The Number and Value of Non-U.S. Firms Listed on the NYSE: 1990

... As the world's second-biggest economy hovers on the brink of a renewed economic downturn, currency market intervention is one of the few recourses Japan's policy makers have at their disposal to encourage growth. But in the past, the Ministry of Finance - the guardian of Japan's currency policy - ha ...

... As the world's second-biggest economy hovers on the brink of a renewed economic downturn, currency market intervention is one of the few recourses Japan's policy makers have at their disposal to encourage growth. But in the past, the Ministry of Finance - the guardian of Japan's currency policy - ha ...

contract design, arbitrage, and hedging in the eurodollar futures

... the expiration of the futures of a long position in the underlying 90-day Eurodollar time deposit and a short position in the futures. This value is supposed to be non-stochastic and zero, which is the case for virtually all other futures contracts. The only solution, y = 0, implies that the intere ...

... the expiration of the futures of a long position in the underlying 90-day Eurodollar time deposit and a short position in the futures. This value is supposed to be non-stochastic and zero, which is the case for virtually all other futures contracts. The only solution, y = 0, implies that the intere ...

ACCT5341 SP05 Exam 1a 031405

... instruments booked at fair value on any reporting date would have what impact on hedge accounting? a. This would eliminate all hedge accounting treatments for financial instruments. [XXXXX Para 247 on Page 132] b. This would have no impact on SFAS 133 hedge accounting rules unless the FASB changed S ...

... instruments booked at fair value on any reporting date would have what impact on hedge accounting? a. This would eliminate all hedge accounting treatments for financial instruments. [XXXXX Para 247 on Page 132] b. This would have no impact on SFAS 133 hedge accounting rules unless the FASB changed S ...

CHAPTER 16 Futures Contracts

... Chicago Mercantile Exchange, and the New York Futures Exchange (NYFE). A stock index futures contract specifies a particular stock market index as its underlying instrument. Financial futures have been so successful that they now constitute the bulk of all futures trading. This success is largely at ...

... Chicago Mercantile Exchange, and the New York Futures Exchange (NYFE). A stock index futures contract specifies a particular stock market index as its underlying instrument. Financial futures have been so successful that they now constitute the bulk of all futures trading. This success is largely at ...

LDH161211

... • Aggregate contracts booked during financial year and outstanding at any point of time should not exceed past performance eligibility , separately for import and export, subject to availability of CEL. • Past performance limits once utilized are not to be reinstated either on cancellation or on mat ...

... • Aggregate contracts booked during financial year and outstanding at any point of time should not exceed past performance eligibility , separately for import and export, subject to availability of CEL. • Past performance limits once utilized are not to be reinstated either on cancellation or on mat ...

Webtrader Business Terms For Securities Trading

... Orders, which are entered into the order book, and trades, which has been merged automatically in or entered into the Trading Platform, must reflect the relevant Securities current market value and represent actual orders and trades. The “current market value” of a trade is the price which based on ...

... Orders, which are entered into the order book, and trades, which has been merged automatically in or entered into the Trading Platform, must reflect the relevant Securities current market value and represent actual orders and trades. The “current market value” of a trade is the price which based on ...

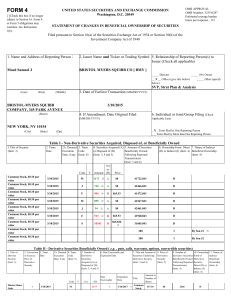

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... /s/ Robert J. Wollin, attorney-in-fact for Samuel J. Moed ...

... /s/ Robert J. Wollin, attorney-in-fact for Samuel J. Moed ...

Declaration on the selected option for the annual fee for the

... the Polish Power Exchange for the consideration of the Application: The documents required for all the markets the Applicant intends to operate on: 1. The list of commodity brokers employed by the Applicant (in case of brokerage houses and commodity brokerage houses please include also stock brokers ...

... the Polish Power Exchange for the consideration of the Application: The documents required for all the markets the Applicant intends to operate on: 1. The list of commodity brokers employed by the Applicant (in case of brokerage houses and commodity brokerage houses please include also stock brokers ...

Trading and Electronic Markets

... that stood when the trades were first ordered. The VWAP (volume-weighted average price) method, which managers commonly use, has many problems. Keeping track of the opportunity costs associated with trades ordered but not executed is very important because this information can help traders know when ...

... that stood when the trades were first ordered. The VWAP (volume-weighted average price) method, which managers commonly use, has many problems. Keeping track of the opportunity costs associated with trades ordered but not executed is very important because this information can help traders know when ...

Options on Futures: The Exercise and Assignment

... Pin risk: Suppose the option series is about to expire out of the money, but that it looks likely that the daily settlement price of the underlying futures contract will be very close to the option strike price. In this circumstance some long position holders may elect to exercise, despite the optio ...

... Pin risk: Suppose the option series is about to expire out of the money, but that it looks likely that the daily settlement price of the underlying futures contract will be very close to the option strike price. In this circumstance some long position holders may elect to exercise, despite the optio ...

TOPIC 1: WHAT IS A SHARE

... Rights and obligations............................................................................................................. 8 Topic 3: Settlement and exercise ............................................................................................... 9 Settlement of option trades ....... ...

... Rights and obligations............................................................................................................. 8 Topic 3: Settlement and exercise ............................................................................................... 9 Settlement of option trades ....... ...

Broker-dealer Companies Indicators

... invests significant amounts of money in securities trading. 22. Trading in securities in case of deviation from fluctuations in prices - offer, the prices enormously deviating from the fluctuation area. 23. The client conducts significant purchase or sale of securities a short time before the publis ...

... invests significant amounts of money in securities trading. 22. Trading in securities in case of deviation from fluctuations in prices - offer, the prices enormously deviating from the fluctuation area. 23. The client conducts significant purchase or sale of securities a short time before the publis ...

Examining the first stages of Market Performance

... differences among them are tremendous. The markets differ in capitalisation, the size of undertaken transactions, the size of involved foreign capital and organisational schemes, and most significantly, the emerging markets differ in age. Some emerging financial markets are relatively old (e.g. The ...

... differences among them are tremendous. The markets differ in capitalisation, the size of undertaken transactions, the size of involved foreign capital and organisational schemes, and most significantly, the emerging markets differ in age. Some emerging financial markets are relatively old (e.g. The ...

The Market Microstructure Approach to Foreign Exchange: Looking

... Asia was divided among Hong Kong, Tokyo, and Singapore.2 In the most liquid currencies the trading day is 24 hours long and trading floors are busiest when both London and New York are open. A currency’s liquidity tends to be deepest during local trading hours and there is a brief “overnight” lull i ...

... Asia was divided among Hong Kong, Tokyo, and Singapore.2 In the most liquid currencies the trading day is 24 hours long and trading floors are busiest when both London and New York are open. A currency’s liquidity tends to be deepest during local trading hours and there is a brief “overnight” lull i ...

THE MARKET CAPITALIZATION VALUE AS A RISK

... total variability of portfolios which is explained by market movements (high R2's). Also, it can be said that thin trading is a problem, given that betas of large firm portfolios were lowered (MV4 and MV5), while the reverse happened to MV1. Our findings are not surprising, given that almost all the ...

... total variability of portfolios which is explained by market movements (high R2's). Also, it can be said that thin trading is a problem, given that betas of large firm portfolios were lowered (MV4 and MV5), while the reverse happened to MV1. Our findings are not surprising, given that almost all the ...

Decimalization, trading costs, and information transmission between

... where Ait (Bit) is the quoted ask (bid) price for stock i at time t, and Mit is the midpoint of the quoted ask and bid prices. Relative quoted spreads are likely to be biased estimators of trading costs, because trades do not always occur at the posted quotes. The relative effective spread (ES) meas ...

... where Ait (Bit) is the quoted ask (bid) price for stock i at time t, and Mit is the midpoint of the quoted ask and bid prices. Relative quoted spreads are likely to be biased estimators of trading costs, because trades do not always occur at the posted quotes. The relative effective spread (ES) meas ...

Non-Display Declaration Form

... OTC Markets Annual Non-Display Usage Declaration Customer Name Click or tap here to enter text. (“Customer”) Reporting Period Click or tap here to enter text. As noted in Section 6.b of the Market Data Distribution Agreement, market data recipients are required to declare all Real Time Non-Display u ...

... OTC Markets Annual Non-Display Usage Declaration Customer Name Click or tap here to enter text. (“Customer”) Reporting Period Click or tap here to enter text. As noted in Section 6.b of the Market Data Distribution Agreement, market data recipients are required to declare all Real Time Non-Display u ...

Lecture 6 - IEI: Linköping University

... final bell each day • used for the daily settlement process ...

... final bell each day • used for the daily settlement process ...

bolsas y mercados españoles, sistemas de negociación, sa

... over the last auction price or last traded price, or when the specialist has accumulated during the session a buyer or seller balance higher than the established amount, the specialist may request a temporary release from specialist-related obligations from the Supervisory Committee until the situat ...

... over the last auction price or last traded price, or when the specialist has accumulated during the session a buyer or seller balance higher than the established amount, the specialist may request a temporary release from specialist-related obligations from the Supervisory Committee until the situat ...

PDF

... and wheat futures, and concludes that the seasonal components for all three commodities peak about two to three months before the beginning of harvest. For the literature on how fundamentals affect volatility, it has been established that volatility is time-varying (Koekebakker and Lien 2004), high ...

... and wheat futures, and concludes that the seasonal components for all three commodities peak about two to three months before the beginning of harvest. For the literature on how fundamentals affect volatility, it has been established that volatility is time-varying (Koekebakker and Lien 2004), high ...

Lei, Noussair, and Plott: Non-Speculative Bubbles in Experimental

... The experiment we ran in class on Tuesday closely resembles many previous experiments run by researchers. A single DOA market is run for a known finite number of rounds. Traders are allowed to buy and sell, raising the possibility of speculation. The asset being sold is typically a risky security th ...

... The experiment we ran in class on Tuesday closely resembles many previous experiments run by researchers. A single DOA market is run for a known finite number of rounds. Traders are allowed to buy and sell, raising the possibility of speculation. The asset being sold is typically a risky security th ...

Greeks- Theory and Illustrations

... Theta is also called the time decay of the portfolio. Theta is usually negative for an option. As time to maturity decreases with all else remaining the same, the option loses value. ...

... Theta is also called the time decay of the portfolio. Theta is usually negative for an option. As time to maturity decreases with all else remaining the same, the option loses value. ...

Financial Accounting and Accounting Standards

... Allied wants to hedge the risk that it might pay higher prices for inventory in January 2009. Allied enters into an aluminum futures contract that gives Allied the right and the obligation to purchase 1,000 metric tons of aluminum for $1,550 per ton. This contract price is good until the contract ex ...

... Allied wants to hedge the risk that it might pay higher prices for inventory in January 2009. Allied enters into an aluminum futures contract that gives Allied the right and the obligation to purchase 1,000 metric tons of aluminum for $1,550 per ton. This contract price is good until the contract ex ...

記錄 編號 6812 狀態 NC094FJU00457001 助教 查核 索書 號 學校

... Through a certain domestic reputed securities company, 53680 individual investors account transaction details were supplied for this research. Based on the research model of Barber and Odean (2001) as the basis, the behavioral framework of procurement decision by dispersed investors is established. ...

... Through a certain domestic reputed securities company, 53680 individual investors account transaction details were supplied for this research. Based on the research model of Barber and Odean (2001) as the basis, the behavioral framework of procurement decision by dispersed investors is established. ...