Risk management through introduction of futures contracts in tea

... • The contract should be closed out either by actual delivery or by cash settlement. The goods supplied under the actual delivery option should be certified by an agency operating under the aegis of the futures market organizer, who could be the broker presently licensed by the auction organizer, wh ...

... • The contract should be closed out either by actual delivery or by cash settlement. The goods supplied under the actual delivery option should be certified by an agency operating under the aegis of the futures market organizer, who could be the broker presently licensed by the auction organizer, wh ...

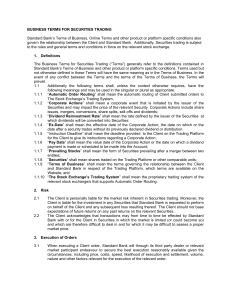

Webtrader Business Terms For Securities Trading

... automatically in or entered into the Trading Platform, must reflect the relevant Securities current market value and represent actual orders and trades. The “current market value” of a trade is the price which based on an overall assessment reflects the current pricing of the relevant Securities. An ...

... automatically in or entered into the Trading Platform, must reflect the relevant Securities current market value and represent actual orders and trades. The “current market value” of a trade is the price which based on an overall assessment reflects the current pricing of the relevant Securities. An ...

Fin432_gj_ch2

... • Underwriting the issue: purchases the security at agreedon price and bears the risk of reselling it to the public • Underwriting syndicate: group formed by investment banker to share the financial risk of underwriting ...

... • Underwriting the issue: purchases the security at agreedon price and bears the risk of reselling it to the public • Underwriting syndicate: group formed by investment banker to share the financial risk of underwriting ...

November 2010 Economic Update - GLS Financial Consultants, Inc.

... This material was prepared by Peter Montoya Inc. and does not necessarily represent the views of the presenting Representative or the Representative’s Broker/Dealer. This information should not be construed as investment advice. The Dow Jones Industrial Average is a priceweighted index of 30 activel ...

... This material was prepared by Peter Montoya Inc. and does not necessarily represent the views of the presenting Representative or the Representative’s Broker/Dealer. This information should not be construed as investment advice. The Dow Jones Industrial Average is a priceweighted index of 30 activel ...

URNER BARRY MARKET REPORTING GUIDELINES

... This is an explanation of guidelines used by Urner Barry Publications to gather, evaluate and report daily market activity. Market quotations for use in Urner Barry’s publications and services are determined using these procedures. These guidelines will provide necessary background so you may unders ...

... This is an explanation of guidelines used by Urner Barry Publications to gather, evaluate and report daily market activity. Market quotations for use in Urner Barry’s publications and services are determined using these procedures. These guidelines will provide necessary background so you may unders ...

Returns and How They Get That Way

... they were at many previous market tops. Thus, you can assume that P/E ratios will stay where they are, and thus that earnings growth will translate into parallel price appreciation. Or you can assume multiple contraction, in which case appreciation will lag earnings gains. But I doubt that a prudent ...

... they were at many previous market tops. Thus, you can assume that P/E ratios will stay where they are, and thus that earnings growth will translate into parallel price appreciation. Or you can assume multiple contraction, in which case appreciation will lag earnings gains. But I doubt that a prudent ...

Optimizing Aggressiveness in Stock Trading Simulations

... parameters are randomized far beyond the preset small ranges, thus making it possible to explore the whole parameter search space. At the same time, Monte Carlo simulation was applied in the model to achieve the best result with the minimal number of simulation rounds. Learning and Interaction In AB ...

... parameters are randomized far beyond the preset small ranges, thus making it possible to explore the whole parameter search space. At the same time, Monte Carlo simulation was applied in the model to achieve the best result with the minimal number of simulation rounds. Learning and Interaction In AB ...

designed to obtain the best possible execution - Abshire

... When executing orders on your behalf in relation to financial instruments, we will take all reasonable steps to achieve what is called “best execution” of your order(s). This means that we will have in place a policy and procedures which are designed to obtain the best possible execution result, sub ...

... When executing orders on your behalf in relation to financial instruments, we will take all reasonable steps to achieve what is called “best execution” of your order(s). This means that we will have in place a policy and procedures which are designed to obtain the best possible execution result, sub ...

Angel Broking-Restricted Scrips Policy Dealing in Restricted Scrips

... any contract has open interest below Rs 25 lacs. We will not allow the trading to happen on all Odin terminals. This doesn’t mean we will be blocking the contract from trading. For such orders we can placed from the centralized desk to avoid any malpractices or erroneous trading. ...

... any contract has open interest below Rs 25 lacs. We will not allow the trading to happen on all Odin terminals. This doesn’t mean we will be blocking the contract from trading. For such orders we can placed from the centralized desk to avoid any malpractices or erroneous trading. ...

offensive selling – selling into strength

... 5. The longer the channel line and the more high points that are connected, the more reliable it is 6. Often occurs in conjunction with climax action Sharp Pullback and Fast Recovery to New Highs 1. Stock breaks sharply to its 10-week moving average line in one to three weeks, and then quickly rebou ...

... 5. The longer the channel line and the more high points that are connected, the more reliable it is 6. Often occurs in conjunction with climax action Sharp Pullback and Fast Recovery to New Highs 1. Stock breaks sharply to its 10-week moving average line in one to three weeks, and then quickly rebou ...

10 Stock Winners in a Market Crash

... Insofar as past performance doesn’t dictate what the future holds for these stocks, having a fat tailed negative market event as a stress test in two separate occasions does offer insight. For example, certain industries are often viewed as safe heavens during market dislocation, such as household p ...

... Insofar as past performance doesn’t dictate what the future holds for these stocks, having a fat tailed negative market event as a stress test in two separate occasions does offer insight. For example, certain industries are often viewed as safe heavens during market dislocation, such as household p ...

SP92: The Equivalence of Screen Based Continuous-Auction and Dealer Markets

... to liquidate or increase their holdings at a later date. ...

... to liquidate or increase their holdings at a later date. ...

Securities Trading of Concepts (STOC)

... 1992, Calder 1977, Fern 1982). However, concept markets may be a useful alternative to these methods for several reasons: 1. Accuracy: In order to win the game, participants have the incentive to trade according to the best, most up-to-date knowledge because of their financial stake in the market. S ...

... 1992, Calder 1977, Fern 1982). However, concept markets may be a useful alternative to these methods for several reasons: 1. Accuracy: In order to win the game, participants have the incentive to trade according to the best, most up-to-date knowledge because of their financial stake in the market. S ...

Securities and Exchange Board of India

... successful bidders in a price priority methodology. (c) “Indicative Price” is the price at which the quantity offered is exhausted. (d) “Floor Price” is the minimum price at which the seller intends to sell the shares. 3. Size of Offer for sale of shares The size of the offer shall be atleast 1% of ...

... successful bidders in a price priority methodology. (c) “Indicative Price” is the price at which the quantity offered is exhausted. (d) “Floor Price” is the minimum price at which the seller intends to sell the shares. 3. Size of Offer for sale of shares The size of the offer shall be atleast 1% of ...

Trading Off The News

... Taking Advantage of the News Intuitively, investment professionals realize you can use news to create profitable trading models Proprietary traders, Stat Arb desks and hedge funds now use news to create Alpha-based trading strategies News based algorithms that can profit from market anomalies ...

... Taking Advantage of the News Intuitively, investment professionals realize you can use news to create profitable trading models Proprietary traders, Stat Arb desks and hedge funds now use news to create Alpha-based trading strategies News based algorithms that can profit from market anomalies ...

What Are Financial Intermediaries Paid For?

... list of capital’’ by identifying an expected return required by investors for a project at a given level of risk. Thus, financial intermediaries, by pricing derivatives created by them, help identify projects that rational firms should be funding. As Merton and Bodie (1995) note, there is one more s ...

... list of capital’’ by identifying an expected return required by investors for a project at a given level of risk. Thus, financial intermediaries, by pricing derivatives created by them, help identify projects that rational firms should be funding. As Merton and Bodie (1995) note, there is one more s ...

course syllabus

... – Reveal and treat in proper way the relationships between different financial indicators – spot and forward exchange rates, interest rates, inflation, real and nominal interest rates. – Test empirically whether international parity conditions hold in particular business situation. – Use covered and ...

... – Reveal and treat in proper way the relationships between different financial indicators – spot and forward exchange rates, interest rates, inflation, real and nominal interest rates. – Test empirically whether international parity conditions hold in particular business situation. – Use covered and ...

Lecture Presentation to accompany Investment

... from which they derived above-average returns on their company stock • Studies showed that public investors who traded with the insiders based on announced transactions would have enjoyed excess risk-adjusted returns (after commissions), but the markets now seems to have eliminated this inefficiency ...

... from which they derived above-average returns on their company stock • Studies showed that public investors who traded with the insiders based on announced transactions would have enjoyed excess risk-adjusted returns (after commissions), but the markets now seems to have eliminated this inefficiency ...

Ch 17 Oligopolies, Concentration Indexes

... A cartel is a formal (explicit) agreement among firms. ...

... A cartel is a formal (explicit) agreement among firms. ...

Lecture_07.1a Oligopolies, Concentration Indexes and Strategiesmand Curves

... A cartel is a formal (explicit) agreement among firms. ...

... A cartel is a formal (explicit) agreement among firms. ...

Association Rule Mining of Intraday Stock Trading Using HADOOP

... Stock markets globally generate very large datasets. These datasets assist in predicting complex and dynamic patterns and analytical insights with data mining tools. Stock market is a central place for trading stocks. The motivation for our system lies in developing a Hadoop based framework to analy ...

... Stock markets globally generate very large datasets. These datasets assist in predicting complex and dynamic patterns and analytical insights with data mining tools. Stock market is a central place for trading stocks. The motivation for our system lies in developing a Hadoop based framework to analy ...