OPPORTUNITIES TO TURN THE WHEATBELT INTO THE FOODBELT

... Social returns – maximum job creation for new Australians Retractable roof production system ...

... Social returns – maximum job creation for new Australians Retractable roof production system ...

doc

... return, there were no transactions costs of borrowing, no liquidity constraints, and all agents had perfect information about all markets, "the" rate of interest would be "the" discount rate. But such is not the case, and discount rates differ. What is your discount rate? We can answer that easily e ...

... return, there were no transactions costs of borrowing, no liquidity constraints, and all agents had perfect information about all markets, "the" rate of interest would be "the" discount rate. But such is not the case, and discount rates differ. What is your discount rate? We can answer that easily e ...

Valuing Floating Rate Notes (FRN) in Excel/VBA

... and its price shows very low sensitivity to changes in market rates. When market rates rise, the expected coupons of the FRN increase in line with the increase in forward rates, which means its price remains constant. Thus, FRNs differ from fixed rate bonds, whose prices decline when market rates ri ...

... and its price shows very low sensitivity to changes in market rates. When market rates rise, the expected coupons of the FRN increase in line with the increase in forward rates, which means its price remains constant. Thus, FRNs differ from fixed rate bonds, whose prices decline when market rates ri ...

More Cash Balance Plan Sponsors Choosing ash

... Every Cash Balance plan has a guaranteed Interest Crediting Rate (ICR) written into the plan document. Plan participants must receive an annual employer contribution plus an interest credit based on the ICR. Prior to the 2010 IRS regulations, most plans used conservative safe harbor rates such as th ...

... Every Cash Balance plan has a guaranteed Interest Crediting Rate (ICR) written into the plan document. Plan participants must receive an annual employer contribution plus an interest credit based on the ICR. Prior to the 2010 IRS regulations, most plans used conservative safe harbor rates such as th ...

Chapter 14 Capital and land

... • Net investment – gross investment minus the depreciation of the existing capital stock. ...

... • Net investment – gross investment minus the depreciation of the existing capital stock. ...

Year-end accounting balance sheet. Current Assets $500,000

... Expected sales for the upcoming year are $4,100,000. Costs of goods sold are 65% of sales and other operating expenses are $850,000. The interest rate on ABC’s short-term debt is 10% per annum. ABC’s tax-rate is 23%. Ignore depreciation in this problem. (c) ABC intends to expand its operations. Sale ...

... Expected sales for the upcoming year are $4,100,000. Costs of goods sold are 65% of sales and other operating expenses are $850,000. The interest rate on ABC’s short-term debt is 10% per annum. ABC’s tax-rate is 23%. Ignore depreciation in this problem. (c) ABC intends to expand its operations. Sale ...

IB SL WORD PROBLEMS Population of animals, people and

... How long will it take for the number of leopards to reach 100? Give your answers to an appropriate degree of accuracy. ...

... How long will it take for the number of leopards to reach 100? Give your answers to an appropriate degree of accuracy. ...

1 - CSUN.edu

... exchange rate was $1.15 per euro. You sold the stock for $135 per share and converted the dollar proceeds into euro at the exchange rate of $1.06 per euro. First, determine the profit from this investment in euro terms. Second, compute the rate of return on your investment in euro terms. How much of ...

... exchange rate was $1.15 per euro. You sold the stock for $135 per share and converted the dollar proceeds into euro at the exchange rate of $1.06 per euro. First, determine the profit from this investment in euro terms. Second, compute the rate of return on your investment in euro terms. How much of ...

FACTORS DETERMINING THE FIRM`S COST OF CAPITAL

... b. We have assumed that the mix of financing sources-debt relative to equity- remains constant for all investments. The reason for this assumption will become clear when we discuss the calculation of the cost of capital. Note that Figure 1 holds investment risk constant so that the same required rat ...

... b. We have assumed that the mix of financing sources-debt relative to equity- remains constant for all investments. The reason for this assumption will become clear when we discuss the calculation of the cost of capital. Note that Figure 1 holds investment risk constant so that the same required rat ...

Show Me the Money! - Fuse Financial Partners

... Rules of the Funding Game 2. Solids or Stripes The Colors of Money 3. What’s the Wager How Use Determines Source 4. Tricky Combo Shots Non-Bank Options ...

... Rules of the Funding Game 2. Solids or Stripes The Colors of Money 3. What’s the Wager How Use Determines Source 4. Tricky Combo Shots Non-Bank Options ...

Fundamentals of Investing Chapter Fifteen

... The interest is paid twice a year, and the principal is repaid at maturity (1-30 years) You can keep the bond until maturity or sell it to another investor ...

... The interest is paid twice a year, and the principal is repaid at maturity (1-30 years) You can keep the bond until maturity or sell it to another investor ...

Chapter 10

... As long as the unique approaches that individual firms adopt are appreciated, ROCE can be useful for inter-firm comparison as it provides a good, albeit crude, assessment of the efficiency with which management in different firms use the funds entrusted to them. Question 4 EPS (earnings per share) i ...

... As long as the unique approaches that individual firms adopt are appreciated, ROCE can be useful for inter-firm comparison as it provides a good, albeit crude, assessment of the efficiency with which management in different firms use the funds entrusted to them. Question 4 EPS (earnings per share) i ...

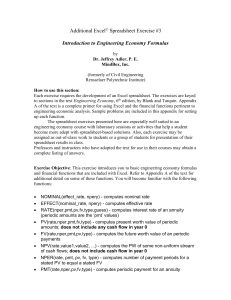

Additional Computer Exercise 3

... Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an investment or loan at the beginning of the investment period. For example, the present value of a l ...

... Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an investment or loan at the beginning of the investment period. For example, the present value of a l ...

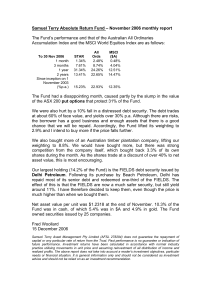

November 2006 - Samuel Terry

... 15 December 2006 Samuel Terry Asset Management Pty Limited (AFSL 278294) does not guarantee the repayment of capital or any particular rate of return from the Trust. Past performance is no guarantee or indication of future performance. Investment returns have been calculated in accordance with norma ...

... 15 December 2006 Samuel Terry Asset Management Pty Limited (AFSL 278294) does not guarantee the repayment of capital or any particular rate of return from the Trust. Past performance is no guarantee or indication of future performance. Investment returns have been calculated in accordance with norma ...

UNIT 1:

... The common stock of Zalid Co. is selling for $40.84. The stock recently paid dividends of $2.94 per share and your expected return is 15%? If you purchase the stock at the market price, what is the expected dividend payment in two years? Assume that dividends will grow at a constant rate. Also the s ...

... The common stock of Zalid Co. is selling for $40.84. The stock recently paid dividends of $2.94 per share and your expected return is 15%? If you purchase the stock at the market price, what is the expected dividend payment in two years? Assume that dividends will grow at a constant rate. Also the s ...

Determination of Rate of Return

... The issue of IRR also needs to be looked into from the perspective of a regulator. For instance, why the Authority allows equity IRR and not the project IRR? The reason is that under the cost plus regime, all prudent expected cost is established by the Authority for a particular project. When, let’s ...

... The issue of IRR also needs to be looked into from the perspective of a regulator. For instance, why the Authority allows equity IRR and not the project IRR? The reason is that under the cost plus regime, all prudent expected cost is established by the Authority for a particular project. When, let’s ...

Download attachment

... rabbiul-mal, sometimes also called sahibul-mal They deposit their money in a Mudharabah investment account at a bank (as the mudharib), with the profit ratio agreed up front (standard contracts in Islamic banks mean that there is usually no negotiation for normal account holders) The customers’ ...

... rabbiul-mal, sometimes also called sahibul-mal They deposit their money in a Mudharabah investment account at a bank (as the mudharib), with the profit ratio agreed up front (standard contracts in Islamic banks mean that there is usually no negotiation for normal account holders) The customers’ ...

Chapter 3

... • IRR (internal rate of return) is the interest in percent that the project's investment will earn. • Calculated by finding the theoretical discount rate for which NPV = 0, or SIR = 1,0. • Theoretically, any project with an IRR greater than the company's cost of capital is profitable (and will have ...

... • IRR (internal rate of return) is the interest in percent that the project's investment will earn. • Calculated by finding the theoretical discount rate for which NPV = 0, or SIR = 1,0. • Theoretically, any project with an IRR greater than the company's cost of capital is profitable (and will have ...

Helpful Comments: Excel Financial functions perform common

... NPER(rate, pmt, pv, fv, type) - computes number of payment periods for a stated PV to equal a stated FV PMT(rate,nper,pv,fv,type) - computes periodic payment for an annuity IPMT(rate,per,nper,pv,fv,type) - computes interest portion of a specific payment for some period of time PPMT(rate,per,nper,pv, ...

... NPER(rate, pmt, pv, fv, type) - computes number of payment periods for a stated PV to equal a stated FV PMT(rate,nper,pv,fv,type) - computes periodic payment for an annuity IPMT(rate,per,nper,pv,fv,type) - computes interest portion of a specific payment for some period of time PPMT(rate,per,nper,pv, ...

Problem Set 6 – Some Answers FE312 Fall 2010 Rahman 1

... national saving; this shifts the saving schedule to the left. Given the world interest rate r*, the decrease in domestic saving causes the trade balance to fall. The decrease in national saving causes the (S – I) schedule to shift to the left, lowering the supply of dollars to be invested abroad. Th ...

... national saving; this shifts the saving schedule to the left. Given the world interest rate r*, the decrease in domestic saving causes the trade balance to fall. The decrease in national saving causes the (S – I) schedule to shift to the left, lowering the supply of dollars to be invested abroad. Th ...

University of Provence - University of North Florida

... • Market Value of Bond = PV of all coupon payments plus principle repayment discounted at opportunity cost for similar bonds • Example - $1000 bond, with 9% coupon rate, with interest payable each October 1 and April 1, to be issued 4/1/2002 and a maturity date of 4/1/2022 ...

... • Market Value of Bond = PV of all coupon payments plus principle repayment discounted at opportunity cost for similar bonds • Example - $1000 bond, with 9% coupon rate, with interest payable each October 1 and April 1, to be issued 4/1/2002 and a maturity date of 4/1/2022 ...