Selling Guide

... means without Fannie Mae’s prior written permission, except as may be provided herein or unless otherwise permitted by law. Limited permission to reproduce this publication in print in whole or in part and limited permission to distribute electronically parts of this publication are granted to Fanni ...

... means without Fannie Mae’s prior written permission, except as may be provided herein or unless otherwise permitted by law. Limited permission to reproduce this publication in print in whole or in part and limited permission to distribute electronically parts of this publication are granted to Fanni ...

Amended Complaint

... Violation of Underwriting Guidelines, Appraisal Guidelines, and Predatory Lending by the Originators Whose Loans Back the PLMBS in this Case.......................................................................................... 108 ...

... Violation of Underwriting Guidelines, Appraisal Guidelines, and Predatory Lending by the Originators Whose Loans Back the PLMBS in this Case.......................................................................................... 108 ...

Servicing and Foreclosure Fraud

... In April 2006, Mrs. Rice filed for bankruptcy claiming the home, co-owned by Mr. Rice and her, as her primary asset. During the pendency of the bankruptcy, the home was foreclosed upon by one of her lenders. Mrs. Rice arranged for a third party to purchase the home from the lender. Mrs. Rice assiste ...

... In April 2006, Mrs. Rice filed for bankruptcy claiming the home, co-owned by Mr. Rice and her, as her primary asset. During the pendency of the bankruptcy, the home was foreclosed upon by one of her lenders. Mrs. Rice arranged for a third party to purchase the home from the lender. Mrs. Rice assiste ...

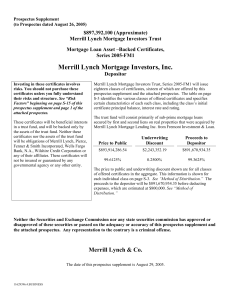

Merrill Lynch Mortgage Investors, Inc.

... for the fixed rate mortgage loans or 100% PPC (a constant prepayment rate of 2% per annum in month 1, building linearly (rounded to the nearest hundredth) to a constant prepayment rate of 30% per annum in month 12 and remaining constant at a constant prepayment rate of 30% per annum from month 12 up ...

... for the fixed rate mortgage loans or 100% PPC (a constant prepayment rate of 2% per annum in month 1, building linearly (rounded to the nearest hundredth) to a constant prepayment rate of 30% per annum in month 12 and remaining constant at a constant prepayment rate of 30% per annum from month 12 up ...

1 LOWLAND MORTGAGE BACKED SECURITIES 1 BV

... The Senior Class A1 Notes will carry a floating rate of interest, payable monthly in arrear on each Payment Date, subject to and in accordance with the Terms and Conditions of the Notes (the "Conditions"). The rate of interest for the Senior Class A1 Notes will be one month Euribor (or, in respect o ...

... The Senior Class A1 Notes will carry a floating rate of interest, payable monthly in arrear on each Payment Date, subject to and in accordance with the Terms and Conditions of the Notes (the "Conditions"). The rate of interest for the Senior Class A1 Notes will be one month Euribor (or, in respect o ...

Review Questions Con..

... Broker K defrauded her by allowing her son and his wife to see the purchase offer he brought to her. d. her consumer protection rights have been usurped by her son and daughter-in-law. ...

... Broker K defrauded her by allowing her son and his wife to see the purchase offer he brought to her. d. her consumer protection rights have been usurped by her son and daughter-in-law. ...

A Model of Trust Building with Anonymous Re-match

... levels of patience) in one side or both sides of a relationship. The reason for starting small in such environments is that, when the history of cooperation is longer, the probability that the other party is of the “good” type is higher, so that the optimal level of interaction increases over time. ...

... levels of patience) in one side or both sides of a relationship. The reason for starting small in such environments is that, when the history of cooperation is longer, the probability that the other party is of the “good” type is higher, so that the optimal level of interaction increases over time. ...

2010-11-23 Weicher Ltr re Use of Interview Materials_1

... four offices: the Office of General Counsel, the Office of Housing, the Office of Policy Development and Research, and the Office of Fair Housing and Equal Opportunity. The goals were established through formal rulemaking, following the procedures required under the Administrative Procedures Act: a ...

... four offices: the Office of General Counsel, the Office of Housing, the Office of Policy Development and Research, and the Office of Fair Housing and Equal Opportunity. The goals were established through formal rulemaking, following the procedures required under the Administrative Procedures Act: a ...

The Collateral Consequences of Payday Loan Debt

... denominations and institutions, sought to deepen the pays $458 in fees for a $350 loan. understanding of payday lending’s consequences by surveying clergy and faith-based service providers. Clergy and faith-based service providers offer a unique perspective on the impact of payday lending. They are ...

... denominations and institutions, sought to deepen the pays $458 in fees for a $350 loan. understanding of payday lending’s consequences by surveying clergy and faith-based service providers. Clergy and faith-based service providers offer a unique perspective on the impact of payday lending. They are ...

Subprime Lending, Suboptimal Bankruptcy: A Proposal to Amend

... the enormous growth in the subprime mortgage lending market is a relatively recent phenomenon. When the Bankruptcy Code was adopted in 1978, policymakers were not concerned with the impact of mortgage lending on bankruptcy policy. Quite the opposite: in the environment of the late 1970s, in which ho ...

... the enormous growth in the subprime mortgage lending market is a relatively recent phenomenon. When the Bankruptcy Code was adopted in 1978, policymakers were not concerned with the impact of mortgage lending on bankruptcy policy. Quite the opposite: in the environment of the late 1970s, in which ho ...

Download attachment

... delinquency independent of loan terms, improved origination practices cannot eliminate the need for better tools to manage mortgage delinquency.10 This Essay identifies and examines a rough management framework for delinquency already in place. Although the United States has wellfunctioning courts a ...

... delinquency independent of loan terms, improved origination practices cannot eliminate the need for better tools to manage mortgage delinquency.10 This Essay identifies and examines a rough management framework for delinquency already in place. Although the United States has wellfunctioning courts a ...

Aalborg Universitet Danish Mortgage Finance, Property Rights Protection and Economic Development

... economic development in general, was found to be contrasted by the nearly global lack of suitable indicator data on the state of implementation of land registration systems and land management for urban development and mortgage pledging. The review found current indicators on property rights protect ...

... economic development in general, was found to be contrasted by the nearly global lack of suitable indicator data on the state of implementation of land registration systems and land management for urban development and mortgage pledging. The review found current indicators on property rights protect ...

Illinois Department of Financial and Professional Regulation

... Tri Star Home Mortgage, Addison – residential mortgage license (MB.6760319) revoked for failure to comply with the department commonly known as SB1167. ...

... Tri Star Home Mortgage, Addison – residential mortgage license (MB.6760319) revoked for failure to comply with the department commonly known as SB1167. ...

Estimating the Effects of Foreclosure Counseling for Troubled Borrowers Assistant Professor

... Starting in 2008, the number of homeowners losing their homes to foreclosure began increasing dramatically. Given that troubled borrowers may not fully understand their options for modifying their mortgage, lenders and policymakers have reacted to rising foreclosure filings by increasing the use of ...

... Starting in 2008, the number of homeowners losing their homes to foreclosure began increasing dramatically. Given that troubled borrowers may not fully understand their options for modifying their mortgage, lenders and policymakers have reacted to rising foreclosure filings by increasing the use of ...

Saving Your Home in Bankruptcy

... bankruptcy under Chapter 13. First, they can reinstate the original mortgage payment schedule by repaying arrears during the five years of the repayment plan, rather than being forced to repay the entire mortgage debt immediately. Second, part or all of their unsecured debt is discharged. Third, deb ...

... bankruptcy under Chapter 13. First, they can reinstate the original mortgage payment schedule by repaying arrears during the five years of the repayment plan, rather than being forced to repay the entire mortgage debt immediately. Second, part or all of their unsecured debt is discharged. Third, deb ...

Accounting for Changes in the Homeownership Rate

... life-cycle e¤ects play a prominent role; rental and owner-occupied housing markets coexist; and households make the discrete choice of whether to own or rent as well as the choice of what quantity of housing service ‡ows to consume. In each period households face uninsurable mortality and labor inco ...

... life-cycle e¤ects play a prominent role; rental and owner-occupied housing markets coexist; and households make the discrete choice of whether to own or rent as well as the choice of what quantity of housing service ‡ows to consume. In each period households face uninsurable mortality and labor inco ...

Turning a Blind Eye: Wall Street Finance of Predatory Lending

... Given investors' concerns, one might expect the capital markets to screen out the riskiest, predatory loans from securitized subprime loan pools. There is growing evidence, however, that securitizing entities perform inadequate screening. When meaningful screening does occur, it focuses on loans ori ...

... Given investors' concerns, one might expect the capital markets to screen out the riskiest, predatory loans from securitized subprime loan pools. There is growing evidence, however, that securitizing entities perform inadequate screening. When meaningful screening does occur, it focuses on loans ori ...

Cross-Collateralized Transaction Rider to Loan

... Freddie Mac will determine the combined loan to value ratio of the Mortgaged Property and the aggregate combined loan to value ratio of the Mortgaged Property and Related Mortgaged Properties based on its underwriting. Borrower will provide Freddie Mac such financial statements and other information ...

... Freddie Mac will determine the combined loan to value ratio of the Mortgaged Property and the aggregate combined loan to value ratio of the Mortgaged Property and Related Mortgaged Properties based on its underwriting. Borrower will provide Freddie Mac such financial statements and other information ...

capitalization rate, mortgage interest rate and

... estate market, and mortgage interest rate measures the cost of debt. They are important factors developers will encounter when making investment and financing decisions. It is difficult to quantify mortgages used to refinance and invest. However, capturing important factors affecting mortgage flows ...

... estate market, and mortgage interest rate measures the cost of debt. They are important factors developers will encounter when making investment and financing decisions. It is difficult to quantify mortgages used to refinance and invest. However, capturing important factors affecting mortgage flows ...

Loan Agreement - Act respecting financial assistance for education

... totime, the repay in advance all or partatofhis theorloan. borrower, her last known address. This agreement will be deemed accepted by the borrower if he or she does not request that the lender modify the terms and conditions of the agreement within 15 days of the date on which it was sent. This rul ...

... totime, the repay in advance all or partatofhis theorloan. borrower, her last known address. This agreement will be deemed accepted by the borrower if he or she does not request that the lender modify the terms and conditions of the agreement within 15 days of the date on which it was sent. This rul ...

WHEDA Advantage Policies and Procedures Manual

... 10.07 Collecting Payments from the Borrower (04/01/14) ................................................................. 62 10.08 Reimbursement if the Borrower Pays Ahead (04/01/14)........................................................... 62 ...

... 10.07 Collecting Payments from the Borrower (04/01/14) ................................................................. 62 10.08 Reimbursement if the Borrower Pays Ahead (04/01/14)........................................................... 62 ...

An Analysis of Default Risk in the Home Equity Conversion

... were not collected. One of the primary theoretical determinants of default in the forward mortgage market, negative equity, is not applicable for reverse mortgages. Rather, lack of financial resources, liquidity constraints, and poor financial management are likely more important. Further, the way ...

... were not collected. One of the primary theoretical determinants of default in the forward mortgage market, negative equity, is not applicable for reverse mortgages. Rather, lack of financial resources, liquidity constraints, and poor financial management are likely more important. Further, the way ...

The Causes of Fraud in Financial Crises: Evidence

... to securities issuers who bundle them together into MBSs. Issuers register and sell MBSs and are responsible for their legal compliance. The sale of MBSs also involves the services of an underwriter, usually an investment bank, who works closely with the issuer to price and market MBSs to investors. ...

... to securities issuers who bundle them together into MBSs. Issuers register and sell MBSs and are responsible for their legal compliance. The sale of MBSs also involves the services of an underwriter, usually an investment bank, who works closely with the issuer to price and market MBSs to investors. ...

Special points of interest: 12,525 SF Available 18` Clear Height 4

... broker must obtain the written consent of each party to the transaction to act as an intermediary. The written consent must state who will pay the broker and, in conspicuous bold or underlined print, set forth the broker’s obligations as an intermediary. The broker is required to treat each party ho ...

... broker must obtain the written consent of each party to the transaction to act as an intermediary. The written consent must state who will pay the broker and, in conspicuous bold or underlined print, set forth the broker’s obligations as an intermediary. The broker is required to treat each party ho ...