Market Risk Management guideline for Co

... the CFI retail bond, might be affected by increasing or decreasing returns on their investments b) Equity risk: - If the price of equities listed and traded on the major stock exchanges changes, then the CFI balance sheet may be affected by a fall in the value of its equities or bonds. Even if equit ...

... the CFI retail bond, might be affected by increasing or decreasing returns on their investments b) Equity risk: - If the price of equities listed and traded on the major stock exchanges changes, then the CFI balance sheet may be affected by a fall in the value of its equities or bonds. Even if equit ...

The Order book for Retail Bonds New Advanced bonds search

... • The accrued days is the number of days since the previous coupon payment. • The accrued interest is the interest accumulated in the period between the previous coupon payment date and the settlement date of the bond trade. • The next pay date is the next date on which the bond’s coupon is payable. ...

... • The accrued days is the number of days since the previous coupon payment. • The accrued interest is the interest accumulated in the period between the previous coupon payment date and the settlement date of the bond trade. • The next pay date is the next date on which the bond’s coupon is payable. ...

L4 bond1 - people.bath.ac.uk

... When the buyer buys the bond between two coupon payments, he must compensate the seller for the interest for the coupon interest earned since the last coupon Accrued interest = C(n1/n2), where n1 is the number of days from the last coupon payment, and n2 is the number of days in the year ...

... When the buyer buys the bond between two coupon payments, he must compensate the seller for the interest for the coupon interest earned since the last coupon Accrued interest = C(n1/n2), where n1 is the number of days from the last coupon payment, and n2 is the number of days in the year ...

Economics 330 Money and Banking Lecture 18

... Hedges by locking in future interest rate if funds coming in future Short position = agree to sell securities at future date Hedges by reducing price risk from change in interest rates if holding bonds Pros 1. Flexible Cons 1. Lack of liquidity: hard to find counterparty 2. Subject to default risk: ...

... Hedges by locking in future interest rate if funds coming in future Short position = agree to sell securities at future date Hedges by reducing price risk from change in interest rates if holding bonds Pros 1. Flexible Cons 1. Lack of liquidity: hard to find counterparty 2. Subject to default risk: ...

lEVEl I SCHWESER`S QuickSheet

... To derive a bond’s value using spot rates, discount the individual cash flows at appropriate rate for each flow’s time horizon; sum PV of the cash flows to get bond’s current value. This value is the arbitrage-free value. ...

... To derive a bond’s value using spot rates, discount the individual cash flows at appropriate rate for each flow’s time horizon; sum PV of the cash flows to get bond’s current value. This value is the arbitrage-free value. ...

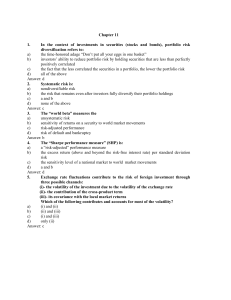

TEST BANK

... Calculate the variance of the monthly rate of return in dollar terms, if the variance of the foreign market’s return (in terms of its own currency) is 1.14, the variance between the U.S. dollar and the foreign currency is 17.64, the covariance is 2.34, and the contribution of the cross-product term ...

... Calculate the variance of the monthly rate of return in dollar terms, if the variance of the foreign market’s return (in terms of its own currency) is 1.14, the variance between the U.S. dollar and the foreign currency is 17.64, the covariance is 2.34, and the contribution of the cross-product term ...

Baltika Breweries pays off first bond issue On November 20, 2007

... Moscow Interbank Currency Exchange (MICEX). This was the first time that the Company distributed bonds among investors on the Russian bond market at the issuer’s discretion – by allocation - a widely practiced principle in Western financial markets. The unique structure of the loan made it possible ...

... Moscow Interbank Currency Exchange (MICEX). This was the first time that the Company distributed bonds among investors on the Russian bond market at the issuer’s discretion – by allocation - a widely practiced principle in Western financial markets. The unique structure of the loan made it possible ...

Arbitrage. Risk neutral valuation relationship

... that asserts that two assets traded in the same market under the same conditions should have the same price. Hence if two assets have different prices there exists an arbitrage opportunity by buying the asset at the lower price and selling it at the higher price. Individuals adopting this strategy m ...

... that asserts that two assets traded in the same market under the same conditions should have the same price. Hence if two assets have different prices there exists an arbitrage opportunity by buying the asset at the lower price and selling it at the higher price. Individuals adopting this strategy m ...

Answers to Questions in Chapter 10

... of such techniques profitable? It will provide some incentive. Even though energy-conserving techniques might not be profitable at present prices, the continuing depletion of resources and the resulting higher energy prices will probably make such techniques profitable in the future. Firms could bor ...

... of such techniques profitable? It will provide some incentive. Even though energy-conserving techniques might not be profitable at present prices, the continuing depletion of resources and the resulting higher energy prices will probably make such techniques profitable in the future. Firms could bor ...

2. Predictability of asset returns Deterministic and Random Walk

... in a portfolio with several different assets. A third step was the Arbitrage pricing theory (APT) of Ross (1976), being a generalization of the latter. ...

... in a portfolio with several different assets. A third step was the Arbitrage pricing theory (APT) of Ross (1976), being a generalization of the latter. ...

Do you have hidden risks in your bond portfolio?

... Investing involves risk, including possible loss of principal. Important Risks: Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able ...

... Investing involves risk, including possible loss of principal. Important Risks: Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able ...

Chapter 11

... Liquidity Risk – you may not be able to convert the investment back into cash quickly enough for your needs Inflation Rate Risk – inflation erodes the value of your assets Time Risk – you may have to pass up better opportunities for investment ...

... Liquidity Risk – you may not be able to convert the investment back into cash quickly enough for your needs Inflation Rate Risk – inflation erodes the value of your assets Time Risk – you may have to pass up better opportunities for investment ...

Electrode Placement for Chest Leads, V1 to V6

... • Businesses are not required to use only one market exclusively. • Most businesses utilize several different markets when raising capital. • No matter what market is used, the key to funding business growth and facilitating movement in all financial markets is . . . money. ...

... • Businesses are not required to use only one market exclusively. • Most businesses utilize several different markets when raising capital. • No matter what market is used, the key to funding business growth and facilitating movement in all financial markets is . . . money. ...