Market Risk - Finance Area Website

... a) A BBB rated bond portfolio with $12M in face value that it plans to hold for less than 1 month. The portfolio has an average time to maturity of 7.5 years, aggregate semiannual coupon of 8.3% and average YTM of 9.2%. b) (ii) A $360.5M position in their equity trading portfolio. The portfolio has ...

... a) A BBB rated bond portfolio with $12M in face value that it plans to hold for less than 1 month. The portfolio has an average time to maturity of 7.5 years, aggregate semiannual coupon of 8.3% and average YTM of 9.2%. b) (ii) A $360.5M position in their equity trading portfolio. The portfolio has ...

Tender offer approval

... submitted on 5 January 2017 in connection with its intention to delist its shares from trading on the Warsaw Stock Exchange. The subject of the Tender Offer are 434 531 shares, i.e. 4.71% of the share capital of the Company, which as at 8 January 2017 were recorded in the securities accounts held at ...

... submitted on 5 January 2017 in connection with its intention to delist its shares from trading on the Warsaw Stock Exchange. The subject of the Tender Offer are 434 531 shares, i.e. 4.71% of the share capital of the Company, which as at 8 January 2017 were recorded in the securities accounts held at ...

Chapter 10

... 14.2 Naked and Covered Positions • Neither a naked position nor a covered position provides a satisfactory hedge. Put-call parity shows that the exposure from writing a covered call is the same as the exposure from writing a naked put. • For a perfect hedge the standard deviation of the cost of writ ...

... 14.2 Naked and Covered Positions • Neither a naked position nor a covered position provides a satisfactory hedge. Put-call parity shows that the exposure from writing a covered call is the same as the exposure from writing a naked put. • For a perfect hedge the standard deviation of the cost of writ ...

ASX Operating Rules Section 01

... adequate clearing arrangements in accordance with Rule [1003] and Schedule 1 for those products and have the technical capacity and knowledge required to exercise the Trading Permission for those Products and will meet any other requirements set out in the Procedures. A Market Participant which has ...

... adequate clearing arrangements in accordance with Rule [1003] and Schedule 1 for those products and have the technical capacity and knowledge required to exercise the Trading Permission for those Products and will meet any other requirements set out in the Procedures. A Market Participant which has ...

DEXIA « Impact Seminar

... Options on futures • A call option on a futures contract. • Payoff at maturity: • A long position on the underlying futures contract • A cash amount = Futures price – Strike price • Example: a 1-month call option on a 3-month gold futures contract • Strike price = $310 / troy ounce • Size of contra ...

... Options on futures • A call option on a futures contract. • Payoff at maturity: • A long position on the underlying futures contract • A cash amount = Futures price – Strike price • Example: a 1-month call option on a 3-month gold futures contract • Strike price = $310 / troy ounce • Size of contra ...

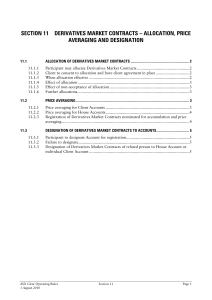

ASX Clear Section 11 - Derivatives Market Contracts – Allocation

... Participant may allocate Derivatives Market Contracts If a Derivatives Market Contract is reported to ASX Clear for registration in the name of a Participant (the “First Participant”), the First Participant may, before the Derivatives Market Contract is registered, allocate the contract to another P ...

... Participant may allocate Derivatives Market Contracts If a Derivatives Market Contract is reported to ASX Clear for registration in the name of a Participant (the “First Participant”), the First Participant may, before the Derivatives Market Contract is registered, allocate the contract to another P ...

Investment Securities Internal Control Questionnaire

... a. That bank officers and employees who make investment recommendations or decisions for the accounts of customers, who participate in the determination of such recommendations or decisions, or who, in connection with their duties, obtain information concerning which securities are being purchased o ...

... a. That bank officers and employees who make investment recommendations or decisions for the accounts of customers, who participate in the determination of such recommendations or decisions, or who, in connection with their duties, obtain information concerning which securities are being purchased o ...

The floating Greeks

... shares sometimes lose value, gradually swinging around the company's net asset value (NAV) number. Many of these bulletin board denizens only know shipping and will take down more shares of whatever is floated, especially when IPO prices are too high, but with the recent run-up in share prices, even ...

... shares sometimes lose value, gradually swinging around the company's net asset value (NAV) number. Many of these bulletin board denizens only know shipping and will take down more shares of whatever is floated, especially when IPO prices are too high, but with the recent run-up in share prices, even ...

MF2458 Grain Marketing Plans for Farmers

... quality and quantity of goods at a specified future date. A price may be agreed upon in advance, or there may be agreement that the price will be determined at the time of delivery. Forward contracts, in contrast to futures contracts, are privately negotiated and are not standardized. ...

... quality and quantity of goods at a specified future date. A price may be agreed upon in advance, or there may be agreement that the price will be determined at the time of delivery. Forward contracts, in contrast to futures contracts, are privately negotiated and are not standardized. ...

The information content of interest rate futures options

... trading volume and an open interest of only 190. Statistics from the ME reveal that the BAX contract is the most actively traded contract at that exchange. The average daily volume and open interest for all BAX contracts for 1998 was 27,104 and 171,354, respectively. In comparison, the OBX futures o ...

... trading volume and an open interest of only 190. Statistics from the ME reveal that the BAX contract is the most actively traded contract at that exchange. The average daily volume and open interest for all BAX contracts for 1998 was 27,104 and 171,354, respectively. In comparison, the OBX futures o ...

The information content of interest rate futures options

... trading volume and an open interest of only 190. Statistics from the ME reveal that the BAX contract is the most actively traded contract at that exchange. The average daily volume and open interest for all BAX contracts for 1998 was 27,104 and 171,354, respectively. In comparison, the OBX futures o ...

... trading volume and an open interest of only 190. Statistics from the ME reveal that the BAX contract is the most actively traded contract at that exchange. The average daily volume and open interest for all BAX contracts for 1998 was 27,104 and 171,354, respectively. In comparison, the OBX futures o ...

Analysis EC proposal for FTT - Insurance Association of Cyprus

... legislation. In UCITS IV4 for instance, Article 2 defines them as “instruments normally dealt in on the money market which are liquid and have a value which can be accurately determined at any time”. This definition therefore sets 3 characteristics: a) capable of being traded, (b) Liquidity, and, (c ...

... legislation. In UCITS IV4 for instance, Article 2 defines them as “instruments normally dealt in on the money market which are liquid and have a value which can be accurately determined at any time”. This definition therefore sets 3 characteristics: a) capable of being traded, (b) Liquidity, and, (c ...

Applying fuzzy parameters in pricing financial derivatives inspired by

... other financial derivatives may be established for such a primary market. These instruments and the derivatives market may prove to be very useful, especially for facilitating turnover, increasing flux liquidity and securing against the overestimation of possible emission reductions and the risk con ...

... other financial derivatives may be established for such a primary market. These instruments and the derivatives market may prove to be very useful, especially for facilitating turnover, increasing flux liquidity and securing against the overestimation of possible emission reductions and the risk con ...

a-team-dec-2016

... Mkt data for TCA, market surveillance & algo back testing must NOT impact T2T, order ack times, or trade execution times. Offload any analytics and above functions separately & asynchronously Proper software can replay market data with multiple algo’s at original rates, latencies, or alter (ex: spee ...

... Mkt data for TCA, market surveillance & algo back testing must NOT impact T2T, order ack times, or trade execution times. Offload any analytics and above functions separately & asynchronously Proper software can replay market data with multiple algo’s at original rates, latencies, or alter (ex: spee ...

DOMTrader

... A trailing limit order tracks the market automatically adjusting its price level position in the exchange’s order book. For a buy order, as the best bid/offer/trade (depending on your settings) moves up, your order moves up with it based on the trailing offset. When the best bid/trade/offer trade mo ...

... A trailing limit order tracks the market automatically adjusting its price level position in the exchange’s order book. For a buy order, as the best bid/offer/trade (depending on your settings) moves up, your order moves up with it based on the trailing offset. When the best bid/trade/offer trade mo ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... Exchange-traded derivative products—futures and options—are standardized, retail-sized products. Although they are retail in nature, they are generally used by the dealers in OTC markets to balance positions when credit lines with other financial institutions are filled or when wholesale counterpart ...

... Exchange-traded derivative products—futures and options—are standardized, retail-sized products. Although they are retail in nature, they are generally used by the dealers in OTC markets to balance positions when credit lines with other financial institutions are filled or when wholesale counterpart ...

Option Hedging with Smooth Market Impact

... Dynamic hedging of an option position is one of the most studied problems in quantitative finance. But when the position size is large, the optimal hedge strategy must take account of the transaction costs that will be incurred by following the Black-Scholes solution. This large position may be the p ...

... Dynamic hedging of an option position is one of the most studied problems in quantitative finance. But when the position size is large, the optimal hedge strategy must take account of the transaction costs that will be incurred by following the Black-Scholes solution. This large position may be the p ...

3. The Black-Scholes model

... 1. Derivatives The Nature of Derivatives A derivative is an instrument whose value depends on the values of other more basic underlying variables. ...

... 1. Derivatives The Nature of Derivatives A derivative is an instrument whose value depends on the values of other more basic underlying variables. ...

Derivatives Trading and Its Impact on the Volatility of NSE, India

... Derivatives trading in the stock market have been a subject of enthusiasm of research in the field of finance the most desired instruments that allow market participants to manage risk in the modern securities trading are known as derivatives. The derivatives are defined as the future contracts whos ...

... Derivatives trading in the stock market have been a subject of enthusiasm of research in the field of finance the most desired instruments that allow market participants to manage risk in the modern securities trading are known as derivatives. The derivatives are defined as the future contracts whos ...

Annexure – 1

... The broker shall be fully responsible and liable for all orders emanating through their DMA systems. It shall be the responsibility of the broker to ensure that only clients who ...

... The broker shall be fully responsible and liable for all orders emanating through their DMA systems. It shall be the responsibility of the broker to ensure that only clients who ...

Technical Analysis on Selected Stocks of Energy Sector

... Technical Analysis is a study of the stock market considering factors related to the supply and demand of stocks. Technical analysis is a method of evaluating securities by analyzing the statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to mea ...

... Technical Analysis is a study of the stock market considering factors related to the supply and demand of stocks. Technical analysis is a method of evaluating securities by analyzing the statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to mea ...

Chapter 1: Intro to Derivatives

... o Short-selling is a way of borrowing money; sell asset and collect money, ultimately buy asset back (“covering the short”) o Reasons to short-sell: o Speculation o Financing o Hedging ...

... o Short-selling is a way of borrowing money; sell asset and collect money, ultimately buy asset back (“covering the short”) o Reasons to short-sell: o Speculation o Financing o Hedging ...

Professor Venkatesh Panchapagesan

... issue and examine it from the perspective of different stake holders such as the regulator, market governing body such as the exchange, large and small investors etc. The objective of this exercise is to use our framework to understand everyday issues related to markets and be able to present intell ...

... issue and examine it from the perspective of different stake holders such as the regulator, market governing body such as the exchange, large and small investors etc. The objective of this exercise is to use our framework to understand everyday issues related to markets and be able to present intell ...

Predatory or Sunshine Trading? Evidence from Crude Oil ETF Rolls

... the markets, in that it causes prices to temporarily overshoot their longer-term equilibrium, and that the predator’s profits come at the expense of the other investor. In this paper, we study individual account trading strategies, overall liquidity levels, and price patterns around the time of larg ...

... the markets, in that it causes prices to temporarily overshoot their longer-term equilibrium, and that the predator’s profits come at the expense of the other investor. In this paper, we study individual account trading strategies, overall liquidity levels, and price patterns around the time of larg ...

MBRM_Aladdin_Overview.pps

... The basic trade type available in Aladdin is the CUPS (CUrrency Protected Swap). Although this is designed to be able to price CUPS trades, it is used most often to price more vanilla single currency trades. The basis of the CUPS sheet is a Fixed/Floating swap. There is a payment dates section, a pr ...

... The basic trade type available in Aladdin is the CUPS (CUrrency Protected Swap). Although this is designed to be able to price CUPS trades, it is used most often to price more vanilla single currency trades. The basis of the CUPS sheet is a Fixed/Floating swap. There is a payment dates section, a pr ...