* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

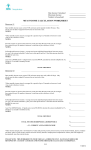

Download 203k select - Primary Residential Mortgage

Payday loan wikipedia , lookup

United States housing bubble wikipedia , lookup

Negative gearing wikipedia , lookup

Security interest wikipedia , lookup

Foreclosure wikipedia , lookup

Mortgage broker wikipedia , lookup

Present value wikipedia , lookup

Syndicated loan wikipedia , lookup

Credit rationing wikipedia , lookup

History of pawnbroking wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

Mortgage law wikipedia , lookup