State of the Family

... Price is related to risk in each transaction and willingness to pay There is no delivery risk for EU Allowances or allowance trading in any other cap and trade domestic regime There is currently significant regulatory risk in CDM/JI projects and there will always be project performance and del ...

... Price is related to risk in each transaction and willingness to pay There is no delivery risk for EU Allowances or allowance trading in any other cap and trade domestic regime There is currently significant regulatory risk in CDM/JI projects and there will always be project performance and del ...

mfin202sampletest2

... C. 9. If the adoption of a new product will reduce the sales of an existing product, then the: A. new product should not be undertaken. B. old product should be abandoned. C. incremental benefits of the new product may be overestimated. D. incremental benefits of the new product may be underestimate ...

... C. 9. If the adoption of a new product will reduce the sales of an existing product, then the: A. new product should not be undertaken. B. old product should be abandoned. C. incremental benefits of the new product may be overestimated. D. incremental benefits of the new product may be underestimate ...

A Survey of Behavioral Finance - Internet Surveys of American Opinion

... • Correct Prices => No Free Lunch • No Free Lunch ≠> Correct Prices • Why Care? ...

... • Correct Prices => No Free Lunch • No Free Lunch ≠> Correct Prices • Why Care? ...

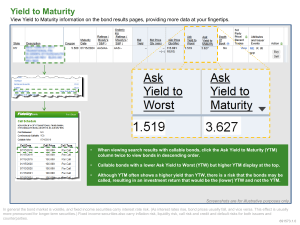

Yield to Maturity

... Although YTM often shows a higher yield than YTW, there is a risk that the bonds may be called, resulting in an investment return that would be the (lower) YTW and not the YTM. ...

... Although YTM often shows a higher yield than YTW, there is a risk that the bonds may be called, resulting in an investment return that would be the (lower) YTW and not the YTM. ...