Godley economics - University of Ottawa

... Investment is a function of capacity utilization rates and real interest rates Inventories are financed by banks Fixed investment is financed by retained earnings or equity issues ...

... Investment is a function of capacity utilization rates and real interest rates Inventories are financed by banks Fixed investment is financed by retained earnings or equity issues ...

Data Case

... 1. In order to obtain the latest financial statement of Novo Nordisk, go to Yahoo! Finance (http://finance.yahoo.com/) and search for Novo Nordisk by entering the company’s ticker symbol, NVO. Go to “Financials” and download the income statement and the balance sheet. Export them to Excel by right c ...

... 1. In order to obtain the latest financial statement of Novo Nordisk, go to Yahoo! Finance (http://finance.yahoo.com/) and search for Novo Nordisk by entering the company’s ticker symbol, NVO. Go to “Financials” and download the income statement and the balance sheet. Export them to Excel by right c ...

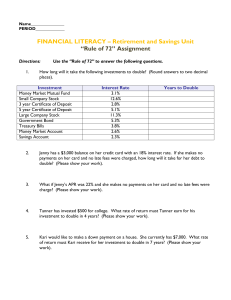

Rule of 72 Assignment

... Tanner has invested $500 for college. What rate of return must Tanner earn for his investment to double in 4 years? (Please show your work). ...

... Tanner has invested $500 for college. What rate of return must Tanner earn for his investment to double in 4 years? (Please show your work). ...

F.IF.B.4: Evaluating Exponential Expressions

... 2 The formula to determine continuously compounded interest is A = Pe rt , where A is the amount of money in the account, P is the initial investment, r is the interest rate, and t is the time, in years. Which equation could be used to determine the value of an account with an $18,000 initial invest ...

... 2 The formula to determine continuously compounded interest is A = Pe rt , where A is the amount of money in the account, P is the initial investment, r is the interest rate, and t is the time, in years. Which equation could be used to determine the value of an account with an $18,000 initial invest ...

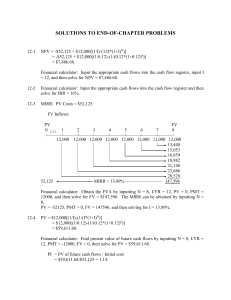

Principles of Managerial Finance by Lawrence Gitman

... and market return are 8% and 12%, respectively. b. Find the risk-free rate for a firm with a required return of 15% and a beta of 1.25 when the market return is 14%. c. Find the market return for an asset with a required return of 16% and a beta of 1.10 when the risk-free rate is 9%. d. Find the bet ...

... and market return are 8% and 12%, respectively. b. Find the risk-free rate for a firm with a required return of 15% and a beta of 1.25 when the market return is 14%. c. Find the market return for an asset with a required return of 16% and a beta of 1.10 when the risk-free rate is 9%. d. Find the bet ...

Factors That Affect the Rate of Return on an Investment

... 9.04 Analyze the factors that affect the rate of return on a given savings or investment plan and calculate the rate of return. H65 ...

... 9.04 Analyze the factors that affect the rate of return on a given savings or investment plan and calculate the rate of return. H65 ...

Investment Analysis

... Despite the fact that we are afraid of risk, we will buy risky assets. Only if we hope to get a reward for it! If we want to make money, we have to buy equity, high-yield bonds of companies that are not so solvent, … It has risk, but we need to take on this risk in order to make money. ...

... Despite the fact that we are afraid of risk, we will buy risky assets. Only if we hope to get a reward for it! If we want to make money, we have to buy equity, high-yield bonds of companies that are not so solvent, … It has risk, but we need to take on this risk in order to make money. ...

Terry`s Place is currently experiencing a bad debt ratio of 4%. Terry

... The cash budget is the primary short-term financial planning tool. The key reasons a cash budget is created are: (II) To estimate the size and timing of your new cash flows (III) To prepare for potential financing needs B. II and III only The NPV value obtained by discounting nominal cash flows usi ...

... The cash budget is the primary short-term financial planning tool. The key reasons a cash budget is created are: (II) To estimate the size and timing of your new cash flows (III) To prepare for potential financing needs B. II and III only The NPV value obtained by discounting nominal cash flows usi ...

1 An investor expects the value of a $1,000 investment to triple

... 2. A firm has a total debt of $1,000,000 and equity of $600,000. What is the debt/net worth ratio and the debt-to-total assets ratio for the firm? Show your calculations. ...

... 2. A firm has a total debt of $1,000,000 and equity of $600,000. What is the debt/net worth ratio and the debt-to-total assets ratio for the firm? Show your calculations. ...

Final Exam, Fall 09 - Department of Finance, Insurance and

... Do not place your name on this exam! SHOW ALL WORK!!! ...

... Do not place your name on this exam! SHOW ALL WORK!!! ...

Problem Set 5 - University of Notre Dame

... (1) Investment and Taxes: Consider a …rm which operates for two periods. It does not require any labor for production. It produces output each period according to the following production function: Y = zK ...

... (1) Investment and Taxes: Consider a …rm which operates for two periods. It does not require any labor for production. It produces output each period according to the following production function: Y = zK ...

The Non-Income Determinants of Consumption and Saving

... • In groups of four, read 191-193. • Try to explain what you read to each other in simple and clear language. • Discuss and complete the following potential test questions: # 4 and # 6 on pg. 223. ...

... • In groups of four, read 191-193. • Try to explain what you read to each other in simple and clear language. • Discuss and complete the following potential test questions: # 4 and # 6 on pg. 223. ...

Chp. 1.1 Simple Interest

... Fixed Interest Rate (r): An interest rate that is guaranteed not to change during the term of an investment or loan. ...

... Fixed Interest Rate (r): An interest rate that is guaranteed not to change during the term of an investment or loan. ...