Deferred Fixed Annuities

... This hypothetical example is for illustrative purposes only. It is not intended to predict or project the direction of interest rates. Actual interest rates may be higher or lower than those shown here. Note: Both the short-term, non-fixed-interest-rate and fixed interest rates are assumed to be ann ...

... This hypothetical example is for illustrative purposes only. It is not intended to predict or project the direction of interest rates. Actual interest rates may be higher or lower than those shown here. Note: Both the short-term, non-fixed-interest-rate and fixed interest rates are assumed to be ann ...

Sustainable growth and financial markets in a natural resource rich

... Surprisingly, oil or gaz producers, even though they have important revenues due to their natural resources, are usually facing high level of debt. For instance, Angola, which is one of the first oil producer of Africa has to deal with an external debt of 22,170 billion of US dollar, and Brazil had ...

... Surprisingly, oil or gaz producers, even though they have important revenues due to their natural resources, are usually facing high level of debt. For instance, Angola, which is one of the first oil producer of Africa has to deal with an external debt of 22,170 billion of US dollar, and Brazil had ...

Low long-term interest rates as a global phenomenon

... Global interest rates are, according to Haldane (2015), now “lower than at any time in the past 5000 years”. As the former Governor of the Banque de France noted in his recent valedictory address, “the prolonged coincidence of low interest rates and low inflation…complicate the task of monetary poli ...

... Global interest rates are, according to Haldane (2015), now “lower than at any time in the past 5000 years”. As the former Governor of the Banque de France noted in his recent valedictory address, “the prolonged coincidence of low interest rates and low inflation…complicate the task of monetary poli ...

Principles of Economics, Case and Fair,9e

... price could he get? It all depends on the prevailing interest rate. Let say the interest rate on Jan 2, 2009 was 20%, do you think he will be able to sell for more or less than $900? ...

... price could he get? It all depends on the prevailing interest rate. Let say the interest rate on Jan 2, 2009 was 20%, do you think he will be able to sell for more or less than $900? ...

Fixed Income in a Rising Rate Enviornment

... November. This was surprising, as many pundits predicted a Trump win would create uncertainty and a flight to quality that would drive investors into low-risk U.S. Treasuries and suppress yields. However, the markets thought the Trump win would benefit the economy and appeared to believe his infrast ...

... November. This was surprising, as many pundits predicted a Trump win would create uncertainty and a flight to quality that would drive investors into low-risk U.S. Treasuries and suppress yields. However, the markets thought the Trump win would benefit the economy and appeared to believe his infrast ...

Dutch economy in calmer waters - Sociaal

... The Social and Economic Council in the Netherlands The Social and Economic Council (Sociaal-Economische Raad, SER) advises government and parliament on the outlines of national and international social and economic policy and on matters of important legislation in the social and economic sphere. Em ...

... The Social and Economic Council in the Netherlands The Social and Economic Council (Sociaal-Economische Raad, SER) advises government and parliament on the outlines of national and international social and economic policy and on matters of important legislation in the social and economic sphere. Em ...

The Correlation of Interest Rate Differential and Exchange Rate over

... This lesson should be taken in the mind of recent Korean Monetary and Foreign Exchange Authorities to manupilate BIS Capital Adequacy ratio, interest rate, stock price, and foreign exchange rate.* Due to the limited data available, author studied Korean commercial banks performance of BIS ratio for ...

... This lesson should be taken in the mind of recent Korean Monetary and Foreign Exchange Authorities to manupilate BIS Capital Adequacy ratio, interest rate, stock price, and foreign exchange rate.* Due to the limited data available, author studied Korean commercial banks performance of BIS ratio for ...

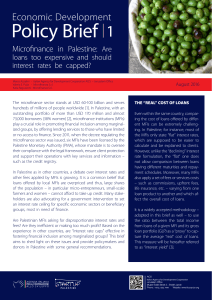

Policy Brief 1

... not seem to be over performing – but on the contrary, ROE and ROA levels appears to be significantly lower than those achieved by MFIs in Jordan, Lebanon, Egypt as well as the MENA region as a whole. This reflects the cost of lending services, which seems to be less than the regional and global aver ...

... not seem to be over performing – but on the contrary, ROE and ROA levels appears to be significantly lower than those achieved by MFIs in Jordan, Lebanon, Egypt as well as the MENA region as a whole. This reflects the cost of lending services, which seems to be less than the regional and global aver ...

Debt and Easy Access Credit - Missouri Council for Economic

... A rent-to-own arrangement starts off as a traditional rental agreement, but the two parties agree to transfer ownership at the end of a specified period of time. The seller benefits from the high monthly interest rates, and the buyer benefits from the less restrictive credit qualifications (only a f ...

... A rent-to-own arrangement starts off as a traditional rental agreement, but the two parties agree to transfer ownership at the end of a specified period of time. The seller benefits from the high monthly interest rates, and the buyer benefits from the less restrictive credit qualifications (only a f ...

Ameriprise® Stock Market Certificate

... Poor’s 500 Index (S&P 500 Index), an unmanaged index of common stocks, is frequently used as a general measure of market performance. The Index reflects reinvestment of all distributions and changes in market prices but excludes brokerage commissions or other fees. It is not possible to invest direc ...

... Poor’s 500 Index (S&P 500 Index), an unmanaged index of common stocks, is frequently used as a general measure of market performance. The Index reflects reinvestment of all distributions and changes in market prices but excludes brokerage commissions or other fees. It is not possible to invest direc ...

Accounting for Notes Receivable

... Promissory Note-a written promise to pay a specified amount of money either on demand or at a definite future date. Promissory Notes may be used in exchange for goods or services, in exchange for loaned funds, or in exchange for an outstanding account receivable. Principal-amount stated on the face ...

... Promissory Note-a written promise to pay a specified amount of money either on demand or at a definite future date. Promissory Notes may be used in exchange for goods or services, in exchange for loaned funds, or in exchange for an outstanding account receivable. Principal-amount stated on the face ...