I. Global Financial Market as a part of Global Financial System

... instruments, commodities, and other fungible items of value at low transaction costs and at prices that reflect supply and demand. Securities include stocks and bonds, and commodities include for example precious metals or agricultural goods. Markets work by placing many interested buyers and seller ...

... instruments, commodities, and other fungible items of value at low transaction costs and at prices that reflect supply and demand. Securities include stocks and bonds, and commodities include for example precious metals or agricultural goods. Markets work by placing many interested buyers and seller ...

Capitol Private Wealth Group LLC Breakthrough or bust: Examining

... It is unclear as to how the 20,000-point milestone will affect the stock market on a long-term scale. Some investors may view 20,000 as an indicator of an economy growing too quickly with an imminent slowdown on the horizon. Subsequently, this could result in a sell-off by bearish investors trying t ...

... It is unclear as to how the 20,000-point milestone will affect the stock market on a long-term scale. Some investors may view 20,000 as an indicator of an economy growing too quickly with an imminent slowdown on the horizon. Subsequently, this could result in a sell-off by bearish investors trying t ...

Effect of Nonbinding Price Controls In Double Auction Trading

... The research task is to isolate the treatment effect of nonbinding price controls on competitive market outcomes including market dynamics. The design used for this exercise has the following key features. 1. All experiments use an electronic (computerized) DA mechanism characterized by a bid/ask co ...

... The research task is to isolate the treatment effect of nonbinding price controls on competitive market outcomes including market dynamics. The design used for this exercise has the following key features. 1. All experiments use an electronic (computerized) DA mechanism characterized by a bid/ask co ...

You can download the slides used in this webinar here

... • Uncertain incomes and profits for growers • May limit capital investment by poorer farmers which then harms produc/vity and real wages in the long run ...

... • Uncertain incomes and profits for growers • May limit capital investment by poorer farmers which then harms produc/vity and real wages in the long run ...

Capital Market Line and Beta

... relationship between risk measured by standard deviation and return of portfolios consisting of risk-free asset and market portfolio in all possible proportions. ...

... relationship between risk measured by standard deviation and return of portfolios consisting of risk-free asset and market portfolio in all possible proportions. ...

Stock Underwriting

... buying stocks from the existing controlling shareholders. – After completing the acquisition, the company could meet the objective of raising money in the capital markets by issuing stock. – Shells have been around for a long time. Shell brokers have negotiable fees and often retain some of the stoc ...

... buying stocks from the existing controlling shareholders. – After completing the acquisition, the company could meet the objective of raising money in the capital markets by issuing stock. – Shells have been around for a long time. Shell brokers have negotiable fees and often retain some of the stoc ...

Code of Conduct on UPSI

... 7. Unpublished Price Sensitive Information on Need-to-Know basis Unpublished Price Sensitive Information shall be handled on a “need to know” basis i.e. unpublished Price Sensitive Information shall be disclosed only to those where such communication is in furtherance of legitimate purposes, perform ...

... 7. Unpublished Price Sensitive Information on Need-to-Know basis Unpublished Price Sensitive Information shall be handled on a “need to know” basis i.e. unpublished Price Sensitive Information shall be disclosed only to those where such communication is in furtherance of legitimate purposes, perform ...

Can a Financial Transaction Tax Prevent Stock Price

... may actually not be a good instrument for increasing the e¢ ciency of stock market prices. The present paper builds upon prior work by Adam, Beutel and Marcet (2014), augmenting it by the introduction of investor heterogeneity and a linear FTT. An important feature of this setup is that investors ar ...

... may actually not be a good instrument for increasing the e¢ ciency of stock market prices. The present paper builds upon prior work by Adam, Beutel and Marcet (2014), augmenting it by the introduction of investor heterogeneity and a linear FTT. An important feature of this setup is that investors ar ...

Collect the Biggest Dividends In Stock Market History

... also why many investors blow their chance at making money from these large payout events. This is the single most important key to why this dividend strategy works… In short, stock exchange market makers drop the price commensurate with the per share dividend payout. Now, at first glance it makes se ...

... also why many investors blow their chance at making money from these large payout events. This is the single most important key to why this dividend strategy works… In short, stock exchange market makers drop the price commensurate with the per share dividend payout. Now, at first glance it makes se ...

Speculative Investor Behavior in a Stock Market with

... heterogeneous expectations within the community of potential investors. Beyond this reasonable supposition, very restrictive assumptions are made. Investors are partitioned into a finite number of internally homogeneous classes, each class having (what amounts to) infinite collective wealth. All inv ...

... heterogeneous expectations within the community of potential investors. Beyond this reasonable supposition, very restrictive assumptions are made. Investors are partitioned into a finite number of internally homogeneous classes, each class having (what amounts to) infinite collective wealth. All inv ...

Examining the Main Street Benefits of our Modern Financial Markets

... individually negotiated on multiple trading venues. In addition to the lower commission costs, this trade would almost certainly be executed faster and at a better price than under the old mechanism described above. Note that this trade made use of several features of modern markets that have been t ...

... individually negotiated on multiple trading venues. In addition to the lower commission costs, this trade would almost certainly be executed faster and at a better price than under the old mechanism described above. Note that this trade made use of several features of modern markets that have been t ...

NEW STANDARD ENERGY LIMITED SECURITIES TRADING

... been approved by the board. This includes decisions relating to whether or not to take up the entitlements and the sale of entitlements required to provide for the take up of the balance of entitlements under a renounceable pro rata issue; ...

... been approved by the board. This includes decisions relating to whether or not to take up the entitlements and the sale of entitlements required to provide for the take up of the balance of entitlements under a renounceable pro rata issue; ...

TA Pai Management Institute - Xavier Institute of Management

... An options contract gives the buyer the right to transact on or before a future date at a price that is fixed at the outset. It imposes an obligation on the seller of the contract to transact as per the agreed upon terms, if the buyer of the contract were to ...

... An options contract gives the buyer the right to transact on or before a future date at a price that is fixed at the outset. It imposes an obligation on the seller of the contract to transact as per the agreed upon terms, if the buyer of the contract were to ...

(the “Stock Exchange”) take no responsi

... under the terms and conditions of the CBBCs (the “Conditions”), a Mandatory Call Event (the “MCE”) in respect of the CBBCs described in the table below occurred at the time (the “MCE Time”) specified in the table below on 11 July 2017 (the “MCE Date”) and trading of the CBBCs has been suspended by t ...

... under the terms and conditions of the CBBCs (the “Conditions”), a Mandatory Call Event (the “MCE”) in respect of the CBBCs described in the table below occurred at the time (the “MCE Time”) specified in the table below on 11 July 2017 (the “MCE Date”) and trading of the CBBCs has been suspended by t ...

Word - HIMIPref

... Ontario’s highest marginal tax-bracket has historically been about 50bp higher through an investment in preferred shares vs. corporate bonds – with return figures calculated using index values and therefore ignoring the potential for excess returns in what remains a highly inefficient marketplace. A ...

... Ontario’s highest marginal tax-bracket has historically been about 50bp higher through an investment in preferred shares vs. corporate bonds – with return figures calculated using index values and therefore ignoring the potential for excess returns in what remains a highly inefficient marketplace. A ...

The information content of an open limit-order book

... the vast majority of trading takes place, lasts until 4:00 P.M. Orders entered during normal trading hours are matched, resulting in trades, or they are stored in the order book automatically. At 4:00 P.M., a five-minute period of “pre-close” begins which is followed by the official single-price clo ...

... the vast majority of trading takes place, lasts until 4:00 P.M. Orders entered during normal trading hours are matched, resulting in trades, or they are stored in the order book automatically. At 4:00 P.M., a five-minute period of “pre-close” begins which is followed by the official single-price clo ...

whole foods market inc

... Looking at where the stock is today compared to one year ago, we find that it is not only higher, but it has also clearly outperformed the rise in the S&P 500 over the same period, despite the company's weak earnings results. Looking ahead, the stock's rise over the last year has already helped driv ...

... Looking at where the stock is today compared to one year ago, we find that it is not only higher, but it has also clearly outperformed the rise in the S&P 500 over the same period, despite the company's weak earnings results. Looking ahead, the stock's rise over the last year has already helped driv ...

implied volatility - AlphaShark Trading

... At the time LLTC May 52.5 Calls were $.15 bid at $.25 offer, 500 up ...

... At the time LLTC May 52.5 Calls were $.15 bid at $.25 offer, 500 up ...

An Assessment on Graham`s Approach for Stock Selection: The

... • The value of the security may not be reflected in its current market price. • The time to buy financial securities is when they are selling significantly below their intrinsic value or what they are really worth based on assets of the company. ...

... • The value of the security may not be reflected in its current market price. • The time to buy financial securities is when they are selling significantly below their intrinsic value or what they are really worth based on assets of the company. ...

Slajd 1 - Property Finance

... They do not account for the time factor (time course of adjustment processes) They do not reflect complex interrelations between the variables and processes (feedback, short- and long-term relationships) Their potential for modification and expansion is limited. ...

... They do not account for the time factor (time course of adjustment processes) They do not reflect complex interrelations between the variables and processes (feedback, short- and long-term relationships) Their potential for modification and expansion is limited. ...

of 6 CIRCULAR CIR/CFD/POLICYCELL/1/2015 April 13, 2015

... acquirer will apply for and use separate Acquisition Windows during the tendering period. If one acquirer chooses to use acquisition window of one Stock Exchange having nationwide trading terminal, it would not be mandatory for the other acquirer to choose the same Stock Exchange. ...

... acquirer will apply for and use separate Acquisition Windows during the tendering period. If one acquirer chooses to use acquisition window of one Stock Exchange having nationwide trading terminal, it would not be mandatory for the other acquirer to choose the same Stock Exchange. ...

TAKEOVER BIDS AND CAPITAL MARKET EFFICIENCY 89

... markets are informationally efficient and new information is immediately reflected in share prices, they can provide a timely warning signal for the assessment of financial stability. Capital market efficiency is also a necessary precondition for share prices to provide accurate information to econo ...

... markets are informationally efficient and new information is immediately reflected in share prices, they can provide a timely warning signal for the assessment of financial stability. Capital market efficiency is also a necessary precondition for share prices to provide accurate information to econo ...

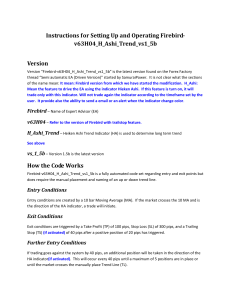

Instructions for Setting Up and Operating Firebird

... “Waiting for Main trend” is referring to a manual trend line that needs to be added before the EA will function. Create this line as a normal trend line. Select the line by right clicking it. Select Trendline properties…, and Common. In the Description field enter “Main_UpTrend_Alert_” if the trend ...

... “Waiting for Main trend” is referring to a manual trend line that needs to be added before the EA will function. Create this line as a normal trend line. Select the line by right clicking it. Select Trendline properties…, and Common. In the Description field enter “Main_UpTrend_Alert_” if the trend ...

International Emerging Markets Separate Account

... MSCI Emerging Markets NR Index measures equity market performance in the global emerging markets. It consists of 26 emerging market countries in Europe, Latin America and the Pacific Basin. Past performance is no guarantee of future results. Market indices have been provided for comparison purposes ...

... MSCI Emerging Markets NR Index measures equity market performance in the global emerging markets. It consists of 26 emerging market countries in Europe, Latin America and the Pacific Basin. Past performance is no guarantee of future results. Market indices have been provided for comparison purposes ...