Saving Your Home in Bankruptcy

... mortgage term, including the principle, interest, late fees, penalties, arrears (payments due in the past that were not paid), interest on the arrears, and additional interest owed because the mortgage had a low “teaser” rate for the first two or three years, but a higher rate thereafter. Finally, d ...

... mortgage term, including the principle, interest, late fees, penalties, arrears (payments due in the past that were not paid), interest on the arrears, and additional interest owed because the mortgage had a low “teaser” rate for the first two or three years, but a higher rate thereafter. Finally, d ...

ACI Dealing Certificate syllabus

... you, the dog will automatically follow, but if you let the chain go, the dog will not automatically run away. 1.1.1.2 the consequences of money creation for banks The creation of money increases the net interest income of a bank. After all, for a loan to its customers the bank charges an interest r ...

... you, the dog will automatically follow, but if you let the chain go, the dog will not automatically run away. 1.1.1.2 the consequences of money creation for banks The creation of money increases the net interest income of a bank. After all, for a loan to its customers the bank charges an interest r ...

exam3a - Trinity University

... c. No. The swap has a notional (the loan principal), settles in cash, and requires no premium. However, it does not have a qualified underlying for a SFAS 133 derivative instrument. d. No. The swap has an underlying (the loan principal), settles in cash, and requires no premium. However, it does not ...

... c. No. The swap has a notional (the loan principal), settles in cash, and requires no premium. However, it does not have a qualified underlying for a SFAS 133 derivative instrument. d. No. The swap has an underlying (the loan principal), settles in cash, and requires no premium. However, it does not ...

18. Ijarah

... bank. In such a situation, the bank can dispose the asset and claim for any loss in value from such disposal as well as other costs incurred due to failure to fulfill the promise. The loss in value and related costs shall be compensated from the security deposit. Any balance from the security deposi ...

... bank. In such a situation, the bank can dispose the asset and claim for any loss in value from such disposal as well as other costs incurred due to failure to fulfill the promise. The loss in value and related costs shall be compensated from the security deposit. Any balance from the security deposi ...

as Microsoft Word - Edinburgh Research Explorer

... Empirically, we have reason to believe that the economy affects mortgage recovery. In our first dataset, we observe a substantial increase in repossession rate2 in the mortgage loan portfolio during the economic downturn experienced by the UK in the early 1990s, as seen in Figure 1. Similarly, in Fi ...

... Empirically, we have reason to believe that the economy affects mortgage recovery. In our first dataset, we observe a substantial increase in repossession rate2 in the mortgage loan portfolio during the economic downturn experienced by the UK in the early 1990s, as seen in Figure 1. Similarly, in Fi ...

5. The impact of real interest rates in the euro area

... agreement on which one is more appropriate in general, with each possessing advantages and disadvantages. Another difficulty is due to the fact that economic agents are heterogeneous. This means that a given measure of the real interest rate might not be relevant for all economic agents. For instanc ...

... agreement on which one is more appropriate in general, with each possessing advantages and disadvantages. Another difficulty is due to the fact that economic agents are heterogeneous. This means that a given measure of the real interest rate might not be relevant for all economic agents. For instanc ...

Filed pursuant to Rule 424(b)(5) Registration No. 333

... The only way to liquidate your investment in the notes prior to maturity will be to sell the notes. At that time, there may be an illiquid market for the notes or no market at all. Changes in our credit ratings may affect the value of the notes. Our credit ratings are an assessment of our ability to ...

... The only way to liquidate your investment in the notes prior to maturity will be to sell the notes. At that time, there may be an illiquid market for the notes or no market at all. Changes in our credit ratings may affect the value of the notes. Our credit ratings are an assessment of our ability to ...

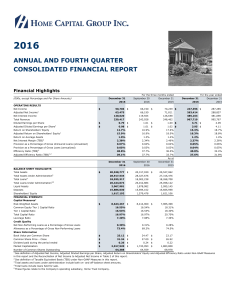

2016 Q4 Report - Home Capital Group

... The traditional single-family residential portfolio is the Company’s “Classic” mortgage portfolio which consists of primarily uninsured mortgages with loan-to-value ratios of 80% or less, serving selected segments of the Canadian financial services marketplace that are not the focus of the major fin ...

... The traditional single-family residential portfolio is the Company’s “Classic” mortgage portfolio which consists of primarily uninsured mortgages with loan-to-value ratios of 80% or less, serving selected segments of the Canadian financial services marketplace that are not the focus of the major fin ...

... loan limits reduce mortgage leverage ratios and they also induce bunching at the loan limits. Loan limits and restrictions of the mortgage interest deduction trigger large declines in mortgage volumes. The leverageand volume responses are larger for young, borrowing-constrained households. The repea ...

Design of Financial Securities: Empirical Evidence from Private-label RMBS Deals

... by exploiting the passage of Anti-Predatory Lending (APL) laws across several states during our sample period. These laws put stricter requirements on the lenders in terms of their lending practices and disclosure policy which, on the margin, made it more difficult for the lenders to originate poor- ...

... by exploiting the passage of Anti-Predatory Lending (APL) laws across several states during our sample period. These laws put stricter requirements on the lenders in terms of their lending practices and disclosure policy which, on the margin, made it more difficult for the lenders to originate poor- ...

The Term Structure of Money Market Spreads

... Each participating bank is asked to base its quoted rate on the following question: "At what rate could you borrow funds, were you to do so by asking for and then accepting interbank offers in a reasonable market size just prior to 11 a.m. London time?" An important distinction is that this is an of ...

... Each participating bank is asked to base its quoted rate on the following question: "At what rate could you borrow funds, were you to do so by asking for and then accepting interbank offers in a reasonable market size just prior to 11 a.m. London time?" An important distinction is that this is an of ...

Cheap Credit, Collateral and the Boom-Bust Cycle

... important distinction because policies that allow households to rollover their debt can only reduce the part of the downturn that is due to the deleveraging of households. My model also enables the analysis of the quantitative role different factors played in the boom-bust cycle of 2000-2010 in the ...

... important distinction because policies that allow households to rollover their debt can only reduce the part of the downturn that is due to the deleveraging of households. My model also enables the analysis of the quantitative role different factors played in the boom-bust cycle of 2000-2010 in the ...