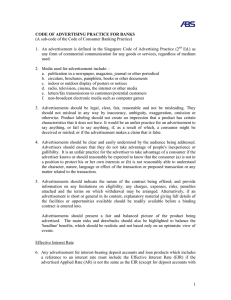

Code of Advertising Practice for Banks_June2010

... information on any limitations on eligibility, any charges, expenses, risks, penalties attached and the terms on which withdrawal may be arranged. Alternatively, if an advertisement is short or general in its content, explanatory material giving full details of the facilities or opportunities availa ...

... information on any limitations on eligibility, any charges, expenses, risks, penalties attached and the terms on which withdrawal may be arranged. Alternatively, if an advertisement is short or general in its content, explanatory material giving full details of the facilities or opportunities availa ...

Deterioration of Bank Balance Sheets and

... conditions led to increase in demand for housing, a higher leverage by households, and an increase in house prices. Real house prices almost doubled between 1995 and 2006. Total mortgage debt outstanding as a fraction of disposable income increased from about 60% to 100%. Once credit conditions star ...

... conditions led to increase in demand for housing, a higher leverage by households, and an increase in house prices. Real house prices almost doubled between 1995 and 2006. Total mortgage debt outstanding as a fraction of disposable income increased from about 60% to 100%. Once credit conditions star ...

Interest Rates in Mexico The Role of Exchange Rate Expectations

... function) to the implicit yield from the secondary market of Mexico's external debt. That is, it is postulated that domestic interest rates in Mexico are closely associated to the international perception of Mexico's creditworthiness, which is captured in the behavior of itsm. 1/ The implicit hypoth ...

... function) to the implicit yield from the secondary market of Mexico's external debt. That is, it is postulated that domestic interest rates in Mexico are closely associated to the international perception of Mexico's creditworthiness, which is captured in the behavior of itsm. 1/ The implicit hypoth ...

Senior Loan Term Sheet

... In the case of unpaid principal, the applicable interest rate plus 2% per annum and, in the case of any other amount, the rate of interest applicable to ABR loans plus 2% per annum. ...

... In the case of unpaid principal, the applicable interest rate plus 2% per annum and, in the case of any other amount, the rate of interest applicable to ABR loans plus 2% per annum. ...

Inflation targeting framework and interest Rates

... expected future inflation so that the central bank is assumed to be forward-looking in setting the prime rate. They found that the Fed moved the fund rate less than one-for-one during the period 1960-1979 violating the Taylor principle. However, a study by Perez (2001) found out that when the Fed’s ...

... expected future inflation so that the central bank is assumed to be forward-looking in setting the prime rate. They found that the Fed moved the fund rate less than one-for-one during the period 1960-1979 violating the Taylor principle. However, a study by Perez (2001) found out that when the Fed’s ...

background on savings institutions

... on additional deposits to accommodate withdrawal requests. If new deposits are not sufficient to cover withdrawal requests, these institutions can experience liquidity problems. To remedy this situation, they can obtain funds through repurchase agreements or borrow funds in the federal funds market. ...

... on additional deposits to accommodate withdrawal requests. If new deposits are not sufficient to cover withdrawal requests, these institutions can experience liquidity problems. To remedy this situation, they can obtain funds through repurchase agreements or borrow funds in the federal funds market. ...

Temi di Discussione

... delinquent at the end of 2005: after two years, roughly 20 per cent had been declared bad loans. Banks should therefore closely monitor this information both when deciding whether to grant a loan to a household and when specifying the price and nonprice terms of the contract. In order to estimate th ...

... delinquent at the end of 2005: after two years, roughly 20 per cent had been declared bad loans. Banks should therefore closely monitor this information both when deciding whether to grant a loan to a household and when specifying the price and nonprice terms of the contract. In order to estimate th ...

File - Jason Murphy

... Daniel wants to invest $25 000 for a total of three years. There are three investment options. Option One ...

... Daniel wants to invest $25 000 for a total of three years. There are three investment options. Option One ...

Financial Intermediaries and the Design of Loan

... particularly in situations where monitoring was difficult and expensive. Anything less than very positive signals would rank the loan as risky. Agents looked for previous successful experience in farming with evidence of industriousness and acumen focussed upon this activity. With existing customers ...

... particularly in situations where monitoring was difficult and expensive. Anything less than very positive signals would rank the loan as risky. Agents looked for previous successful experience in farming with evidence of industriousness and acumen focussed upon this activity. With existing customers ...

1 A $1000 bond has a coupon of 6% and matures after

... The net present values decline in both cases, but the net present value of A is still positive, so the firm should make that investment. (You should point out that the increase in the cost of capital does not change the investments' internal rates of return. However, since investment B's internal r ...

... The net present values decline in both cases, but the net present value of A is still positive, so the firm should make that investment. (You should point out that the increase in the cost of capital does not change the investments' internal rates of return. However, since investment B's internal r ...

Real Estate Retention Agreement 2.5" Margin

... share of the direct Subsidy that financed the purchase, construction, or rehabilitation of the property, reduced for every year the Borrower occupied the unit, shall be repaid to the Member for reimbursement to the FHLBI from any net gain realized upon the refinancing, unless the property continues ...

... share of the direct Subsidy that financed the purchase, construction, or rehabilitation of the property, reduced for every year the Borrower occupied the unit, shall be repaid to the Member for reimbursement to the FHLBI from any net gain realized upon the refinancing, unless the property continues ...

Compiled by CA. Aditya Kumar Maheshwari AS – 30 :: Financial

... Change of intention (Say to be kept till maturity) Fair Value no longer available In preceding two years, assets from HTM have not been sold The fair value as on the date of classification becomes cost. The balance in Investment Revaluation Reserve should either remain in the same reserve or s ...

... Change of intention (Say to be kept till maturity) Fair Value no longer available In preceding two years, assets from HTM have not been sold The fair value as on the date of classification becomes cost. The balance in Investment Revaluation Reserve should either remain in the same reserve or s ...

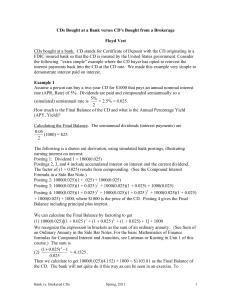

CDs Bought at a Bank verses CD`s Bought from a Brokerage Floyd

... particular CD the Value at Maturity is the same as the price, but for CDs bought on the secondary market, this may not be true. The dividends of a brokered CD are typically paid into a “sweep” money market fund in the name of the CD owner. Of course, dividends might be reinvested at a “good” rate. ( ...

... particular CD the Value at Maturity is the same as the price, but for CDs bought on the secondary market, this may not be true. The dividends of a brokered CD are typically paid into a “sweep” money market fund in the name of the CD owner. Of course, dividends might be reinvested at a “good” rate. ( ...

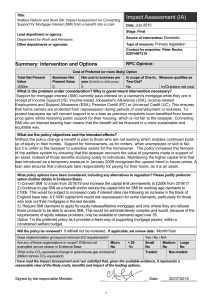

Impact Assessment (IA)

... recouped from the equity in the property when it is sold, or repaid when the claimant returns to work. If there is insufficient equity in a claimant’s property to repay the whole SMI loan, the balance would be written off. People who are acquiring a potentially valuable asset will in the future have ...

... recouped from the equity in the property when it is sold, or repaid when the claimant returns to work. If there is insufficient equity in a claimant’s property to repay the whole SMI loan, the balance would be written off. People who are acquiring a potentially valuable asset will in the future have ...

The EGP Exchange Rate Questions

... This Report is compiled and furnished solely for informative purposes to be considered by the intended recipients who have the knowledge to assess the information contained herein. Pharos Research ('Pharos') makes no representation or warranty, whether expressed or implied, as to the accuracy and/or ...

... This Report is compiled and furnished solely for informative purposes to be considered by the intended recipients who have the knowledge to assess the information contained herein. Pharos Research ('Pharos') makes no representation or warranty, whether expressed or implied, as to the accuracy and/or ...

N. Financial Assumptions and Discount Rate

... The discount rates that are used for the three major categories of retail load-serving entities (municipals/PUDs, coops and IOUs) are distinguished by their financing costs and estimates can be derived from the above values. Municipal utilities and public utility districts are assumed to be able to ...

... The discount rates that are used for the three major categories of retail load-serving entities (municipals/PUDs, coops and IOUs) are distinguished by their financing costs and estimates can be derived from the above values. Municipal utilities and public utility districts are assumed to be able to ...