stock exchange

... bond transactions for the top companies in the United States and the world. – The Nasdaq is the second largest securities market and the largest electronic market. ...

... bond transactions for the top companies in the United States and the world. – The Nasdaq is the second largest securities market and the largest electronic market. ...

PDF

... Insurance and financial markets offer individual and index-based contracts to producers who want to manage their risks. For example, farmers can choose forward contracts and/or futures contracts to deal with commodity price risk. They can also cover crop yield shortfalls using individual yield insur ...

... Insurance and financial markets offer individual and index-based contracts to producers who want to manage their risks. For example, farmers can choose forward contracts and/or futures contracts to deal with commodity price risk. They can also cover crop yield shortfalls using individual yield insur ...

SP92: The Equivalence of Screen Based Continuous-Auction and Dealer Markets

... market licenses some traders to act as market makers, but in an auction market these same traders are not licensed to provide this facility, but free entry into the market allows them submit limit orders because they anticipate a profitable trading gain. (ii) A continuous-auction market allows for t ...

... market licenses some traders to act as market makers, but in an auction market these same traders are not licensed to provide this facility, but free entry into the market allows them submit limit orders because they anticipate a profitable trading gain. (ii) A continuous-auction market allows for t ...

Reducing TBA-MBS Trade Fails - A Round Robin

... Since the onset of the financial crisis, the to-be-announced mortgage-backed securities (TBA-MBS) market has faced an unusual set of challenges. Led by an absence of supply, investors faced a difficult trading environment amid low levels of mortgage origination while the Federal Reserve MBS Purchase ...

... Since the onset of the financial crisis, the to-be-announced mortgage-backed securities (TBA-MBS) market has faced an unusual set of challenges. Led by an absence of supply, investors faced a difficult trading environment amid low levels of mortgage origination while the Federal Reserve MBS Purchase ...

Derivatives and Risk Management Made Simple

... flexibility around asset allocation. For example, a pension scheme could hedge the interest rate risk associated with its liabilities with a derivative allowing it to allocate its cash into assets which have limited interest rate sensitivity such as equities or alternative assets; however, this intr ...

... flexibility around asset allocation. For example, a pension scheme could hedge the interest rate risk associated with its liabilities with a derivative allowing it to allocate its cash into assets which have limited interest rate sensitivity such as equities or alternative assets; however, this intr ...

The New Risk Management: The Good, the Bad

... value to copper prices varies in response to the interim information, and this changing sensitivity should be reflected in our trades. In the current example, we assume that the firm is using copper futures contracts to hedge changes in copper prices. Futures serve the same economic purpose as forwa ...

... value to copper prices varies in response to the interim information, and this changing sensitivity should be reflected in our trades. In the current example, we assume that the firm is using copper futures contracts to hedge changes in copper prices. Futures serve the same economic purpose as forwa ...

Application - BSP SouthPool

... in accordance with the rules of the Exchange, including the appendices and other regulations of BSP SouthPool applicable, (hereinafter referred to as “Exchange Rules”). This application form (hereinafter referred to as “Application”) is the form required in accordance with the Rules for the Operatio ...

... in accordance with the rules of the Exchange, including the appendices and other regulations of BSP SouthPool applicable, (hereinafter referred to as “Exchange Rules”). This application form (hereinafter referred to as “Application”) is the form required in accordance with the Rules for the Operatio ...

Limit Orders and the Intraday Behavior of Market Liquidity

... disseminated to the public on the real time basis. Large order traders have the option of not disclosing the part of the order which exceeds 5,000 shares. However, traders might want to make public their orders since the TSE gives priority to disclosed orders over ...

... disseminated to the public on the real time basis. Large order traders have the option of not disclosing the part of the order which exceeds 5,000 shares. However, traders might want to make public their orders since the TSE gives priority to disclosed orders over ...

The information content of an open limit-order book

... A majority of equity and derivative markets around the world are organized as electronic limit-order books. Such equity markets include the Electronic Communication Networks (ECNs) in the United States, the Toronto Stock Exchange, and the Hong Kong Stock Exchange. Electronic trading platforms in der ...

... A majority of equity and derivative markets around the world are organized as electronic limit-order books. Such equity markets include the Electronic Communication Networks (ECNs) in the United States, the Toronto Stock Exchange, and the Hong Kong Stock Exchange. Electronic trading platforms in der ...

Fees for 1999 Type of fee Securities Listed capital MIN NOK MAX

... the assessment of the fee basis and fee rates for options and terms have been delegated to the Stock Exchange Managing Director. This will be applicable until changed by the Stock Exchange Council. ...

... the assessment of the fee basis and fee rates for options and terms have been delegated to the Stock Exchange Managing Director. This will be applicable until changed by the Stock Exchange Council. ...

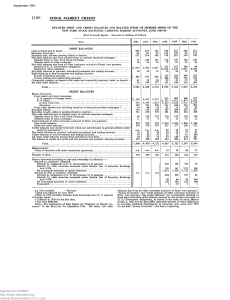

Detailed Debit and Credit Balances and Related Items of Member

... balances due from all other customers exclusive of firms' own partners," "money borrowed," and "credit balances of other customers exclusive of firms' own partners—free credit balances" are conceptually identical to these items (including debit balances secured by and money borrowed on U. S. Governm ...

... balances due from all other customers exclusive of firms' own partners," "money borrowed," and "credit balances of other customers exclusive of firms' own partners—free credit balances" are conceptually identical to these items (including debit balances secured by and money borrowed on U. S. Governm ...

Causes and Consequences of Margin Levels in Futures Markets

... realized variance slowly mean-reverts. Margin changes are of course endogenous as they are set by the clearing house primarily based on volatility, and I address this endogeneity problem throughout the paper. Traders in commodity futures often state that margin increases squeeze out speculators and ...

... realized variance slowly mean-reverts. Margin changes are of course endogenous as they are set by the clearing house primarily based on volatility, and I address this endogeneity problem throughout the paper. Traders in commodity futures often state that margin increases squeeze out speculators and ...

Disclosure of Transaction Data to Forex Customers—NFA

... has determined that retail forex customers should have greater transparency with respect to FDM transaction execution data. The proposed rule change will provide retail forex customers with a framework for obtaining execution information to review the quality of the execution the customer received c ...

... has determined that retail forex customers should have greater transparency with respect to FDM transaction execution data. The proposed rule change will provide retail forex customers with a framework for obtaining execution information to review the quality of the execution the customer received c ...

Lecture 1

... Items traded in the market for immediate delivery and payment are traded in the spot market. When delivery at a specific price(payment) is not "spot," a "futures” or “forward” market transaction has occurred. • Futures contracts are traded on organized exchanges. • Forward contracts are traded over ...

... Items traded in the market for immediate delivery and payment are traded in the spot market. When delivery at a specific price(payment) is not "spot," a "futures” or “forward” market transaction has occurred. • Futures contracts are traded on organized exchanges. • Forward contracts are traded over ...

Recovering Risk-Neutral Densities from Exchange Rate Options: Evidence in Turkey

... measured as the difference between the markets perceived distribution of the future rate of inflation and target inflation can be assessed via RNDs. Since there is no direct instrument available to compute RND for inflation, he suggests using the RND of long-term interest rates to measure uncertaint ...

... measured as the difference between the markets perceived distribution of the future rate of inflation and target inflation can be assessed via RNDs. Since there is no direct instrument available to compute RND for inflation, he suggests using the RND of long-term interest rates to measure uncertaint ...

Full text - Высшая школа экономики

... short run means that even if price is way above the one dictated by fundamentals it can take a long time for it to affect inventory levels. The second major problem in the way of proving that speculators caused prices to change is providing a link between speculators and physical markets. Speculator ...

... short run means that even if price is way above the one dictated by fundamentals it can take a long time for it to affect inventory levels. The second major problem in the way of proving that speculators caused prices to change is providing a link between speculators and physical markets. Speculator ...

Commodity forward curves: models and data

... • Market may be in full carry for very short-dated deliveries, but below full carry for more distant dates • EG, LME metals: one day prices may be at carry, cash-3 month spread at less than full carry • This occurs when there are positive inventories, but there is some possibility of a stockout in t ...

... • Market may be in full carry for very short-dated deliveries, but below full carry for more distant dates • EG, LME metals: one day prices may be at carry, cash-3 month spread at less than full carry • This occurs when there are positive inventories, but there is some possibility of a stockout in t ...

С П Е Ц И Ф И К А Ц И Я

... The Option shall be American. The Option right may be requested on any trading day on the Exchange during the validity period of the Option according to the procedure established herein and by the Trading Rules and Clearing ...

... The Option shall be American. The Option right may be requested on any trading day on the Exchange during the validity period of the Option according to the procedure established herein and by the Trading Rules and Clearing ...

COM SEC(2009)

... COM/2008/0602 final - COD 2008/0191 amending Directives 2006/48/EC and 2006/49/EC as regards banks affiliated to central institutions, certain own funds items, large exposures, supervisory arrangements, and crisis management. Although it may vary significantly from one segment to another. The same c ...

... COM/2008/0602 final - COD 2008/0191 amending Directives 2006/48/EC and 2006/49/EC as regards banks affiliated to central institutions, certain own funds items, large exposures, supervisory arrangements, and crisis management. Although it may vary significantly from one segment to another. The same c ...

Division 2 - Customer`s Moneys

... (f) where applicable, the date on which the subject-matter of the transaction was realised or otherwise disposed of and the amount of money received from the realisation or disposal, if any; and (g) where applicable, the name of the person, if any, to whom or through whom the subject-matter of the t ...

... (f) where applicable, the date on which the subject-matter of the transaction was realised or otherwise disposed of and the amount of money received from the realisation or disposal, if any; and (g) where applicable, the name of the person, if any, to whom or through whom the subject-matter of the t ...

Does Payment for Order Flow to Your Broker Help or Hurt You?

... While $12.50 for a round-trip trade of 100 shares may not sound like much, it eventually adds up. The average daily trading volume in IBM stock in January 1983 was 990,804 shares. If the market maker bought 495,400 shares at the bid and sold 495,400 shares at the offer, she could earn $61,925 in one ...

... While $12.50 for a round-trip trade of 100 shares may not sound like much, it eventually adds up. The average daily trading volume in IBM stock in January 1983 was 990,804 shares. If the market maker bought 495,400 shares at the bid and sold 495,400 shares at the offer, she could earn $61,925 in one ...

Equity Trading by Institutional Investors: To Cross or Not

... price is not observable at the time of order submission. The participants in the cross “agree not to disagree” about the price at which the given quantities are matched. When an order is submitted to a crossing network, there is therefore uncertainty both as to whether the order will be filled and, ...

... price is not observable at the time of order submission. The participants in the cross “agree not to disagree” about the price at which the given quantities are matched. When an order is submitted to a crossing network, there is therefore uncertainty both as to whether the order will be filled and, ...

Market Risk

... a) A BBB rated bond portfolio with $12M in face value that it plans to hold for less than 1 month. The portfolio has an average time to maturity of 7.5 years, aggregate semiannual coupon of 8.3% and average YTM of 9.2%. b) (ii) A $360.5M position in their equity trading portfolio. The portfolio has ...

... a) A BBB rated bond portfolio with $12M in face value that it plans to hold for less than 1 month. The portfolio has an average time to maturity of 7.5 years, aggregate semiannual coupon of 8.3% and average YTM of 9.2%. b) (ii) A $360.5M position in their equity trading portfolio. The portfolio has ...

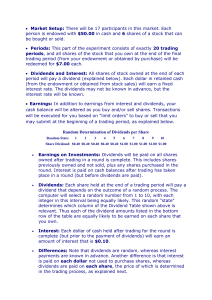

Experimental Instructions

... interest rate. The dividends may not be known in advance, but the interest rate will be known. Earnings: In addition to earnings from interest and dividends, your cash balance will be altered as you buy and/or sell shares. Transactions will be executed for you based on "limit orders" to buy or sel ...

... interest rate. The dividends may not be known in advance, but the interest rate will be known. Earnings: In addition to earnings from interest and dividends, your cash balance will be altered as you buy and/or sell shares. Transactions will be executed for you based on "limit orders" to buy or sel ...

Financial Market Failures and Systemic Risk

... unprecedented magnitude. For the first time, these attacks occurred without the dollar playing a major role. For the first time also, hedging strategies made an extensive use of currency options. The Lira was an early example of the new mood among currency traders. In the early 90's, after the Itali ...

... unprecedented magnitude. For the first time, these attacks occurred without the dollar playing a major role. For the first time also, hedging strategies made an extensive use of currency options. The Lira was an early example of the new mood among currency traders. In the early 90's, after the Itali ...