Name ______ Honors Brief Calc Period ____ 6.2 WS Compound

... 15. What rate of interest compounded annually is required to double an investment in 3 years? ...

... 15. What rate of interest compounded annually is required to double an investment in 3 years? ...

Renewal Rates (3-Year) - Brighthouse Financial

... declared renewal rate for each allocation. If your current Shield Option(s) is no longer available, we will automatically transfer these amounts to the Fixed Account. If the Fixed Account is not available, these amounts will automatically transfer into the Shield Option with, in order of priority, t ...

... declared renewal rate for each allocation. If your current Shield Option(s) is no longer available, we will automatically transfer these amounts to the Fixed Account. If the Fixed Account is not available, these amounts will automatically transfer into the Shield Option with, in order of priority, t ...

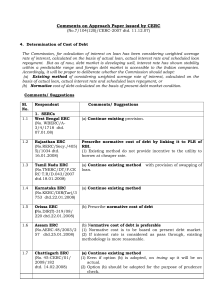

TO DETERMINE INTEREST AND LOAN DEFAULT RATES AMONG

... commercial banks in Kenya. The period of analysis was five years from 2008 to 2012. The findings indicate an increasing trend of average market interest rates ranging from 12.02 in the year 2008 to 19.20 in the year 2012. This indicates improved performance in the macro economic variables over the y ...

... commercial banks in Kenya. The period of analysis was five years from 2008 to 2012. The findings indicate an increasing trend of average market interest rates ranging from 12.02 in the year 2008 to 19.20 in the year 2012. This indicates improved performance in the macro economic variables over the y ...

colony capital, inc. - corporate

... Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to su ...

... Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to su ...

DISCHARGE OF A CAVEAT MAY NOT BE SUFFICIENT

... An interesting situation involving the need to differentiate between registration of an estate, interest or right (essentially to establish the priority of same) on the one hand, and the creation and existence of an estate, interest or right apart from any registration of same on the other hand, is ...

... An interesting situation involving the need to differentiate between registration of an estate, interest or right (essentially to establish the priority of same) on the one hand, and the creation and existence of an estate, interest or right apart from any registration of same on the other hand, is ...

2.2.1 What

... tremendous risk because the inflation will just eat their investment up. An investment with risk of 6.5% inflation and interest rate of their investment only being 5% will not be attractive since their investment is negative by 1.5%. In order to prevent the inflation risk they choose indexation mort ...

... tremendous risk because the inflation will just eat their investment up. An investment with risk of 6.5% inflation and interest rate of their investment only being 5% will not be attractive since their investment is negative by 1.5%. In order to prevent the inflation risk they choose indexation mort ...

Analysis of Chosen Strategies of Asset and Liability Management in

... performance, but also the profit. The core problem in asset and liability management is the fact that the main asset of commercial bank - credits – not always can be liquid, especially if the country‘s economy is in deep recession. Upon such conditions, the need for restructuring of some credits ari ...

... performance, but also the profit. The core problem in asset and liability management is the fact that the main asset of commercial bank - credits – not always can be liquid, especially if the country‘s economy is in deep recession. Upon such conditions, the need for restructuring of some credits ari ...

The Expectations Theory of the Term Structure and Short

... that, in equilibrium, the expected returns from different investment strategies with the same horizon should be equal. ...

... that, in equilibrium, the expected returns from different investment strategies with the same horizon should be equal. ...