Base Prospectus dated 22 March 2017 VIVENDI EURO

... manager(s) (the "Stabilising Manager(s)") (or person(s) acting on behalf of any Stabilising Manager(s)) in the applicable Final Terms may over-allot Notes or effect transactions with a view to supporting the market price of the Notes at a level higher than that which might otherwise prevail. However ...

... manager(s) (the "Stabilising Manager(s)") (or person(s) acting on behalf of any Stabilising Manager(s)) in the applicable Final Terms may over-allot Notes or effect transactions with a view to supporting the market price of the Notes at a level higher than that which might otherwise prevail. However ...

CP11/31 - Mortgage Market Review - updated 1/2/12

... The UK mortgage market has worked well for the vast majority of consumers. But in the run-up to the financial crisis there was a tail of poor lending to borrowers who could not afford to repay out of income, with both lenders and borrowers assuming that house price rises would make repayment or refi ...

... The UK mortgage market has worked well for the vast majority of consumers. But in the run-up to the financial crisis there was a tail of poor lending to borrowers who could not afford to repay out of income, with both lenders and borrowers assuming that house price rises would make repayment or refi ...

The Valuation and Risk Management of a DB Underpin

... formula that includes such factors as years of service and salary. For example, a defined benefit pension might be calculated as 1.5% of average salary for the final 5 years of employment, for every year of service with an employer. The benefits in most traditional DB plans may be protected, within ...

... formula that includes such factors as years of service and salary. For example, a defined benefit pension might be calculated as 1.5% of average salary for the final 5 years of employment, for every year of service with an employer. The benefits in most traditional DB plans may be protected, within ...

RTF - Vornado Realty Trust

... We plan to demolish two adjacent Washington, DC office properties, 1726 M Street and 1150 17th Street in the first half of 2016 and replace them in the future with a new 335,000 square foot Class A office building, to be addressed 1700 M Street. The incremental development cost of the project is app ...

... We plan to demolish two adjacent Washington, DC office properties, 1726 M Street and 1150 17th Street in the first half of 2016 and replace them in the future with a new 335,000 square foot Class A office building, to be addressed 1700 M Street. The incremental development cost of the project is app ...

Base prospectus - €2,000,000,000 Debt Issuance Programme

... principal amount of the relevant Tranche of Notes) or effect transactions with a view to supporting the market price of the Notes of the Series of which such Tranche of Notes forms part at a level higher than that which might otherwise prevail. However, there is no assurance that the Stabilising Man ...

... principal amount of the relevant Tranche of Notes) or effect transactions with a view to supporting the market price of the Notes of the Series of which such Tranche of Notes forms part at a level higher than that which might otherwise prevail. However, there is no assurance that the Stabilising Man ...

Word - corporate

... nature unless disclosed otherwise. These interim consolidated financial statements, including notes, have been prepared in accordance with the applicable rules of the Securities and Exchange Commission (“SEC”) and do not include all of the information and disclosures required by U.S. generally accep ...

... nature unless disclosed otherwise. These interim consolidated financial statements, including notes, have been prepared in accordance with the applicable rules of the Securities and Exchange Commission (“SEC”) and do not include all of the information and disclosures required by U.S. generally accep ...

Testing for Rating Consistency in Annual Default

... respect to specific credit quality characteristics. For example, debt issuers that are subject to greater potential ratings volatility (transition risk) are generally rated lower than issuers that share the same default probability but have lower transition risk.3 Moreover, although two issuers carr ...

... respect to specific credit quality characteristics. For example, debt issuers that are subject to greater potential ratings volatility (transition risk) are generally rated lower than issuers that share the same default probability but have lower transition risk.3 Moreover, although two issuers carr ...

162/16 - Manitoba Public Utilities Board

... now calculated at $159 million of Basic total equity by MPI. In its Order No. 128/15, in respect of MPI's compulsory 2016/17 driver and vehicle insurance premiums, the Board approved a methodology for setting the upper threshold for the Basic target capital range, which was the use of a 100% Minimum ...

... now calculated at $159 million of Basic total equity by MPI. In its Order No. 128/15, in respect of MPI's compulsory 2016/17 driver and vehicle insurance premiums, the Board approved a methodology for setting the upper threshold for the Basic target capital range, which was the use of a 100% Minimum ...

Structural Features of Australian Residential Mortgage

... measured by the size of the outstanding balance of its subordinated notes as a percentage of the aggregate outstanding balance of all notes. As a result of credit tranching, RMBS can be structured to have senior notes with much lower credit risk than the credit risk of the underlying mortgage pool b ...

... measured by the size of the outstanding balance of its subordinated notes as a percentage of the aggregate outstanding balance of all notes. As a result of credit tranching, RMBS can be structured to have senior notes with much lower credit risk than the credit risk of the underlying mortgage pool b ...

securities and exchange commission

... facility with Wachovia Bank, National Association and SunTrust Bank, replacing the Registrant’s previously existing $30 million revolving line of credit facility with another lender. A copy of the Credit Agreement, which evidences this credit facility, is attached to this Current Report as Exhibit 4 ...

... facility with Wachovia Bank, National Association and SunTrust Bank, replacing the Registrant’s previously existing $30 million revolving line of credit facility with another lender. A copy of the Credit Agreement, which evidences this credit facility, is attached to this Current Report as Exhibit 4 ...

Download attachment

... 8. Emily Paradise Achtenberg & Peter Marcuse, The Causes of the Housing Problem, in Critical Perspectives on Housing, supra note 1, at 4, 9 (noting that in the 1980s a “growing number who live a paycheck or two ahead of the bank risk the loss of their equities—as well as their homes—to foreclosure”) ...

... 8. Emily Paradise Achtenberg & Peter Marcuse, The Causes of the Housing Problem, in Critical Perspectives on Housing, supra note 1, at 4, 9 (noting that in the 1980s a “growing number who live a paycheck or two ahead of the bank risk the loss of their equities—as well as their homes—to foreclosure”) ...

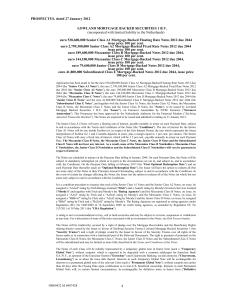

1 LOWLAND MORTGAGE BACKED SECURITIES 1 BV

... Notes") as described in the Conditions. The expression "Global Notes" means the Temporary Global Note of each Class and the Permanent Global Note of each Class and the expression "Global Note" means each Temporary Global Note or each Permanent Global Note, as the context may require. The Senior Cla ...

... Notes") as described in the Conditions. The expression "Global Notes" means the Temporary Global Note of each Class and the Permanent Global Note of each Class and the expression "Global Note" means each Temporary Global Note or each Permanent Global Note, as the context may require. The Senior Cla ...

Fixed Income Analysis: Securities, Pricing, and Risk

... 10.4.1 The Ho-Lee (extended Merton) model . . . . . . . . . . . . . . . . . . . . . 233 10.4.2 The Hull-White (extended Vasicek) model . . . . . . . . . . . . . . . . . . . 234 10.4.3 The extended CIR model . . . . . . . . . . . . . . . . . . . . . . . . . . . . 235 10.5 Gaussian HJM models . . . . ...

... 10.4.1 The Ho-Lee (extended Merton) model . . . . . . . . . . . . . . . . . . . . . 233 10.4.2 The Hull-White (extended Vasicek) model . . . . . . . . . . . . . . . . . . . 234 10.4.3 The extended CIR model . . . . . . . . . . . . . . . . . . . . . . . . . . . . 235 10.5 Gaussian HJM models . . . . ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Cash and Cash Equivalents - TJX generally considers highly liquid investments with a maturity of three months or less at the date of purchase to be cash equivalents. Investments with maturities greater than three months but less than a year at the date of purchase are included in short-term investme ...

... Cash and Cash Equivalents - TJX generally considers highly liquid investments with a maturity of three months or less at the date of purchase to be cash equivalents. Investments with maturities greater than three months but less than a year at the date of purchase are included in short-term investme ...