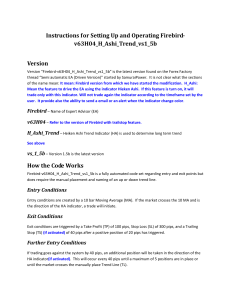

Instructions for Setting Up and Operating Firebird

... standard size ($100,000) lots. If the trading account is set up as a non-standard size, (mini, micro, nano) then the profit or loss from each trade will be smaller by a factor or 10, 100, or 1000. For those accounts created at brokers who use a four decimal place format, some of the Firebird’s varia ...

... standard size ($100,000) lots. If the trading account is set up as a non-standard size, (mini, micro, nano) then the profit or loss from each trade will be smaller by a factor or 10, 100, or 1000. For those accounts created at brokers who use a four decimal place format, some of the Firebird’s varia ...

CME SPAN - CME Group

... specific set of market conditions from a set point in time to a specific point in time in the future. • Risk Arrays typically consist of 16 profit/loss scenarios for each contract. • Each Risk Array scenario is comprised of a different market simulation, ...

... specific set of market conditions from a set point in time to a specific point in time in the future. • Risk Arrays typically consist of 16 profit/loss scenarios for each contract. • Each Risk Array scenario is comprised of a different market simulation, ...

Foreign Exchange Management

... C. Demand and Supply for spot currency. D. None of the above. 13. According to International Fisher Effect A. Forward Premium for a currency indicates its depreciation in future. B. Forward Premium for a currency indicates its appreciation in future. C. Forward Rates and spot rates are not linked D. ...

... C. Demand and Supply for spot currency. D. None of the above. 13. According to International Fisher Effect A. Forward Premium for a currency indicates its depreciation in future. B. Forward Premium for a currency indicates its appreciation in future. C. Forward Rates and spot rates are not linked D. ...

Regulation 10(5)

... prior to the transaction. If not, nature of relationship or association with the TC or its promoters Details of the proposed acquisition a. Name of the person(s) from whom shares are to be acquired b. Proposed date of acquisition c. Number of shares to be acquired from each person mentioned in 4(a) ...

... prior to the transaction. If not, nature of relationship or association with the TC or its promoters Details of the proposed acquisition a. Name of the person(s) from whom shares are to be acquired b. Proposed date of acquisition c. Number of shares to be acquired from each person mentioned in 4(a) ...

chapter 2: the structure of options markets

... Exchange-listed options expire on the Saturday following the third Friday of the month. ...

... Exchange-listed options expire on the Saturday following the third Friday of the month. ...

QuizWeek06a

... time value) and the volatility of the underlying increases (also increases time value). Volatility is measured by the s parameter in the Black-Scholes model on Page 78 of “Managing Financial Risk.” In terms of this formula, the following factors increase the value of a purchased call option: ...

... time value) and the volatility of the underlying increases (also increases time value). Volatility is measured by the s parameter in the Black-Scholes model on Page 78 of “Managing Financial Risk.” In terms of this formula, the following factors increase the value of a purchased call option: ...

How the Foreign Exchange Market Works.p65

... foreign exchange contracts negotiated, indicating amounts purchased and sold with the respective buying and selling rates. Secondly, the Bank of Jamaica traders interact with market participants constantly throughout the trading day to gather information on routine as well as unusual developments th ...

... foreign exchange contracts negotiated, indicating amounts purchased and sold with the respective buying and selling rates. Secondly, the Bank of Jamaica traders interact with market participants constantly throughout the trading day to gather information on routine as well as unusual developments th ...

Schedule F · High-Risk Investment Notice

... Buying options involves less risk than selling options because, if the price of the underlying asset moves against you, you can simply allow the option to lapse. The maximum loss is limited to the premium, plus any commission or other transaction charges. However, if you buy a call option on a futur ...

... Buying options involves less risk than selling options because, if the price of the underlying asset moves against you, you can simply allow the option to lapse. The maximum loss is limited to the premium, plus any commission or other transaction charges. However, if you buy a call option on a futur ...

Bulgarian Academy of Sciences Economic Research Institute

... • It is remarkable that in spite of global financial markets deterioration in 2014 the KRX succeeded in achieving a 70% increase of IPO companies • Korean experience in encouraging listing of companies is unique and transferable; • Cooperation between the stakeholders is of interest • The changing r ...

... • It is remarkable that in spite of global financial markets deterioration in 2014 the KRX succeeded in achieving a 70% increase of IPO companies • Korean experience in encouraging listing of companies is unique and transferable; • Cooperation between the stakeholders is of interest • The changing r ...

Currency Trading using the Fractal Market Hypothesis

... investor must accept greater risk. Why should this be so? Suppose the opportunity exists to make a guaranteed return greater than that from a conventional bank deposit say; then, no (rational) investor would invest any money with the bank. Furthermore, if he/she could also borrow money at less than ...

... investor must accept greater risk. Why should this be so? Suppose the opportunity exists to make a guaranteed return greater than that from a conventional bank deposit say; then, no (rational) investor would invest any money with the bank. Furthermore, if he/she could also borrow money at less than ...

A Fully-Dynamic Closed-Form Solution for ∆-Hedging

... from reality. Practioners who trade large positions are familiar with the concept of market impact when trading in real markets with finite liquidity. For instance, a buyer who crosses the spread and lifts orders from the other side eats up liquidity in the order book, pushing his execution price ev ...

... from reality. Practioners who trade large positions are familiar with the concept of market impact when trading in real markets with finite liquidity. For instance, a buyer who crosses the spread and lifts orders from the other side eats up liquidity in the order book, pushing his execution price ev ...

Algorithms for VWAP and Limit Order Trading

... • Option 2: Sell it to a brokerage – What should be the price – The future VWAP over the next month [minus some commission cost] • Brokerage: Needs to sell the shares at the VWAP (more or less) – brokerage takes on risk ...

... • Option 2: Sell it to a brokerage – What should be the price – The future VWAP over the next month [minus some commission cost] • Brokerage: Needs to sell the shares at the VWAP (more or less) – brokerage takes on risk ...

Derivatives and Volatility on Indian Stock Markets

... in derivative markets, especially in the case of National Stock Exchange (NSE), has shown a tremendous increase and presently the turnover in derivative markets is much higher than the turnover in spot markets. This article makes an effort to study whether the volatility in the Indian spot markets h ...

... in derivative markets, especially in the case of National Stock Exchange (NSE), has shown a tremendous increase and presently the turnover in derivative markets is much higher than the turnover in spot markets. This article makes an effort to study whether the volatility in the Indian spot markets h ...

Day Effects in Korean Stock Market

... high trading volume and significant price fluctuation in the cash market due to efforts of program traders to unwind their positions before the expiration to avoid the cumbersome settlement procedure. As the first step to examine the existence of the price effects in the Korean stock market, we comp ...

... high trading volume and significant price fluctuation in the cash market due to efforts of program traders to unwind their positions before the expiration to avoid the cumbersome settlement procedure. As the first step to examine the existence of the price effects in the Korean stock market, we comp ...

JSE Equity Options Brochure

... There are two types of options traded on the JSE’s Equity Derivatives market, call options and put options. Call options give the buyer the right, but not the obligation, to buy the underlying shares at a predetermined price, while put options give the buyer the right, but not the obligation, to sel ...

... There are two types of options traded on the JSE’s Equity Derivatives market, call options and put options. Call options give the buyer the right, but not the obligation, to buy the underlying shares at a predetermined price, while put options give the buyer the right, but not the obligation, to sel ...

Methodology of Exchange Design

... Generalized Uniform Price Call Market works very well with single-minded traders. – Open question: what if they are not single-minded? Conjecture from BFL: still ok. ...

... Generalized Uniform Price Call Market works very well with single-minded traders. – Open question: what if they are not single-minded? Conjecture from BFL: still ok. ...

Limit Orders - Fight Finance

... Exchange and OTC Trading Listed stock, futures, options and some bonds are commonly traded on securities exchanges such as the NYSE, LSE, or ASX. Foreign exchange (FX), short term debt (money market securities), bonds, forwards and swaps are commonly traded in the over-the-counter (OTC) markets. OTC ...

... Exchange and OTC Trading Listed stock, futures, options and some bonds are commonly traded on securities exchanges such as the NYSE, LSE, or ASX. Foreign exchange (FX), short term debt (money market securities), bonds, forwards and swaps are commonly traded in the over-the-counter (OTC) markets. OTC ...

Strategic Challenges Facing HKEx

... Current usage of IP services is low and inactive Trading process via IP not very convenient IPs are not direct registered members of the companies ...

... Current usage of IP services is low and inactive Trading process via IP not very convenient IPs are not direct registered members of the companies ...

Derivatives on RDX USD Index

... Bonds, Eurex Repo as w ell as the Eurex Exchanges and their respective servants and agents (a) do not make any representations or w arranties regarding the information contained herein, w hether express or implied, including w ithout limitation any implied w arranty of merchantability or fitness for ...

... Bonds, Eurex Repo as w ell as the Eurex Exchanges and their respective servants and agents (a) do not make any representations or w arranties regarding the information contained herein, w hether express or implied, including w ithout limitation any implied w arranty of merchantability or fitness for ...

Marketing Livestock and Poultry

... Marketing • Marketing is an important aspect of any livestock system. • Definition: producers exchange livestock and products for cash. ...

... Marketing • Marketing is an important aspect of any livestock system. • Definition: producers exchange livestock and products for cash. ...

How Do Canadian Banks That Deal in Foreign Exchange Hedge

... The futures market is a close substitute for the forward market, although there are a number of differences. FX futures contracts are traded on organized exchanges (in particular, the International Money Market at the Chicago Mercantile Exchange), while forward contracts are traded over the counter. ...

... The futures market is a close substitute for the forward market, although there are a number of differences. FX futures contracts are traded on organized exchanges (in particular, the International Money Market at the Chicago Mercantile Exchange), while forward contracts are traded over the counter. ...

Index Derivatives Reference Manual

... will maximize the expected return for a given measure of risk. Portfolios that satisfy this objective are said to be “efficient portfolios”. An efficient portfolio can be constructed by assembling a basket of equities that corresponds to the overall make-up of an economy, weighting each stock so tha ...

... will maximize the expected return for a given measure of risk. Portfolios that satisfy this objective are said to be “efficient portfolios”. An efficient portfolio can be constructed by assembling a basket of equities that corresponds to the overall make-up of an economy, weighting each stock so tha ...

Price Discovery in Iran Gold Coin Market

... the literature. Despite this initial similarity, the IS and PT models use different definitions of price discovery. Hasbrouck (1995) defines price discovery in terms of the variance of the innovations to the common factor. Thus the IS model measures each market’s relative contribution to this varia ...

... the literature. Despite this initial similarity, the IS and PT models use different definitions of price discovery. Hasbrouck (1995) defines price discovery in terms of the variance of the innovations to the common factor. Thus the IS model measures each market’s relative contribution to this varia ...

Market Close Summary by Guotai Junan (Hong Kong)

... Ping An Insurance (2318), which announced satisfactory first-quarter results last Friday, also inched down 0.59%. In addition, Anhui Conch Cement (0914), China’s largest cement manufacturer, issued additional A shares to the controlling shareholder and connected party to acquire assets; the connecte ...

... Ping An Insurance (2318), which announced satisfactory first-quarter results last Friday, also inched down 0.59%. In addition, Anhui Conch Cement (0914), China’s largest cement manufacturer, issued additional A shares to the controlling shareholder and connected party to acquire assets; the connecte ...