Lecture Notes_Chapter 1 - the School of Economics and Finance

... Pricing Approaches Pricing an asset by analogy (using no-arbitrage): • Find another asset, whose price you know, that has the same payoffs of the asset to be priced. Arbitrage is any trading strategy requiring no cash input that has some probability of making profits, without any risk of a loss • L ...

... Pricing Approaches Pricing an asset by analogy (using no-arbitrage): • Find another asset, whose price you know, that has the same payoffs of the asset to be priced. Arbitrage is any trading strategy requiring no cash input that has some probability of making profits, without any risk of a loss • L ...

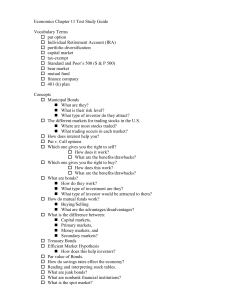

Chapter 12.2 notes - Effingham County Schools

... • You make money when the price goes up • Called capital gains ...

... • You make money when the price goes up • Called capital gains ...

chapter 2 : markets and instruments

... does not give the holder voting rights in the firm. Preferred stock is like equity in that the firm is under no contractual obligation to make the preferred stock dividend payments. Failure to make payments does not set off corporate bankruptcy. With respect to the priority of claims to the assets o ...

... does not give the holder voting rights in the firm. Preferred stock is like equity in that the firm is under no contractual obligation to make the preferred stock dividend payments. Failure to make payments does not set off corporate bankruptcy. With respect to the priority of claims to the assets o ...

Agenda

... SWAPS MATH: What Are Your Swaps Worth? November 30, 2011 10am-11:15am PT Interest rate swaps are financial tools used by many local government agencies to manage interest rate risk. The swap market at times provides issuers the opportunity to lower their cost of financing versus traditional alternat ...

... SWAPS MATH: What Are Your Swaps Worth? November 30, 2011 10am-11:15am PT Interest rate swaps are financial tools used by many local government agencies to manage interest rate risk. The swap market at times provides issuers the opportunity to lower their cost of financing versus traditional alternat ...

TopicsInAnalysis

... Consequences of the “no-arbitrage” principle Market friction (bid-asked spread, transactions costs, measurement error) and accuracy of our results (b) Connections between models and reality: What’s real? What’s a theoretical construct? (c) The “financial principle of relativity” – laws must be valid ...

... Consequences of the “no-arbitrage” principle Market friction (bid-asked spread, transactions costs, measurement error) and accuracy of our results (b) Connections between models and reality: What’s real? What’s a theoretical construct? (c) The “financial principle of relativity” – laws must be valid ...

US High Yield Fund

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

JAMES M. SANFORD, CFA 107 STONEY HILL ROAD SAG

... Managing Director : Credit and Convertible Bond Sales -Market high yield, preferred/tier 1/hybrid securities, investment grade corporate, and convertible bonds to hedge funds and prop desks using firm-wide credit and equity research. -Spearhead expansion of ...

... Managing Director : Credit and Convertible Bond Sales -Market high yield, preferred/tier 1/hybrid securities, investment grade corporate, and convertible bonds to hedge funds and prop desks using firm-wide credit and equity research. -Spearhead expansion of ...

View PDF

... characteristics of companies such as the skill of C-level management. This presents an opportunity for the hedge fund that can properly value the management team. Corporate restructurings such as business unit spin-offs can offer value due to their complexity. Shares with limited coverage, such as s ...

... characteristics of companies such as the skill of C-level management. This presents an opportunity for the hedge fund that can properly value the management team. Corporate restructurings such as business unit spin-offs can offer value due to their complexity. Shares with limited coverage, such as s ...

Introduction

... Hedging Examples • A US company will pay £10 million for imports from Britain in 3 months and decides to hedge using a long position in a forward contract • An investor owns 1,000 Microsoft shares currently worth $73 per share. A two-month put with a strike price of $63 costs $2.50. The investor dec ...

... Hedging Examples • A US company will pay £10 million for imports from Britain in 3 months and decides to hedge using a long position in a forward contract • An investor owns 1,000 Microsoft shares currently worth $73 per share. A two-month put with a strike price of $63 costs $2.50. The investor dec ...

31. On December 1, you borrow $210,000 to buy a house. The

... 33. Interest rates or rates of return on investments that have not been adjusted for the effects of inflation are called _____ rates. nominal 34. You own a bond that has a 7 percent coupon and matures in 12 years. You purchased this bond at par value when it was originally issued. If the current mar ...

... 33. Interest rates or rates of return on investments that have not been adjusted for the effects of inflation are called _____ rates. nominal 34. You own a bond that has a 7 percent coupon and matures in 12 years. You purchased this bond at par value when it was originally issued. If the current mar ...

The primary objective of business financial

... 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the timing of expected cash flows. 3. Consider a bond that has a $1000 face value, a 6.875% ...

... 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the timing of expected cash flows. 3. Consider a bond that has a $1000 face value, a 6.875% ...

Total Yield Bond Fund Adding New Investment

... the investor’s capital while seeking a total return on the investment. This could be described as trying to consistently “vacuum up pennies.” The manager, BlackRock, has the latitude to invest throughout global bond markets to develop a well-diversified portfolio that produces those pennies. On July ...

... the investor’s capital while seeking a total return on the investment. This could be described as trying to consistently “vacuum up pennies.” The manager, BlackRock, has the latitude to invest throughout global bond markets to develop a well-diversified portfolio that produces those pennies. On July ...

FREE Sample Here

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...