1 - BrainMass

... 9. theory of interest rate parity states that the annual percentage differential in the forward market for a currency quoted in terms of another currency is equal to the approximate difference in _____ prevailing in the 2 countries a. b. c. d. ...

... 9. theory of interest rate parity states that the annual percentage differential in the forward market for a currency quoted in terms of another currency is equal to the approximate difference in _____ prevailing in the 2 countries a. b. c. d. ...

29A.1 Deriving AD from the AE model

... In earlier math notes, we derived the formula for equilibrium GDP as the solution to the following equation: Y = C + Ig + G + Xn where C = a(W, E, B, i) + b(Y – T), Ig = f(i, r(A, B, C, K, E)) + ∆V and Xn = Xn(Yf, t, P$). In words, consumption is assumed to be a linear function of disposable income, ...

... In earlier math notes, we derived the formula for equilibrium GDP as the solution to the following equation: Y = C + Ig + G + Xn where C = a(W, E, B, i) + b(Y – T), Ig = f(i, r(A, B, C, K, E)) + ∆V and Xn = Xn(Yf, t, P$). In words, consumption is assumed to be a linear function of disposable income, ...

Answers

... This has answers to the problems which I believe, but cannot guarantee, are correct. 1. Under certain conditions, a particular project may have more than one IRR. One condition under which this situation can occur is if, in addition to the initial investment at time = 0, a negative cash flow occurs ...

... This has answers to the problems which I believe, but cannot guarantee, are correct. 1. Under certain conditions, a particular project may have more than one IRR. One condition under which this situation can occur is if, in addition to the initial investment at time = 0, a negative cash flow occurs ...

View/Open - Pan Africa Christian University

... compound interest on deposits at a rate of 12% p.a. as long as Martin does not make any withdrawals in the intermediate period. Martin doesn’t know how much he should be depositing every year in order for him to accumulate the required amount by end of the 10th year. He has approached you for an adv ...

... compound interest on deposits at a rate of 12% p.a. as long as Martin does not make any withdrawals in the intermediate period. Martin doesn’t know how much he should be depositing every year in order for him to accumulate the required amount by end of the 10th year. He has approached you for an adv ...

capital investment

... In short, the economic interpretation (that it is the return on invested funds) is lost because it also requires that the surplus funds earn the same rate of interest in order to cover the cash outflow in the last year. In fact, there is an IRR for each time that the cash flows change sign (in this ...

... In short, the economic interpretation (that it is the return on invested funds) is lost because it also requires that the surplus funds earn the same rate of interest in order to cover the cash outflow in the last year. In fact, there is an IRR for each time that the cash flows change sign (in this ...

Slides

... The value of b is how quickly the rate is decreasing as the size of the investment is increasing ...

... The value of b is how quickly the rate is decreasing as the size of the investment is increasing ...

Engineering Economics - Inside Mines

... Selecting a Discount Rate “There is nothing so disastrous as a rational investment policy in an irrational world” John Maynard Keynes We have discussed the time value of money and illustrated several examples of its use. In all cases an interest rate or “discount rate” is used to bring the future c ...

... Selecting a Discount Rate “There is nothing so disastrous as a rational investment policy in an irrational world” John Maynard Keynes We have discussed the time value of money and illustrated several examples of its use. In all cases an interest rate or “discount rate” is used to bring the future c ...

Chapter 9

... Capital budgeting analysis can be complicated by capital rationing, that is, when the total outlay for projects exceeds available funds. One method for maximizing the wealth of the firm given a funds constraint is the profitability index approach, which involves the following steps: ...

... Capital budgeting analysis can be complicated by capital rationing, that is, when the total outlay for projects exceeds available funds. One method for maximizing the wealth of the firm given a funds constraint is the profitability index approach, which involves the following steps: ...

Chapter 6

... investment decisions, the IRR itself remains useful. IRR measures the average return of the investment and the sensitivity of the NPV to any estimation error in the cost of capital. ...

... investment decisions, the IRR itself remains useful. IRR measures the average return of the investment and the sensitivity of the NPV to any estimation error in the cost of capital. ...

SFM L08 - WordPress.com

... investment projects whose returns (cash flows) are expected to extend beyond one year. Project analyzed in capital budgeting has three criteria: a large up-front cost, cash flows for a specific time period, and a salvage value at the end, which captures the value of the assets of the project when ...

... investment projects whose returns (cash flows) are expected to extend beyond one year. Project analyzed in capital budgeting has three criteria: a large up-front cost, cash flows for a specific time period, and a salvage value at the end, which captures the value of the assets of the project when ...

Investment Opportunities

... Investment offers needed ranging from $1,000 to $50,000 with a cap of $50,000. Short and long-term opportunities available. ...

... Investment offers needed ranging from $1,000 to $50,000 with a cap of $50,000. Short and long-term opportunities available. ...

7. Investment Projects. Criteria for Capital Budgeting. Special Issues

... some budget constraints. Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best projects. It is important to understand that this approach is inconsistent with the goal of value maximization. Regardless of how high t ...

... some budget constraints. Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best projects. It is important to understand that this approach is inconsistent with the goal of value maximization. Regardless of how high t ...

A corporate bond maturing in 5 years carries a 10% coupon rate and

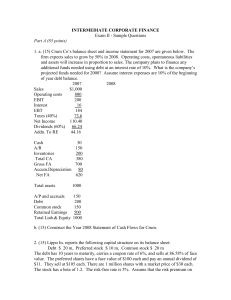

... a. What is the after-tax cost of debt, preferred stock and common stock? b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an ope ...

... a. What is the after-tax cost of debt, preferred stock and common stock? b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an ope ...

Exam review solutions ch-1

... b) 232 months, or 19 years 4 months c) The regular payment investment is worth about $5000. The single payment investment has doubled to $7200, so it is worth more. 2. a) He would need 9.607… or 9.61% annual interest compounded every 2 weeks. b) i) $66.51 ii) $812.22 c) It would take 10.4 years, or ...

... b) 232 months, or 19 years 4 months c) The regular payment investment is worth about $5000. The single payment investment has doubled to $7200, so it is worth more. 2. a) He would need 9.607… or 9.61% annual interest compounded every 2 weeks. b) i) $66.51 ii) $812.22 c) It would take 10.4 years, or ...

Seminar in Financial Management

... The derivation of post-tax investment rules and neutral tax systems under risk neutrality and risk aversion for irreversible investment projects. ...

... The derivation of post-tax investment rules and neutral tax systems under risk neutrality and risk aversion for irreversible investment projects. ...

ex1

... May lead to incorrect decisions when comparing mutually exclusive investments; (4) May be useful when the available investment budget is limited. a. NPV b. PI c. IRR d. AAR e. Payback period ...

... May lead to incorrect decisions when comparing mutually exclusive investments; (4) May be useful when the available investment budget is limited. a. NPV b. PI c. IRR d. AAR e. Payback period ...

Sample Questions - C..

... 4. Hancock Furniture Inc. is considering new expansion plans for building a new store. In reviewing the proposed new store, several members of the firm's financial staff have made a number of points regarding the proposed project. Which of the following items should the CFO include in the analysis w ...

... 4. Hancock Furniture Inc. is considering new expansion plans for building a new store. In reviewing the proposed new store, several members of the firm's financial staff have made a number of points regarding the proposed project. Which of the following items should the CFO include in the analysis w ...