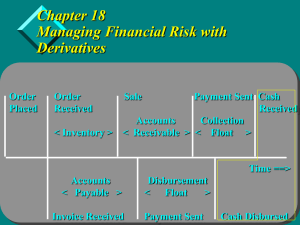

Chapter 17: Managing Interest Rate Risk

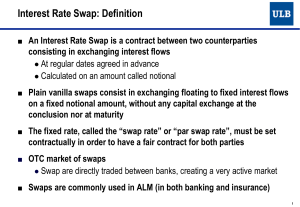

... market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is comparatively cheaper than that for its floating-rate debt, then it can issue a fixed-rate bond and swap it into floating, for an all-in cost lower than that for a floating-rat ...

... market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is comparatively cheaper than that for its floating-rate debt, then it can issue a fixed-rate bond and swap it into floating, for an all-in cost lower than that for a floating-rat ...

Mortgage Interest Rates

... Factors other than those presented in this document that may have an influence on interest rates were not discussed due to their relatively small impact. More specifically, these include changes in the exchange risk premium, which aims to compensate foreign investors for any loss due to fluctuations ...

... Factors other than those presented in this document that may have an influence on interest rates were not discussed due to their relatively small impact. More specifically, these include changes in the exchange risk premium, which aims to compensate foreign investors for any loss due to fluctuations ...

Interest Rate Swap

... ● In T1: Investment of nominal values of the expired bonds in new bonds with same maturity as the forward swap (if possible), and new coupon rate C1. ● From T1: The company receives a fixed coupon rate C1 and the fixed rate K1 of ...

... ● In T1: Investment of nominal values of the expired bonds in new bonds with same maturity as the forward swap (if possible), and new coupon rate C1. ● From T1: The company receives a fixed coupon rate C1 and the fixed rate K1 of ...

The Dutch housing market - mortgage interest rates, house prices

... securitisation are not higher in the Netherlands than in other countries. First, Dutch mortgages have a low incidence of payment defaults, compared to the mortgages in other countries.8 Dutch households that have purchased their first home during the past 10 years, however, do have a relatively high ...

... securitisation are not higher in the Netherlands than in other countries. First, Dutch mortgages have a low incidence of payment defaults, compared to the mortgages in other countries.8 Dutch households that have purchased their first home during the past 10 years, however, do have a relatively high ...

Document

... react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is co ...

... react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is co ...

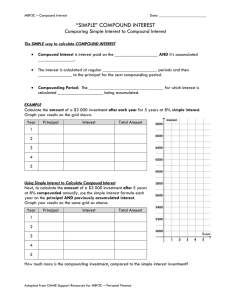

SIMPLE INTEREST VS COMPOUND INTEREST

... a) Carlene wants to borrow $7 000 for five years. Compare the growth of this loan at 7% per year, simple interest, to the same loan at 7% per year, compounded annually. ...

... a) Carlene wants to borrow $7 000 for five years. Compare the growth of this loan at 7% per year, simple interest, to the same loan at 7% per year, compounded annually. ...

Economics 302

... expenditure is higher when we have a trade deficit. Thus neither argument is valid. h. Advisors for the second candidate have proposed two arguments against the other two candidates. The first argument is that an open economy is better than a closed economy as it promotes investment and economic gr ...

... expenditure is higher when we have a trade deficit. Thus neither argument is valid. h. Advisors for the second candidate have proposed two arguments against the other two candidates. The first argument is that an open economy is better than a closed economy as it promotes investment and economic gr ...

doc

... What is your discount rate? We can answer that easily enough if you answer the following kinds of questions: If you had a choice between a dollar today and $1.10 a year from now, would you take the dollar today or the $1.10? If you answered the dollar today, we know your discount rate is at least 10 ...

... What is your discount rate? We can answer that easily enough if you answer the following kinds of questions: If you had a choice between a dollar today and $1.10 a year from now, would you take the dollar today or the $1.10? If you answered the dollar today, we know your discount rate is at least 10 ...

Cooking the Books Workbook - Association of Certified Fraud

... mortgage loans. It is much more likely that industry insiders, who may retain PPI from previous transactions, use this information over and over without the knowledge of the borrowers. Some schemes involve the use of a deceased individual’s SSN, while other cases involve using an issued SSN that has ...

... mortgage loans. It is much more likely that industry insiders, who may retain PPI from previous transactions, use this information over and over without the knowledge of the borrowers. Some schemes involve the use of a deceased individual’s SSN, while other cases involve using an issued SSN that has ...

Dynamic portfolio and mortgage choice for homeowners

... Stocks: dS / S R f S S dt S dzS Real riskless rate: dr r r dt r dzr Expected inflation rate: d dt dz ...

... Stocks: dS / S R f S S dt S dzS Real riskless rate: dr r r dt r dzr Expected inflation rate: d dt dz ...

G.S. 24-1.1E - North Carolina General Assembly

... cosigner, or guarantor obligated to repay a loan. A lender may not make a high-cost home loan unless the lender reasonably believes at the time the loan is consummated that one or more of the obligors, when considered individually or collectively, will be able to make the scheduled payments to repay ...

... cosigner, or guarantor obligated to repay a loan. A lender may not make a high-cost home loan unless the lender reasonably believes at the time the loan is consummated that one or more of the obligors, when considered individually or collectively, will be able to make the scheduled payments to repay ...

Document

... In the long run, the fall in the demand for a country’s exports leads to a depreciation of its currency, but the higher tariffs lead to an appreciation. Therefore, the effect on the exchange rate is uncertain. The dollar will appreciate. Because expected U.S. inflation falls as a result of the annou ...

... In the long run, the fall in the demand for a country’s exports leads to a depreciation of its currency, but the higher tariffs lead to an appreciation. Therefore, the effect on the exchange rate is uncertain. The dollar will appreciate. Because expected U.S. inflation falls as a result of the annou ...

Presentation - Federal Reserve Bank of New York

... ON RRP: “the Federal Reserve intends to use an overnight reverse repurchase agreement facility and other supplementary tools as needed to help control the federal funds rate. The Committee will use an overnight reverse repurchase agreement facility only to the extent necessary and will phase it ou ...

... ON RRP: “the Federal Reserve intends to use an overnight reverse repurchase agreement facility and other supplementary tools as needed to help control the federal funds rate. The Committee will use an overnight reverse repurchase agreement facility only to the extent necessary and will phase it ou ...

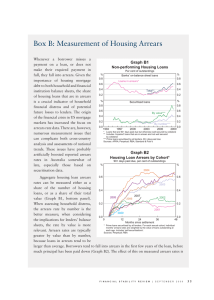

Box B: Measurement of Housing Arrears Graph B1

... lenders. In Australia, housing loans are defined as non-performing if they are either ‘past due’ – where repayments are at least 90 days past due, but the loan is well covered by collateral – or ‘impaired’ – at least 90 days past due or not in arrears but otherwise doubtful, and the loan is not well ...

... lenders. In Australia, housing loans are defined as non-performing if they are either ‘past due’ – where repayments are at least 90 days past due, but the loan is well covered by collateral – or ‘impaired’ – at least 90 days past due or not in arrears but otherwise doubtful, and the loan is not well ...

Full Page with Layout Heading - Michigan Department of Education

... Ability to invest sinking fund payments to further reduce interest cost and possibly even principal cost Debt is typically marketed as a single “bullet” maturity due at end of term (15 year term with 14 years of interest only payments and one single payment of principal for full amount borrowed ...

... Ability to invest sinking fund payments to further reduce interest cost and possibly even principal cost Debt is typically marketed as a single “bullet” maturity due at end of term (15 year term with 14 years of interest only payments and one single payment of principal for full amount borrowed ...

The role of regional factors in determining mortgage interest

... of the pass-through coefficients in a cross section framework. They find that macroeconomic characteristics of these countries such as inflation and GDP play a significant role in the determination of the pass-through process. Debond (2002) and Debond (2005) followed the same approach and used the E ...

... of the pass-through coefficients in a cross section framework. They find that macroeconomic characteristics of these countries such as inflation and GDP play a significant role in the determination of the pass-through process. Debond (2002) and Debond (2005) followed the same approach and used the E ...