Liquidity provision, banking, and the allocation of interest rate risk*

... possible that at some point refinancing costs may exceed investment returns, or, equivalently, that the market value of the initial investment may fall below the repayment obligation to the initial financiers. A case lesson is provided by the crisis of the savings and loans industry in the United St ...

... possible that at some point refinancing costs may exceed investment returns, or, equivalently, that the market value of the initial investment may fall below the repayment obligation to the initial financiers. A case lesson is provided by the crisis of the savings and loans industry in the United St ...

Form 10-Q - Town Sports International Holdings, Inc.

... 2011 Senior Credit Facility On May 11, 2011, TSI, LLC entered into a $350,000 senior secured credit facility (“2011 Senior Credit Facility”). The 2011 Senior Credit Facility consisted of a $300,000 term loan facility (“2011 Term Loan Facility”) and a $50,000 revolving loan facility (“2011 Revolving ...

... 2011 Senior Credit Facility On May 11, 2011, TSI, LLC entered into a $350,000 senior secured credit facility (“2011 Senior Credit Facility”). The 2011 Senior Credit Facility consisted of a $300,000 term loan facility (“2011 Term Loan Facility”) and a $50,000 revolving loan facility (“2011 Revolving ...

The Hazard Rates of First and Second Default

... FHA borrowers have higher hazards of default. These suggest that middle- and upperincome borrowers who turn to FHA do so because they have credit problems that preclude their use of conventional mortgages. Lower income borrowers, on the other hand, may be prone to use FHA insurance because of low do ...

... FHA borrowers have higher hazards of default. These suggest that middle- and upperincome borrowers who turn to FHA do so because they have credit problems that preclude their use of conventional mortgages. Lower income borrowers, on the other hand, may be prone to use FHA insurance because of low do ...

Endogenous Interest rate Wedge and Productivity Growth in an

... high productivity growth rate subsidy saving. Moreover, the wedge is decreasing on level of financial development and on the income per capita. The saving wedge is one type of financial friction that creates the gap between the rental rate of capital for domestic firms (which equals to world interes ...

... high productivity growth rate subsidy saving. Moreover, the wedge is decreasing on level of financial development and on the income per capita. The saving wedge is one type of financial friction that creates the gap between the rental rate of capital for domestic firms (which equals to world interes ...

NBER WORKING PAPER SERIES Mark Aguiar Gita Gopinath

... standard business cycle model in which shocks represent transitory deviations around a stable trend. We find that default occurs extremely rarely — roughly two defaults every 2,500 years. The intuition for this is described in detail in Section 3. The weakness of the standard model begins with the ...

... standard business cycle model in which shocks represent transitory deviations around a stable trend. We find that default occurs extremely rarely — roughly two defaults every 2,500 years. The intuition for this is described in detail in Section 3. The weakness of the standard model begins with the ...

INSTITUTE OF ECONOMIC STUDIES Faculty of social sciences of

... a higher/lower quote means that the quoting dealer is willing to transact a swap in which he receives/pays the given spread over the yield on a benchmark security the benchmark interest rate is usually the yield on the most liquid government bond with remaining maturity closest to that of the swap 7 ...

... a higher/lower quote means that the quoting dealer is willing to transact a swap in which he receives/pays the given spread over the yield on a benchmark security the benchmark interest rate is usually the yield on the most liquid government bond with remaining maturity closest to that of the swap 7 ...

Interest Rates and Real Business Cycles in Emerging Markets S. Tolga TİRYAKİ

... in developing country business cycles, we observe that real interest rates are also strongly countercyclical in developing countries compared to the weakly procyclical relationship in developed countries. Lastly, it is widely documented that developing countries are subject to sudden stops in capita ...

... in developing country business cycles, we observe that real interest rates are also strongly countercyclical in developing countries compared to the weakly procyclical relationship in developed countries. Lastly, it is widely documented that developing countries are subject to sudden stops in capita ...

What can a lender learn from a loan application?

... payments. In 1992, the borrowers had obtained a home loan for about $53,000 to build a house. The borrowers had subsequently found it necessary to take out a series of loans, each one refinancing the last and for a larger amount, in order to meet interest and expenses. The case concerned a loan ent ...

... payments. In 1992, the borrowers had obtained a home loan for about $53,000 to build a house. The borrowers had subsequently found it necessary to take out a series of loans, each one refinancing the last and for a larger amount, in order to meet interest and expenses. The case concerned a loan ent ...

Making Borrowing Work for Today`s Students

... loans, but those undergoing persistent hardship will have their remaining balance forgiven after twenty-five years. Borrowers will not owe any taxes on the forgiven amounts. Borrowers will pay an interest rate that varies over the life of the loan. Importantly, payments will not vary as interest rat ...

... loans, but those undergoing persistent hardship will have their remaining balance forgiven after twenty-five years. Borrowers will not owe any taxes on the forgiven amounts. Borrowers will pay an interest rate that varies over the life of the loan. Importantly, payments will not vary as interest rat ...

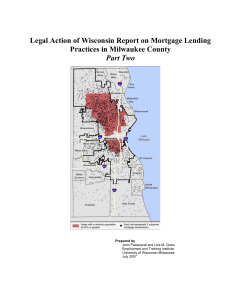

Legal Action of Wisconsin Report on Mortgage Lending

... or lengthen the time of their mortgages, or to move from an adjustable-rate mortgage to a fixed-rate loan. Refinancing activity increased in 1998 and again in 2003 and 2004 as interest rates dropped below the levels in place when many homeowners had previously purchased their homes. ...

... or lengthen the time of their mortgages, or to move from an adjustable-rate mortgage to a fixed-rate loan. Refinancing activity increased in 1998 and again in 2003 and 2004 as interest rates dropped below the levels in place when many homeowners had previously purchased their homes. ...

PPT

... default). G tried to borrow money from Bentley Ltd to redeem the mortgages. Bentley said no, right up until a day or so before the auction. Bentley agreed to buy the property from G for enough money to clear the mortgages. Bentley agreed in writing – an agreement negotiated by their lawyers to recon ...

... default). G tried to borrow money from Bentley Ltd to redeem the mortgages. Bentley said no, right up until a day or so before the auction. Bentley agreed to buy the property from G for enough money to clear the mortgages. Bentley agreed in writing – an agreement negotiated by their lawyers to recon ...

Fabozzi_Ch05_BMAS_7thEd

... There is not one repo rate but a structure of rates depending on the maturity of the loan and the specific issue being financed. With respect to the latter, there are times when dealers are in need of particular issues to cover a short position. When a dealer needs a particular issue, that dealer wi ...

... There is not one repo rate but a structure of rates depending on the maturity of the loan and the specific issue being financed. With respect to the latter, there are times when dealers are in need of particular issues to cover a short position. When a dealer needs a particular issue, that dealer wi ...

Chapter 27 Risk Management and Financial Engineering

... Hedging marketwide sources of risk, on the other hand, does not seem to provide any real service other than reduced volatility. In addition, this risk reduction is costly in terms of the resources required to implement an effective risk-management program. There are direct costs associated with hedg ...

... Hedging marketwide sources of risk, on the other hand, does not seem to provide any real service other than reduced volatility. In addition, this risk reduction is costly in terms of the resources required to implement an effective risk-management program. There are direct costs associated with hedg ...

Accounting for Changes in the Homeownership Rate

... choice for younger cohorts. Roughly, 80 percent of the predicted increase in the participation rate for the younger cohorts can be attributed to the introduction of new mortgage instruments. Demographic changes by themselves are not able to account for the increase in the participation of these hou ...

... choice for younger cohorts. Roughly, 80 percent of the predicted increase in the participation rate for the younger cohorts can be attributed to the introduction of new mortgage instruments. Demographic changes by themselves are not able to account for the increase in the participation of these hou ...