, might not be familiar with l ...

Leverage, Default, and Forgiveness: Lessons from the American

... more mathematical research department. After I returned to Yale he suggested that since I had hired all the people, I could lead its research direction from Yale, while leaving the details to the heads of the various divisions I had created. In those years Kidder Peabody became the dominant investme ...

... more mathematical research department. After I returned to Yale he suggested that since I had hired all the people, I could lead its research direction from Yale, while leaving the details to the heads of the various divisions I had created. In those years Kidder Peabody became the dominant investme ...

NBER WORKING PAPER SERIES ADVANTAGE? Jiandong Ju

... argues for reverse causality: the size of financial markets, an empirical measure of financial development, is itself influenced by comparative advantage and international trade. Suppose, for reasons unrelated to financial development, country A has a comparative advantage in a sector that uses more ...

... argues for reverse causality: the size of financial markets, an empirical measure of financial development, is itself influenced by comparative advantage and international trade. Suppose, for reasons unrelated to financial development, country A has a comparative advantage in a sector that uses more ...

Alternatives to Paying Big Bonuses?

... counterparts. The latter require skill sets that are more common and can be motivated with rewards that are less variable. For these roles, a broad package of financial and non-financial rewards is more appropriate. • Linking rewards to long-term stock price appreciation and better addressing risk ...

... counterparts. The latter require skill sets that are more common and can be motivated with rewards that are less variable. For these roles, a broad package of financial and non-financial rewards is more appropriate. • Linking rewards to long-term stock price appreciation and better addressing risk ...

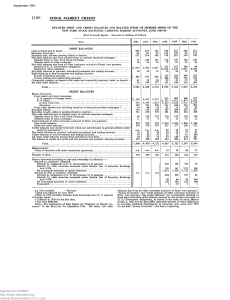

Detailed Debit and Credit Balances and Related Items of Member

... Entirely by obligations of U. S. Government or its agencies Entirely by other securities exempted under Section 3 (a) of Securities Exchange Act—1934 By nonexempt securities or mixed collateral Secured by firm or partners' collateral: Entirely by obligations of U S. Government or its agencies Entire ...

... Entirely by obligations of U. S. Government or its agencies Entirely by other securities exempted under Section 3 (a) of Securities Exchange Act—1934 By nonexempt securities or mixed collateral Secured by firm or partners' collateral: Entirely by obligations of U S. Government or its agencies Entire ...

systemic risk

... loss of value of the underlying investments A significant rise in surrender rates – inspired by consumers’ needs for cash or because of rumored or real failure of insurance companies – could be disastrous. Many people would be unable to obtain the same insurance from a competitor for the same price ...

... loss of value of the underlying investments A significant rise in surrender rates – inspired by consumers’ needs for cash or because of rumored or real failure of insurance companies – could be disastrous. Many people would be unable to obtain the same insurance from a competitor for the same price ...

2016 Projection Assumption Guidelines

... Montréal, Québec City, Toronto and Vancouver). When making assumptions around real estate growth, it is important to consider an appropriate starting valuation for the property and use an inflation-based assumption that is suitable based on the local market context. It is also important to note that ...

... Montréal, Québec City, Toronto and Vancouver). When making assumptions around real estate growth, it is important to consider an appropriate starting valuation for the property and use an inflation-based assumption that is suitable based on the local market context. It is also important to note that ...