Impact of the U.S subprime crises on MENA stock markets: new

... countries. To this effect, they used stock indices daily returns of these markets observed for the period from the January 3rd 2006 to February 26th 2010. They concluded that during the subprime crisis, contagion is strong between the US and the developed and emerging countries. More specifically, t ...

... countries. To this effect, they used stock indices daily returns of these markets observed for the period from the January 3rd 2006 to February 26th 2010. They concluded that during the subprime crisis, contagion is strong between the US and the developed and emerging countries. More specifically, t ...

Regulation 2016 - Federal Register of Legislation

... The reference to a ‘foreign exchange contract’ is included to deal with the issues which arise in relation to short-term foreign exchange derivatives under 7.1.04 of the Corporations Regulation 2001 (). The reference to forwards, swaps, options and combinations of those things in relation to one or ...

... The reference to a ‘foreign exchange contract’ is included to deal with the issues which arise in relation to short-term foreign exchange derivatives under 7.1.04 of the Corporations Regulation 2001 (). The reference to forwards, swaps, options and combinations of those things in relation to one or ...

The Bear Stearns Companies Inc.

... International Securities Exchange (“ISE”). Basis of Presentation The Condensed Consolidated Financial Statements include the accounts of the Company, its wholly owned subsidiaries and other entities in which the Company has a controlling interest. Additionally, in accordance with Financial Accountin ...

... International Securities Exchange (“ISE”). Basis of Presentation The Condensed Consolidated Financial Statements include the accounts of the Company, its wholly owned subsidiaries and other entities in which the Company has a controlling interest. Additionally, in accordance with Financial Accountin ...

Leverage

... With an increase in sales of 25% from Rs. 2,000 to Rs. 2,500, profits have increased from Rs. 700 to Rs. 1000, an increase of 43%. This is the effect of leverage. If the firm had no fixed costs at all but all its costs were variable, there would have been no leverage and the percentage change in sal ...

... With an increase in sales of 25% from Rs. 2,000 to Rs. 2,500, profits have increased from Rs. 700 to Rs. 1000, an increase of 43%. This is the effect of leverage. If the firm had no fixed costs at all but all its costs were variable, there would have been no leverage and the percentage change in sal ...

Transcript - SNL Financial

... 3.4 percent in October. So far in 2017, we have seen rates decline slightly from year-end levels. ...

... 3.4 percent in October. So far in 2017, we have seen rates decline slightly from year-end levels. ...

Stifel to Acquire Ziegler Lotsoff Capital Management

... management business. The acquisition will bring new asset management strategies and capabilities to Stifel’s existing asset management platform. ZLCM will continue its long-term partnership with B.C. Ziegler by continuing to offer investment management services to their mutual current and prospectiv ...

... management business. The acquisition will bring new asset management strategies and capabilities to Stifel’s existing asset management platform. ZLCM will continue its long-term partnership with B.C. Ziegler by continuing to offer investment management services to their mutual current and prospectiv ...

Incorporation of financial ratios into prudential definition of assets

... Asset classification systems require banks to segregate financial assets into risk buckets according to credit risk characteristics. The prudent segregation of assets by credit quality is vital for estimating related expected and unexpected credit losses and assessing if a bank’s capital level adequ ...

... Asset classification systems require banks to segregate financial assets into risk buckets according to credit risk characteristics. The prudent segregation of assets by credit quality is vital for estimating related expected and unexpected credit losses and assessing if a bank’s capital level adequ ...

Housing Markets and the Financial Crisis in Europe, Asia, and Beyond

... national, state and local levels, the weak economic recovery has raised questions about the underlying structure of the U.S. housing market and the basis for current U.S. housing policy. What aspects of the U.S. housing market allowed these problems to develop and fester? What role did U.S. housing ...

... national, state and local levels, the weak economic recovery has raised questions about the underlying structure of the U.S. housing market and the basis for current U.S. housing policy. What aspects of the U.S. housing market allowed these problems to develop and fester? What role did U.S. housing ...

Constant proportion debt obligations: what went

... what went wrong and what is the future for leveraged credit? INTRODUCTION On 23 May 2008, the CEO of Moody’s issued a public statement starting as follows: ‘As you may be aware, there have been reports in the news media of an error in a model that Moody’s Investors Service used in certain of its rat ...

... what went wrong and what is the future for leveraged credit? INTRODUCTION On 23 May 2008, the CEO of Moody’s issued a public statement starting as follows: ‘As you may be aware, there have been reports in the news media of an error in a model that Moody’s Investors Service used in certain of its rat ...

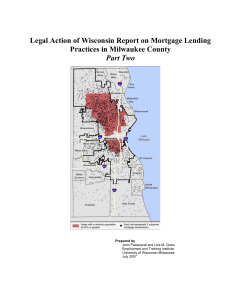

Legal Action of Wisconsin Report on Mortgage Lending

... acquire immediate cash (liquidity) based on their equity in the home and its increased market value since they acquired their first mortgage. This cash may be used to consolidate credit-card or other debts, but puts the borrower’s home at risk if mortgage payments are not met. In the last few years, ...

... acquire immediate cash (liquidity) based on their equity in the home and its increased market value since they acquired their first mortgage. This cash may be used to consolidate credit-card or other debts, but puts the borrower’s home at risk if mortgage payments are not met. In the last few years, ...

Financial Amplification Mechanisms and the Federal Reserve`s

... addressed the funding needs of borrowers in select credit markets. With these facilities, the Fed accepted a certain amount of credit risk which it managed by appropriate selection of haircuts on the collateral put to it. The increased credit risk is due to the longer maturity of the loans (up to 5 ...

... addressed the funding needs of borrowers in select credit markets. With these facilities, the Fed accepted a certain amount of credit risk which it managed by appropriate selection of haircuts on the collateral put to it. The increased credit risk is due to the longer maturity of the loans (up to 5 ...

Credit Derivatives, Leverage, and Financial

... from the focus of this article on leverage, liquidity, and monetary policy. Professor Steven Ramirez has argued that financial regulation plays a vital role in macroeconomic stability by promoting investor confidence. Steven A. Ramirez, Fear and Social Capitalism: the Law and Macroeconomics of Inves ...

... from the focus of this article on leverage, liquidity, and monetary policy. Professor Steven Ramirez has argued that financial regulation plays a vital role in macroeconomic stability by promoting investor confidence. Steven A. Ramirez, Fear and Social Capitalism: the Law and Macroeconomics of Inves ...

Clarifications to Questions and Criticisms on the Johansen

... feedback in the valuation of assets leading to unsustainable growth ending with a finite-time singularity at some future time tc . One can identify two broad classes of positive feedback mechanisms. The first technical class includes (i) option hedging [5], (ii) insurance portfolio strategies (see p ...

... feedback in the valuation of assets leading to unsustainable growth ending with a finite-time singularity at some future time tc . One can identify two broad classes of positive feedback mechanisms. The first technical class includes (i) option hedging [5], (ii) insurance portfolio strategies (see p ...

Multilateral CSA Notice: Regulation 45

... misrepresentation that are available in New Brunswick, Nova Scotia and Saskatchewan in the exempt offering document or notice delivered to a permitted client. Instead, the exempt offering document or notice is only required to include notification that statutory rights of action exist. We have propo ...

... misrepresentation that are available in New Brunswick, Nova Scotia and Saskatchewan in the exempt offering document or notice delivered to a permitted client. Instead, the exempt offering document or notice is only required to include notification that statutory rights of action exist. We have propo ...

A Study of Financial Distress based on MDA

... There are lots of causes of corporate failure which include the liquidity, solvency and profitability position. In today’s economic climate overtrading can also create the risk of illiquidity and lead to corporate collapse. A prediction is a report regarding the means effects will take place in the ...

... There are lots of causes of corporate failure which include the liquidity, solvency and profitability position. In today’s economic climate overtrading can also create the risk of illiquidity and lead to corporate collapse. A prediction is a report regarding the means effects will take place in the ...

annual report - Beige Capital

... of the Redenomination of the Cedi, among other roles played in key initiatives rolled out by the Bank of Ghana towards the reform of the banking sector. ...

... of the Redenomination of the Cedi, among other roles played in key initiatives rolled out by the Bank of Ghana towards the reform of the banking sector. ...

Poplar Forest Cornerstone Fund Summary Prospectus

... • General Market Risk – Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. • Management Risk – If the ...

... • General Market Risk – Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. • Management Risk – If the ...