fair value hedges

... cash settlement for price changes in the commodity underlying the contract. 4. An option on a financial instrument is a derivative that permits its holder either to buy or to sell the instrument at a specified price and within a given time period, without the obligation to exercise the option. D. Al ...

... cash settlement for price changes in the commodity underlying the contract. 4. An option on a financial instrument is a derivative that permits its holder either to buy or to sell the instrument at a specified price and within a given time period, without the obligation to exercise the option. D. Al ...

Soobschenie_viplata_kupon_09.12.10_EN

... In accordance with the Decision on securities issues, Interest/coupon rate of the first Bond coupon is 8.8% as specified by Order of Director General of JSC TransContainer No. 64 of June 08, 2010. 2.5. Date of decision on determining the rate (procedure for determining the rate) of interest/coupon p ...

... In accordance with the Decision on securities issues, Interest/coupon rate of the first Bond coupon is 8.8% as specified by Order of Director General of JSC TransContainer No. 64 of June 08, 2010. 2.5. Date of decision on determining the rate (procedure for determining the rate) of interest/coupon p ...

PRODUCT GUIDELINES FHA STANDARD and HIGH BALANCE

... AUS Approve - Chapter 7 must be > 2 years since date of discharge and borrower must have re-established good credit, or chosen not to incur new credit obligations. If < 2 years, but not < 12 months, may be acceptable, if borrower can show that bankruptcy was caused by extenuating circumstances (must ...

... AUS Approve - Chapter 7 must be > 2 years since date of discharge and borrower must have re-established good credit, or chosen not to incur new credit obligations. If < 2 years, but not < 12 months, may be acceptable, if borrower can show that bankruptcy was caused by extenuating circumstances (must ...

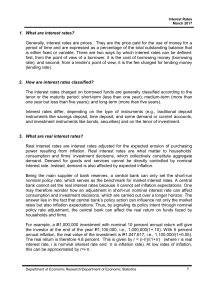

Interest Rates

... Interbank Call Loan Rate - the rate on loans among banks for periods not exceeding 24 hours primarily for the purpose of covering reserve deficiencies. Philippine Interbank Offered Rate (PHIBOR) - represents the simple average of the interest rate offers submitted by participating banks on a dai ...

... Interbank Call Loan Rate - the rate on loans among banks for periods not exceeding 24 hours primarily for the purpose of covering reserve deficiencies. Philippine Interbank Offered Rate (PHIBOR) - represents the simple average of the interest rate offers submitted by participating banks on a dai ...

Study on Prevention of the American Sub-prime Mortgage Loan Risk

... professional criminals. In recent years, the leading type of loan in sub-prime loan market is mixed type ARM, the rate of which was fixed in the first two years and then increased once every half year. Usually it was raised by much range, and many loaners can not afford the monthly payment, so they ...

... professional criminals. In recent years, the leading type of loan in sub-prime loan market is mixed type ARM, the rate of which was fixed in the first two years and then increased once every half year. Usually it was raised by much range, and many loaners can not afford the monthly payment, so they ...

Patrick Bayer, Duke University and NBER

... purchased their homes between 2004 and 2007 – i.e., those drawn into the market at the peak of the credit expansion. Taken together, our results provide strong evidence that minority households drawn into homeownership late in the recent housing market boom were especially vulnerable in the subsequ ...

... purchased their homes between 2004 and 2007 – i.e., those drawn into the market at the peak of the credit expansion. Taken together, our results provide strong evidence that minority households drawn into homeownership late in the recent housing market boom were especially vulnerable in the subsequ ...

From low to negative rates

... asset side. This means that if market rates drop the asset side potentially follows suit and even drops into negative territory while the bank still pays for its refinancing. In other words: A negative interest rate environment causes the reference rate to be unrepresentative of the true refinancing ...

... asset side. This means that if market rates drop the asset side potentially follows suit and even drops into negative territory while the bank still pays for its refinancing. In other words: A negative interest rate environment causes the reference rate to be unrepresentative of the true refinancing ...

Solutions to Chapter 11

... 10. In 2010, the Dow was nearly four times its 1990 level. Therefore, in 2010, a 40-point movement was far less significant in percentage terms than it was in 1990. We would expect to see more 40-point days in 2010 even if market risk as measured by percentage returns is no higher than it was in 199 ...

... 10. In 2010, the Dow was nearly four times its 1990 level. Therefore, in 2010, a 40-point movement was far less significant in percentage terms than it was in 1990. We would expect to see more 40-point days in 2010 even if market risk as measured by percentage returns is no higher than it was in 199 ...

Using Derivatives to Manage Interest Rate Risk Derivatives A

... fixed-rate/pay floating-rating forward rate agreement with County Bank (as the buyer) with a six-month maturity based on a $1 million notional principal amount The floating rate is the 3-month LIBOR and the fixed (exercise) rate is 7% Metro Bank would refer to this as a “3 vs. 6” FRA at 7 percent on ...

... fixed-rate/pay floating-rating forward rate agreement with County Bank (as the buyer) with a six-month maturity based on a $1 million notional principal amount The floating rate is the 3-month LIBOR and the fixed (exercise) rate is 7% Metro Bank would refer to this as a “3 vs. 6” FRA at 7 percent on ...

Using Derivatives to Manage Interest Rate Risk

... fixed-rate/pay floating-rating forward rate agreement with County Bank (as the buyer) with a six-month maturity based on a $1 million notional principal amount The floating rate is the 3-month LIBOR and the fixed (exercise) rate is 7% Metro Bank would refer to this as a “3 vs. 6” FRA at 7 percent on ...

... fixed-rate/pay floating-rating forward rate agreement with County Bank (as the buyer) with a six-month maturity based on a $1 million notional principal amount The floating rate is the 3-month LIBOR and the fixed (exercise) rate is 7% Metro Bank would refer to this as a “3 vs. 6” FRA at 7 percent on ...

China | Looking for new monetary policy tools in

... rate liberalization, the PBoC need to develop new price tools in their policy ammunitions. It is reported that the PBoC increased their operations under the MLF to inject a large amount of liquidity in the run-up to the Chinese New Year, so as to stabilize interbank market rates. Meanwhile, the PBoC ...

... rate liberalization, the PBoC need to develop new price tools in their policy ammunitions. It is reported that the PBoC increased their operations under the MLF to inject a large amount of liquidity in the run-up to the Chinese New Year, so as to stabilize interbank market rates. Meanwhile, the PBoC ...

Rose

... Consumer Loans, Credit Cards, And Real Estate Lending To learn about the many types of loans lenders make to consumers(individuals and families) and to real estate borrowers and to understand the factors that influence the profitability and risk of consumer and real estate loans. In addition, the ch ...

... Consumer Loans, Credit Cards, And Real Estate Lending To learn about the many types of loans lenders make to consumers(individuals and families) and to real estate borrowers and to understand the factors that influence the profitability and risk of consumer and real estate loans. In addition, the ch ...